The last decade changed Australia.

We became a country who held asylum seekers hostage in concentration camps where they were regularly abused and offered no hope for the future. Various Australians were demonised – Muslims, those of Lebanese and African descent, the Chinese diaspora. The superiority of Western Christian civilisation was to be taught in schools.

We cut off services to remote Indigenous communities, unwilling to support their “lifestyle choices”, placed them on income management despite no evidence that it improved anything, took their children and locked up their youth in record numbers, some as young as ten years old, and rejected the invitation offered by the Uluru statement.

Our aged care system is in an appalling state. Lack of regulation and oversight has led to a private industry whose prime motive is profit rather than care. The heart-breaking stories from the Royal Commissions into the aged and disability care sectors should shame us all.

Prominent women have been bullied, harassed, intimidated, demeaned and silenced. Julia Gillard, Gillian Triggs, Yassmin Abdul-Magied, Christine Holgate, Sarah Hanson-Young have all been treated deplorably and it’s worth noting that Peter Dutton was one of the prime offenders.

During Dutton’s failed leadership coup against Turnbull, Liberal women were reduced to tears and threatened with the loss of their preselection. No-one denies this happened – many women spoke out at the time – but there were no consequences.

The rainbow community have been used as political footballs in the Coalition’s attempt to woo the religious vote. The country had publicly debated their right to marry, to study or work, to play sport, to aged care, to order a wedding cake or flowers, to pronouns – even where they go to the toilet had been endlessly pored over by conservative media.

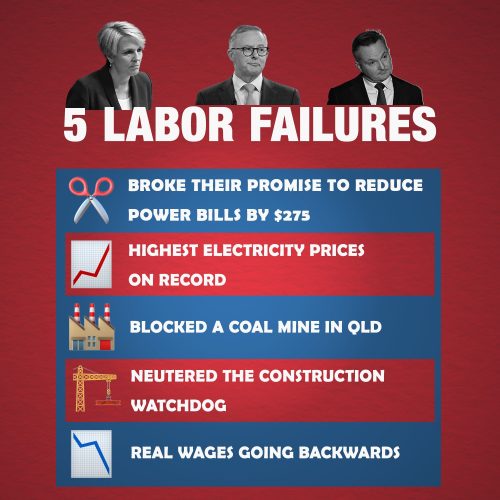

The Coalition set about demonising and undermining unions in order to remove the ability of workers to have a collective voice. They have kept unemployment benefits below the poverty level and cut penalty rates to the lowest paid workers. Wages have stagnated whilst cost of living has soared.

We gave tax cuts and concessions to the wealthy and then, in the name of budget repair, illegally pursued welfare recipients for historical debts with the onus on them to prove they didn’t owe anything.

So much has been made by the government of the need for coal and gas to provide cheap reliable power, that they refuse to admit that it is our very reliance on these fuels that is driving up prices. We stupidly sold our resource development to foreign shareholders who then determine to whom they will sell and for how much. It’s all about profit and nothing about benefit for local consumers.

Supposedly fixing this would risk national sovereignty – investors would be wary, they say. I would suggest any slack left by fossil fuel investors would be quickly picked up by investment in renewable energy, storage and transmission. But that wouldn’t please Gina and Clive and a few coal miners in Queensland who want to keep their exorbitantly high-paying jobs.

Housing has become unaffordable, not because of a lack of supply, but because of tax concessions and low interest rates that have seen the market swamped by investors. A look at politicians’ property portfolios, Peter Dutton’s for example, may explain why they are so reluctant to change this.

We have fallen from a world leader in introducing a price on carbon to a pariah, labelled the Colossal Fossil for our resistance to any action on climate change. We are now a global leader in wildlife extinctions.

Water has become a commodity for the use of miners and large-scale irrigators, or for landowners to sell to the government. The abuse and corruption has been exposed many times, but still it continues as our waterways dry up, fish die, and towns truck in water to survive.

There is no better example of this than John Norman – a cotton farmer charged with defrauding the Murray-Darling plan of tens of millions of dollars and causing significant damage to neighbouring farms. His property was in David Littleproud’s electorate and he is Littleproud’s ex-wife’s cousin. Despite being charged in 2018, I can find no record of prosecution to date though it appears he may have sold his property along with its significant water allocation.

Barnaby Joyce and Angus Taylor are also up to their eyeballs in this. Tanya Plibersek will have an uphill battle trying to sort this mess out.

One of the most disturbing factors of the previous government was their increasing secrecy – refusing to release reports, shutting down FoI requests, employing consultants rather than using the public service, contracts awarded without tender. But what is most chilling has been their attacks on press freedom.

Journalists’ homes and offices have been raided and they have been threatened with prosecution or defamation suits. The ABC has had its funding cut and had countless complaints from government and endless inquiries into its supposed bias, all concluding it is not. Respected journalists like Emma Alberici and Nick Ross have been sacked because the government didn’t like what they wrote.

We have had to have spelled out to politicians that pork-barrelling is, in fact, illegal – something they refuse to accept. The arrogance of government using public money for political gain, or the enrichment of associates, has become so entrenched that they believe it a legitimate right of power.

Bestowing positions as rewards for party loyalty rather than on merit and expertise is endemic. Appointing Sophie Mirabella to the Fair Work Commission in the dying days of government, a job she will hold until age 65 at a huge salary, was a prime example of this. They also gifted her husband Greg a senate seat in Victoria. Sophie has always had an eye for the prize.

Universities have also been under attack – locked out from Jobkeeper assistance, no foreign students, funding cuts, interference in research grants and courses, demeaned as out-of-touch indulgent “elites”. Anti-intellectual, anti-science rhetoric has emboldened climate change deniers and anti-vaxxers – groups the government actively supported and pursued.

We have become a hateful place over the last decade – suspicious of each other, greedy, unprincipled, uncaring, focused only on what’s in it for me.

The election showed the country is ready for a reset. It will be up to all of us to be part of that. We can and must do better.

Like what we do at The AIMN?

You’ll like it even more knowing that your donation will help us to keep up the good fight.

Chuck in a few bucks and see just how far it goes!

Your contribution to help with the running costs of this site will be gratefully accepted.

You can donate through PayPal or credit card via the button below, or donate via bank transfer: BSB: 062500; A/c no: 10495969