Firstly, let’s remember that from June 2007 to December 2012, before the introduction of carbon pricing, average electricity prices rose by 70 per cent, so the big hike we all endured had nothing to do with action on climate change. A 2012 report by the Productivity Commission found network services, or poles and wires, to be the single most costly component of electricity supply accounting for around 45 per cent of total electricity prices from 2007-2012.

Next, let’s get the terminology straight. We have a fixed price emissions trading scheme which was slated to move to a floating price in 2015 under Gillard, moved forward to 2014 under Rudd. This means that our current system has two months to run, after which time we were going to align with the EU market which is estimated to move to about $9 per tonne this year, a significant reduction from our current carbon price.

Abbott said “the average power bill will be $200 a year lower and the average gas bill will be $70 a year lower.” He went on to say the average family would be $550 a year better off with the rest of the saving supposed to come from a general reduction in prices of goods and services passed on by other businesses, many of whom claim they had not increased prices because of carbon pricing and would therefore be unable to reduce prices.

The Queensland Competition Authority’s report estimates that, if the carbon tax is repealed, the average electricity user can expect their bill to increase by 5.4 per cent, or about $76. This is less than if the carbon price remained, but prices will increase not decrease nevertheless.

Gas prices in the eastern market – Queensland, NSW, Victoria, South Australia, ACT and Tasmania – are projected to rise sharply in the coming years as exports and demand for domestic consumption increase.

Energy Australia said it is important for the government and community “to be aware there is no guarantee that final energy prices will move proportionately with the average carbon price reduction in wholesale energy market”.

AGL Energy says that it usually needs a lead time of months to make price changes, and that “non-carbon” factors will drive prices after July 1 this year.

A joint submission by power and gas companies cast doubt on Tony Abbott’s promised price cuts of 9 per cent for electricity and 7 per cent for gas from the abolition of the carbon tax warning “it is difficult to specify exactly how much electricity prices will fall once the carbon price is repealed”.

The submission argues the carbon price impacts vary by region, by supplier, by retailer and in many cases by individual contract. The carbon tax applies to the cost of electricity generation where fossil fuels are burned, which represents about 30 per cent of the electricity price. Network charges for transmission represent a “significant portion” of retail prices and these could rise on July 1, except in Victoria, and this will have an impact on electricity prices that may reduce any cuts associated with carbon tax repeal. In Western Australia and the Northern Territory the electricity price is determined directly by the government, so regulatory changes will take time to implement.

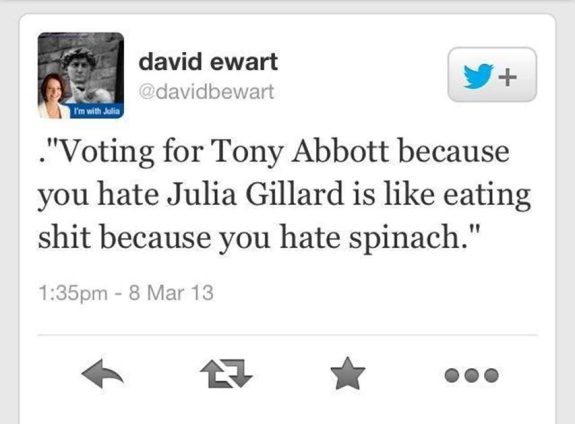

So when Abbott, Hockey and Corman tell us we will be $550 a year better off they are talking crap, plain and simple. They use a price that won’t apply after July 1 and ignore industry advice that prices will not go down. Even if we didn’t move to a floating price until 2015, any supposed savings would only be for one year.

Instead of collecting about $13 billion in revenue from polluters over the next four years we will be paying over $3 billion of taxpayers’ money to polluters. As Mr Abbott has chosen to keep the compensation package, this means over $16 billion difference to government coffers, or about $450 per household per year. Add to that the fact that every single expert has said Direct Action will not achieve our targets without a far greater expense if at all, and we will patently be much worse off financially and environmentally.

Frank Jotzo, Director of the Centre for Climate Economics and Policy at the ANU Crawford School of Public Policy, believes we should keep the fixed price on carbon.

“If it wasn’t for the poisonous politics of the “carbon tax”, the best option would be to stick with the gradually increasing fixed price, and keep it for longer. The effect on cost of living from the $23 carbon price has been minor, and most households are better off financially because of income tax cuts and welfare increases.

Impacts on industrial competitiveness have been negligible. Keeping the fixed price would cause no further impacts. The carbon price immediately reduced emissions from the power system, because it made some of the dirtiest electricity plants too expensive to operate. Lowering the price could undo many of the gains, bringing old clunkers online once again.”

The fact that companies are still announcing closures, even with the promised repeal of the carbon tax, shows how small a factor it plays.

Global investment in renewable energy dropped 11% in 2013, according to EY’s latest quarterly Renewable energy country attractiveness index (RECAI), with policy uncertainty in particular reducing investor appetite across many markets.

China closed the gap on the US at the top of the index, installing a record-breaking 12GW of solar capacity in 2013 and ramping up its consolidation effort to accelerate market recovery.

Germany remains in third place, but lost ground following the announcement of subsidy cuts and watered-down renewables targets by the new coalition government. Rapid solar market growth and a burgeoning offshore sector helped Japan to replace the UK in fourth place.

Ambitious targets and a series of large-scale project announcements have seen India jump to seventh place. Competitive bidding trendsetters Brazil and South Africa have also risen in the index thanks to a plethora of new projects awarded in 2013 auctions.

Australia has dropped from sixth to eighth spot in the rankings, off the back of the expected repeal of the carbon tax and review of the Renewable Energy Target (RET) creating an uncertain investment environment, particularly in regard to large scale renewable energy, EY said.

Australia’s largest renewable energy company, Hydro Tasmania, has posted a record $238 million operating profit. The state-owned power generator says it made $70 million from the carbon tax, exporting record amount of clean power to mainland Australia. The company was able to pay a $116 million dividend to the State Government. This will be jeopardised if carbon pricing is removed.

Nathan Fabian, head of the Investor Group on Climate Change, told the Senate Committee looking into Direct Action:

“My members are looking at the United Kingdom, Ireland, the United States, France and some South American countries as having more stable investment environments for low-carbon opportunities. Direct action is not an investment grade policy.”

Tim Buckley, from the US-based Institute for Energy Economics and Financial Analysis, told the same hearing that Australia was missing out on hundreds of billions of dollars being invested every year in renewables, in energy efficiency and in development of these new technologies, and the hundreds of thousands of jobs being created in China, Germany and in America.

When the economists agree with the scientists it is surely time to start thinking well this is the way to go, or should we decide what’s best on the basis of talk-back radio hosts and polls printed in the Telegraph.

So to sum up, removing the carbon price will not lower your bills, nor will it save businesses. Direct Action will not lower emissions. Uncertainty about the renewable energy target is costing us investment in a growing industry of the future and the jobs that go with it. And we are now seen internationally as lightweights, easy prey to corporate greed and unwilling to share the global burden of action on climate change.

Oh and just a heads up on a potential new rort – You may now become a “Service Provider” with the government’s Green Army romp. You can submit a tender for as many projects as you like and you will be paid $192,500 per project, $22,500 for administration, and provided with a workforce that you pay between $10.14 and $16.45 per hour with no superannuation. How many employers will decide it’s far cheaper to be a “Service Provider”?

Like what we do at The AIMN?

You’ll like it even more knowing that your donation will help us to keep up the good fight.

Chuck in a few bucks and see just how far it goes!

Your contribution to help with the running costs of this site will be gratefully accepted.

You can donate through PayPal or credit card via the button below, or donate via bank transfer: BSB: 062500; A/c no: 10495969