British Labour’s National Investment Fund: Redefining Centre-Left Politics

Denis Bright invites discussion on Jeremy Corbyn’s National Investment Fund. Can it assist in revitalising the British economy and the finacial hub of the City of London? Is the future of Britain in better hands with the remnants of Thatcherism as claimed by Conservatives at their Annual Conference?

Following Labour’s net gain of 30 seats at the UK General Elections on 8 June 2017, Jeremy Corbyn’s inspirational Conference Speech at Brighton continues the paradigm changes in British politics

Challenges remain in coping with the continued loss of 35 seats to the Scottish Nationalist Party (SNP). There are big swathes of Comservative blue constituencies across England between London and the Industrialized North. Seventy constituencies are still required to form a majoirty government.

The latest YouGovernment/Times Poll shows that support base for the Conservative Party has declined by 4.5 per cent since the national elections. This gives Labour a 4 per cent lead in the polls to 22-24 September 2017.

The minority government of Theresa May seems to have run out of consistent solutions to the economic and wider structural problems facing Britain.

The Conservative Government’s only support base is from the over 65 year age group. Amongst younger voters in the 18-24 year range, Labour outpolls the Conservatives by a remarkable 70 to 15 per cent margin.

The UK Economic Context

As the UK Economy enters the troubled waters of Brexit, short-term economic projections are being scaled back. Britain has to craft a new economic identity beyond the remnants of Thatcherism which favours more leadership from the corporate sector as the only path forward.

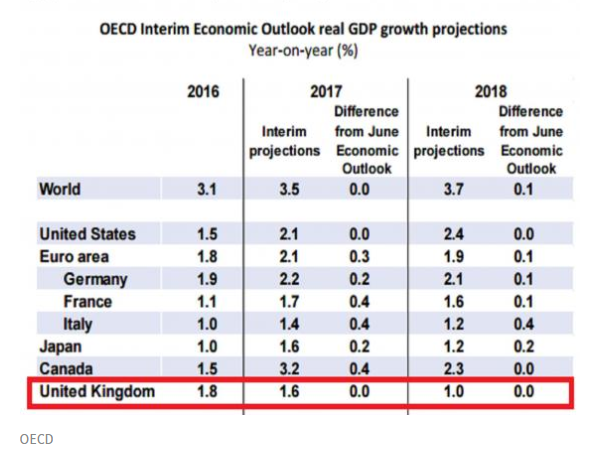

At the Conservative Party Conference in Manchester, there is growing concern at the lack of direction in Theresa May’s government as economic growth rates for 2018 pose new challenges:

The editorial in the UK Guardian Online sums up the likely reactions from Insiders within the Conservative Party at Manchester (Guardian Online 1 October 2017):

Mrs May made it abjectly clear on Sunday that she is both temperamentally and politically too weak to sack someone who is disloyal to her and an embarrassment to the country.

It is possible that Mrs May will get her wish this week and survive. The Conservative party has deep instincts of self-preservation and discipline. The idea that a new leader, Mr Johnson least of all, would unite either the party or the country on Brexit or anything else lacks credibility. Though they are divided on many things, the Tories are as one in their wish to avoid handing power to Jeremy Corbyn. But the real question is not whether Mrs May will survive but whether she deserves to. The reality is that there is almost no sign whatever of that.

Britain’s once robust financial sector is being challenged by investment flows towards the most dynamic European markets such as Switzerland, the Netherlands and Spain.

The global profile of British financial markets has declined since the Global Financial Crisis (GFC).

The McKinsey Global Institute has just summarised the current situation (McKinsey Global Institute Online August 2017):

The largest banks in the United Kingdom have already reduced their foreign bank assets by one-quarter since 2007. Gross inflows of loans and other investment to the United Kingdom were negative over the past three years (2014 to 2016), indicating that foreigners are withdrawing capital. Gross loan outflows from the United Kingdom were negative in 2012, 2013, and 2015, indicating that UK-based lenders (including foreign subsidiaries of European and US banks based in London) were reducing their stock of foreign loans. The City of London has shed jobs. Much will depend on how Brexit negotiations proceed and on what access banks based in London will have to EU markets.

Even when British financial markets were thriving before the GFC, investors targeted gains from speculation in subprime lending ventures, financial derivatives and futures markets which have little real impact on productive investment in the wider economy. The City of London welcomed money laundering from developing countries and transfers from investors in the US to avoid banking and taxation controls.

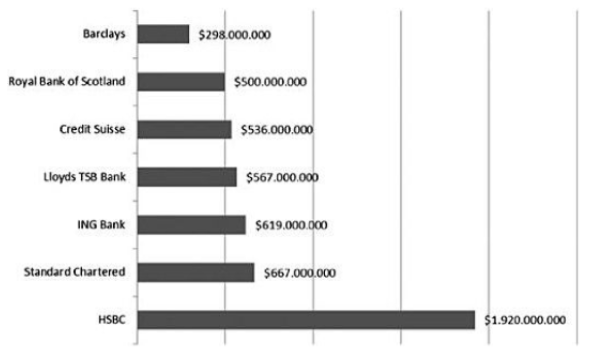

During the Obama Years, British financial institutions were prominent on the list of fines imposed in the US financial regulatory agencies for money laundering activities. Large sections of The Handbook of Business and Corruption (2016) are available online from Emerald Group Publishing.

More enlightenment on the role of the City of London in Global Finance comes from Tony Norfield. Having worked for twenty years at Bloomberg, Tony Norfield moved on to become head of foreign exchange strategies at the Dutch lender ABN Amro. From this former insider role, Tony Norfield is aptly qualified to offer a negative insider interpretation of the roles played by the City of London in global finance.

Tony Norfield identifies London as the world’s biggest international banking and foreign exchange market, shaping the development of global capital (Amazon Books 2017).

London as a global financial hub attracts all the big international companies-not just the banks. Tony Norfield offers a shocking and insightful interpretation of the role of the US dollar in global trading, the network of British-linked tax havens, the flows of finance around the world and the system of power built upon financial securities.

Such provocative interpretations contrast with the favourable interpretations of Thatcherism from conservative think-tanks in the UK and Australia.

Until the arrival of Jeremy Corbyn, Thatcherism enjoyed a fair degree of bipartisan support. Any return to government intervention in directing financial priorities was perceived as a vote loser by British Labour.

The Paradigm Change to Labour’s National Investment Fund

Released in Labour’s Manifesto for the 2017 General Election, a National Transformation Fund offered a a 250 billion pound investment fund to modernise essential infrastructure over ten years. Capital investment of these dimensions would come from a National Investment Bank (NIB). This would be established by a 20-billion pound bond issue. The NIB would then attract corporate investment from Brtiain and abroad.

Support for this type of government involvement in the direction of essential public investment flows would provide alternatives to Thatcherite financial processes.

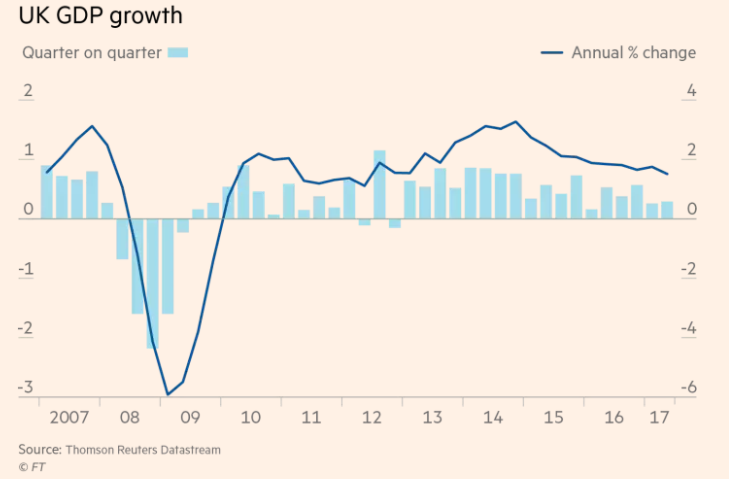

The consequences of a continued focus on deficit reductions by Conservative Governments are reflected in the falling trend-lines for UK GDP Growth (FT Online 30 September 2017).

As the Conservative Party Conference approaches in Manchester this week, the centre-right political rhetoric fluctuates wildly between appeal for a soft Brexit (EU Brexit Summit in Florence), a re-statement of Thatcherite values (Bank of England Address) and a commitment to more responsible social policies (Manchester Conference).

Can Britain as the world’s ninth largest economy in PPP terms, still speak so defiantly in the Trump Era when the US Department of Commerce has imposed a 220 per cent tariff on the C-series Bombardier airliners with a Made in British Ulster Tag for the Canadian firm, Bombardier? (Independent Online 29 September 2017).

Jeremy Corbyn’s public investment agenda will be in stark contrast to the rhetorical flair of attempts by British Conservatives to re-market a new post-Brexit version of neoliberalism at the forthcoming Conference which is expected to attract more protesters than Delegates (Metro Online Manchester 28 September 2017).

Denis Bright (pictured) is a registered teacher and a member of the Media, Entertainment and Arts Alliance (MEAA). Denis has recent postgraduate qualifications in journalism, public policy and international relations. He is interested in promoting discussion to evaluate pragmatic public policies that are compatible with contemporary globalization.

Denis Bright (pictured) is a registered teacher and a member of the Media, Entertainment and Arts Alliance (MEAA). Denis has recent postgraduate qualifications in journalism, public policy and international relations. He is interested in promoting discussion to evaluate pragmatic public policies that are compatible with contemporary globalization.

16 comments

Login here Register here-

RonR

-

Andrew Smith

-

Mia

-

Lalnama

-

Karlo

-

Paul

-

Jaquix

-

Marcus

-

Tom

-

Patrick for Left Unity

-

Tessa

-

James

-

win jeavons

-

Stella

-

Kyran

-

jimhaz

Return to home pageWe had what Corbyn Eventually wants a National Bank of Public Credit but it was destroyed by Menzies serving the City of London

Seems quite logical, but not comfortable with either the state or politicians trying to pick winners, like when the UK made a sub-optimal political and economic choice regarding the exit from the EU. Further, like Australia has a ‘Future Fund’ sounding like it’s saving surpluses or windfalls for the nation, when in fact it is funded by general revenue and is to pay baby boomer generation public servant defined benefit retirement schemes (think all public servants are now on super schemes, undefined benefits).

Too many of the economic policies in the UK, implied and actual, are suggestive of a ‘balanced economy’ and primacy of the nation state, popular since the time of Malthus and Ricardo, but nowadays informed by old nativist ideology like Herman Daly’s ‘steady state economy’ for which Brexit is a desired outcome. Exemplified by sovereignty, an ‘Anglosphere’, strong borders, withdrawal from trade agreements and supra-national bodies like the EU, avoid services, visa/immigration restrictions, citizenship and voting restrictions, zero economic growth (naively assumes growth remains within a band of positive to nil, but ignores impacts of negative growth on society) etc.

Perfect world for the top 1% with obedient lower orders on the greasy pole obsessing about their (generally) WASP identity and voting against their own interests; clever long game.

The article is relevant to Australia as well. We need money invested in infrastructure but good governance needs to be applied and the continued support for the Adani project by both Federal and State governments is highly questionable.

Inter sting article Denis, seems like a good idea on Corbin part, unless we have incredible infrastructure the whole society is taken backwards as the economy is impacted on adversely. In this sphere society is compromised.

We desperately need a Corbyn type out here. Someone with vision and not a member of the same as, same as club. Neo-liberal economics is a failed experiment but still holds sway over our government and most of the opposition. Time to move on.

Thanks for the interesting article Denis!

There is some real merit in an infrastructure investment fund. Something British and other governments should consider.

With the UK having voluntary voting, Jeremy Corbyn will be going all out to motivate and mobilise the young vote. Labor should do the same here. Heartening to see a record number of 18-24yr olds enrolling in time for the marriage equality survey. Just have to hope they eventually found a post box. Or maybe Mum and Dad posted it for them.

Faith in Thatcherism seems to be on the wane in Britain. But what about Australia? Where is Labor’s alternative while Thatcherism is still rules in the LNP.

A great mainstream interpretation of global financialization. British Labour is distancing itself from the key articles of faith of British Conservatives: Corporate control of society and arms deals with despots in places like Saudi Arabia and Egypt.

Bipartisan support for Thatcherism has brought appalling social consequences and fragmented Labor’ support base

The ideals of Margaret Thatcher are still alive and well in Australia!

An article that challenges the tenets of the financialisation as the mainstream agenda of politics.

The difference between Labor ( Aus.) and Labour (UK) is the extent of “u” in the policies.

Thanks for another interesting article Denis about the British political situation. The concept of the infrastructure investment fund is definitely one which could be applied here in Australia.

The passing of the ‘Brexit baton’ appears to be slipping. ‘Brexit’ had two power sources, IMO.

The ‘proletariat’, who were told their jobs were threatened by ‘foreigners’, provided much support. The ‘elite’s’, who knew that proposed EU regulations would, at the very least, inhibit their power and influence, provided much capital.

In the middle of the two were the politicians. What a unique opportunity. They harnessed the fear of both groups, however ill-founded, and used it for the most vile of notions. Advocate for ignorance, based on nothing more than slogans, supported by nothing other than fear.

In the absence of remedy, or solution, all that was on offer was rhetoric.

When they won the argument, built on fear and ignorance, they were left in the invidious position of having to formulate a remedy, a solution, that would appease both groups of supporters.

How do you sell the unsellable?

How do you explain to the ‘proletariat’ that restricting those coming into England to ‘get jobs’, will now restrict them leaving to get work in Europe?

How do you explain to the ‘elite’s’ that losing the status of GFC (Global Financial Capital) will do far more damage to their power and influence than remaining in an ‘unholy partnership’?

How do you explain to your ‘future ex’, at the commencement of negotiations, that you never really liked them, but they should be nice to you because you’re leaving?

For what it’s worth, May needs all the friends she can get. The most vocal advocate of Brexit was Murdoch. The seismic shift in the passing of the ‘Brexit baton’ wasn’t any of the foregoing. Under her stewardship, he has been referred to enquiry for his most recent ‘Sky’ bid attempt.

With friends like that, who needs enemies? Right? It has to be the ultimate wedgie.

Brexit was always about yelling. Corbyn’s policies are based, for the most part, on listening.

May. Murdoch. Rot in hell.

However they wish to address it, they have a hell of a problem.

“Jeremy Corbyn’s public investment agenda will be in stark contrast to the rhetorical flair of attempts by British Conservatives to re-market a new post-Brexit version of neoliberalism at the forthcoming Conference which is expected to attract more protesters than Delegates…”

Just out of curiosity, how did that conference go?

Thank you Mr Bright and commenters. Take care

This chart really demonstrates we are dealing with something quite unusual in terms of income distribution. It has the appearance of a control takeover by the very rich. We need a form of socialism that is less about ownership (other than utilities) and more about ensuring flat income distribution from growth.

Our Broken Economy, in One Simple Chart (US)

https://www.nytimes.com/interactive/2017/08/07/opinion/leonhardt-income-inequality.html?t=1&cn=ZmxleGlibGVfcmVjcw%3D%3D&refsrc