What’s up, GetUp?

By Ric Testori

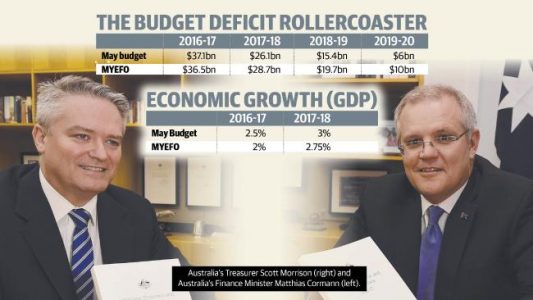

With the Australian Federal Budget coming in a month or so, what can we expect from our government and opposition parties which are both fully committed to the false neo-liberal concepts of fighting budget deficits and accepting unnecessarily high levels of unemployment/underemployment? My answer is “Not much”.

At the same time, I see and admire so much thought and effort being given by a handful of activists and thinkers associated with Modern Money Theory (MMT). And then I receive several new messages and memes from other activist groups such as GetUp who it seems are actively working against these very people that I admire so much. I joined GetUp and donate to them because I wanted to help everyday Australians have their voice over the noise and alt-truths of the mainstream media.

How disappointing it is for me to see GetUp continuing to push the same neoclassical economic bullshit in its own campaigns. They complain that the LNP have increased the “national debt” without considering how much worse things might be if spending on welfare and services were cut to reduce that inconsequential number. They fight hand and nail against tax cuts for the middle class and corporations without considering that taxes do not fund government spending. By giving honour to the stupid “deficit” lies they undermine everything they say they are fighting for. They continuously compare the LNP´s claim of “better management” to their apparent inability to control debt levels, without considering that the increasing debt is a result of the automatic stabilizers (Newstart etc) which are the only things keeping us out of a serious depression.

I can understand that MMT is not yet a platform supported by GetUp, but surely they can gain a little education in the matter of economics and stop fighting against us. They can stop supporting the false, orthodox neoclassical bullshit and speak honestly and truthfully about the necessity for budget deficits in appropriate times (like now).

These are the policies GetUp have launched as part of their Brighter Budget campaign:

1. Reform negative gearing.

2. Reform superannuation tax concessions.

3. Introduce the ‘Buffett Rule’.

4. Scrap the capital gains tax discount.

5. Cut fossil fuel subsidies.

6. Impose a super profits tax on banks.

7. Introduce a ‘Tobin Tax’ on high frequency financial transactions.

8. Place a duty on wealthy estates.

All of these policies seek to increase tax revenues, although (to give credit to their wording) the reasons given are mostly to increase fairness and combat inequality. But by making the campaigns lopsided against wealthier taxpayers and corporations, they almost guarantee the creation of a strong opposition against their implementation and their ultimate defeat.

A far better and more effective campaign would surely be to educate everyone, including activists, journalists and politicians, that taxes do not fund government expenditure. And that the concept of a “national debt” and similarities to household budgets are totally meaningless when applied to our fiat currency issuing federal government. As long as terms like a “balanced budget” are given power, force and meaning within our community there can never be fairness or honesty in any budget from any Australian government.

By ignoring Modern Money Theory (MMT), the GetUp organisation is playing directly into the hands of the neo-liberals who are clearly in charge of both LNP and ALP fiscal policies. Not even the Greens acknowledge the total failure of neoclassical economics to manage, describe or make reasonable predictions for the real world we live in.

Not even the glaringly obvious benefits and desirability of a federal Job Guarantee are mentioned anywhere in GetUp´s literature. The horrors and costs of involuntary unemployment (or underemployment) do not seem to exist as a policy worth consideration or mention.

For anyone looking for more information on MMT:

Prof Bill Mitchell – http://bilbo.economicoutlook.net/blog

Why Minsky Matters – L. Randall Wray

The 7 Deadly Innocent Frauds of Economic Policy – Warren Mosley

23 comments

Login here Register here-

pierre wilkinson -

Ken Butler -

longwhitekid -

Jaquix -

Paolo Soprani -

Samar Singh -

Matters Not -

silkworm -

Kaye Lee -

silkworm -

Kaye Lee -

Matters Not -

Kaye Lee -

Matters Not -

Heterodox (@mmt_rod) -

Matters Not -

silkworm -

Ric Testori -

James Grafton -

Heterodox (@mmt_rod) -

Heterodox (@mmt_rod) -

Anomander -

Don A Kelly

Return to home pagemaybe Get Up is so one sided in its’ demands because there has been so much one sidedness for so many years in promoting the wealthy to become wealthier at the expense of the working class

Exactly!

I applaud Get Up! and I support what they do, by putting my money where my mouth is. They do so much good (and you know they’re getting it right when Liberal MPs are running scared). However there was one disturbing response from them which was in 2014, when Freya Newman outed Tony Abbott’s daughter over her fraudulent receipt of a huge and non-existent scholarship and failed pecuniary declaration, and as a result, Tony Abbott was basically going to destroy Newman’s life for revealing it. I wrote and asked them why they were not supporting Newman’s case in any way at all? and they wrote back to me and said that basically it wasn’t ‘enough of a priority’ for them. For that case was much bigger than viewed simply as an act of making classified information of a highly illegal and extremely unethical activity public for the best interests of citizens. It was what it stood for in a number of ways. Get Up! stood by while Abbott victimized Newman by dragging her through high court and not so much as a petition. I was floored. I will not forget that.

There is so much the Liberal government is doing wrong, that to be a purist and want to “overthrow” the existing monetary narrative, would probably be counterproductive. The list the author gives, is a fair one, and a HUGE one. These are the things ordinary people want reformed, and they can relatively easily be reformed with the right, well thought out policies. Personally I dont think there is anything to be gained by taking on “monetary theory” at this time, better to concentrate all efforts on reforming what is wrong in the policies.

Thank you. Someone who is prepared to say that tax does NOT fund government expenditure and that comparing federal budgets to ‘household budgets’ is utter nonsense.

Paolo: Agreed. But GetUp! cannot afford to get into a massive controversy right now, when simple logic and reasoning is enough to get things done. The real nature of budgets, tax etc. needs to be approached very softly, because most people find it ” mind-boggling” – not because it is very complicated, but because it means repudiating what one believed until now. I have said before that the 3-sector financial identity, although just arithmetic, is difficult enough for most people, when they are faced with the consequences.

Perhaps GetUp understands that:

MMT has much to offer re ‘how it works’ but for most people it’s counter-intuitive. That is, it’s contrary to intuition or to common-sense expectation.

Don’t know one politician from either side of the political aisle who outs him/herself as an adherent to MMT. Given politicians work within an existing ‘common sense’ why would GetUp leap into the political unknown? To be a political martyr? To become a political joke? To destroy their credibility?

Thankfully, those who direct GetUp are much smarter than that.

It is not enough that we take from the rich. We must take from the rich and give to the poor. Giving to the poor – the unemployed, the disabled, pensioners and part-time workers – benefits the whole of society, as the poor are likely to spend back into the economy, while the wealthy are more likely to save. Wealth trickles up, not down.

This was proven by Rudd and Swan’s stimulus package at the end of 2008 and which saved Australia from the GFC. The stimulus targeted pensioners and the unemployed. The stimulus occurred in November, just in time to boost Christmas shopping and save many businesses. Exactly the same course can be taken now to increase employment.

If people are worried about taxes, the increase in employment pays off as increase in tax revenue. I even remember Shorten talking about this a few years ago, but he seems to have gone off his game recently.

MMT ignores other aspects of taxation like redistribution and behavioural change. I also have never got an answer on the possible effects on the exchange rate.

I agree in principle with many of the concepts proposed by MMT but they tend to ignore things in their enthusiastic zeal for converts. It would make a lot more sense, to me anyway. to say government spending is not constrained by the level of taxation and that deficits do not have to be funded by bond issuance. The idea that taxation destroys money and government spending creates money completely ignores any form of accounting and the other functions of taxation as mentioned above.

“MMT ignores other aspects of taxation like redistribution…”

No it doesn’t. It acknowledges redistribution as one of the aims of taxation, countering inflation as the major one, but it rejects the notion that taxes fund spending.

“… and behavioural change.”

Don’t know what you are alluding to here.

Things like property tax concessions skewing investment away from more productive enterprises, or the carbon tax reducing energy demand.

Yes, MMT suggests all sorts of ‘political’, ‘economic’ and ‘social’ possibilities. (Among others).

That we don’t live in a perfect world is clear. Lots of ‘demand’, broadly defined, across the ‘spectrum’ outlined above. Why is it so? Why the ‘waste’? Who would deny: That there’s (physical) ‘labour power’ sitting idly by. That there’s (intellectual) ‘labor power’ simply vegetating. That there’s physical resources not being utilised. That there’s underutilised ‘technology’. And so on. Seems a terrible waste, particularly when the only facilitating ingredient is the availability of ‘money’ (Or not). A ‘commodity’ that appears to be readily available – if there’s the political will.

In times gone by – when there was no ‘money’ – all members of a social group were considered ‘useful’ – all had a role to play – and so on.

Seems to me that MMT has a ‘political’ problem because it hasn’t been sold – explained or whatever.

Then there’s some ‘nonsense’ concepts that serve as distractions. Try the destruction of money as an example.

I wish they would drop the destruction of money message. Even when I agreed that we could “call it destruction” because it did effectively reduce the purchasing power of the taxed, that was not enough. When I pointed out that I deposit my tax liabilities into an account which is duly credited, it was dismissed as immaterial. I think they argue too much about what, to me, are philosophical semantics (if there is such a thing).

So do I – particularly when there’s no visible, physical (symbolic) destruction of the currency available for all to see.. As for the electronic destruction of same – when it’s instantly recreated on a one for one basis (apparently) and as verified by the year by year arithmetic – seems counter productive. (Just imagine the political possibilities – today as Treasurer, I created (or destroyed) X billions).

Not sure whether you would have to ‘sell’ tickets to such an event or just simply give them away. Perhaps we could celebrate an alternative Easter? The Resurrection of the Dollar ? – bought to you by …

“The idea that taxation destroys money and government spending creates money completely ignores any form of accounting”.

Money is a liability of the Government when you pay back taxes the liability is extinguished hence money is destroyed.

An easily checked example is the RBA’s weekly balance sheet, all currency on issue is shown as a liability, when money is returned for destruction the liability is extinguished.

Heterodox (@mmt_rod)

Sounds promising. Perhaps you could provide the odd link or two by way of explanation? A screen shot? A before and after? Whatever you like. A step by step explanation would be appreciated.

As for ‘money is liability of the government’ – please explain?

The Brighter Budget campaign looks like it is the second half of a progressive platform. The first half would be the spending preferences, such as increasing the minimum wage, strengthening the welfare net, affordable housing and rent reduction, job creation, support for renewables, etc.

I agree Silkworm that the existing GetUp policies appear to be missing the spending preferences. But this raises the standard questions ¨Where does the money come from?¨ or ¨How do we pay for it?¨. The neo-liberal (and standard) answer is that taxes must pay for it, but this is proved false by the facts supporting MMT. I understand that the standard answer is almost universal, but in this case it is universally wrong and that was the point of my article.

The Govt want to reduce the deficit, and so reduce wages, spending into the economy. This results in less money in the economy for consumers to spend, so the seek and buy cheaper imports than Aust products. Which results in increase deficit. Which the Govt try to reduce by cutting more money from the economy…

Taxes effectively take money out of the economy, so increased taxes won’t result in more consumer spending. Specific actions such as removing fossil fuel subsidies will increase the cost of energy in the short term. Without increases in wages, either less is consumed or reduced spending on other purchases occur. Less energy spending will increase health issues, particularly elderly, increasing demand on medical facilities and budgets. Less general consumer spend will mean lower general business turn over either closing business or increasing costs, which will again reduce purchases, and turn consumers to buying cheaper imports.

Matters Not

Money is created by balance sheet expansion, it appears as an asset and a liability and nets to zero.

Since you can’t spend your liabilities the asset side is transferred/spent into the economy which leaves the liability on your balance sheet.

When money is returned through taxation it cancels the liability or is destroyed in the case of RBA used notes.

The RBA is a wholly owned subsidiary of the Government, the Governments bank and according to our Constitution the Govt is responsible for the issuance of Australian $.

Any Australian money in the economy in the end when all debit/credits etc are applied must be a liability of the Government.

http://www.rba.gov.au/statistics/frequency/stmt-liabilities-assets.html

Matters Not

More on the history of money going back to tally sticks which were issued as a tax credit or a liability of the King

It is an enormous leap for most people to grasp MMT. Hell, it did my head in for a quite a while, but the moment you comprehend it, your mind is literally blown.

Unfortunately, we have been sold the lie for far too long and the message that the government is run like a household budget is simply overwhelming. It is repeated day-in, day-out. It is almost impossible not to get caught-up in the spiral.

One only need look at the simplistic messages that are driving so many people toward One Notion – very few of these people are capable or willing to absorb a whole new way of economic thinking.

It is easier to initially argue in terms of inequality first before trying to introduce a whole new way of thinking.

There is so much misunderstanding and lack of information about Deficits, their meaning and the effect on the economy. The Federal Government’s fiscal position is simply the difference between what the government spends and what they take in taxes. If the government is spending more than what they take in taxes then the fiscal position is in Deficit.

One way a government can reduce the size of a deficit would be if the government spent less in relation to what they took in taxes. Any non-ideologically driven economist would say that cutting government spending would not improve the state of a struggling economy. By that, what is meant is that there are unemployed resources, people looking for work who can’t find it, equipment, tools, raw materials sitting idle and gathering rust and dust rather than being used to produce the goods and services we need.

The last thing we need Is for a major consumer in the economy, which is the Federal Government, to spend less on goods and services because, obviously, if a major consumer spends less, then less in the way of goods and services will be purchased and that will mean less people getting jobs producing what the Federal Government isn’t purchasing. So cutting spending will make a struggling economy worse off than otherwise.

We have historical evidence for what has happened in the past, Menzies and Rudd for example, when the economy is in recession. In order to overcome the recession the government spends more money without changing its taxes, that means of course that the deficit goes up, but the effect of the government spending more money while raising the deficit, has such a stimulating effect on the economy by the government buying more goods and services, more people are put to work, they in turn buy more goods and services, putting yet more people into work. This stimulating effect of a deficit drives up the overall economy so that the deficit actually becomes smaller as a percentage of GDP, even though it was increased in an absolute way.

When somebody says “the deficit is too high” we should ask “in relationship to what?”.