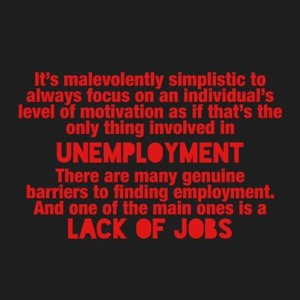

The acronym NEET (Not in Employment, Education or Training) is becoming more prevalent with those who enjoy the art of welfare bashing. For those who see themselves as a class above the unemployed, specialised welfare bashing is the new team sport.

Welfare bashing is no longer homogeneous. There are so many individual groups to welfare bash; it has now turned into a team sport. For those who enjoy the sport of welfare bashing, like any sport, it is very important to pick a side. Picking a side ensures the stigmatisation of anyone on welfare is further ingrained in society, because it adds to the generalisation that anyone on welfare is lazy and undeserving. Those who participate in welfare bashing see themselves as part of an elite class; even if they fail to recognise it in themselves.

Let’s have a look at four of the leading Welfare Bashing Teams, currently active in society today.

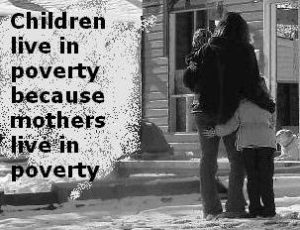

The Single Mother Welfare Basher

There are those who enjoy the art of welfare bashing the single mother. Gender is important here; because the act of sexual activity of behalf of a woman is still in 2016, considered a slovenly act by so many, particularly if it produces a child out of marriage.

For the women who have been brave enough to leave a domestic violent relationship; this too does not matter. Single Mother Welfare bashing jersey wearers truly believe that women are stupid and should have thought of not having kids if she was with someone violent.

No matter how you plead for leniency and understanding towards single mothers, the loud obnoxious Single Mother welfare bashers all point their fingers at the woman and her vagina as the spawn of all the evil in the world, which takes away their hard earned taxes.

Team Colours: Yellow and Red – (opposites to Purple and Green the power colours for women)

Favourite Stigma Play: Stigmatising mothers who are unable to work due to caring responsibilities as scum and a burden on society

War Cry: Keep your legs crossed!

The Unemployed Youth Welfare Basher

It is important to distinguish the Unemployed Youth Welfare basher as separate from one who welfare bashes all unemployed people. I have come across a significant peculiarity amongst some voices in mature aged welfare. Although these baby boomers are currently unemployed, it is not unusual for people within this group to see their welfare as more deserving than unemployed youth. I have seen some very disheartening comments from people who belong to mature job seeker groups and general welfare groups on social media. Including degrading comments about young single mothers as a particular favourite.

General comments about young people unemployed are normally associated with ‘laziness and bludging’ however conversations around mature aged unemployed are normally blamed on external factors such as ‘ageism and discrimination.’

Young people are seen as desperate to avoid employment and mature aged jobseekers are seen as desperate to find employment.

The media also encourages this separation. For example, A Current Affair appears empathetic to mature aged jobseekers, whilst demonising the rest of the unemployed, including single mothers (with hard hitting investigative stories like “should single mothers be forced to go on contraception?”).

Disparaging media claims about unemployed youth focus on young people rejecting jobs, participating in welfare rorting, ripping off the system, sleeping through interviews, choosing welfare over work and being idle and lazy, playing X-Box and eating Cheetos.

Regardless of how you ask for consideration that there are far more unemployed youth, than there are jobs for them to fill; the unemployed youth basher, will strongly argue that ‘they are not trying hard enough.’ They often compare their 1970’s utopia of going straight from year 10 into an apprenticeship as if that still exists today. They often still believe that free university education exists and that even TAFE is free and completely accessible for all.

Team Colours: Black – (opposite to white for poverty awareness)

Favourite Stigma Play: Stigmatising young unemployed people because the Government is too lazy to engage in job creation policy and laying the burden of this on jobless young people.

War Cry: YA BLUDGER!!!!! TRY HARDER!!!!

The Homeless person Welfare Basher

The homeless person welfare basher is a particular type of sick and cruel person. This type of welfare bashing jersey wearer places all blame on the individual and truly believes homelessness is their own making. They believe that the homeless are truly lazy individuals and do not want to work due to alcohol or drug addiction, or are just destructive young people who could go home if they really wanted to.

Race is also particularly important. Those that don this welfare bashing jersey see if people of colour are homeless; it is simply because their skin colour makes them drug addled, drunk, lazy and homeless, according to the loud mouthed, obnoxious, racist, vile crap that can smack you in the face all over social media.

This group champions official authoritarian responses to further degrade homeless people. The increased ban on homeless people using public restrooms, nail spikes to prevent sleeping in some areas and pop up sprinklers to deter them as well. Income management, especially for indigenous homeless people is a real vote winner for the Homeless Person welfare basher.

This group likes to point out that there are groups that help homeless people, so what is the problem? Some Government Ministers even like to blame the groups they cut funding from for the problem of homelessness; such as Western Australian Minister Liza Harvey who defended the use of sprinklers in Perth:

“The accommodation is there, the support services are there, the not-for-profit groups are there, the money’s flowing into the system. Clearly if there’s homeless people sleeping on King Street, those people aren’t doing their jobs properly.”

No matter how you much you plead for understanding and consideration of factors, which cause homelessness, the homeless person welfare basher will always, insist that all of these measures are avoidable. The ones that are not avoidable, such as mental illness or child sexual abuse, they should ‘just get over’ so they can stop being homeless.

Team Colours: Yellow (opposite to Purple the colour for homelessness)

Favourite Stigma Play: Stigmatising homeless people because they insist homelessness is their choice.

War Cry: Get off the drugs and get a job!!!

And Introducing….The NEET Welfare Basher

NEET hailed from the UK as a young person Not in Employment, Education or Training. The NEET Welfare basher is the hipster of all welfare bashers. They target this niche group of welfare recipients as the most abhorrent and lazy of all welfare recipients. In fact, it doesn’t even matter if the young person is in receipt of benefits; being under 25 they may well be reliant upon their parents for support. As long as the young person is not in school, TAFE, Uni or employed, the finger is extended to frantically point with judgemental criticism and wailing screams of ‘back in my day..’ at the NEET.

The NEET welfare basher is often someone who has had the luxury of getting a job when they were young, through the ‘it’s not what you know, it’s who you know’ or the ‘Daddy has rich friends employment scheme’. Or the woman who married someone quite young, who has the income to support both of them, whilst she stays at home and looks after the children.

The NEET welfare basher has had no hindrances to enter into university or has no confidence or financial issues with undertaking study. The NEET welfare basher also falls into the same category as the youth unemployment welfare basher who still lives in the utopia of the 1970s where public sector exams and entrance to the public sector was the norm, or apprenticeships for young men were in abundance, all done by just completing junior high school with a pass average.

The NEET welfare basher feels quite comfortable that they have the undeniable right to judge and stigmatise young people who are not engaged in employment or education, because to them finding a job or going to TAFE all seems so simple.

This type of welfare basher reassures themselves that there is nothing wrong with welfare bashing NEETs, because they believe that this group faces no hardships whatsoever.

They do not see themselves as stigmatising a young person who is the primary carer for a child or a disabled parent; or a young person who is disabled themselves. They just see it as degrading a lazy young person, who deserves it.

The NEET welfare basher can normally clear their conscience by asking a NEET who has been severely depressed due to constant rejection from employment, “RUOK” on that one day of the year. This self-absolves them from being arseholes.

The main factors associated with being a NEET are low level of education, low household income, having some type of disability, immigration background, living in a remote area, and a difficult family environment (Eurofound 2012). In tougher labour markets, the size of the NEET group will increase.

Regardless of how many facts that are presented by journalists who want to present the actual facts about NEETs; the NEET welfare basher reminisces about their youth and when they job hunted and how easy it was for them and waves the facts away with an indignant snarl.

Team Colours: Orange (opposite to Green, the colour for hope)

Favourite Stigma Play: Stigmatising young people who are not engaged in employment or education, because they truly believe after 30 odd years of a punitive jobsearch framework, coupled with the idea that ‘the free market will sort the jobs out’ that hindrances to employment for young people are just a myth.

War Cry: “Back in my day…”

In a country where we consider young people, ‘young’ up to 25 years of age and where the Prime Minister champions the ‘free market’ as the answer to everything, rejects Government intervention for job creation and truly believes that anyone can just go and be innovative and create an App to bring themselves out of poverty and into self-employment; welfare bashing will be an Olympic sport by 2020.

Originally published on Polyfeministix