What’s the diff?

With Tony Abbott keen to make superannuation an election issue and a point of differentiation between the parties, it is worth revisiting the Coalition’s record.

In 1985, the government and the ACTU struck a deal which saw the trade union movement forfeit a claim to 3% productivity improvement as wages to instead be paid in compulsory superannuation – endorsed by the Arbitration Commission and managed by superannuation funds with equal representation of the unions in the industry and the employers.

Leader of the Opposition, John Howard, reacted by saying:

“That superannuation deal, which represents all that is rotten with industrial relations in Australia, shows the government and the trade union movement in Australia not only playing the employers of Australia for mugs but it is also playing the Arbitration Commission for mugs”.

The Coalition has steadfastly opposed every increase in compulsory superannuation since that time.

In the 1995 budget, Ralph Willis unveiled a scheduled increase in compulsory super from 9% to 12% and eventually to 15%. It was to be one of the Keating government’s major legacy reforms.

Howard went to the 1996 election promising to “provide in full the funds earmarked in the 1995 — 96 Budget to match compulsory employee contributions according to the proposed schedule” but, 6 months after releasing the policy, dropped the plan in the 1996 budget because it was “too expensive”.

In 2007, facing a tough election, Howard went on a vote-buying spree making radical changes to the superannuation rules which had a huge impact at the time and whose effects we are grappling with today.

The majority of workers could now withdraw their superannuation tax-free upon reaching the age of 60. Most self-employed could claim their superannuation contributions as a tax deduction. In addition, semi-retired people could continue to work part-time, and use part of their tax-free superannuation to top up their pay.

Despite the relatively generous tax treatment of capital gains, the new superannuation tax treatment led to the selling off of some assets, particularly rental housing, as people sought to take advantage of the opportunity to add funds to their superannuation accounts and claim them back later tax-free.

People were allowed to transfer up to A$1 million into their superannuation accounts before June 30, 2007, after which an annual maximum of A$150,000 of after-tax contributions could be made. The effect of this change in the rules was enormous. In the June quarter of 2007, A$22.4 billion was transferred to superannuation accounts by individuals. This compares with A$7.4 billion in the June quarter of 2006. June 2007 was the first time in Australia that member contributions exceeded employer contributions.

In 2010, Abbott went to the election with a superannuation policy that was criticised by the industry as “failing to address retirement income adequacy and the challenge of Australia’s ageing population.”

The Association of Superannuation Funds of Australia (ASFA), the Australian Institute of Superannuation Trustees (AIST) and the Financial Services Council (FSC) said in a joint statement that a failure to increase the superannuation guarantee (SG) to 12 percent, the failure to raise the concessional caps for individuals over 50 and the failure to provide a super tax contribution rebate for low-income earners would adversely impact Australian workers.

In 2011 Abbott did a backflip, reversing the party’s position insisting that the Coalition would not rescind the higher guarantee. This was done without consulting the party room.

In 2012, John Roskam from the IPA wrote

“Compulsory superannuation offends practically every principle of what should be Liberal Party philosophy. If an Abbott government does keep compulsory superannuation it must, at a minimum, make drastic changes.”

Moving forward to February 2013, we were receiving mixed messages from Abbott and Hockey.

In a doorstop interview, when asked if he would cut those initiatives, Hockey replied “Absolutely, you can’t afford them.”

Two hours later, after the PM’s office went into a flurry of denial, Hockey tweeted

“Would be nice if Nine News had checked the facts…Coalition remains committed to keeping increase in compulsory superannuation from 9-12%.”

In April 2013 Tony Abbott said “We will ensure that no more negative unexpected changes occur to the superannuation system so that those planning for their retirement can face the future with a higher degree of predictability.”

One month later Abbott announced he would delay the compulsory superannuation guarantee increase for two years and do away with co-contributions for low income earners so it appears Joe had let the cat out of the bag a few weeks early.

Abbott also promised to do away with Labor’s plan for a 15 per cent tax on superannuation pension earnings over $100,000 saying it was too hard to implement.

According to the chief executive of Industry Super Australia, David Whiteley, this resulted in 3.6 million Australians on low incomes being out of pocket $500 a year, while just 16,000 of the nation’s top earners benefitted from the scrapping of the 15 per cent tax.

After winning government, the Coalition has made further delays in the increase of the superannuation guarantee freezing the rate at 9.5% for seven years after which it increases gradually to 12% by 2025 rather than 2019 as originally scheduled.

For an average worker who has recently joined the workforce, that could reduce retirement balances by about 5 per cent, or $40,000.

For those on lower incomes, the impacts will be magnified if the Low Income Super Contribution (LISC) scheme is shelved, as planned, in 2017. LISC ensures that people earning relatively low incomes do not end up paying a higher tax rate on their super contributions than they pay on their ordinary income.

Abbott is committed to cutting costs for employers and protecting the income of wealthy retirees at the expense of entitlements of workers and those most likely to need a top-up in retirement. Freezing the SG has not led to wage increases despite Abbott’s assertion that this puts more money into the pockets of workers.

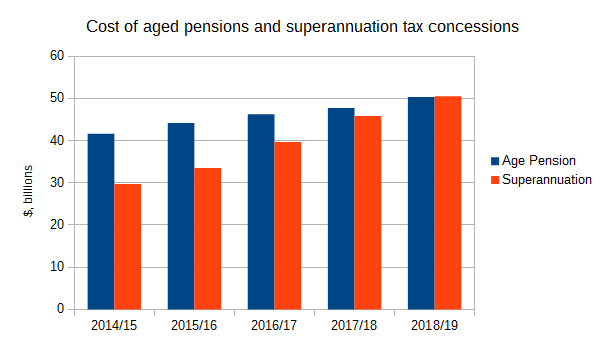

With the cost of superannuation tax concessions set to overtake the age pension, it indeed should be an important point of differentiation between the two parties at the next election.