Paying the price

By Khaled-Oula Elomar

The COVID-19 virus and its effects are as real as you are.

Now many people, or more like conspirators, say that:

1 It has started with bat consumption. WTF? Bats have been eaten for thousands of years. Why the sudden problem?

2 It is manufactured in a lab by man. Anthrax, bombs, bullets and explosives are created by man, too. In fact, we are so disoriented that the Nobel Peace Prize is named after Alfred Nobel: The guy who discovered TNT.

3 It has started as a result of cell mutation from the 5G RF. If that were the case, then why is it only targeting lung cells? Why not all other cells within the human body?

Fuck all these conspiracies. Wake the fuck pp and realise that humans have fucked with nature for so long, now it is nature taking a stance against us and saying:

“… Oh, humans, settle the fuck down. You’ve screwed me over for decades now. It’s time for me to take control once again and put you back in your place. You are not the supreme species. If anything, how you’ve damaged me and other species including your own self by your choices and methods, you are fairly Evil. I call the shots here, humans.

You’re living your life but are susceptible to more harm because of your fragile state and health which resulted from your processed foods and the different pollutants that you release thus exposing yourselves and my other living creatures to.

You’ve killed each for millennia. Not that killing one another is acceptable but give me one fucking reason why you do kill one another? I’ve warned you many times to stop your ways, but you never got the hint. Hints like tornadoes, cyclones, fires, higher temperatures, floods etc, but all fell on death ears.

You think you own me, but I will show who is boss. I will take you back 150 years from now where everything was cherished, and nothing taken for granted. The environment was clean. There were no processed foods thus grossly affected your immune system. Food had more value than money.

Families stuck by one another and enjoyed each other’s company. Husbands and wives loved one another for who they are and not what they were or how much money they have.

A time where people ate little meat and more vegetables. A time where sugar wasn’t in everything that you eat.

An era where if you shook hands with someone, then you honoured that and deceit, though existent, but hardly practised. A time where kids enjoyed the outdoor activities, got dirty, skinned their knees and felt alive rather than being zombies stuck behind the evil screen.

Yes, granted that you still found wicked reasons to fight and kill one another but the scale of damaged and number of deaths is far less than the current days if you made a comparison in a specific duration of time. I’ve had with you and your demonic methods and practices. I’ll show you who I am and how I will break your fucking ego. You are nothing. Created from nothing and will return to nothing.

Once I am done with this virus, I will come at you in a different way if you haven’t learnt your lesson. I will always be watching you and what you do. Change yourself before I force you to change yet again. Abandon your desires and I will grant you ultimate Nirvana. Fucking twits …”

Nature works in mysterious ways. COVID-19 is its way now. It could be COVID-## in the future as it was H1N1 and H5N1 in the past. Enough with your conspiracies, please. We are doomed now because of our own actions and current deficient immune system.

Changing our ways, our own thoughts, our practices and looking after our health and each other is the way we can ensure that Nature Stands With Us and Not Against Us.

#changestartswithme

Like what we do at The AIMN?

You’ll like it even more knowing that your donation will help us to keep up the good fight.

Chuck in a few bucks and see just how far it goes!

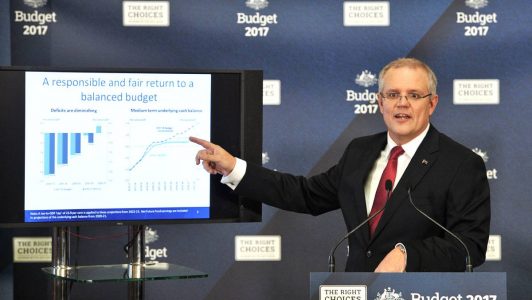

The government, we are told, is the same as a household, only much bigger. But it’s all balderdash! The problem is, the government is not the same as a household; our personal financial management, our household management, is not the same as the government’s financial management. The difference is simple. We can’t issue money. Only the federal government can do that.

The government, we are told, is the same as a household, only much bigger. But it’s all balderdash! The problem is, the government is not the same as a household; our personal financial management, our household management, is not the same as the government’s financial management. The difference is simple. We can’t issue money. Only the federal government can do that. Yes, we encourage our children to believe in Santa Claus and the Easter Bunny but at least, as the children grow older, they work it out. Why then do we continue to believe the “taxes are for spending” myth? Why, as adults, haven’t we worked it out?

Yes, we encourage our children to believe in Santa Claus and the Easter Bunny but at least, as the children grow older, they work it out. Why then do we continue to believe the “taxes are for spending” myth? Why, as adults, haven’t we worked it out?