Delivery Strategies for Australia’s New Infrastructure Consensus

Denis Bright invites discussion about of the most appropriate delivery models for best practice in bipartisan commitments to Australian transport infrastructure.

The LNP’s conservative template for a low tax, low service state presents a challenge to Malcolm Turnbull.

If the new Prime Minister wishes to preside over the delivery of new infrastructure for cities, Cabinet must come up with the financial priorities to reverse the current cutbacks in the transport and communication sectors in the 2015 Budget.

Joe Hockey’s last budget has left a cupboard that is bare of new funding. Commitments to transport and infrastructure have faced the steepest reduction in real budget expenditure.

Rather than wait for the Mid-Year Economic and Financial Outlook (MYEFO), Cabinet can proceed with a mini-budget to implement the Prime Minister’s new vision for nation building and infrastructure commitments.

This positive vision is cheered from across the political spectrum as shown by the enthusiasm for a more extensive light rail system on the Gold Coast.

So far, Malcolm Turnbull has been tight lipped about any wider commitment to infrastructure funding because the choices available within the LNP’s conservative political template are not so obvious.

Prospects for market based new infrastructure

Private sector options for the delivery of new transport infrastructure are available to the LNP within appropriate regulatory structures. The Australian Competition and Consumer Commission (ACCC) continues to regulate potential restrictive trade practices affecting transport infrastructure.

Market-based infrastructure delivery within the conservative political template of Thatcherism has been an abysmal failure from Canada to Britain and New Zealand.

In places like Mexico and Argentina, privatization of transport infrastructure has left few remaining passenger and rail freight services and new networks of expensive commercial road tollways.

However, since the 1990s, global transport infrastructure firms have emerged with the capacity to supervise the construction and management of essential infrastructure.

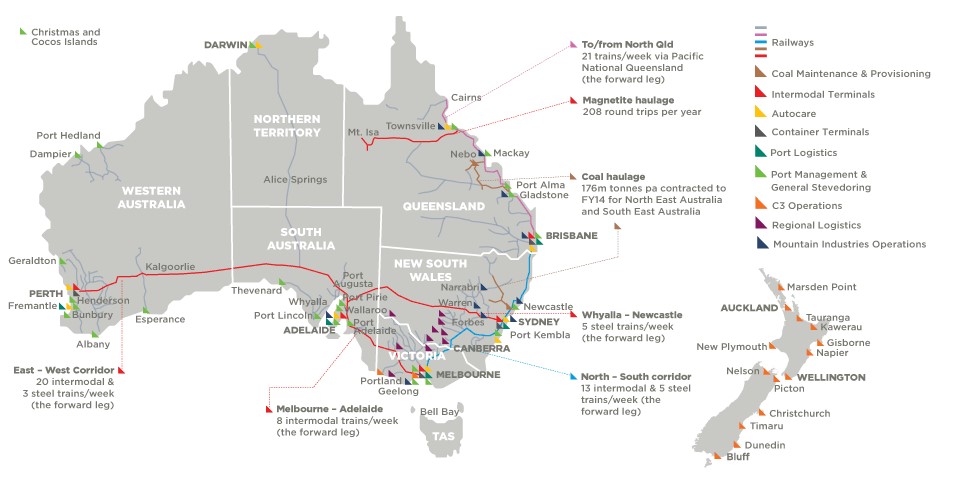

Even where rail track is still in government hands, freight delivery by Australian firms such as Asciano and Aurizon competes in the competitive delivery of containers and the motive power for some of the remnants of interstate passenger traffic.

Asciano’s vast transport network

ACCC has temporarily rejected a take-over bid by Brookfield Infrastructure Partners for Asciano. Brookfield’s modified proposals will be reviewed again in December 2015.

Brookfield Infrastructure Partners currently operates the West Australian Government Railway network including train movements along the Indian Pacific Route west from Kalgoorlie under an exclusive leasing arrangement until 2049.

Brookfield Infrastructure Partners is also one of the many companies interested in acquiring the Australian Rail Track Corporation (ARTC) which has been offered for privatization by the federal LNP at a potential sale price of $4 billion.

The LNP government has proceeded slowly on its commitment to privatization of the management of 8,100 kms of interstate rail tracks between Brisbane and Kalgoorlie. The final section between Kalgoorlie, Perth and Kwinana is in fact operated by Brookfield Infrastructure Partners.

Aurizon Holdings is also interested in acquiring the ARTC. This former Queensland Rail public sector carrier is currently the largest integrated rail-road freight business in Australia.

Any future acquisitions of ARTC by Brookfield Infrastructure Partners will have immense implications for Aurizon’s capacity as a freight leader. Both Aurizon and Anciano are likely to face takeover offers by other global transport infrastructure giants.

https://www.youtube.com/watch?v=I-40iQ_ViLE

Even before the accession of Prime Minister Turnbull, there was considerable reappraisal of the decision to privatize the ARTC.

ARTC monitoring does not extend to the Queensland freight lines beyond Brisbane which carry freight trains from Asciano and Aurizon on tracks which are still owned by the Queensland Government.

In the midst of current confusion over national infrastructure policies, there are now opportunities for federal Labor to excel with a more even-handed national infrastructure plan.

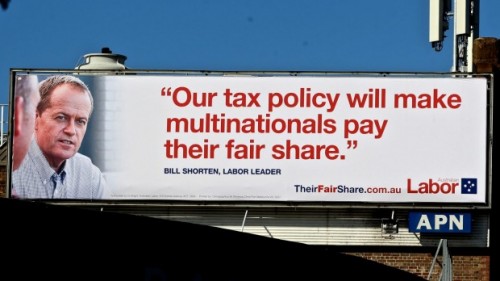

So what is Bill Shorten offering to fill the confusion in federal LNP ranks?

Federal Labor’s Alternative Infrastructure Programme

In addressing the Queensland Media Club on 8 October 2015, Opposition Leader Bill Shorten signalled that Labor is also quite pragmatic about the extent of market involvement to end Australia’s infrastructure backlog.

Labor offered $10 billion to support Infrastructure Partners Australia (IPA) as the co-ordinator of transport infrastructure funding.

Logically, IPA would take on the responsibilities of an expanded ARTC with its financial support for rail track maintenance across the network.

Bill Shorten warned Australians that the Australian LNP Government’s investment in infrastructure in the June Quarter of 2015 had fallen by 20.1 per cent compared with the last quarter when Labor was in government.

An excellent case has been presented to support reliance on the social market to deliver nine key transport infrastructure projects. These projects include rail access to the new Sydney Airport, new commitments to Melbourne’s Metro rail projects, Brisbane’s cross-river metro rail link, the light rail extensions on the Gold Coast and major motorway projects in most states.

Prior to the accession of Prime Minister Turnbull, Sydney’s airport project at Badgerys Creek was offered a $3.8 billion motorway and tunnel space for a future unfunded rail connection. Now Prime Minister Turnbull is committed to new rail access.

While Prime Minister Turnbull’s team is currently working on the specifics of its market-based approach, Labor has time to refine its initial proposals to add new financial traction to the proposed IPA.

Adding financial traction to IPA

In these days of national political consensus over rhetorical commitment to new transport infrastructure, more financial traction could be given to an expanded role for Bill Shorten’s IPA.

Labor can learn from the manner in which corporate giants like Brookfield Infrastructure Partners hedges long-term investments in infrastructure with financial gains from equity management funds.

Brookfield Asset Management Fund is a specialist in property development, renewal energy, infrastructure and private equity management for a total of $200US billion with recent links to Brookfield Business Partners in Bermuda.

In a touch of irony that a major multinational company has been a financial adviser through the Brookfield Asset Management Fund to the Investment Corporation of Dubai. This fund operates a sovereign wealth fund to promote new age investment and infrastructure at home and abroad.

Financial activities on behalf of the IPA could multiply the Australian government’s financial support for longer-term infrastructure projects by inviting investment equity from entrepreneurs and corporations in a safe government guaranteed hedge-fund which takes risk-taking investment on financial markets and in established companies.

The McKinsey Global Institute notes that investment in environmentally sustainable infrastructure is now a major niche in the global economy as countries with differing levels of development try to counter the productivity losses from congestion in sprawling cities.

As well as transforming transportation and planning options for Australian cities, the IPA could become an innovative investor and project manager internationally adding more traction to Australia’s currently reduced overseas assistance programmes.

Work has commenced on urban subway systems in both Hanoi and Ho Chi Minh City (HCMC). Most of the funding for the first subway line in HCMC has been donated by Japan and the construction is a Japanese-Vietnamese joint venture which is now scheduled for completion in 2020.

While Australian governments have cut overseas assistance programmes, Japan has embarked on Win Win Approaches to overseas assistance to assists both donor and recipient alike.

The IPA could provide opportunities to share Australia’s renewed commitment to the social market internationally. This would not be beyond the resources of Australia as a significant middle ranking economy.

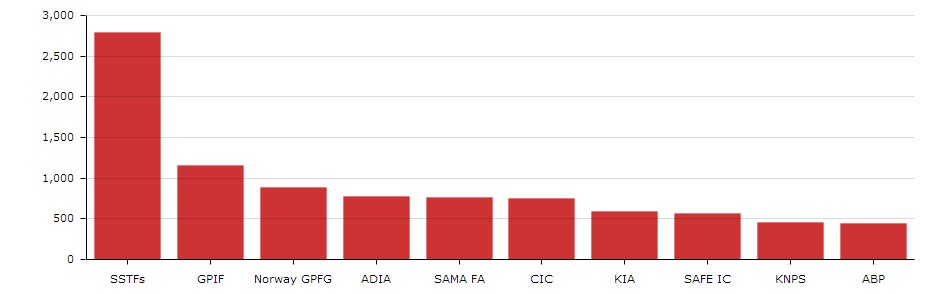

The financial commitments of overseas sovereign wealth and pension funds have been summarized by the Sovereign Wealth Fund Institute (SWFI). These funds have become an important resource for governments of differing political complexions.

Portfolio assets of major sovereign wealth and pension funds (Billions $US)

Sovereign wealth funds do not exist only in distant overseas capitals.

The Queensland Investment Corporation (QIC) successfully handles the investment of superannuation contributions and other financial transactions assigned to it by the Queensland Treasury Corporation. QIC thrives on both canny financial transactions and real investment acquisitions.

Labor’s IPA could follow this model by attracting capital from local and international corporations and entrepreneurs who need a safe haven for both short-term and long term deposits.

QIC uses capital equity for profitable investments on the financial market and in the acquisition of targeted enterprises with a real future.

The QIC has successfully acquired the Iona Gas Storage Facility west of Melbourne on 8 October 2015 for $1.78 billion and the profits are expected to flow back to Queensland from the December Quarter of 2015.

QIC recorded a profit of $100 million in 2014-15 and assets under management base of $73.8 billion on 30 June 2015.

Meanwhile, Bill Shorten has developed a well argued case for staying with the Australian social market to fund assist in delivering nine key infrastructure projects. These commitments include Airport Rail for Badgerys Creek, Sydney, Melbourne’s Metro Rail Project, Brisbane’s cross-river rail metro link and key motorway projects across Australia.

The electorate is still waiting for the details of Malcolm Turnbull’s market-based model for the renewal of Australian infrastructure. It might be a long wait if the LNP infrastructure plans come from the political template in which tax cuts for more comfortable families take precedence over important national priorities.

A real opportunity exists for Bill Shorten to highlight the LNP’s current indecision about the best model for the delivery of market-based national infrastructure. By adding an investment fund to the proposed IPA, Labor could have a real opportunity to avoid the excesses of an ideologically-based market approach.

Denis Bright (pictured) is a registered teacher and a member of the Media, Entertainment and Arts Alliance (MEAA). He has recent postgraduate qualifications in journalism, public policy and international relations. He is interested in developing progressive public policies that are compatible with commitments to a social market model within contemporary globalization.

Denis Bright (pictured) is a registered teacher and a member of the Media, Entertainment and Arts Alliance (MEAA). He has recent postgraduate qualifications in journalism, public policy and international relations. He is interested in developing progressive public policies that are compatible with commitments to a social market model within contemporary globalization.