Seeking the Post-Corona Sunshine: Time to Consolidate the Australian Social Market?

By Denis Bright

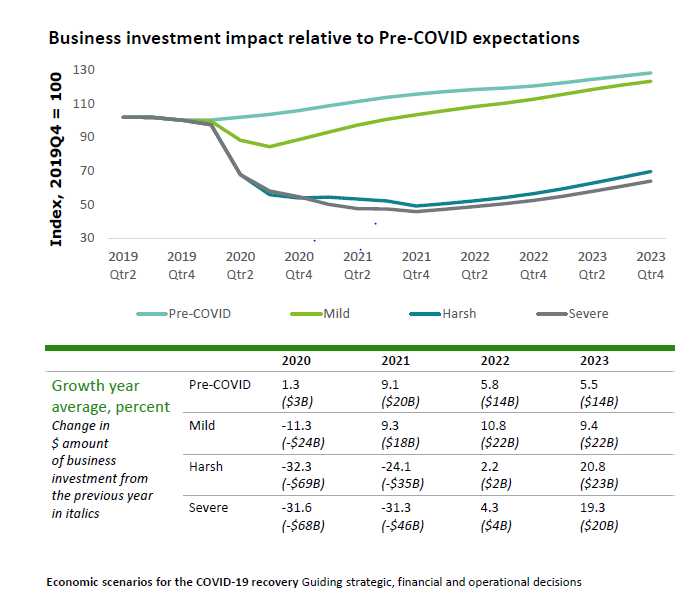

From Deloitte in May 2020: Businesses have halted any plans for investment … Leaving a lasting impact on future productivity.

Throughout Australian history those dire events like the Great Depressions of the 1890s and 1930s, the Pacific War or even the cost of the Great War in lives and government debts have been the great forces for social change with consequences for voting patterns at state and federal elections. There have been fluctuations in commitment to the Australian social market as a result of these upheavals. Sometimes, expected outcomes do not eventuate.

Both the Great War and the Great Depression eroded some of the historical advances in the Australian social market from the Federation era. Cold war politics brought great reverses prior to a more tolerant phase of federal LNP domestic policies after the Credit Squeeze and implementation of the recommendations of the Vernon Report. The way had already been paved for the Rise of Gough Whitlam after he became Opposition Leader in 1967.

The recommendation of the Vernon Report brought federal funding for rail standardization and assistance for Australian Industry Development Corporation (AIDC), Commonwealth Development Bank and expansion of the Commonwealth Serum Laboratories. Both major political parties can indeed achieve consensus on proactive commitments to the expansion and diversification of the Australian economy. Labor’s commitment to consensus-building about the value of the social market has always paid political dividends.

There is a possibility of course that this bipartisanship can be expanded to repair economic disruptions associated with the coronavirus. Insiders in Canberra are surely well aware of the longer-term implications of the current coronavirus crisis. Without JobKeeper and JobSeeker, there would have been unrest across Australia as in previous economic crises. The Australian trade union movement has completely supported such contemporary initiatives and seeks the extension of these programmes beyond September 2020.

Contrast this situation with the social unrest associated with the Great Depression of the 1890s.

The social unrest in the 1890s occurred at trade union hotpots such as the shearing sheds of Central Queensland, the mining fields at Broken Hill and the wharves of large ports. Mass unionism confronted attempts to lower wages and working conditions. Employers justified these actions as business profits were eroded by the serious economic downturns.

At Barcaldine in Central Queensland, the arrival of police squadrons and colonial troops to quell potential unrest is still acknowledged nostalgically each year on the Mayday Weekend (Tree of Knowledge Festival):

The ghost gum, Eucalyptus Papuana, which grew outside the Railway Station, earned its claim to fame as the founding site of the political movement we now know as the Australian Labor Party. In 1891 Barcaldine was the centre for the striking shearers during the “Great Shearers Strike” when they met under its boughs. In May 1891, about 3000 striking shearers marched under the “Eureka” flag to put forward their protests against poor working conditions and low wages. Because the area beneath the Tree of Knowledge was the scene of actions and decisions which had a profound effect on the future of labour and politics in Australia, it has become an icon of the Labor Party and Trade Unions.

The Tree of Knowledge was included in the National Heritage List on 26th January 2006. Sadly, it was poisoned in 2006 and did not recover.

What was once a one day float parade on the Labour Day Monday and known as May Day Parade & Celebrations has grown to a full weekend of community celebration embracing a diverse range of activities including Street Festival, Rev Fest, and Goat Racing now known as the Tree of Knowledge Festival.

Now in Queensland’s safest federal LNP seat of Maranoa, conservative elites have little to tremble about in the voting trends at the Barcaldine Polling Booth in 2019:

Preferences from the assortment of minor candidates, built up the One Nation Vote in Barcaldine from 13.04 per cent to 25.60 per cent. Federal LNP Member David Littleproud won this local booth with a 74.40 per cent vote after preferences.

It was a different scenario in 2016 when Labor won the Barcaldine Booth. Back in 2007, Labor won the federal seat of Flynn when Barcaldine was located in that seat. Other Queensland seats of Leichhardt, Dawson and Capricornia were won by Labor. The Labor Heartland will rally to the call if the political communication is exciting and credible enough. If Labor can retain the seat of Eden Monaro on 4 July 2020, some traction will be generated for the 2022 federal election.

At this stage, there is still significant apathy in the Labor Party’s potential heartland support base. Boasts about branch stacking in Victoria are contrary to Labor values and have brought a swift response from National ALP President Wayne Swan and Opposition Leader Anthony Albanese.

There have been similar instances in Liberal Party Branches particularly in the electorate of Ryan in Brisbane (ABC News 7 June 2019). The abuse of political office to advance personal over social market goals has become quite systemic.

While discussion of political issues might continue to excite a section of the community on both sides of politics, the vast majority are turned off by discussion of formal politics. For the majority, political involvement is simply a personal choice rather than a core value in Australian democracy.

Evidence of non-participation in formal political processes is not difficult to find.

The AEC’s estimates of electoral non-enrolment exceed 10 per cent of potential voters in 45 federal seats. In four federal seats the non-enrolment rate exceeds 20 per cent. The federal seats most affected are Sydney, Melbourne, Lingiari and Durack. Even a non-enrolment rate of 5 per cent translates into almost a million absent votes in contemporary national elections as noted in Dr Greg Kramer’s doctoral thesis at the Queensland Institute of Technology (2018).

Neglect of Indigenous communities by the federal government extends to the administrative management of electoral rolls by the Australian Electoral Commission (AEC). AEC estimates show that 24.4 per cent of indigenous Australians were not enrolled to vote on 30 June 2019. Electoral outcomes could have been affected in the Labor seats of Solomon, Lingiari and Blair as well as the marginal LNP seats of Longman, Leichhardt and Forde in Queensland.

More systematic checks of electoral enrolment are of course not in the interest of the LNP in its most marginal seats. Some voters have never been enrolled to vote and others take advantage of the federal LNP’s EasyPay service to cover the token administrative fines for failure to request a vote.

Beyond the administrative challenges of failure to vote or to enrol to vote is the evidence of high rates of informal voting and the appeal of protest votes for populist candidates.

The dire warnings from Deloitte Economics should justify more emphasis on the relevance of the alternative visions for our future within mainstream political parties. Labor should highlight the divide between hard right neoliberal agendas and progressive agendas to advance The Politics of Us.

Dire Short-Term Economic Projections

The prospects of a return to normalcy in the Australian economy are not sustained by forecasts from Deloitte Economics. This makes a farce of the curtailment of the JobSeeker and JobKeeper programmes from September 2020.

Image: Deloitte May 2020

The Reserve Bank (RBA) has responded to the current economic crisis by lowering official interest rates and offers of assurance to financial institutions in a similar vein to commitments made during the GFC. Last week’s reverses on share markets threaten dividends on superannuation assets particularly for self-funded retirees who are means-tested out of the receipt of part-pensions. Recovery will be difficult for at least two quarters if the global battle against COVID-19’s second wave are kept at bay.

The combined effects of the evolving global economic recession and the trade war between the US and China will have a major impact on Australia’s recovery from the current crisis.

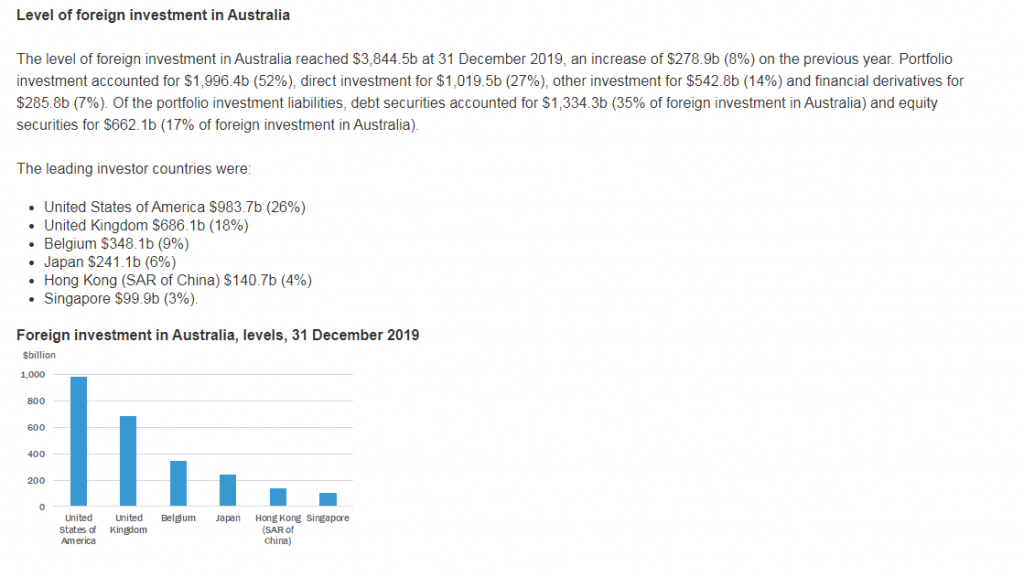

The level of net Chinese investment in Australia and related investment through Hong Kong has been greatly exaggerated by senior LNP ministers. Even with the inclusion of investment from Hong Kong, investment from China in Australia is currently running at about 6-7 per cent of all net investment in the year to December 2019 (ABS 5352.0 Released 7 May 2020):

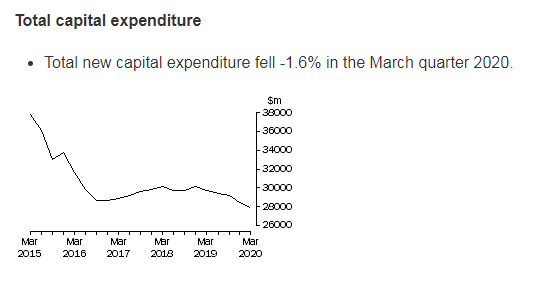

Even before the current COVID-19 Crisis, the contribution of Australia’s investment multiplier was burning like a damp fire as revealed in the latest data on capital expenditure in the March Quarter (ABS 5625.0 Released 28 May 2020):

All sectors recorded negative capital expenditure growth with the exception of mining (+4.2 per cent) and manufacturing (+5.7 per cent).

Another bright spot is the strength of the Australian dollar which hovers in the 65-71 cent exchange range to the US dollar.

With overseas tourism grounded, there may be opportunities to attract more capital flows into Australia, particularly from Asian countries where investors are looking for a safe-haven currency.

Failure of the senate to endorse a lowering of company taxes for all companies, left the Morrison Government awash with revenue prior to the 2019 elections. Largesse was possible for business support, income tax redistribution and even those grants to sporting clubs.

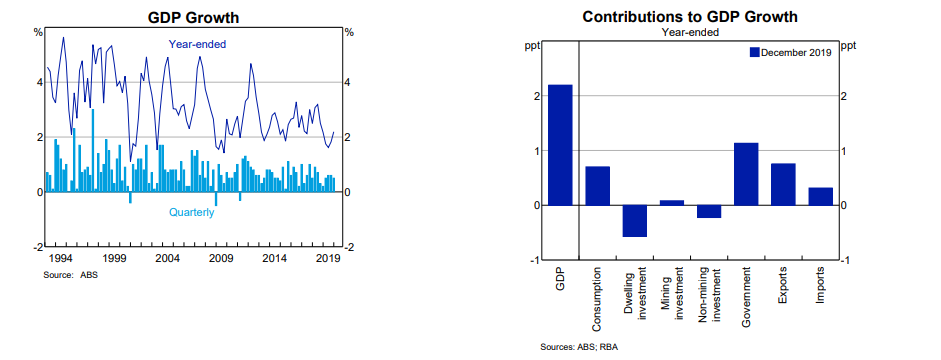

It was the government sectors at both state and federal levels that were already carrying the Australian economy prior to the current COVID-19 crisis when Australia’s GDP was growing at just over 2 per cent for the year to December 2019 (RBA Charts for June 2020):

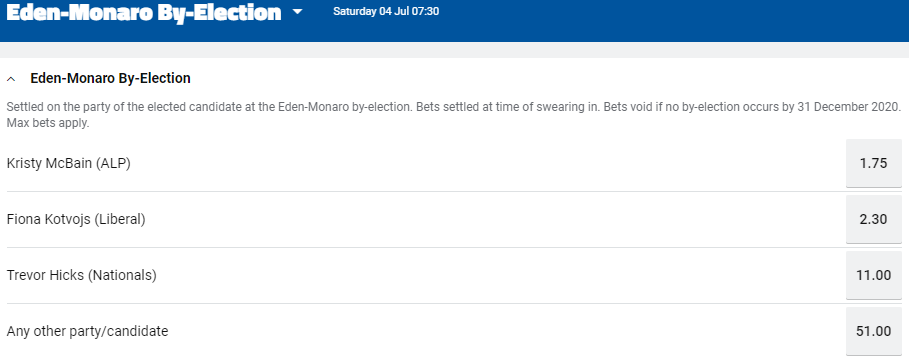

Crush time will come for the federal LNP well after the Eden-Monaro by-election date when the perceived generosity of JobKeeper and JobSeeker programmes are curtailed. In the short-term, the Sports Bet predicts a close result in Eden Monaro which has not yet been updated since the problems of branch-stacking were identified in the Victorian ALP. This corruption has tainted the image of the Labor Movement nationally at a most critical time for Australian politics during our first recession in almost 30 years.

Initial financial over-commitment level to the cost of JobKeeper is now being followed by the first signs of the austerity measures which will be followed in the future to ease the blow-out in the federal budget deficit by the premature removal of childcare subsidies (ABC News 10 June 2020):

But the COVID-19 smash-up is already looking like the “pink” recession, with women disproportionately affected by the shutdowns.

Think retail, food services and hospitality for a start. Women make up the majority of workers in these low-paid areas of employment, all of which have been hit hard.

“Health crises can exacerbate existing gender inequalities,” the relevant Government agency observed last month.

So why the Federal Government should choose the childcare sector as the first to prematurely lose the JobKeeper wage subsidy is rather perplexing.

Of any sector, it is one of the most female dominated.

“A lot more women have either lost jobs or lost hours than men and I would’ve thought that involvement in early childhood was one of the best things Government could do to protect jobs for women,” Early Childhood Australia chief executive Sam Page told the ABC.

“Both to support women who are relying on childcare to get back to work, but also to support nearly 200,000 who work in this sector, of which 97 per cent are women.”

If the Australian economy was already relying on government expenditure and consumer debt to keep everyone afloat prior to the COVID-19 Crisis, a minimum wage freeze is taking us back to the Fraser years and the onset of the 1981-82 recession. There is no hint that this freeze on the slender incomes of lower income casual workers should be balanced by a deferral of tax concessions to higher income workers and a freeze on executive salaries.

Even Channel Nine News dared to expose the take—home incomes of some of our political and financial elites (8 June 2020):

The chiefs of some of Australia’s top public offices are earning close to $1 million a year as the nation works to attract top talent to its most remunerated jobs.

Publicly available figures from the Australian Government Remunerational Tribunal show wages of full-time offices – which does not include the positions of parliamentary secretaries or CEOs of government-owned businesses – top out at more than $886,750 a year.

The top total remuneration was earnt by Wayne Byres, Chair of the Australia Prudential Regulation Authority (APRA) with $886,750.

A three-way tie for second place with a total remuneration of $775,910 was Rod Sims (Chairperson of the Australian Competition and Consumer Commission), James Shipton (Chairperson of the Australian Securities and Investments Commission) and Dr. Stephen Donaghue QC (Solicitor-General).

Then comes CEO of Services Australia Rebecca Skinner with $748,210 followed by the Australian Federal Police Commissioner Reece Kershaw with $720,480.

Two other positions on the same remuneration of $720,480 were the Commissioner of the Australian Public Service Peter Woolcott and Director General of the Office of National Intelligence Nick Warner.

Instead of deferring the tax concessions for middle to upper income families, the federal LNP will campaign on the benefits of lower taxes and a return to the normalcy of corporate ideology and the generation of patriotic fervour against the resurgence of China as a global superpower.

Progressive Australia must have some real alternatives to a repeat of the fear strategies which won Scott Morrison another term of government in 2019 and depressed Labor’s heartland vote in electorates like Capricornia and Blair. The federal LNP is adept at the development of communication strategies which torpedo essential initiatives like more equitable access to specialist medical services for the treatment of cancer through fairer bulk-billing incentives as extravagant extras.

The appeal of tax relief by neoliberal parties has worked well internationally in Britain and Germany. Where social democratic parties hold power in places like Spain, Denmark and Sweden, it is usually with the co-operation of minor parties to from workable coalitions. Unless economic conditions really deteriorate, it will be difficult for social democratic parties here and beyond to break out of the bind which is being imposed by the tax weapon used by neoliberal parties to project their credentials. Are there any alternatives to this communication bind?

Prospects for New Australian Progressive Options?

One way out of the current impasse over the risks of higher taxes might be to allow national and state investment funds to take investments from the local and especially the overseas corporate sectors to diversify available funding for essential and potentially income earning essential services.

State investment funds such as the Queensland Investment Corporate (QIC) have routinely managed essential services such as motorways, ports or housing projects. Some of these investment projects were sold off by the state LNP but a balance of portfolios still exist.

Cut-backs in public broadcasting are a real threat to our integrity as a sovereign nation and investment in innovative ABC programming could be a key export of both programmes and technical services internationally.

In NSW, the state LNP is still cautious about public sector investment which potentially creates dividends for local and overseas corporate investors. NSW has sold public electricity networks to assist in funding its NSW Generations Fund (NGF) which can certainly assist with the delivery of essential services and public infrastructure.

Yet the NSW Treasurer Dominic Perrottet appropriately talks up the value of the Fund without too much attention to its dark past in the sale of public assets to seed the new fund (First Annual Report):

The NSW Government announced the NGF in June 2018, a world-first sovereign wealth fund to guard against intergenerational budgetary pressures and keep debt sustainable in the long-term, while also delivering for communities today.

Seeded with $10 billion in late 2018, $7 billion following the sale of a 51 percent stake in WestConnex and $3 billion from balance sheet reserves, the NGF had a balance of $10.9 billion as at 30 June 2019, outperforming expectations.

The overall vision and purpose of the NGF is to support the State’s Triple-A credit rating over the long-term and ensure the NSW Government can plan for the future by responsibly delivering the essential productive infrastructure for the people of New South Wales without burdening future generations with debt. It is legislated that funds within the NGF can only be used for the purpose of paying down debt, or funding community services and facilities projects.

Perhaps more NSW Public Assets could have been retained under state or corporatized controls if the NGF was opened to voluntary corporate funding. Dividend payments would always be at the discretion of the NGF as with returns on the superannuation contribution of wage-earners. In contrast, NSW T-Bonds are largely long-term options from traditional fixed interest arrangements. NSW Treasury is welcome to clarify the situation.

Perhaps opportunities exist to achieve bipartisan support for unwelcome privatization programmes in the quest for new investment capital when corporate providers both here and overseas are willing to make an investment contribution that delivers wealth generation for the wider community through sustainable programmes such as catchment and coastal management, alternative energy projects, or affordable housing linked to transport oriented developments (TODs) in urban and regional planning.

Similar initiatives should be taken at a federal level to overcome the backlogs in our essential services through the creation of a National Investment Fund either as a separate entity or a complementary financial additive to the Future Fund. There is a possibility that investments in any future Australian Investment and Essential Service Funds might also attract some taxation relief for individual investors and especially for major superannuation firms.

The usual hassles about funding the ABC and other public broadcasting networks could perhaps be eased by corporate investment in creative programmes that inspire domestic audiences and add to export revenue. The technical expertise of public broadcasting is indeed an exportable service for consultancy services to the Asia-Pacific Regions.

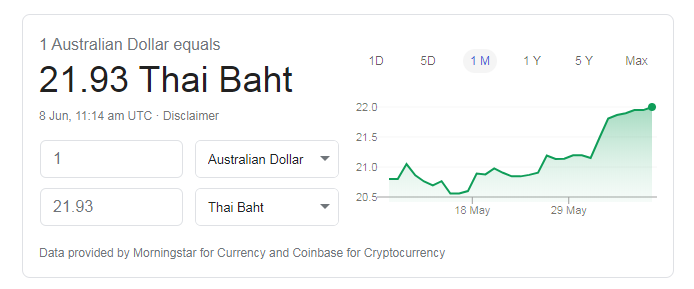

The relative strength of the Australian dollar is a great national asset in attracting new investment in state and federal infrastructure and essential service funds.

Being able to invest in sustainable development programmes in Australia would have instant appeal to corporate sectors in countries with more unstable currencies particularly from our Asian and Middle Eastern neighbours. Currency conversation rates are always on the move in a volatile market and all these rates have moved ever so slightly against the Australian dollar in the last week since I accessed the data (Morningstar Currency Converters 8-13 June 2020).

The appeal of a relatively stable Australian hedge-fund currency is an asset which will also strengthen the profile of our own financial sector globally and offer capital flows to our state and federal governments without those nasty election debates about the value of neoliberalism as the best mechanism for sustainable economic development.

From Less Stable Currencies to Australian Hedge Fund Investments?

Alienated constituents across Australia are more likely to respond to the politics of hope based on some daring bipartisan initiatives. Progressive Australia needs to support strategies to promote political involvement even if some degree of risk-taking is involved in challenging cautious assumptions about Normalcy in Australian Democracy. Talking up the value of the social wage offered by Medicare, affordable housing and income support programmes in difficult times must always be a part of that return to Normalcy which the federal LNP so desperately wants to foster to return to business as usual practices. The generation of wealth through a broadened investment multiplier would indeed become a bipartisan priority for sustainable economic and social recovery in the post-coronavirus sunshine which everyone welcomes.

Denis Bright (pictured) is a financial member of the Media, Entertainment and Arts Alliance (MEAA). Denis is committed to consensus-building in these difficult times. Your feedback from readers advances the cause of citizens’ journalism. Full names are not required when making comments. However, a valid email must be submitted if you decide to hit the Replies Button.

Denis Bright (pictured) is a financial member of the Media, Entertainment and Arts Alliance (MEAA). Denis is committed to consensus-building in these difficult times. Your feedback from readers advances the cause of citizens’ journalism. Full names are not required when making comments. However, a valid email must be submitted if you decide to hit the Replies Button.

Like what we do at The AIMN?

You’ll like it even more knowing that your donation will help us to keep up the good fight.

Chuck in a few bucks and see just how far it goes!

Your contribution to help with the running costs of this site will be gratefully accepted.

You can donate through PayPal or credit card via the button below, or donate via bank transfer: BSB: 062500; A/c no: 10495969

12 comments

Login here Register here-

Matters Not -

New England Cocky -

Mia -

Leila -

Frankie -

Chris -

Paul -

Clio -

andy56 -

Tessa_M -

James -

rubio@coast

Return to home pageAnother excellent article Denis. Noted the remuneration paid to senior public servants and, while it’s below what can be earned in the private sector, it still looks excessive. Then again, it boosts the comparative case for increases in ministerial salaries. After all – can’t have public servants earning too much more than their responsible minister.

Re your repeated reference to the ‘social market’ caused me to check its definition and its evolution/history which was also worthwhile. Nothing too surprising but will include a video reference.

Noted also the current exchange rates with now having a better insight into the grumbles of those expats on pensions currently living in Thailand. Remember the times when one Australia dollar returned 30 plus baht and not the approx 20 baht currently on offer. Such is life.

@MN: Uhm ….. why would you increase the remuneration packed alone paid to politicians when they are currently subsidising their living expenses with travel expenses and other financial rorts that Canberra considers are “legitimate” ancillary income?

AS for the so-called “public servants” ….. I doubt t that any political appointment to the APS can justify receiving those quoted remunerations in terms of outcomes for the benefit of Austrian taxpayers.

Eden Monaro is not a safe Labor seat by any means

Best wishes to Labor’s Kristy McBain in this potentially close contest.

Thanks Denis for your interest in the social market which used to be associated with the social wage concept but this was extended by the LNP to encourage more Commonwealth Government involvement in national development even before the election of Gough Whitlam.

Denis, thanks for an interesting article about the economy in the post CoVid era.

Thanks Denis for raising your concerns about the maintenance of JobKeeper and JobSeeker.

Thanks for the brilliant article Denis.

Business precincts could assist in generating dividends from Casino to Coolangatta Airport Rail Link. In the short-term Jobkeeper and JobSeeker must be extended even if it means that the tax relief for higher income earners is abandoned.

Thanks Denis for sharing these amazing insights. Let’s how that the recovery method aligns with the article you have written.

Why is it i feel that more trees have been cut down for nothing. We dont need anymore evidence, its all around us, we just need to get angry and get some pitchforks out. Its just a clear waste of time trying to defeat with a pen that which would use all the system’s resources against us.

Then Birmingham says australia’s borders will remain closed till the new year. he better make sure people are not destitute or he will be tared and feathered

Government commitment to the NSW Regions is vital. There are no more big state assets to sell here to fund the NSW Generations Fund.

What is the National Party federal member for Page doing to assist our region?

Crunch time is coming after the Eden Monaro by-election. Australia will be very unstable by the next election year particularly if Trump is defeated and the USA resumes its normal leadership role and positive relations with China. Will we really need SCOMO’s ballistic missiles which are just an emotional distraction for the by-election campaign.