By Ken Wolff

Late in the 1970s Keynesian economics was largely abandoned when it failed to explain the stagflation that had occurred during that decade. Recently, in my piece ‘What economic plan?’, I quoted an Australian analyst with the CBA who suggested that recent national data released by the ABS was showing ‘bizarre’ results, an ‘anomaly’. That sounds suspiciously like the criticism of Keynesian economics in the ’70s. It suggests that it is time we reconsidered the current dominant economic models.

Under Keynesian economics inflation was normally associated with an expanding economy and increasing employment, leading to rising wages and prices. In the 1970s, however, inflation was rising but so was unemployment and production was falling – stagflation. Many put this down to the ‘oil-price shocks’ (which occurred twice during the decade) but Milton Friedman, with his monetary theory, put it down to faulty monetary policy on the part of governments and central banks. Although he had been developing his theory since the 1950s, the problems of the 1970s meant it was ready and waiting to be adopted and was initially taken up by the Reagan and Thatcher governments.

Friedman argued that inflation is always a monetary phenomenon: that prices could not increase without an increase in the money supply – he pointed out that the money supply should be matched to economic growth (GDP) to keep inflation under control and also to prevent governments simply printing as much money as they pleased. He also believed there was a ‘natural’ level of unemployment and inflation would also occur if unemployment fell below that level.

In his work Capitalism and Freedom he espoused the free market as the solution to many problems rather than leaving problems to government to resolve: government should keep an eye on the money supply and allow the market to take care of itself — the market was considered more efficient in dealing with inflation and unemployment.

His emphasis on monetarism and the free market led to two related approaches: supply-side economics and the rise of neoliberalism.

The free market which Friedman emphasised is based on the individual’s rights over private property, which the individual then uses to engage in the market. That was used by the neoliberals to place the individual at the forefront, not only economically but socially. The approach had been spelt out by the philosopher Robert Nozick during the 1970s.

Nozick considered that as each individual owns the products of her or his own endeavours and talents, it is possible for an individual to acquire property rights (as long as they are not gained by theft, force or fraud) over a disproportionate amount of the world. Once private property has been acquired in that way, it is ‘morally’ necessary (in a philosophic sense) for a free market to exist so as to allow further exchange of that property – it is only individual private property rights and market mechanisms that are logically important.

That captures much of the approach adopted by the neoliberals and helped give their approach a philosophic underpinning.

Nozick also posited that the state’s single proper duty is the protection of persons and property and that it requires taxation only for that purpose. That matches the current neoliberal argument for small government and minimal taxes and also fits with supply-side economics.

The basic argument of supply-side economics is that high taxes, particularly high marginal tax rates, are a disincentive to work, saving, investment and the efficiency of resource use. Some other taxes can also distort investment decisions by treating different types of capital investment unequally.

Supply-side proponents argue that:

- lower taxes on wages will increase labour supply and increase employment by reducing the pre-tax real wage but increasing the post-tax real wage

- lower taxes on interest and capital gains will lead to an increase in savings, leading to more savings flowing into capital markets and raising investment

- for governments, lowering taxes will actually lead to higher tax revenue as people will work or invest more, thus increasing the size of the tax base.

What have these approaches actually achieved since the 1980s?

Following supply-side economics, many governments around the world have, since the 1980s, lowered marginal tax rates on income, including company tax rates, and the rates for earnings from investments and capital gains. Many other economists accepted that some of the outcomes suggested by the supply-side theories were possible but their impact was measurable only in decimal points of a percentage and the benefits were not as large as claimed by supply-side theories. The tax cuts made by the Reagan government were a classic example of supply-side theory but led not to an increase in government revenue but a huge increase in government debt, which other economists suggested over-rode any potential benefit.

Economists acknowledge that supply-side actions take a long time to show their benefits – although governments usually prefer to take short-term actions.

In 1996 one researcher wrote of the USA:

Economic growth, at its simplest, is the result of more people working and more output per hour (ie, increased productivity). Given two facts — annual productivity growth of about 1.1 per cent for more than two decades, and a slowdown in the growth of the working-age population — slower economic growth is the inevitable result. Since cutting (or raising) taxes has made no obvious, large difference in productivity, the idea that tax cuts will noticeably increase long-term economic growth is without merit.

More recently, to cover the long term nature of supply-side changes, some research has looked at the history of tax cuts in the USA going back to 1945, thus covering a period of about 65 years (at the time of the research). The research was conducted by the Congressional Research Service and first appeared in 2012. It found that there was no correlation between lower tax rates and saving, investment or productivity. What was found was that the changes had helped concentrate wealth in the hands of the top 1%, and particularly the top 0.1% of income earners, as their tax rates had fallen by more than 50%.

The market emphasis on the individual, supported by the neoliberal approach, basically endorses inequality because it results from individual ‘effort’. It ignores social responsibility and the common good. I won’t go into this as we have covered it before on TPS but it leads to the economists and neoliberals seeing no role for government in ameliorating the situation, or as the philosopher Nozick put it:

While it is true that some individuals might make sacrifices of some of their interests in order to gain benefits for some other of their interests, society can never be justified in sacrificing the interests of some individuals for the sake of others. [emphasis added]

Under this approach, governments should not intervene in the market, nor over-rule individual rights to reduce the increasing inequality, although it has been government decisions, under pressure from supply-side economists and neoliberals, that has exacerbated the situation.

Greg Jericho, writing recently in The Guardian, also pointed to the unusual outcomes occurring under the current economic approach:

The OECD has just released its latest compendium of productivity indicators and it shows that across the world productivity growth was slower in the decade from 2004‒2014 than it was from 1996‒2004.

But as the OECD notes, the slowdown in productivity growth has come during a time of “rapid technological change” and increasing participation of firms and countries in the global market – things which should see improved growth.

It is a “paradox” which the authors of the paper rather unsettlingly attribute to among other things, difficulties of measurement.

For its failures, supply-side economics has been disparaged and dismissed as ‘voodoo economics’ (used by George H Bush as regards Reagan’s economic approach during the 1980 presidential primaries), although it still lingers among many governments, including the Liberal government in Australia. Despite the evidence, our government still believes that lowering taxes will help investment, economic growth and ultimately government revenue. In Fairfax papers on 9 June, Peter Martin wrote that the government’s company tax reduction would cost a nett $8 billion a year (after some increased income from personal taxation). For that cost, the benefit would be an improvement in gross national income of between 0.5% and 0.7% ‘after several decades’ or less than 0.1% per year (so low that at one decimal point it rounds to zero):

And the boost to jobs would be even smaller. Independent Economics says employment would eventually climb by 0.17% if the tax cut was funded by a tax on households, or by as little as 0.02% if it was funded by cutting government spending. That’s an eventual increase of between 2400 and 20,400 jobs. By way of comparison employment has climbed by an average of 24,000 per month over the past year. It means that after 20 to 30 years the $8 billion per year holds out the prospect of delivering an extra month’s worth of employment growth.

That certainly echoes the long-held criticism of supply-side economics that it produces only marginal improvements over very long time spans.

Another common problem is the acceptance of Friedman’s ‘natural’ level of unemployment: our government does nothing to reduce unemployment below 5%. That figure is the accepted norm within the Australian Treasury and its longer term projections, such as in the Intergenerational Reports, use that figure consistently over many years (linked to stable inflation). While it is all but impossible to achieve zero unemployment, prior to Friedman’s approach unemployment at about 2% was considered ‘full employment’. If we now accept that another 3% of the labour force (over 300,000 people in Australia) should always remain unemployed, doesn’t that also have an impact on demand and production?

To me, as an economic layman, controlling the money supply seems to have become more difficult because financial institutions have created artificial financial products that do not appear to bear any relationship to their actual value. In relation to the GFC, there was a small number of economists and market analysts, who pointed out that the total value of derivatives and futures traded was greater than the money supply in the US and of the total value of the goods being traded – so something had to give!

Following Friedman’s approach, perhaps that situation indicated the money supply was too low but, in fact, it was too high – deregulation of financial markets had seen to that!

Friedman and other monetarists envisioned strict controls on the reserves held by banks, but this has mostly gone by the wayside as deregulation of the financial markets took hold and company balance sheets became ever more complex. As the relationship between inflation and the money supply became looser, central banks stopped focusing on strict monetary targets and more on inflation targets.

For that reason, some argue that Friedman’s theory has not failed but that governments have moved away from it. Rather than controlling inflation through the money supply, control is now more focused on interest rates set by the central banks. On the other hand, Friedman argued for freedom in the markets and deregulation is just a way of achieving that – so is there an inconsistency in his arguments?

A number of governments around the world, have engaged in increasing the money supply (quantitative easing) following the GFC but it has not increased inflation (and growth) as Friedman’s theory suggests. Instead national economies are stagnating or growing painfully slowly and employment and production are not rising significantly. So if increasing the money supply is not working what will?

Whichever way you look at it there are more and more questions and anomalies in the current economic situation not explained by Friedman’s monetarism or supply-side theory.

A Keynesian would increase government spending and, if necessary, government debt to stimulate the economy. Friedman, however, warned that government debt is bad because it encourages governments to allow inflation to rise as a way to effectively reduce the debt – which was how many governments paid the debt they had accumulated during WW2. But as explained in ‘Bankers 3 Democracy 0’, such inflation is resisted by financial institutions because they are the ones that stand to lose.

Finally, some investment advisers in the US are warning that there is a danger that America could face the return of stagflation. While advising that it is only a small risk at this time, they are suggesting that investors may wish to hedge their position by placing more of their investments in gold and government bonds. If even Friedman’s approach is potentially leading to stagflation, shouldn’t it also be abandoned?

Do we return to Keynesian economics? Although supply-side economists say it shouldn’t work, it worked for Australia in the GFC: the Rudd government provided cheques to households to spend. That was pure Keynesian because it allowed a demand-driven boost to the economy without changing the underlying tax base (and thus future government revenue).

Which Australian political party will be brave enough to stand up to the economists, including those in Treasury, and say your current economic theories aren’t working? – reconsider what you are telling us and tell us something that will actually work! There are other economic approaches available, such as Modern Monetary Theory (MMT) and what is sometimes termed ‘middle out’ economics which uses a demand-driven model that emphasises the capacity for spending of the middle class to drive economic growth. Perhaps it is time that government, and the Treasury, gave these approaches more heed because Friedman’s monetary theory and supply-side economics certainly aren’t working.

What do you think?

Why should we stick by Friedman’s approach and supply-side economics when it is clear they are not explaining current ‘anomalies’ or ‘paradoxes’?

How can we support an economic approach whose greatest achievement seems to be increasing inequality?

This article was originally published on The Political Sword

Like what we do at The AIMN?

You’ll like it even more knowing that your donation will help us to keep up the good fight.

Chuck in a few bucks and see just how far it goes!

Your contribution to help with the running costs of this site will be gratefully accepted.

You can donate through PayPal or credit card via the button below, or donate via bank transfer: BSB: 062500; A/c no: 10495969

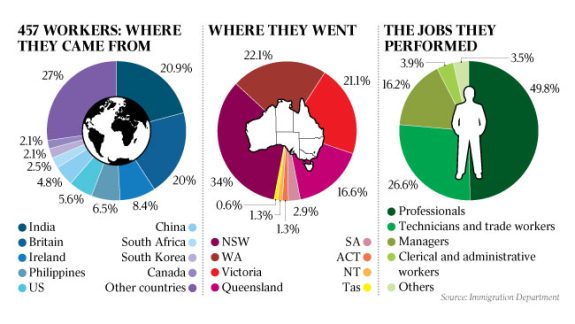

Here is what he writes,

Here is what he writes,

Workers in full time jobs fell for the third month in a row in April,

Workers in full time jobs fell for the third month in a row in April,

Neither major party understands this. So the government concocts this half-hearted effort to give the impression that they are about jobs and growth when, in reality, they are not. They believe a pool of unemployed is necessary to keep a lid on wage claims and other perks that management take for granted.

Neither major party understands this. So the government concocts this half-hearted effort to give the impression that they are about jobs and growth when, in reality, they are not. They believe a pool of unemployed is necessary to keep a lid on wage claims and other perks that management take for granted.