Is Turnbull about to end 25 years of growth?

Australia’s last recession was 25 years ago in 1991. As 2016 finishes, the previous quarter’s figures suggest that this 25 years of good fortune could be at an end, reports John Haly.

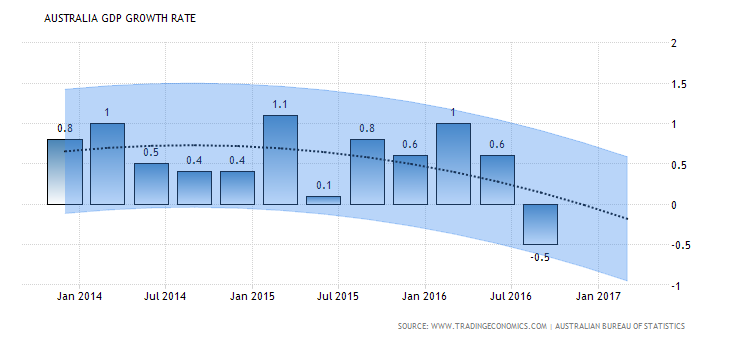

Australia’s GDP for the September quarter had a demonstrated contraction. Not a surprise when you consider a full range of economic indicators for the Abbott/Turnbull Government. The September quarter revealed a .5% shrinkage in our GDP, not seen since the Queensland floods affected the March 2011 quarter. Prior to that the last mitigating circumstance for a contraction had been the Global Financial Crisis. This time there is no clear alibi, except the coalitions inadequate financial management demonstrated by the low growth figures in each of the last year’s quarters. In June 2015 quarter it was our accounting standards that defer payment recordings that recognised a 41.5% jump in government defence spending that secured a tiny growth rate. There was no defence spending finalised to save us in September 2016.

Coalition excuses

The Coalition team were quick to allay fears of recession, as was the media. The Treasurer blamed the deterioration on the lack of opportunity to provide tax cuts for corporations. The same corporations that by in large provide little to no tax revenue to our country’s bounty and often relocate locally generated profits, overseas.

Construction failures

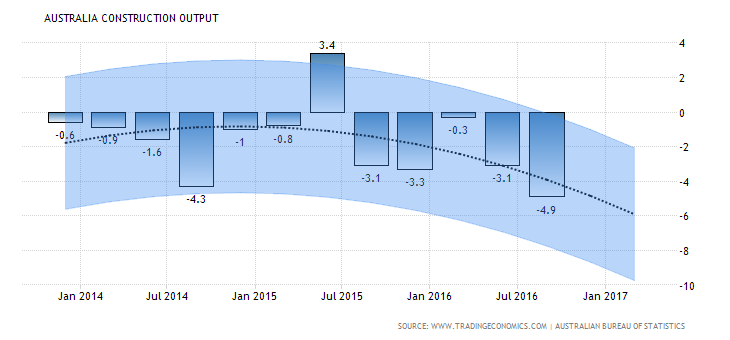

The largest contributor to the fall in GDP growth according to the Australian National Accounts was the reduced output of the construction industry. Construction work had continued to tumble for the 3rd consecutive quarter taking its biggest fall of 4.9% in September’s quarter. Some are blaming poor weather (i.e. rainfall) for a fall in building activity. Aside from the fact that we are now in the monsoon wet season meaning things will get worse, is the industry suggesting “construction” doesn’t make allowances for rain? To be fair, the Bureau of Meteorology had been reporting higher rainfalls than normal for July thru September. (You need to read the PDFs for each monthly weather review in the last link). Interestingly, it has also reported a longer term decline of rainfall of around 11 per cent since the mid-1990s in the April–October in the continental southeast and 19% in the southwest of Australia. Forgive the pun, but does rainfall as an excuse, hold water? Might there be other factors in the construction downfall?

Image from http://www.tradingeconomics.com/australia

Rising Chinese investments

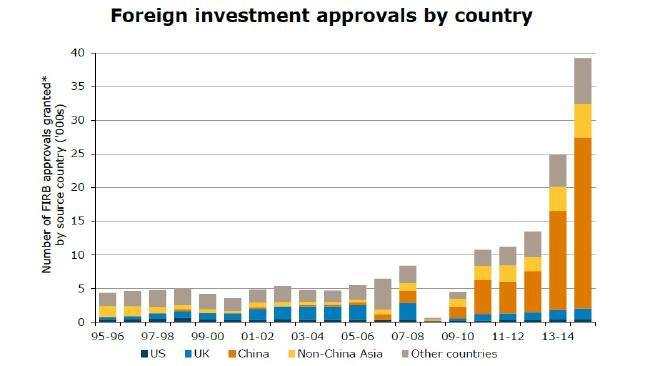

An August News article showed foreign investment approvals have shown a sharp rises in Chinese nationals particularly in the last few years. The 2015 Chinese investment approvals segment almost exceeding all foreign investment for the previous year. Now the previous linked News article suggested the tightening of bank lending was unlikely to adversely affect Chinese enthusiasm for Australian real estate. But is this true? Concerns about Chinese investors laundering money in the Australian real estate market was exposed by the Four Corners program “The Great Wall of Money” in late 2015. Three significant events occurred in the period after this program went to air.

- Despite much procrastination because of the economic risks to the banking system, the prudential regulator of banks, APRA began to enforce some of their own rules on high risk lending.

- Australian Banks uncovered evidence of numerous and sophisticated fraudulent income statements made by Chinese borrowers. To mitigate risks they have begun to restrict lending to offshore investors.

- The Chinese Government began cracking down on Money laundering corruption.

Three consequences have been reported in the media.

- Robert Gottliebsen reported in August that “The mass of Chinese property buyers who snapped up Australian apartments “off the plan” on the basis of a 10 per cent deposit have started to walk away from their agreements in Sydney”. Melbourne has larger volumes of Chinese buyers.

- To secure sufficient financial collateral and because banks consider development projects high risk ventures, developers depend of being able to provide evidence to banks of “off-the-plan” purchases of apartments.

- Risk avoidance by the banks is resulting in restricting or pulling finance on the Chinese markets. This means construction become nonviable and added to buyer pull out, it may likely be the greater cause of any given developer may ceasing or stalling construction.

Image from http://www.tradingeconomics.com/australia/

While not wanting to “rain” on anyone’s parade, a more likely reason for a drop in construction might be the exit – of what was last year a huge influx of Chinese Buyers. In fact, given the huge influx of Chinese buyers in the market in 2015, it could be hypothesised that Chinese buyers were keeping our economy afloat.

Image from news.com.au

So what hope is there left in the last month of this quarter for us not to discover some time in February that we are in a recession? Because two depressed GDP terms is an official recession and we have less than one month to go of the 2nd term.

- Manufacturing? – Ford is gone, Holden fired-up the final V6 motor at its Port Melbourne plant on the 29th of November and Toyota is in palliative care expecting to pass away next year.

- Renewable energy market? – The government is slashing support for that industry

- Mining? – Mining investment fell for the twelfth consecutive quarter and the seasonally adjusted estimate fell 0.8%

- Exports? – Net Exports of goods fell 0.3% which is a bit surprising given how cheap our dollar is.

- Retail? – This is the first decline in over 3 years as the seasonally adjusted estimate fell 0.8% so perhaps that is just a glitch.

- Real estate industry services? – which fell by 2.4% which is no surprise given the continued unaffordability of the housing market.

Industries such as education, health, power, hospitality, transport, professional and scientific services etc contributed virtually nothing. So where are our major economic booms?

- Information Media & Telecommunications? – rose 1.6% driven by rises in telecommunications and internet services, so be thankful for Youtube, iView, Netflix and Facebook but how much can we rely on this given our lack of an innovative and internationally competitive NBN.

- Agriculture, forestry and fishing? – driven by rises in grains, cotton and livestock production it had a 7.5% increase. One of the larger beneficiaries of the TPP was the agricultural industry, its prospective dissolution by Donald Trump does not provide hope for the future.

- Hotels, Cafes and Restaurants? – Up by 2.2%, as the cafe dwelling, latte-sipping hipster in inner city cultures put their money up to keep the economy going. Though given how disparaging the government are to this community, it would not be wise to tell them to stay home.

- Insurance and other financial services? – Up by 1.3% as the insurance and finance salesmen of the country are proving their worth for their company’s bonuses.

What (or who) can rescue us …

Unless the government can quickly pay off a huge defence “lay-by” as they did last year, it’s in your hands people. Our consistently strong industries have been Retail and Services Industries driven by household expenditures which have been traditionally strong areas of our economy. It’s Christmas, the retail and services industry awaits your patronage, if you still have a job that pays a decent wage. You have only weeks left to buy us out of a recession. Buy up big for your kids, travel, eat out and stay in a nice motel. God help Australia, but is our last hope to avoid recession, “Santa Claus“?

About the author: John Haly is a freelancer writer and multimedia specialist. A beneficiary of a more egalitarian and tolerant political landscape in which he grew up, his observations of the changing harsher political posturing have prompted him to write articles on social justice and political issues.

Educated initially with a Bachelor of Business, he followed these later with Diplomas in multimedia and graphic design as well as film studies at the now defunct Metro Screen. When not writing, he manages a freelance business, “Halyucinations Studios” in Sydney, doing work for clients in photograph, video production, design, IT support and web development and management. He is also the secretary of the film collaborative, NAFA, and a founding member of the Australia Arts Party.

Formerly a long time IT contractor for commercial banks (including the Reserve Bank), mining, transport, computer companies, government, university and a number of outsourcing firms, his introduction to the media was in two separate project management roles for the ABC. This developed an awareness of the need for advocacy for public broadcasting as well as providing a background in a diverse range of commercial and public service organisations.

A fifth generation Australian born son of an English teacher and an AICD Gold Medal Award winning businessman – whose contributions to the finance sector were recognised with an Order of Australia. John has lived and worked here and overseas, although mainly around Australia and lately in Sydney, NSW.

You can follow John on twitter @halyucinations or on his blog at http://auswakeup.info/.

13 comments

Login here Register here-

helvityni

-

Andreas Bimba

-

James O'Neill

-

kerri

-

Kronomex

-

Ella

-

crypt0

-

jim

-

iggy648

-

Andreas Bimba

-

-

Mike

-

Mike

Return to home pageHow ironic, Mr Growth will actually end the growth; our kids can all become baristas, and then find out that the most of our tourists are Chinese, and drink TEA…

The Conservatives deliver appalling economic management that shrinks the economy combined with the neoliberal agenda which is designed to transfer an ever greater share of national wealth to the most wealthy, especially the financial sector.

Our relatively wealthy and egalitarian past has been steadily destroyed for no good reason. The electorate believing the lies of a complicit mass media and a corrupt political class have been duped to vote for their own destruction.

Either the electorate rejects neoliberalism and regains a functioning democracy or we are heading towards the life of impoverished serfs in a brutal militaristic and feudal form of extreme corporate rule on a planet rapidly dying from runaway global warming.

Agriculture may have been a (prospective) beneficiary of the TPP, although the downside of that agreement would more than offset it. Fortunately there is a better deal in the pipeline, the RCEP, which has the advantage (which the TPP did not) of being centred on our largest trading partner by far, China.

We need to stop blaming the trashing of the economy on individuals! It is the fault of the LNP!

To blame Morrison and/or Turnbull means the sheeple will simply vote LNP again believing the next LNP leader won’t make the same mistakes!

The problems with the economy are the result of an ideology not a person!

Abbott has turned politics personal and this is why Julia Gillard was offed for being a woman, a redhead, a witch, barren, atheistic etc etc etc.

Mind you the ALP could do a lot more to get themselves out of the fug they are in if they would distinguish themselves from being LNP light and would offer a real alternative not just more of the same!

If we are on the slippery slide of a recession we must not forget whose fault it will be and it won’t be the LNP.

” It is in your hands people”

I don’t think so !!!!

How much can you consume before your house is full of junk?

How can anyone with conscience go over board at Christmas when millions are dying in the Middle East .

If they are ‘lucky’ they are in miserable refugee camps!!!! Will the children there have a Merry Christmas? I don’t think so !!!

Until this idiotic government accepts that;

If you are lucky enough to have a job , your wage is so low that many are becoming the working poor, so whose money do they use to spend up big?? Malcolm’s, Mr. Morrison’s?

Our economy won’t improve till this government accepts that there is a revenue problem, which can not be completely solve by cutting spending.

When this government accepts that there is no need to give money to polluters not pollute,

when it accepts that it is about time corporations payed their fair due,

when it accepts that just because you give corporations tax cuts…it does not necessarily follow that they will create more jobs, they will more than likely use it give greater returns to the investors ( who are not in Australia)

When this government learns that it is worth while to invest in the renewable industries and good infrastructure then and maybe then

the economy will pick up.

BUT don’t hold your breath , all hell will freeze over before this government begins to see the light.

NO I won’t be spending up big!

I would rather give money to organisations who have social justice at their heart.

What is more ,

sending a E Christmas card won’t save this government.

In the rather unlikely scenario that the economy started to show real signs of growth, at some point interest rates would rise.

Then all the negatively geared housing speculators would find themselves under real pressure.

The LieNP refuse to take any action to make housing more affordable for younger generations … e.g. curtail the negative gearing trick and so I wonder how many of the LieNP are in on that lurk, and is there any real incentive for this rabble to preside over a burgeoning economy anyway ?

Unlikely as that is in any event.

Not forgetting the casual manner in which about 200,000 jobs in the auto industry and associated were wilfully thrown away for lack of about half the dollars these fools and worse wish to gift the Adani coal mine.

Are they not trying, or are they just hopelessly ideologically conflicted and incompetent ?

The lowest spending government EVER EVER was not the Lying national party, what a laugh the rains at fault now as well. FMD.

I’m with you crypt0. Maybe increases in the US interest rates will have the same effect and lead to raising interest rates here. One of the major tricks at the next election will be to encourage young voters to actually vote, and to vote for those who have said they will water down the destructive impact of the negative gearing and CGT rorts. That way as wages increase over the following decade, and if house prices don’t,increase as stupidly as they have been, ordinary people will be able to afford to buy a home again. Then, as the mortgages of all the average Joes and Josephines come down as a proportion of their income, they’ll have more to spend on “stuff” and business will grow to produce more “stuff”. I have a vague recollection that one of the car manufacturing companies (GMH?) was asking for a boost of about $500M to stay in business. The government would have recouped a large proportion of that in taxes paid by the auto workers and all the spin-off business created.

Iggy648, Holden in 2013 wanted an additional $80 million per year (total $160 million per year) till 2023 in grants to replace the Commodore and Cruze and to upgrade their assembly plants and yes this would have been returned many times over in taxation paid by workers and suppliers. These grants were to ensure viability given the removal of all tariff protection. Thailand for example has production costs that are about 10% lower than Australia.

If Australia were to manufacture at least 50% of local vehicle demand in Australia the entire industry would employ at least 100,000. This is an unforgivable squandered opportunity in such a competitive world and also makes it more difficult to establish other manufacturing or knowledge based industries and also has serious national defence implications.

Pingback: The myth of Jobs Growth – Australia Awaken – ignite your torches

Turnbull won’t end our run of growth, LIMITS TO GROWTH will.

Peak oil, peak debt, climate change. Wouldn’t matter who’s in charge, the party is over.

Anyone who believes in infinite growth on a finite planet is either an idiot or an economist.