We need to talk about Jean

This week, in response to Labor’s announcement that shareholders who pay no tax will no longer be getting cash back from the government, the Herald Sun introduced us to Jean.

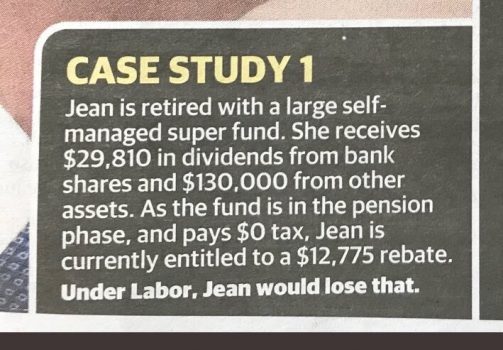

Case Study 1: Jean is retired with a large self-managed super fund. She receives $29,810 in dividends from bank shares and $130,000 from other assets. As the fund is in the pension phase, and pays $0 tax. Jean is currently entitled to a $12,775 rebate. Under Labor, Jean would lose that.

Now, let’s just get something straight right up front. Jean only ever got this cash back in the first place because Howard and Costello wanted to sure up her vote in case she was tempted by racism to vote for Pauline Hanson. This is not a usual way for governments to manage shareholders and company tax – Australia is only one of four countries that offers such a scheme and the original dividend imputation policy designed by the Keating government had no such rort, I mean perk. I meant rort actually.

But, now that we know about Jean, who ‘would lose that’, I think this is the perfect time for us to talk about Jean. We should thank the Herald Sun for kicking off this healthy discussion.

Let’s start at the beginning. We knew the Liberals, in concert with their media arm, the Murdoch press, would launch a propaganda scare campaign against Labor’s very sensible, fiscally responsible, wealth-inequality battling policy to no longer give self-funded retirees cash they don’t need. How did we know? Because that’s what the Liberals and their media arm, the Murdoch press, exist to do. The sky is falling. Everyone is ruined. The economy will rise up like an angry god and smite us all for hurting those who have bestowed trickle-down wealth upon us. And so on and so forth.

I must admit, it’s a sad turn of events that the likes of Leigh Sales on ABC’s 730 is also playing this game, seeking out Lyle-we need those dividends to live-Essery, to show their sad sad faces on TV, to tell Labor how naughty and mean they are for hurting Jean and Lyle, who did nothing to deserve this. But that’s the thing. Jean and Lyle did do nothing to deserve this magical cash-back bribe from Howard and Costello, other than possibly considering voting for Pauline Hanson, and no one should be rewarded for that dirty idea.

But, now that the likes of Jean, and the ABC’s Lyle, are all over the media sharing their suffering, and being given a national audience to urge people not to even consider voting for the possibly-Communist Labor Party who want to spend Jean and Lyle’s cash-back on evil things like schools, healthcare, income tax cuts for workers who haven’t had a pay rise in years, and have the highest house prices and power bills of any generation ever, I have three questions:

1) Why am I meant to be sympathetic to Jean and her poor share portfolio, but I’m not being asked to be sympathetic to people with disabilities and the unemployed who are constantly being bullied and threatened by the Turnbull government who is working as hard as they can to pull their social safety net out from under them, leaving them destitute and possibly homeless? Could they possibly move in with Jean?

2) Related to the above, why is cutting welfare spending framed as a perfectly legitimate government policy, responsible in fact, in order to do the ‘heavy lifting’ job of ‘budget repair’ in response to a supposed ‘debt and deficit disaster’, but saving billions by not giving people with share portfolios most of us could never dream of owning, nor the tax accountants to minimise our tax to zero to help fund it, is apparently bad bad bad?

3) Why does Lyle get to tell his sad ‘my share portfolio might need to be rearranged’ story on TV, but we don’t get to hear the stories of workers who are locked out of their work for asking for a pay rise, or the people being villainised for being unemployed, or the families of children who attend underfunded schools, or the single-mother who can’t afford to take her child to the doctor because of Liberal cuts to Medicare? Why do the Liberals and the media, not just Murdoch-run, but Fairfax and the ABC as well, give Jean and Lyle a run, but don’t tell the other side of the story?

I would like to talk about this please. Because, the problem is not just this story. This same situation happens time and time again, political story after political story, the frame is always the same. I think Jean is just the wakeup call this country’s political landscape needs. What is the society we really want, and how are the Liberals, their media-arm and their rusted-on self-entitled Liberal voting Jeans and Lyle’s stopping us getting that? And if we’re really serious about doing something about wealth inequality, how are we going to get there with this tsunami of elite and powerful opposition against positive change? Answers can be posted below, cheers.

74 comments

Login here Register here-

Alpo -

Sue -

ajogrady -

Janet Simpson -

Ill fares the land -

Henry Rodrigues -

Keitha Granville -

Peter F -

Kaye Lee -

wam -

Phil -

Rossleigh -

Kaye Lee -

babyjewels10 -

New England Cocky -

Zathras -

Harry -

Harry -

helvityni -

Conrad -

Christopher -

Kaye Lee -

Jaquix -

Janet Simpson -

Janet Simpson -

Janet Simpson -

Janet Simpson -

Janet Simpson -

Ria young -

Janet Simpson -

Stephen Brailey -

Cubism -

Kronomex -

Harry -

MikeW -

Harry -

Zathras -

mrflibble4747 -

helvityni -

Geoff Andrews -

GraemeF -

townsvilleblog -

Janet Simpson -

Wun Farlung -

Harry -

Jon Chesterson -

Pete Petrass -

Timothy Nicholson -

paul walter -

paul walter -

paul walter -

Kaye Lee -

paul walter -

corvus boreus -

paul walter -

Kaye Lee -

paul walter -

Kaye Lee -

paul walter -

Kaye Lee -

paul walter -

Kaye Lee -

paul walter -

Kaye Lee -

Zathras -

helvityni -

Henry Rodrigues -

paul walter -

Paul -

paul walter -

paul walter -

Kaye Lee -

helvityni -

Cool Pete

Return to home pageVery good article, Victoria!

The Media are completely out of control, and now the ABC has completely lost the plot and has become the Liberal Pravda of Australia.

This is a post I wrote for The Guardian today:

“….deleted….”… Gees, seriously, I stopped writing this post to double check on the text of my post to The Guardian, only to discover that it had been DELETED!!!

In short, in the post I commented on today’s ABC news where the news of Dutton’s racist idea about white SAfrican farmers and the SA state election were reported.

For the Dutton story the ABC interviewed the leader of the Nationals and then the leader of the Greens with Alex Bhathal (the Greens candidate for tomorrow’s Batman by-election) standing by his side.

For the South Australia state election they interviewed the SA leader of the Liberal party S. Marshall and the leader of SABest N. Xenophon.

At the end of the post I asked: “Who is missing?”…. The point was: In both stories not a single representative of the ALP was interviewed!!!

But as I now know, the post has been deleted…. Telling the truth is becoming dangerous in this country!

Have I got this wrong? Jean earns nearly $160,000 per year in retirement? And then gets nearly $13000 from the government? And we are supposed to feel sorry for her? Most people who are working full time don’t earn that much.

The L/NP and the MSM are a criminal cabal that is stealing our country and destroying our democracy. The people of Australia deserve a better media but will they vote against the corrupt L/NP. Australia has more in common with Colombia than with the United States as far as government corruption goes but will Australians see the L/NP for what they are, corrupt traitors to Australia. Below is an extract from Game of Mates:

In the United Kingdom, Singapore, Switzerland, Sweden, the Netherlands and Hong Kong, they found no-one; not a single billionaire. In the United States they found only 1 per cent of the billionaires to be politically connected. But four countries stood out.

In Colombia 85 per cent of the billionaires were politically connected, in India 66 per cent, in Australia 65 per cent and in Indonesia 64 per cent.

That’s right, on this one rough and ready measure, Australia had more in common with Colombia than with the United States.There are none so blind then those who will not see.

Very persuasive, but at the same time you have used the same emotive clap-trap as the media do. Schools and hospitals…blah blah blah. Many people with much smaller asset bases bought shares when encouraged to do so by Howard (google it) and based their super and retirement strategies on the law as it has been. I can see the logic of the ALP decision, but I am 74 and I don’t want to lose my $7K pa, after I saved and scrimped to ensure my old age would not be impoverished. To change a law like this without reasonable warning, or without “grandfathering” is to hurt many small time share holders who received shares in demutualisations like NRMA or floats like CBA. These people may also be the true believers who give out ALP How To Votes in cold, wet, hot, windy conditions year after year. If Howard should never have introduced this, then scale it down or out slowly, so those who are not wealthy can make other arrangements. I for one acted on advice and have done nothing wrong, I am not wealthy and am not bleeding the system dry. The ALP should do its homework first.

The same day as this Pensioner Hit was announced, an academic reported that Australia is forgoing billions in taxes from the mining industry….why not start there for “schools and hospitals”? Oh, yes, they can spend $20m reacting to such a proposal. Retirees are so much simpler to attack.

Of course the battlefield of retiree taxation is littered with entitlements. If Jean was a normal taxpayer, that income would result in tax of around $46,000 (after a tax offset for franking credits). So, the tax difference between Jean and a “normal” non-retiree is around $58,000 – and a normal taxpayer would need about $200,000 income to pay that much tax (these figures are “rough” – if you want to pick them apart after doing them more accurately, knock yourself out). The difference between Jean and a normal pensioner is that they have around $24,000 of cash from their pension: Jean has about $171,000. Where is the “fairness” test instead of the “entitlements of the greedy” test?

The reality for the greedy Jean’s of the world is that super funds in pension phase should never have been exempted from tax – or the pension they should never have been exempted from tax. Having both in lace is simply impossible to sustain – but the party that has the strength to address this (likely to be Labor – the LNP would never alienate its voter base in that way); will be utterly crucified by the gutter press. The Jean’s need no help from the taxpayer purse, but the press scream about how Jean will be financially crippled by the proposed change. As usual, no intelligent debate ensues.

Alpo – I agree. I noted the ABC on Thursday with the story of Hinch. In the morning ABC news, there was a subtle inference that he might have been pissed, for the sake of embellishing a non-story (70 year olds fall over and hurt themselves every day and don’t get into the press) – and his protestations that he had 2 glasses of wine only were almost laughingly mentioned. By the evening, the ABC was virtually leading the story with the part about him drinking, as if to say that he definitely was pissed. This is farce in the name of news. It is even worse from the ABC, because it, of all of the gutter press, should be held to a higher standard. .

Great rebuttal to the nonsence and utter BS being peddled by the usual culprits, Murdoch’s minions, now augmented by so called ‘intelligent’ journos on the ABC and even a finance reporter masquerading as a financial guru on SBS namely, the dappish Ricardo Gonsalves, who reports the end of day results of the sharemarket and then imputes that it is all down to the brilliant leadership of the golden Turdball. The whole media are just grubby toads seeking to get noticed and gain some recognition, or reprieve in next round of staff load shedding. As for that poor lady whose considerable income has been tax free since Howard’s and Costello’s ever so generous handouts, tough luck. The workers whose take home pay was cut have more reason to be resentful than her.

If Jean receives $29000 in dividends she has a hell of a share portfolio !!

I am confident that over the next 12 months the Labor party will release policy outlining future benefits for all pensioners, self-funded or not. Let us never forget THIS LNP government are the ones who took away the health card for self funded retirees, and the energy supplement, not to mention changes to assets tests. Retirees have lost a hell of a lot more over the past 2-3 years than Jean, and they do NOT have the luxury of her income.

Some people in the dividend imputation world have incomes much higher than Jean so let’s start comparing apples with apples.

More examples please of the wealthier end of this stick and let’s start lobbying the Labor party to make sure that the bottom end is helped so they DON’T lose out.

@Keitha — Absolutely.

Jean’s weekly income is $3,073 without touching her capital. If her bank shares are with the CBA, they alone are worth over $1 million.

The welfare handout she receives from the government is a little more than what a single person on Newstart is expected to live on for a year.

The time to talk about it, beyond no tax no rebate was not days before an election when labor was never going to get a fair hearing. Shorten gave Di’s boys and slimy X an unexpected boost on top of his silly adani comments with Jay standing next to him.

I do not credit shorten with political nous and if he uses any of the 6 foci, before exposing the economic mismanagement of the LNP, for the next election he will fail.

The point is no tax no refund is a good principle.

Oh spare us Janet Simpson – that two word slogan “Pensioner Hit” says so much more than you realise.- it undermines your entire following argument which is centred wholly on self interest.

Janet, if you’re getting a $7000 rebate then you must be getting an income of about $23,000 in dividends. Most companies would be around three or four percent, but even if we assume that you have only Telstra shares which are paying about eight percent, that gives you a share portfolio of nearly $300,000.

While I understand that nobody likes to be going backwards, are you telling us that these are your only assets? If so, surely you’d be eligible for a part pension at least.

Janet wants us to hit mining companies for the tax they should be paying. Apparently she doesn’t realise that the tax they do pay is what is being handed back to shareholders like her in refunds for excess franking credits. Every one of those refunds reduces the amount of company tax collected by the government.

Alpo. I’ve also had comments deleted on The Guardian. I used to pay my $100 a year but don’t any more though I still get their daily emails. I’m running out of hope altogether.

It appears that Jean has established a nice retirement income nearly equal to a back bench politician without the responsibilities of misgovernment. But there is no reasonable reason for her to receive the about $12,000 cash rebate because there is obviously no financial need as the SMSF is in the pension phase and pays no tax. No work effort, no tax paid, no cash tax rebate required. QED.

I hate to quote myself but on a similar thread I suggested that as a self-funded retiree (like myself) all she theoretically does for society now is to take up space and consume resources.

She didn’t technically earn that rebate from “the sweat of her brow” but she wants to make others who did sweat for that money, pay it to her just because she’s entitled to it.

So she’s made some wise investment choices and good luck and well done to her, but isn’t it time she put a bit back into the country that provided her with those opportunities?

She didn’t do it all by herself. Other people also paid taxes to provide her with the roads, schools and hospitals she’s used throughout her life.

I’m entitled to a much more modest refund but I simply don’t bother. After the Tax Agent takes his cut it’s nothing to get particularly excited about. I’m just happy enough with the zero tax payable on my own pension fund without resorting to greed to grab as much more as I can get.

I realise others have different circumstances but Jean is far from “typical”.

If the goal is to reduce inequality then fine, make sure those who are very well off have some of their capacity to spend cut back, like Jean. She can well afford it.

But as it stands this measure will also negatively impact quite a number of retirees who receive a few hundred or several thousand dollars PA in imputation credits. Is that what we want, to also cut back the lower income retiree?

I predict that Labor will end up modifying this ill-thought out policy by putting a cap on the maximum in imputation credits to some figure that ONLY hits the very well off as otherwise Labor might see its electoral lead evaporate and the Coalition could get back in.

Disclosure: my wife and I are self-funded retirees who receive $4000 or so PA in tax credits. We are comfortable but hardly wealthy.

Jen Simpson:

I am with you. Grandfathering is an option but I think simply putting a cap on the cash for imputation credits would exempt retirees like you and I. Labor could regret this if they do not quickly modify this policy.

If Labor is trying to “repair the budget” it should focus first and foremost on the big end of town, not hit those who are likely to support it.

Oh and the federal government does not need taxes to spend. Taxes serve to control demand and hence inflation and to reduce inequality.

Harry, we are in similar situation as you, we are reasonably well off, but not wealthy….I too hope that Labor will modify this policy.

The selling of this policy has been a shambles. No warm up period, no explanations, no reassurances to the many non-wealthy part-pension folk. The result: so many questions, so much anxiety, so many bitter letters in the newspapers. Shorten gets a Fail score for this. Is he so dumb as the non-selling of this plan suggests?

Go Harry, we’ve got to get traction on it’s spend then tax. Taxes don’t ‘pay’ for anything that the Fed Govt spends. I am an economist and feel like I’m a broken record, a conspiracy theorist. Have known how money works for 30 plus years. The banks create all the new money with a franchise given by our corrupt govt.

Conrad,

The Labor Party are not in government and probably won’t be until March next year. Any legislation would then have to be debated in the house, voted on, and then sent to the Senate who then often ask for amendments and the process starts again.

To say “No warm up period, no explanations, no reassurances to the many non-wealthy part-pension folk” is hardly fair. They have 12 months to flesh out the details before the election and announce other measures that may be relevant. The legislation then has to pass both houses. The commencement date will be some time in the future. Surely that gives investors and their advisers enough time to consider what to do. You might be better off spending some of your capital.

If people are currently eligible for a part pension, if they get less money for excess franking credits then they will get more pension. Also, if the Coalition are returned, they want to cut company taxes which immediately cuts franking credits (and raises income tax for those who still pay any).

Fantastic article Victoria! Very, very good. Best Ive seen so far!

Janet Simpson & Others, you can be sure the accountants and financial advisers are already plotting and planning how to rearrange your affairs to ensure you get your $7,000 some other way. There may well be more productive investments with better returns, for you. There will be a leadup to this policy of at least 18 months anyway, so stop panicking

Labor also has policy announcements coming for pensioners. And income tax cuts for workers. There are far better ways of spending $6 billion a year currently going out in “cash backs” (back for what?) to overwhelmingly wealthy people. At least 75% is going to the top 10% of income earners. One received a $25 million “cash back” cheque. That is just not sustainable. Future governments (including Libs) will thank Labor for bringing in this change. Saves them going through the pain themselves. Meantime, they pile on the garbage.

Jaquix

It is not a sign of panic to point out the flaws of the currently announced plan. That is how amendments and tweaking get done. Patronising won’t advance the argument one bit.

Phil

And if the best you can do is an ad hominem argument, and with a nasty tone, you have added nothing to the debate. What’s your story?

Rossleigh.

and your point is???…..

Kaye Lee

Your logic defeats me. see Harry’s comments. They are rational.

Zathras

how do you know if she does any volunteering, charity work, donations etc? you make assumptions you have no right to make.

My interpretation of the tax law regarding double taxation is as follows. The company issuing dividends does so from after tax profits. Dividends are taxable as income in the hands of the recipients. This is what the tax law was trying to deal with. Obviously if the recipient does not pay any tax on superannuation disbursements after the age of 60, the no double tax applies. Dividend income added to other income outside of superannuation, suc,h as interest from bank deposits is taxable, do double taxation would apply if the total amount of income is greater than the threshold applicable to aged residents, which I think is about $27,000. If this lady is getting huge sums from superannuation, then this must be the result of Howard’s super changes encouraging rich people to put $1,000,000 into super some years ago, before the GFC. If it is not from a superannuation fund, then it is taxable anyway, and the franking credits would be a deduction. I somehow think that the story told is not really factual.

http://www.abc.net.au/news/2018-03-16/grattan-what-batman-soft-voters-say-about-bill-shorten/9554454

Another great policy decisions by the Labour Party following their announcement to direct the health insurance rebate money directly to Medicare. The trifecta of socially responsible policy would be to end the ridiculous funding of private schools and put the money back into public education where it belongs. We’d be just a little bit further along the road to being the smart lucky country we used to be!

My concern is that the COALition will tear Labor to pieces over this. They’ve been trying to get the “sovereign risk” label to stick to Shorten over Adani but have got no traction. The single biggest risk (arguably the only risk) associated with investing in superannuation is sovereign risk. Shorten just announced a great big sovereign risk policy wrt superannuation. The COALition will make damn sure that every voter goes to the next election asking themselves “Who do I trust with my retirement income? Bill ‘sticky fingers’ Shorten or Mal ‘responsible economic manager’ Turnbull?” Of course that’s bulldust, but it’s perceptions that matter in politics not reality. If reality mattered then we would never have COALition governments.

The government are on the rails and the PM is staring at 30 negative Newspolls and a possible leadership challenge – Labor just handed him a free pass. I hope tomorrow’s Batman result makes it worthwhile.

And so the LNP fantasy based scare campaign rolls on with Labor portayed as the evil orcs and ogres out to destroy the lifestyles of the beautiful elves of the gold pedestals.

You know you understand modern money when…

You know the difference between a currency issuer and a currency user.

You know that Australia, the US, UK [or name your sovereign currency-issuing nation] will never be like Greece.

You know that currency-issuers can never run out of their own money.

You know that too much foreign-denominated debt can limit a currency-issuing nation’s options, but debt denominated in their own currency cannot.

You know that interest rates are established by the central bank, not by market forces.

You know sovereign (currency-issuing) nations will never be forced by “markets” to pay interest rates above what it desires.

You know that taxes simply remove money that first came from the government when it spent them into existence.

You know that taxation creates demand for the sovereign currency and influences economic behavior but in no way funds the government.

You know that it is our real resources that are scarce and that money is always able to be issued to utilize (or preserve) scarce resources.

You know that involuntary unemployment can be ended anytime with the right kind of tax cuts and spending increases.

You know that recessions can always be ended with the right combination of tax cuts and spending increases.

You know that if the government “tightens its belt” during a recession, the recession only gets worse.

You know that the fiscal policies of a currency-issuing government are nothing like the budgets of a business or household.

You know that real fiscal responsibility means the currency-issuing government is responsible for balancing the economy, the needs of the people and the sustainability of resources, not balancing the accounting of tax receipts and spending.

You know that the national “debt” is actually the net savings of the nation’s currency around the world.

You know that reducing the “debt” means reducing those savings.

You know that children and grandchildren can never be burdened by the accumulation of such savings.

You know the government can always pay its bills and any future financial obligations when the time comes, and that what really matters for the future are the real resources needed by the people.

You know that if a nation has the necessary human and real resources, it can always afford to deploy them for needs such as healthcare or modern infrastructure.

You know that nations can always afford to invest in their human capital such as education, research & technology development.

You know that most financial crises are related to too much private debt, not how much money the government had issued into the economy over time (what many call “deficits” and “debt” but are really net injections of new money accumulated as savings).

You know that businesses grow when they have more customer demand, not because they have less taxes or lower interest rates.

You know that customer demand comes from growing household incomes that are subsequently spent.

You know that taxing reduces customer demand and that government spending increases it.

You know that all sovereign nations can use modern money for the well-being of their people, and you are intent on seeing that happen!

Poor Jean, maybe she will have to cut back a little on her Moet her Grange. Don’t think she will be drinking pensioner piss like most of us retirees do.

“Class warfare” is a feature of neoliberal politics because it sets up one group against another. Both the Coalition and Labor do this but I much prefer Labor’s overall, despite the monumentally poor timing of their recent tax announcement and their stupid goal of returning the budget to surplus, somehow……

But this is the sort of nonsense you get when you accept the prevailing, but oh so damaging paradigm that our national government, which creates money out of thin air (as it enacts laws out of thin air), requires out taxes before it can spend. OK, that IS the case for you and I, business, State and Local government. We are currency USERS, but our national government is a currency ISSUER. It can spend without limit if it so desires. Of course, there are ALWAYS limits, just not any financial limits.

There are real and ecological constraints, because we can run out of people, skills, technology, equipment, infrastructure, natural resources, and ecological space.

So, why do we pay taxes? There are many distributional, or microeconomic, functions which the tax system fulfils. However, at the macroeconomic level, the purpose of taxation is very simple. It is necessary for people to pay taxes to destroy (to use a provocative word) some private sector spending power, to make room within the economy for the government to conduct its desired spending on public goods and services, without pushing total spending in the economy beyond the productive capacity of the economy and causing inflation. Taxes limit inflation, helping us to maintain the spending power of money, so that people maintain their confidence in the value of money.

“Class Warfare” is an accusation made by the wealthy when they feel under financial threat.

When the poor are under attack it’s not a matter of class and the wealthy are strangely silent.

I wonder why the amount of Super in the Jean Scenario is the only piece of data withheld?

What could “a large SMSF” possibly be? If this figure was included would it completely undermine the intended “message”?

Is this Class Warfare only happening in the Capitalist countries like Oz and US, where only the have-less pay taxes and millionaires have clever accountants to help tax-avoidance…..and pay none.

In the social democratic Scandinavian countries everyone pays their fair share of taxes, and they are rather high, Never mind, you get plenty for it; cost-free education, good infrastructure etc, everyone, be they rich or less so, gets a pension…There’s also none of this wide divide between them as us,as the societies are more egalitarian…

Just wondering…

Thanks, Harry.

http://www.abc.net.au/news/2018-03-13/labor-plan-scrap-5-billion-year-shareholder-refund-policy/9541016

No one is talking about the people getting $2.5 million in cash back. That is simply wrong.

For me it is an easy decision, I back the proposal. Never having had enough money to live well on and certainly not knowing anyone who has Jeans circumstances, I say make the rich bastards pay their fair share of tax, and save the rest of us the trauma of subsidizing them, but don’t forget the multinationals who pay no tax on their billion dollar incomes and also introduce a 15% of income mimimum taxation contribution from these multinational corporations. It’s time all Australian businesses and citizens paid a fair share of taxation to this wonderful country. As hockey told us the era of entitlement is over!

the problem is One Size Does Not Fit All.

For many years I was able to claim a tax rebate because I worked in remote areas. The rebate amounted to (from memory) about $2000/year. Money for nothing

The rebate eligibility was changed several years ago to apply only to people who actually lived in the remote areas, fair enough I thought , it was good while it lasted but we won’t be going hungry and homeless

To Janet, Conrad and co … ho hum

Christopher:

Thanks, at times I feel like you that I am peddling some sort of conspiracy theory.

One of the problems is that most/many thoughtful people do not understand money despite using it everyday. They believe there is a finite amount of money that is basically limited to our taxes and that spending over and above that has to be “financed” by debt. And they believe this debt can build up to an unsustainable level course. So we have endless political fights over who should pay more tax and how much in order to fund spending – class warfare by both sides, though the Coalition is more audacious and heartless than Labor about it.

A national government can “afford” to buy/build/fund anything for sale in its own currency. (State, Local government IS limited by taxes and national government transfers, as are we and business).

Of course, consideration should still given to the impact of overall spending on the economy, prices, output, foreign trade, etc., but there is never a shortage of money unless it is self-imposed.

Any constraints such as budget limits and deficit ceilings are self-imposed and often are hindrances to the proper functioning of the monetary system and the health of society and the economy.

The national government can create money endlessly by spending it into existence, out of thin air. Of course if they create too much relative to the capacity of the economy, inflation may occur and/or the value of the currency may fall).

Taxes are essential to make money function. Without taxation, money has no value or wide circulation. Taxes also “make room” for government spending; otherwise, if the government wants to command more resources it may have to destroy some of the spending capacity of some or all of us. But taxes do not pay for a single penny of government spending, but the pretence is that they do.

Who to tax, how much to tax are political, not economic decisions. If the goal is to reduce inequality (a sound aim I think) the very well off should have more of their spending curtailed by taxes they will not be able to easily or legally dodge than those who are less well off.

In this neoliberal-dominated world many people have been convinced the national government must eventually return the budget to surplus. But that is a self-serving narrative that allows neoliberals to reduce the role of government and argue that most services such as health, education, social support, energy, transport etc must be privately provided as government is short of money. That has resulted in a much less inclusive society with much poorer public services than is possible. Neoliberals have been able to persuade voters that There Is No Alternative (TINA).

Never before have so many been lied to by so few but then the few have a lot to gain!

SMILE I AM DOING YOU A FAVOUR – In conjunction with this story of Jean, we should also be asking why we allow Turnbull to give $30 million to Murdoch and News Corp so he can spend it for free on a beguiling Beatles TV advertising campaign to expand his Daily Telegraph market.. you know the one that brainwashes the population with its neoliberal capitalist lies, sensationalism and political blackmail. So everyone who pays for the Telegraph will obviously be voting Liberal.

We are talking brainwashing the people, scaremongering, bought votes and bought with tax payer/public money. This is a shoring up campaign in preparation for the next general election, funds flowing the other way to political donations but get the same result. This is the treachery of this unholy alliance between media and the Liberals!

Why is Murdoch treated the same as Jean, so he can breed more pseudo-Jeans out there, than know for their own good, let alone the good of others or the country? Why is this allowed, it’s not as if we don’t know about it?

Do we wait until the burglar points his gun at us and says smile I am doing you a favour?

I would be surprised if Jean or Lyle are actually real, just more fake Lieberal stories to make Labor look bad. I would like to earn $160k a year let alone get that much as retirement income. Someone on that much in retirement has no right to cry poor over $12k and are the real target of Bill’s policy.

The first article I read about Jean did mention the $30k from share dividends but absolutely no mention of the other $130k. How does an ex teacher get so much money anyway???

quite simply total income $160,000 and ZERO TAX? #shame definitely time to #ChangeTheRules and #PayYourShare #auspol

Victoria is right. The policy is fine.

But the release of a policy so easy to misrepresent in the media in the same week as the Batman byelection and the SA election, was it tin ear politics?

But what’s this, scrolling up?

Conrad wonders, perhaps in more blunt terms than I, as to the way the thing has been done.

Very surprised at the Kaye Lee response, one of her few problematic responses at AIM.

Food for thought…closer to how it should be explained but wouldn’t be in the Murdoch tabloids:

http://www.canberratimes.com.au/federal-politics/political-news/labor-to-become-the-party-of-personal-tax-cuts-20180313-p4z46y.html

paul,

Why? All I was pointing out is that there is plenty of time for Labor to flesh out the details and to see them in the context of other policies before the next election. This won’t come into force for some time after that giving investors time to reorganise if necessary. And if you are a part pensioner, then less income would mean more pension.

As for it being bad timing to announce it before the Batman and South Australia elections, that would only be the case if you think it is a bad policy which I don’t. I am really glad to see them tackling some of the unsustainable perks for those who already have plenty of assets. Inequality is one of our greatest problems and we need politicians with the guts to address it.

No Kaye, you are not at your best today. I mentioned in my comment the problem at this stage is the the likelihood of tabloid media and press spin so close to cliffhanger elections.

Consider this. Marshall in SA has been forced to admit to expenditure cuts and PS sacking on the eve of the election, but people have been instead diverted by the tabloids to more crude stuff about the ALP ripping off pensioners.

You’d agree, next week would have better…you do, don’t you?

So Jean currently ‘earns’ more than 4 times a year what I do through my (taxed) wages, pays absolutely no tax, and still gets gifted an extra annual $12,770 rebate?

And, under Labor’s proposed reform, Jean might lose this additional rebate?

My heart pumps purple piss for Jean.

Besides, Jean is a silly bitch.

Doesn’t she realise she can’t put it in a sack and take it with her when she falls off her perch.

As her age she should be past shallow conspicuous consumption and be aiming for a humbler, more spiritual lifestyle on the realisation of the transitory nature of life as we know it.

No Paul, I don’t. This sort of policy would make me vote for a party. I give Shorten credit for having the courage of his convictions. If it’s good policy next week, it’s good policy this week. The fact that the usual suspects are misrepresenting it doesn’t detract from it. If amendments need to be made, stakeholders have plenty of time to make that case but I would suggest it would be a very small group of people who would actually be plunged into need by this change.

And me. But I am not talking about the politically literate minority, but the easily manipulated majority.

At the moment the AIM is going toe to toe with organisations who are concentrating on anything BUT equity and the maths.

The Guardian is an example, let alone the Murdoch tabloids and the ABC.

I made it clear that my argument is not with the policy but the timing.

The vast majority of voters are not affected by the change. Do you really think it will be foremost in the majority of voters minds? There may be many who think $59 billion over the medium term could be better spent.

I hope not. The ghosts of recent elections continue to haunt me though.

Most recently, Tasmania.

Just on the media, there has been a bit this week about TV’s Sunrise misrepresenting the government proposal re a new Stolen Generation as humane.

The media and press can poison anything. That is what bothers me. And yes I could be feeling better on a humid day in Adelaide myself, during this hiatus between voting and counting.

paul,

I should add I am a lousy judge of politics. I swore black and blue that Labor wouldn’t dump Julia Gillard. I thought Tony Abbott was unelectable. I thought the Liberals would never dump a sitting PM. I thought Malcolm Turnbull would be better.

Sometimes, knowing things can cloud your judgement because you can’t understand how other people don’t know them. Sometimes, relying on the truth can be very disappointing.

A tidbit..just watching the early news, apparently a robocallout early today told pensioners not to bother voting if they were over seventy, something that has worried the ALP. My bet is the Tories rather than the Greens, but god help the Greens if they become implicated.

In Adelaide, the blather is just starting as to today’s election with Chris Uhlman tipping twenty seats each for the majors with the remaining seven divided between Xylophone and some independents.

Michael Sukkar tweeted at 8am this morning “It’s clear that if Labor loses Batman, Shorten will have to dump his rotten retirees tax”

https://twitter.com/MichaelSukkarMP?ref_src=twsrc%5Etfw&ref_url=https%3A%2F%2Fwww.theguardian.com%2Faustralia-news%2Flive%2F2018%2Fmar%2F17%2Fsouth-australian-election-plus-batman-byelection-results-live

Soooooo…..since Labor won, will Mr Sukkar be tweeting his acceptance of the policy?

David Speers, who yesterday wrote the Herald Sun article that Sukkar linked to, said

“The judgment was this would be a political winner in the Green-leaning inner-Melbourne seat. A promise to end cash hand-outs for investors who don’t pay any income tax would surely play well among the hipsters and battlers of Batman. Or so the theory went.

That’s not quite how it played out. The media, understandably, focused on the unintended victims.”

I wonder if David is now having a rethink about the power of his pen.

http://www.heraldsun.com.au/news/opinion/david-speers-bold-bills-on-the-back-foot-over-tax-grab/news-story/83fe30728fc775fb776b4d8f7420f042

Well, yet another example of just how twisted perverted Murdoch/LNP thinking is. In SA, the poison worked, after all that has happened lately they still put them (lnp) in, so still no point ever over estimating the intelligence of the public.

It’s interesting reading how wrong our so-called expert political journalists get things at times.

Katherine Murphy gave Labor basically no chance in Batman and questioned why Shorten would announce the policy just before the election.

Interestingly, she says in her article…

“There’s one thing that would put the all hand-wringing and the jockeying to bed, and that’s an upset victory in Batman by Kearney on Saturday night.”

https://www.theguardian.com/australia-news/commentisfree/2018/mar/17/why-did-bill-shorten-light-retirees-short-fuse-in-such-an-explosive-week

Maybe Shorten is smarter than you think.

I think Cathy Wilcox has summed it up pretty well in this cartoon –

https://static.ffx.io/images/$width_828/t_resize_width/t_sharpen%2Cq_auto%2Cf_auto/3d88412993a5c222be965db29fa25a8e1ec8a72f

It’s a matter of perspective.

paul walter

March 17, 2018 at 10:33 pm

Dumb people prefer leaders they like and understand, Pauline, Abbott….

Pleased about Batman, and at least Wetherill had many years in the job, still a pity .that he lost.

Kaye Lee, as for Murphy’s predictions re Batman, what do you expect from Mal’s girl..

Helvityni…… I had a glance at the Guardian’s headlines,(won’t bother reading any of the articles), Katharine’s main story is about the Libs win in SA but not a word on Labor’s win in Batman. The one eyed, dyed in the wool, rose coloured glasses wearing chief political editor, just can’t her over her adoration and unrequited love for the turd. Tch Tch…….

Back to Jean.

Jean is also a silly cow, as she hunches over her cents, because as the country goes increasingly conservative deregulation will ensure undetected ripoffs of the sort the banks have already perpetrated as to the principal that spits out the cents as dividend.

Paul Walter 10.33pm… we keep saying it, dont we. It must be the poison pen media, the lying truth twisting spin and propaganda that elects and re-elects conservative governments both state and federal regardless of their records of harm and damage to the nation, communities and individuals.

How about we just face the truth. Once upon a time australians seriously subscribed to the myth of “the fair go” and this was reflected by most people supporting immigration, social services, charity donations, foreign aid, workers rights and so on.

Now there are sufficient selfish, greedy, racist, NIMBY, ‘I’m alright Jack’ oriented people who sincerely believe that the LNP is their personal pathway to a “better” life for them and theirs and f##k everybody else.

No amount of bleating about climate change, clean energy, disadvantage, unfairness, hungry children, beaten wives, homelessness, extermination of native fauna……..ad effing nauseam, will make any difference.

Tasmanians and South Australians proved just how totally f##ked in the heads nearly half our population are.

Fat, smug and lazy, Paul…Fat smug and lazy.

Re Zathras, Willcox never misses, does she?

I think one thing adding to the change in Australia and elsewhere is the corporatisation of businesses.

When I was young, people, rather than shareholders, owned businesses. Their reputation was important to them and someone’s word and a handshake meant more than a contract.

Shareholders are removed from any moral or ethical responsibility. Companies exist to maximise profit. Shareholders expect them to. CEOs’ salary and bonuses depend on them boosting profits/dividends/share prices.

No-one thanks directors for their concern for the welfare of their employees or for their contribution to building the infrastructure they use and the health and education of their workforce. No-one will thank them for sourcing inputs locally if they can be bought cheaper overseas. No-one says don’t export our produce because it is needed in Australia. No-one congratulates them for innovation in sustainable practice if it cost’ something. It’s all about the bottom line.

We see some signs of shareholder activism and ethical investing, and some companies do better than others at making sustainability a consideration.

Perhaps the way we should start the conversation is for individuals to truly look at how much they have and compare that to the need of others. Are there things we could give up? Should we support ethical businesses? Should we demand the companies in which we own shares fulfil their part of the social contract? Can we reduce our personal carbon footprint?

We could all negotiate, Take leave loading for example. If we got rid of leave loading then we would be on solid ground to ask employers to give a little in wage rises or in reinstating the scheduled increase in the superannuation guarantee. It annoys me that that is ignored because that decision adversely affected the retirement savings of every single employee.

So many aspects to greed and lack of personal responsibility and obligation….those of us who are not struggling all need to give a little.

Henry Rodrigues, same here ,I don’t bother reading her articles anymore…

If the Herald Sun expects us to feel sorry for poor Jean who receives more from shares and assets than someone on purely the age pension, then they’ve got another thing coming. Jean is a wealthy retiree, who doesn’t need her pension on top of her assets. All right, she might not dine on Black Caviar and drink Moet, but she is doing better than many more. How about the Herald Sun, start telling the truth, I know it’s a big ask, with bolt on the payroll, not just about this, but about the fact that pensioners were not living on cat food and stale biscuits in order to pay electricity bills, but that electricity bills were high due to gold-plating of networks, privatisation of electricity retail and generation, and not the Carbon Pricing Scheme?