Smile, I am doing you a favour

By Barddylbach

Years ago, when I was young I had a Latin teacher and I didn’t like him very much. He was in fact English, least I think he was – whatever that might be – and he taught Latin. At the end of term, and sometimes on a Saturday morning, he would ditch Latin and set us some logic puzzles and twisters to figure out. This was mostly fun except when he occasionally threw in a never-ending staircase disguised as a riddle or a matrix with no solution. Illusions can be fun, but the type we are often confronted with today are deceiving. He was doing us a favour, but usually what he did was not fun, it was rather more like a smile through his beard with a gun.

And this brings me to the illusory, the wealthy but poor old ‘Jean’, and what will happen to Jean and the faeries if Labor get in, according to the Liberal corporate spin.

‘Case Study 1: Jean is retired with a large self-managed super fund. She receives $29,810 in dividends from bank shares and $130,000 from other assets. As the fund is in the pension phase, and pays $0 tax, Jean is currently entitled to a $12,775 rebate. Under Labor, Jean would lose that’.

Here’s the twister – Under the dividend imputation (tax) benefits scheme, Jean has an accountant called Peter, a stockbroker called John, a financial advisor called Scott, a bank manager called Malcolm and an industrious flurry of faeries; let’s call them Blossom, all living comfortably on coffee and coiffure in her handbag. By the way, she doesn’t read Rupert’s paper (no-one with any intelligence does), but that doesn’t stop Peter, her accountant from claiming the cost of depreciation she would be entitled to if she did. Rather like a sock allowance.

The puzzle – If she were to pay 1% of her bank dividends to Malcolm plus 10% of that in GST to John, subtract one tenth of the difference between her gross bank dividends and other assets from the remaining balance, donate 5% of her rebate from Peter to pay Paul whoever he is (but I’m pretty sure it’s Tony), allowing for additional entitlements of $1 for every day of the year in family tax benefit for each undeclared faerie in her handbag minus $4,344.34 depreciation, assuming we arrive at the same figure she would have received in the first place:

1) How big would her handbag need to be? (guess)

2) How many faeries are there actually in her handbag? (there is a solution to this)

3) How much would she lose? (hmmm …)

And the moral of the story is?

Oh, Jean you!

Now while some are cleverly racking their brains for the solution, here’s another treacherous question for the rest of us who prefer just to ponder.

Case Study 2: I have no solution for this one!

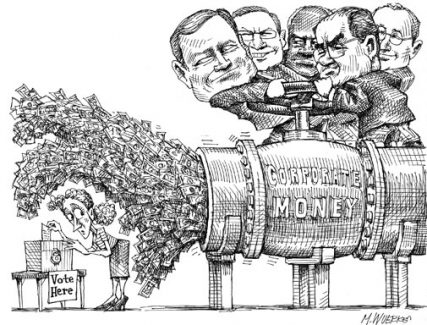

In conjunction with this story of Jean, shouldn’t we really be asking why we allow Malcolm Turnbull to give $30 million to Rupert Murdoch and News Corp so he can spend it for free on a beguiling Beatles TV advertising campaign to expand his Daily Telegraph market … you know the one that brainwashes the population with neoliberal capitalist lies, sensationalism and political blackmail. So everyone who pays for the Telegraph will obviously end up voting Liberal.

We are talking brainwashing the people, scaremongering, bought votes and bought with tax payer/public money. This is a shoring up campaign in preparation for the next general election, funds flowing the other way to political donations but get the same result. This is the treachery of this unholy alliance between media, money and the Liberals, the illusion of democracy and freedom of choice!

Why is Murdoch treated the same as Jean, so he can breed more pseudo-Jeans out there than know for their own good, let alone the good of others or the country? Why is this allowed, it’s not as if we don’t know about it?

Do we wait until the burglar points his gun at us and says “smile, I am doing you a favour”?

14 comments

Login here Register here-

ajogrady -

Jaquix -

New England Cocky -

DrakeN -

Christopher -

Christopher -

Blair -

RatMatrix -

etnorb -

Jon Chesterson -

Jon Chesterson -

Matters Not -

Matters Not -

Gavin

Return to home pageI am still trying to understand why advertising in the blatantly biased News limited media outlets is not considered a political donation.

Enjoyed this article!

Poor ole Jean …. struggling to exist on more than an old age pensioner … the poor dear, she must have been a Liberal voter ….

Jean seems to have the “Poor Me” victimised gene.

When you tax a corporation and then give it back to the Jean’s of the world, the income is no longer taxed. This wasn’t the intent, the intent was not to tax the income twice.

If you don’t pay tax, no refund is the correct result. Yet Labor doesn’t seem able to make the message simple. Bit like when Hewson tried to explain his GST with a cake.

I’ll add that the more startling observation for me is why Jean’s substantial income is not taxed at all?

i get the feeling “Jean” would never votr Labor anyway.

Good on you Bill! We need to get the fascist vandals out of government.

It seems logical to me that countering the ‘Jean ad’ with, say, a ‘Joan ad’ who exists at the other end of the socio-economic spectrum would be an effective neutering agent.

If the Terrorgraph readers are so gullible as to believe the Jean ad then surely they would be just as easily swayed to Joan’s situation?

The only negative I can think of is that repugnant, liver-spotted arse-barnacle Murdoch would get more advertising revenue.

Alll I can say is fck Jean, fck ALL Mudrakes right wing, lying, flat earth so-called “newspapers” (sic) & just hope that Fairfax etc will have some balls with all the misinformation etc currently being sprouted by the Mudrake press, all the inept, lying shock jocks & any other companies or persons who have obviously not really sat down & studied jut what Shorten is proposing. Long live the “free press” (?) here in Australia, what a wonderful job they are always doing, NOT!!! Great article Barddylbach!

LIBERAL-GOVERNMENT SCAM

The dividend imputation (tax) benefits scheme that argues or assumes gross company profits really belong to shareholders is a tedious, tenuous and circulatory argument, worse it is an excuse and a Liberal-Government scam. The company is in business and produces goods and services creating profit, not the shareholders who are indirect or secondary beneficiaries as investors… and ‘owners’ is also misleading – Do any of us own the government we elect or its ‘public’ assets (semantics)? The company is legitimately taxed as the primary operator and it is corporation tax, just like the rest of us pay income tax.

Whatever you argue it is still a dodgy loop to feed the wealthy few, while gaining some extra votes from upper middle incomes. The middle and lower incomes gain very little proportionally and the lower you go, the closer it gets to zero. It is not responsible government to re-distribute wealth from the many ‘have-nots’, strugglers and the poor to the wealthier few, it has always been socially and morally expected to be the other way round, just a question of how much – a balance. So we can call this forced trickle-up economics, unlike trickle-down which the Liberals also rely on, and of course is a busted myth.

So nice re-frame still whether chicken or egg. It’s a corporate tax dodge whichever way you look at it, a large global corporate declares all its profits under shareholder earnings (after it has already syphoned off much of it into an off-shore tax haven); and along come the biggest shareholders, both private millionaire individuals, holding companies, banks, insurance, investment firms and superannuation schemes, who claim it all back either offset under corporate losses from their own operations or (in the case of wealthier individuals) through the dividend imputation (tax) benefits scheme.

Indeed there will be a very small number in the middle-low income group who would be able to do this and what do the Liberals and Scott Morrison do, not even a middle income package scare tactic but the very lowest 610,000 income earners under $18,200 where hardly a few if not none, zilch would have such shares and holdings or be ineligible to claim it.

Nice dodge and great cover for the Liberals to pull the wool over the public’s eyes and get some false electoral mileage out of it, a LIE to fudge the next general election, once again.

Is any of this untrue?

UPDATE: LIBERAL SCAREMONGERING & LABOR RESPONSE TO REPEAL THE OBSCURE ‘ DIVIDEND IMPUTATION (TAX) BENEFITS SCHEME’

Questions first: (1) Did you find out the answer’s to Jean’s Puzzle? (2) Will Jean be needing a smaller handbag after all? (3) Have we scared off the faeries?

…and yes I know some of you are wondering who Jean is and if she even exists, let alone as it’s claimed, to be a pensioner. We do know she can’t be struggling on a combined pension income of $170,000 plus per annum including her dividend imputation (tax) benefits refund, and she pays no tax! And Jean isn’t as poor as the Liberals tell us, what did Scotty say, ‘one of 610,000 pensioners on less than $18,200 – hell she earns ten times that Scotty my friend, where do you get your ‘facts’ from?

Helicopters for Bronwyn, Carribean cruises for John, an expensive handbag or two or three for Jean to take her faeries with her everywhere she goes (all in the retirement honeypot), and the next general election in the ‘BAG OF THE BIG BAD WOLF’ for the public – by Liberal bribes, puffing and blowing, and imputation.

Here is Labor’s genuine and informative response to the current disingenuous fabricated Liberal, Telegraph and Australian media propaganda and electoral hearts scaremongering campaign – No lies, propaganda and obfuscation here!

‘Over the past couple of weeks you might have heard some wild claims in the media about Labor’s plans to close an obscure tax loophole that 92 per cent of taxpayers can’t access and have probably never heard of.

Here are the simple facts: Labor’s reforms to excess dividend imputation credits will crack down on a tax loophole that mainly benefits millionaires who don’t pay income tax, and we’ll use the money we save to improve our schools and hospitals.

Under Labor’s plan, no Australian will lose a cent from their super contributions, no one will lose a cent from their pension and no one will lose a cent from their share dividends. Not a single cent.

And we’ll protect Australian pensioners – with Labor’s new Pensioner Guarantee.

Labor believes in a fair go for pensioners. We know they are struggling with the cost of living, so we’re making sure that pensioners and allowance recipients can still access cash refunds.

This protects pensioners while still delivering a budget improvement of $55 billion over the decade. That’s the fair thing to do.

I know the age pension is not a king’s ransom, it’s a modest sum. This is why Labor has a strong set of policies to help pensioners with the cost of living. In addition to our new Pensioner Guarantee:

We’re going to make it more affordable to see the doctor or a specialist, by abolishing Turnbull’s Medicare freeze.

We’re going to help with rising electricity bills, by keeping the energy supplement for pensioners.

And – unlike the Liberals – we’re not going to increase the pension age to 70. We believe Australia should have the world’s best retirement savings system, not one of the developed world’s oldest retirement age.

Australian pensioners will always be better off under Labor.

I understand some people who pay no tax and have millions in super and shares will wish they were still getting a cash bonus from the tax office each year. But if we leave this loophole open, pretty soon it’s going to be costing Australia $8 billion a year.

$8 billion is more than the Commonwealth spends on public schools, or childcare. It’s three times what Australia spends on the Federal Police. Giving this kind of money away in cash from the tax office isn’t sustainable and it’s not fair.

Politics is about priorities and choices.

In the Labor Party, we choose better schools and hospitals. We choose more resources for our kids’ education and shorter waiting lists for surgery. We choose tax relief for working and middle class Australians.

We’re making the big policy choices in opposition, so we can do the right thing for Australians in government. Today is another step.

Thanks for standing with us’.

Jon Chesterson – yes you have faithfully reproduced the current ALP political line via a simple cut and paste of a press release. Congratulations on that achievement. While this might be a progressive leaning site have you anything to add that goes beyond reproducing blatant ALP propaganda?

Are you aware, for example, that once upon a time when Labor strongly supported dividend imputation? If not then why not?

Over recent times, Bill Shorten, Chris Bowen, Jim Chalmers, Andrew Leigh et al have advanced the line that policy X:

In a sense, they have advanced a principle on which they hope (presumably) to underpin a future administration. Congratulations are in order. A set of principles in advance of assuming government. Nevertheless, that calls into question as to how far that sustainability principle will be universalised. As Chomsky noted:

Will we see Labor politicians leading by example (in this time of unsustainability) by reducing their salaries, daily allowances, pensions and like? You know – rising to the standards they apply to others.

I suspect not!

JC @ 3:12pm “Is any of this untrue?” No, all true and well said. Haven’t seen that Labor statement before, good to see they’re taking an axe to the more outrageous sections of the tax system.

ABC news is running a story today where someone entitled tax dodger claimed $760,000 in tax deductions on income of $27,000 for a holiday home that was available for rent for only about 5 weeks last year.

http://www.abc.net.au/news/2018-03-28/holiday-home-tax-deduction-rorts-targeted-by-ato/9593834

This is how ridiculous the tax system has become, so skewed that ‘investors’ are able to offset ‘investment’ property deductions against unrelated personal/PAYE income. There is a virus in the system that needs to be exorcised, send the cheats to the backbench, they’ve forfeited their right to make decisions on behalf of the community.