Corruption viewed within fine print of super reforms

Australia’s union movement has steadfastly rejected the Morrison government’s latest proposed reforms on superannuation on the grounds that workers would be worse off if choices about such accounts were left to the banks rather than to themselves or their employers.

And in addition to leaving Australia’s working classes potentially being worse off for retirement, the proposed reforms would leave the banks richer and grant the government’s superannuation minister – presently, Jane Hume – with a set of new powers that would go unchecked and with zero accountability.

In essence, the government seeks to use its Parliamentary and legislative powers to overhaul the superannuation system.

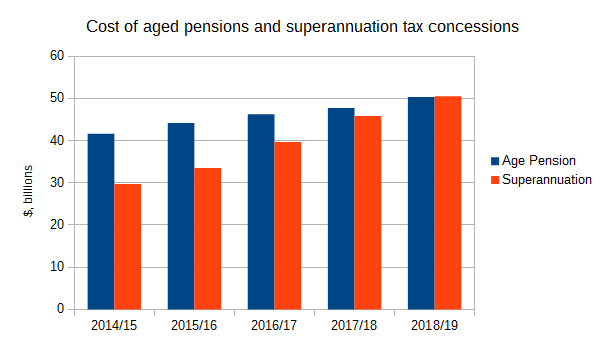

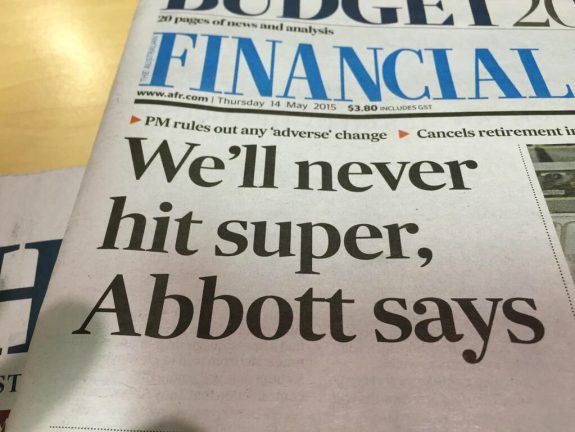

And doing so in a manner that leaves a trail of corruption in its wake, especially after the Australian Council of Trade Unions (ACTU) has recently called for an ending of a freeze on superannuation rates that have been an LNP government policy staple since 2014.

“The union movement stands ready to resist any attacks on workers’ retirement savings. Like with Medicare, we need to improve and strengthen our retirement system, which is already the envy of the world – not tear it down,” Michele O’Neil, the ACTU’s president, said last month when defending the status quo of the superannuation system.

Under the government’s reform proposals, whose exposure drafts and explanatory materials are being weighed up in the midst of a Federal Senate Inquiry on the Superannuation Sector, would take the rights of choice among superannuation funds away from workers, particularly those new to the workforce or to a new employer, and be steered towards any for-profit funds run by the banks.

The ACTU, by labelling these reforms as “predatory”, views the suggested reforms as being politically motivated and as an attack based on ideology, and have unsurprisingly called for their legislative defeat.

“The federal government’s superannuation reforms will shortchange workers and erode the hard-won retirement savings of millions of Australians,” Scott Connolly, the ACTU’s national assistant secretary, said on Monday.

“A worker could be locked into an underperforming for-profit fund that is funnelling money to shareholders through exorbitant administration fees – and be misled by the Government that they are in a good fund,” added Connolly.

The ACTU juxtaposes the Industry Super network of superannuation funds against the perils of the banking-based for-profit funds advocated by the LNP and the Morrison government, due to the fact that Industry Super-linked funds perform better via all profits going to each of its respective fund’s members.

However, under the government’s reforms, that would change, thereby leaving workers worse off in the long run towards planning their retirements.

“If these laws are passed, for-profit funds will have a systemic advantage over all-profit-to-member funds, leaving workers worse off,” said Connolly.

“The exposure draft legislation represents an attack on working people, their retirement savings, and the best performing and best-governed superannuation funds,” he added.

As the superannuation sector inquiry is scheduled to resume in the Senate next month when the federal Parliament returns from its summer break, and expected to wrap up in March, the Department of the Treasury highlights its reform package to include:

- Members being given notification upon whenever a superannuation fund fails an annual transparency performance test administered by the Australian Prudential Review Authority (APRA), and if this occurs two years in a row, trustees for such superannuation products are prohibited from accepting new beneficiaries into the product

- Providing certainty and transparency about the basis by which superannuation products will be ranked and published on a website maintained by the ATO

- Invoking a new set of standards to ensure that superannuation trustees work in a manner upholding its members’ best interests.

Employers will still be required to make contributions to an employee’s single nominated superannuation fund. However, wrinkles are being proposed to ensure that unnecessary fees and insurance premiums are not paid on unintended multiple superannuation accounts.

“It is no coincidence that administration fees are excluded from benchmark proposals, as for-profit funds performances will be overstated to members and potential members,” said Connolly.

The ACTU has also brought the recent memories of the Banking Royal Commission into recall, as the proposed superannuation reforms would grant extended powers to whomever its minister would be.

As Hume currently holds the portfolio for superannuation, as she has within the Morrison government since 2019, a bit of background about her history is required – especially since she is facing the prospect of having her powers expanded in a big way.

Although Hume served as a senior strategic policy advisor with Australian Super prior to her ascension to politics as a Senator for Victoria in 2016, she possesses a storied past in the banking sector.

Hume was a former Deutsche Bank Australia vice president in 2008-09 after previously working as a National Australia Bank sales and marketing research manager, investment manager and a private banker from 1995-99 before moving on to Rothschild Australia as a senior business development manager in the asset management division, and briefly as a key accounts manager from 2000-2002.

Any superannuation minister, present or future, would be given the power to possess the authority to deem as illegal any expense, investment, or activity, by any fund, at any time, as well as extending the preference for a single superannuation fund over any or all others while lacking the transparency is not required to give notice nor reason for those actions.

Moreover, the decisions of the minister nor any new regulations undertaking under the minister’s watch do not require to be challenged in court.

Given the context of what the Banking Royal Commission revealed, Connolly and the ACTU have called out the rogue nature of these reforms – as well as the extended, unchecked powers of any current or future superannuation minister for the government of the day.

“Despite the Banking Royal Commission finding for-profit funds blatantly rorting members, the government continues to favour them by making benchmarking based on net investment return,” said Connolly.

Also by William Olson:

Now is not the time for subsidy cuts, says ACTU

Qantas workers cannot be denied sick leave, says ACTU

Like what we do at The AIMN?

You’ll like it even more knowing that your donation will help us to keep up the good fight.

Chuck in a few bucks and see just how far it goes!

Your contribution to help with the running costs of this site will be gratefully accepted.

You can donate through PayPal or credit card via the button below, or donate via bank transfer: BSB: 062500; A/c no: 10495969