Delivery Strategies for Australia’s New Infrastructure Consensus

Denis Bright invites discussion about of the most appropriate delivery models for best practice in bipartisan commitments to Australian transport infrastructure.

The LNP’s conservative template for a low tax, low service state presents a challenge to Malcolm Turnbull.

If the new Prime Minister wishes to preside over the delivery of new infrastructure for cities, Cabinet must come up with the financial priorities to reverse the current cutbacks in the transport and communication sectors in the 2015 Budget.

Joe Hockey’s last budget has left a cupboard that is bare of new funding. Commitments to transport and infrastructure have faced the steepest reduction in real budget expenditure.

Rather than wait for the Mid-Year Economic and Financial Outlook (MYEFO), Cabinet can proceed with a mini-budget to implement the Prime Minister’s new vision for nation building and infrastructure commitments.

This positive vision is cheered from across the political spectrum as shown by the enthusiasm for a more extensive light rail system on the Gold Coast.

So far, Malcolm Turnbull has been tight lipped about any wider commitment to infrastructure funding because the choices available within the LNP’s conservative political template are not so obvious.

Prospects for market based new infrastructure

Private sector options for the delivery of new transport infrastructure are available to the LNP within appropriate regulatory structures. The Australian Competition and Consumer Commission (ACCC) continues to regulate potential restrictive trade practices affecting transport infrastructure.

Market-based infrastructure delivery within the conservative political template of Thatcherism has been an abysmal failure from Canada to Britain and New Zealand.

In places like Mexico and Argentina, privatization of transport infrastructure has left few remaining passenger and rail freight services and new networks of expensive commercial road tollways.

However, since the 1990s, global transport infrastructure firms have emerged with the capacity to supervise the construction and management of essential infrastructure.

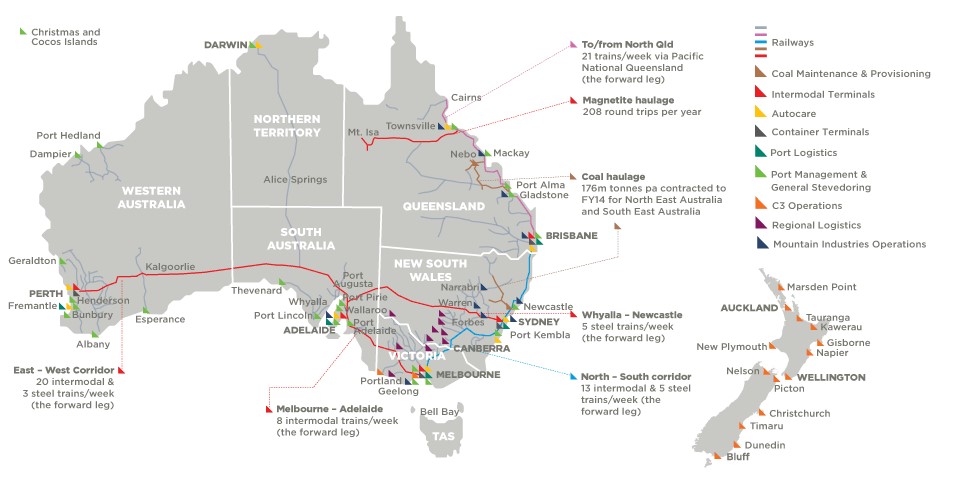

Even where rail track is still in government hands, freight delivery by Australian firms such as Asciano and Aurizon competes in the competitive delivery of containers and the motive power for some of the remnants of interstate passenger traffic.

Asciano’s vast transport network

ACCC has temporarily rejected a take-over bid by Brookfield Infrastructure Partners for Asciano. Brookfield’s modified proposals will be reviewed again in December 2015.

Brookfield Infrastructure Partners currently operates the West Australian Government Railway network including train movements along the Indian Pacific Route west from Kalgoorlie under an exclusive leasing arrangement until 2049.

Brookfield Infrastructure Partners is also one of the many companies interested in acquiring the Australian Rail Track Corporation (ARTC) which has been offered for privatization by the federal LNP at a potential sale price of $4 billion.

The LNP government has proceeded slowly on its commitment to privatization of the management of 8,100 kms of interstate rail tracks between Brisbane and Kalgoorlie. The final section between Kalgoorlie, Perth and Kwinana is in fact operated by Brookfield Infrastructure Partners.

Aurizon Holdings is also interested in acquiring the ARTC. This former Queensland Rail public sector carrier is currently the largest integrated rail-road freight business in Australia.

Any future acquisitions of ARTC by Brookfield Infrastructure Partners will have immense implications for Aurizon’s capacity as a freight leader. Both Aurizon and Anciano are likely to face takeover offers by other global transport infrastructure giants.

https://www.youtube.com/watch?v=I-40iQ_ViLE

Even before the accession of Prime Minister Turnbull, there was considerable reappraisal of the decision to privatize the ARTC.

ARTC monitoring does not extend to the Queensland freight lines beyond Brisbane which carry freight trains from Asciano and Aurizon on tracks which are still owned by the Queensland Government.

In the midst of current confusion over national infrastructure policies, there are now opportunities for federal Labor to excel with a more even-handed national infrastructure plan.

So what is Bill Shorten offering to fill the confusion in federal LNP ranks?

Federal Labor’s Alternative Infrastructure Programme

In addressing the Queensland Media Club on 8 October 2015, Opposition Leader Bill Shorten signalled that Labor is also quite pragmatic about the extent of market involvement to end Australia’s infrastructure backlog.

Labor offered $10 billion to support Infrastructure Partners Australia (IPA) as the co-ordinator of transport infrastructure funding.

Logically, IPA would take on the responsibilities of an expanded ARTC with its financial support for rail track maintenance across the network.

Bill Shorten warned Australians that the Australian LNP Government’s investment in infrastructure in the June Quarter of 2015 had fallen by 20.1 per cent compared with the last quarter when Labor was in government.

An excellent case has been presented to support reliance on the social market to deliver nine key transport infrastructure projects. These projects include rail access to the new Sydney Airport, new commitments to Melbourne’s Metro rail projects, Brisbane’s cross-river metro rail link, the light rail extensions on the Gold Coast and major motorway projects in most states.

Prior to the accession of Prime Minister Turnbull, Sydney’s airport project at Badgerys Creek was offered a $3.8 billion motorway and tunnel space for a future unfunded rail connection. Now Prime Minister Turnbull is committed to new rail access.

While Prime Minister Turnbull’s team is currently working on the specifics of its market-based approach, Labor has time to refine its initial proposals to add new financial traction to the proposed IPA.

Adding financial traction to IPA

In these days of national political consensus over rhetorical commitment to new transport infrastructure, more financial traction could be given to an expanded role for Bill Shorten’s IPA.

Labor can learn from the manner in which corporate giants like Brookfield Infrastructure Partners hedges long-term investments in infrastructure with financial gains from equity management funds.

Brookfield Asset Management Fund is a specialist in property development, renewal energy, infrastructure and private equity management for a total of $200US billion with recent links to Brookfield Business Partners in Bermuda.

In a touch of irony that a major multinational company has been a financial adviser through the Brookfield Asset Management Fund to the Investment Corporation of Dubai. This fund operates a sovereign wealth fund to promote new age investment and infrastructure at home and abroad.

Financial activities on behalf of the IPA could multiply the Australian government’s financial support for longer-term infrastructure projects by inviting investment equity from entrepreneurs and corporations in a safe government guaranteed hedge-fund which takes risk-taking investment on financial markets and in established companies.

The McKinsey Global Institute notes that investment in environmentally sustainable infrastructure is now a major niche in the global economy as countries with differing levels of development try to counter the productivity losses from congestion in sprawling cities.

As well as transforming transportation and planning options for Australian cities, the IPA could become an innovative investor and project manager internationally adding more traction to Australia’s currently reduced overseas assistance programmes.

Work has commenced on urban subway systems in both Hanoi and Ho Chi Minh City (HCMC). Most of the funding for the first subway line in HCMC has been donated by Japan and the construction is a Japanese-Vietnamese joint venture which is now scheduled for completion in 2020.

While Australian governments have cut overseas assistance programmes, Japan has embarked on Win Win Approaches to overseas assistance to assists both donor and recipient alike.

The IPA could provide opportunities to share Australia’s renewed commitment to the social market internationally. This would not be beyond the resources of Australia as a significant middle ranking economy.

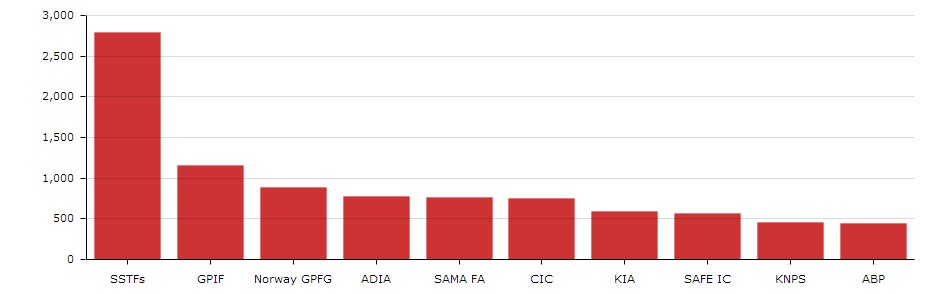

The financial commitments of overseas sovereign wealth and pension funds have been summarized by the Sovereign Wealth Fund Institute (SWFI). These funds have become an important resource for governments of differing political complexions.

Portfolio assets of major sovereign wealth and pension funds (Billions $US)

Sovereign wealth funds do not exist only in distant overseas capitals.

The Queensland Investment Corporation (QIC) successfully handles the investment of superannuation contributions and other financial transactions assigned to it by the Queensland Treasury Corporation. QIC thrives on both canny financial transactions and real investment acquisitions.

Labor’s IPA could follow this model by attracting capital from local and international corporations and entrepreneurs who need a safe haven for both short-term and long term deposits.

QIC uses capital equity for profitable investments on the financial market and in the acquisition of targeted enterprises with a real future.

The QIC has successfully acquired the Iona Gas Storage Facility west of Melbourne on 8 October 2015 for $1.78 billion and the profits are expected to flow back to Queensland from the December Quarter of 2015.

QIC recorded a profit of $100 million in 2014-15 and assets under management base of $73.8 billion on 30 June 2015.

Meanwhile, Bill Shorten has developed a well argued case for staying with the Australian social market to fund assist in delivering nine key infrastructure projects. These commitments include Airport Rail for Badgerys Creek, Sydney, Melbourne’s Metro Rail Project, Brisbane’s cross-river rail metro link and key motorway projects across Australia.

The electorate is still waiting for the details of Malcolm Turnbull’s market-based model for the renewal of Australian infrastructure. It might be a long wait if the LNP infrastructure plans come from the political template in which tax cuts for more comfortable families take precedence over important national priorities.

A real opportunity exists for Bill Shorten to highlight the LNP’s current indecision about the best model for the delivery of market-based national infrastructure. By adding an investment fund to the proposed IPA, Labor could have a real opportunity to avoid the excesses of an ideologically-based market approach.

Denis Bright (pictured) is a registered teacher and a member of the Media, Entertainment and Arts Alliance (MEAA). He has recent postgraduate qualifications in journalism, public policy and international relations. He is interested in developing progressive public policies that are compatible with commitments to a social market model within contemporary globalization.

Denis Bright (pictured) is a registered teacher and a member of the Media, Entertainment and Arts Alliance (MEAA). He has recent postgraduate qualifications in journalism, public policy and international relations. He is interested in developing progressive public policies that are compatible with commitments to a social market model within contemporary globalization.

26 comments

Login here Register here-

Chris Blaikie -

Delivery Strategies -

Moving On -

Sally K -

Going with the Infrastructure Parters Australia (IPA) Option -

Florence nee Fedup -

Wally -

Well Spoken Wally -

Florence nee Fedup -

Wally -

withsobersenses

-

Regional Infrastructure for North Queensland -

Regional Transport -

Still Waiting -

Urban Planner -

ben (qut) -

MBA Student: Uni of Sydney -

Paul -

Politics of the Possible -

Fresh Approach? -

Denis Bright in Brisbane -

Patricia Ryan -

Not An After-Thought -

The Peoples Versus the Infrastructure Multinationals -

Mary -

Rubio@Coast

Return to home pageAny prospective sale of Australian Rail Track Corporation (ARTC) should be very careful to consider the many sites of biological significance and/or remnant vegetation sites that are ‘managed’ as part of their asset portfolio. I would expect that any privatization of ARTC would result in the destruction of many important sites. That’s what a corporation would be likely to do rather than seriously take on the management of those kind of sites. Get rid of them rather than accept the liability.

Look out for your local indigenous vegetation sites.

(Not the kind of infrastructure comment you were looking for but important none the less)

Agree with Chris! Infrastructure delivered for profit will serve private interests first and foremost. The Adani Mine in Qld is attracting a new freight line if its gets going but it is to be associated with environmental destruction and global warming. In the spirit of Australia, environmentl concerns are parmount. Time to chllenge the new PM on the superiority of market-led development, Bill Shorten!

A good alternative to old style infrstructure projects for commercil gain as the mainstrem model for Australia. Planning for great corporate projects is political diversion when our cities and regions are not are left without ways and means in the present.

Have you considered this funding method?

New public transport infrastructure usually results in very significant increase in land values in nearby locations. “Land value capture” applied as an increase to the property rates for these locations would allow a small proportion of this publicly created capital gain to help fund the infrastructure. The proceeds from this revenue stream can be securitised and sold as part of the income stream paid to infrastructure bondholders.

Prime Minister Turnbull has indicated that this option is being considered. Currently this value uplift funding model is being used in USA and Britain.

There are several articles about it on the Prosper Australia website:

https://www.prosper.org.au/2015/10/16/putting-right-price-on-infrastructure/

The AFR editorial quoted in the article says that this system would provide a market mechanism to pick the projects that are worth doing and avoid projects of marginal benefit being approved.

It is not a new idea. A third of the cost of Sydney Harbour Bridge was funded in this way and the famous transit system and parks of New York City built from 1921 to 1931 were funded by shifting taxes off buildings and onto land values, according to this article by Catherine Cashmore.

http://www.macrobusiness.com.au/2013/11/land-tax-must-kill-negative-gearing-stamp-duty/

It could also give Australians something better to invest in than property speculation or the gamble of the stock market.

I like the funding suggestions in this article which mimic what is being done by corporate giants like Brookfield Wealth Management to hedge its long-term investment projects that do not offer immediate commercial gains.

The Alice Springs to Darwin railway has narrow commercial priorities and ends at freight terminal some 30 kms out of town.

Bill Shorten’s IPA model has merit and can be supported by a new wealth management fund along the lines of the QIC in Queensland.

Time to go back to how government funded infrastructure in the pass. Harbour Bridge, Freeway to Newcastle good examples

Government could build infrastructure itself, funding by say government bonds or out of revenue.

Cut the middleman out, that have to make big profits for their shareholders.

Paid back by tolls.

Worked well in the past.

“The LNP’s conservative template for a low tax, low service state ”

This policy does not work and is not feasible for any sector of our community because the LNP tax policy is to extract as much tax as possible from low income earners so massive tax breaks can be provided for the top earners and companies. And user pays only applies to the average worker and the government funds infrastructure for companies for free on the pretence that it is good for all of us.

This user pays system which the article criticises is appalling. Road tollways across Argentina are no infrastructure model for Australia. The added insult is their ownership by multinational companies whose CEOs act like the Sheriff of Nottingham in a Robin Hood fable.

Howard and now this mob’s move to user pay, for all government services is short sighted. The wealthy pay less tax. The lower income earners will find they have much less disposable income. No room discretionary spending. Health and education will still be essentials for starters.

Florence nee Fedup

“Howard and now this mob’s move to user pay, for all government services is short sighted.”

Extremely short sighted when considering who the end user really is, often the expense is incurred by a worker that is not for their benefit but a necessity to attend or carry on their employment. Then employers complain that the cost of labour is too expensive.

See my arguments on the rise and fall of the plans for infrastructure stimulation here:

cheers

Dave

Like the author, I am a fan of working up Bill Shorten’s Infrastructure Partners idea. Regional infrastructure is vital for both residents and tourists in every state and territory. Malcolm Turnbull may have a grand rhetorical commitment to transport infrastructure but it will take ages before the private sector gains the momentum for effective infrastructure delivery. Bill Shorten’s ideas are able to be implemented immediately with Infrastructure Partners assessing applications for financial support for existing rail, bus and regional air-services which need support to continue. Without this extra financial support for less profitable routes, even existing services will be terminated. The billion dollars being spent on the air war in Iraq and Syria is needed back home to save our regions where youth unemployment is almost twice the national average. Today’s ABC news reports place it over 20% of the workforce. If Bill Shorten wants traction for his ideas, he can visit regional North Queensland and receive enthusiastic support for localities where have drifted to the Katter Party which will also offer him a unity ticket on this issue.

Regional carriers are doing a wonderful job for moving people outside the major cities. Some assistance from Bill Shorten’s new Infrastructure Body would be most appreciated. Bus and air fares out of Mt. Isa for example need some additional subsidies. Carriers like Rex Air are trying to look after the regions but many disadvantaged people cannot afford the tickets and tourists cannot afford to come in the winter months to have their break from the cold weather in Southern Australia.

Where are Malcolm Turnbull’s real infrastructure plans within the Budget that he has inherited from Joe Hockey?

Good to see practical infrastructure commitments being taken up by Bill Shorten and supported by Denis Bright in this article: Labor must become a social interventionist party again to compete with minor parties gaining token representation in the House of Representatives

nice article man, keep it up!

Not many household retain operational appliances from before the 1950s. But much of Sydney’s rail system was designed in the 1920s. This is worse than an old Wikins Service washing machine with a ringer drier. The lapses in productivity from this ancient infrastructure are appalling and encourage everyone to zip off in their cars when real public transport alternatives are needed. Bill Shorten is offering something positive. Thanks to the author for telling us about these new sustainable and affordable ways and means of delivering real infrastructure in the immediate future. Waiting for the market and multinationals to deliver our future has no appeal to me.

Excellent article Denis. Australia certainly is in need of state of the art infrastructure projects to provide transport, jobs and accessibility to the nation into the future. We need real futurist to ask the difficult questions and explore the topic further. Appropriate Public Private Projects can work effectively provided the product is efficient, fast and affordable otherwise, the people will continue to use cars and planes.

These projects are not cheap but the long term benefits can be sensational for the economy and people. We need futurist to educate and promote the need for these products with more gusto so they get better traction with the public and become a priority for the government of the day.

The right products and projects will attract stable investors but we need to let the wealth funds know that Australians are ready for the projects and we will embrace them.

Thanks again for a thought provoking article on a very important topic for our future and the next generation.

The article raises a good point about financing delivery strategies for essential infrastructure.

Seems everyone is still waiting for Godot to delivery through market strategies.

Having travelled on the Ghan to Darwin, I happened to notice that this private railway is still mainly using old government rolling stock from the days when the Commonwealth Railways were in the public sector.

If the Left wins in Argentina again in the second round of the elections on 22 November, rail transport will be brought back into the public sector again after the failure of decades of privatization.

Time to ensure that this Market actually delivers or work for achievable alternatives to multinational control of infrastructure and more commercial Tollways for cars and freight.

If PM Turnbull does have a fresh approach to transport infrastructure, this will hardly be respected by decades of commitment to Thatcherism within the LNP. Menzies was the last leader with a more rounded approach to the positive role of the government sector and that was after a near defeat in 1961.

The leadership change to Malcolm Turnbull has delayed the privatization of the Australian Rail Track Corporation (ARTC) which was foreshadowed in February 2015.

ARTC manages interstate rail tracks maintenance between Brisbane and Kalgoorlie within a public sector model that has been starved of funding by LNP Governments.

The remainder of the WA Government Railways (WAGR) is already in private hands under leasehold to the Canada’s Brookfield Infrastructure Partners until 2049.

Corporate deals are being considered to offset the opposition of the ACCC to potential restrictive trading practices associated with increased vertical and horizontal integration within the Australian transport sector.

In the last month, Qube has acquired a 19.9 per cent interest in Asciano backed by funding from two North American investors, the Canada Pension Plan Investment Board (CCPIB) and Global Infrastructure Partners.

While the LNP dithers with its transport infrastructure plans during the honeymoon phase of Malcolm Turnbull’s new leadership, it is to be hoped that Labor will continue to refine its Infrastructure Partners Australia (IPA).

Transport infrastructure must remain within a social market. It should not be a play-thing for corporate insiders.

It is ironical that corporate infrastructure giants are relying on both commercial and public sector sovereign wealth management funds to pick off the best sectors of Australia’s transport infrastructure.

Many of these funds have links to corporate international tax havens. Australian governments are unlikely to receive their full taxation value from privatized commercial operations.

IPA with links to an accountable national wealth infrastructure fund can be represent Australian interests in what is one of our most basic service sectors: affordable transport in a country which spans a whole continent.

Thanks for your concerns about market-based infrastructure. Big multinational companies can hardly have the interests of Australia as their first priority. I support Bill Shorten’s commitment to infrastructure Partners Australia as a real alternative option.

Very brave of the Opposition Leader to talk up specific infrastructure policy initiatives while Malcolm Turnbull negotiates with the big end of town to carve up the remnants of public infrastructure for multinational companies with links to wealth funds in exotic tax havens.

Hutchison Ports sacked its employees by text messages . It reduced its operating profits with the convenient use of overseas wealth management funds.

An Australian based infrastructure co-ordinating body is absolutely essential and Not An After-Thought to corporate take-over plans for our essential infrastructure.

Thanks so much for raising this essential debate about our future.

After excusing the corporate giants with their money laundering, it seems Prime Minister Turnbull has plans for a 15% GST to bring the budget into surplus.

A great juxtaposition with the LNP representing the Multinational providers against the wider electorate

Great article Denis

Let’s ask for more than the LNP has to offer in more failed social infrastructure like the abandoned railway from Sydney to the Gold Coast. The Gold Coast federal LNP members are a disgrace sitting on big majorities but offer nothing.