What’s the diff?

With Tony Abbott keen to make superannuation an election issue and a point of differentiation between the parties, it is worth revisiting the Coalition’s record.

In 1985, the government and the ACTU struck a deal which saw the trade union movement forfeit a claim to 3% productivity improvement as wages to instead be paid in compulsory superannuation – endorsed by the Arbitration Commission and managed by superannuation funds with equal representation of the unions in the industry and the employers.

Leader of the Opposition, John Howard, reacted by saying:

“That superannuation deal, which represents all that is rotten with industrial relations in Australia, shows the government and the trade union movement in Australia not only playing the employers of Australia for mugs but it is also playing the Arbitration Commission for mugs”.

The Coalition has steadfastly opposed every increase in compulsory superannuation since that time.

In the 1995 budget, Ralph Willis unveiled a scheduled increase in compulsory super from 9% to 12% and eventually to 15%. It was to be one of the Keating government’s major legacy reforms.

Howard went to the 1996 election promising to “provide in full the funds earmarked in the 1995 — 96 Budget to match compulsory employee contributions according to the proposed schedule” but, 6 months after releasing the policy, dropped the plan in the 1996 budget because it was “too expensive”.

In 2007, facing a tough election, Howard went on a vote-buying spree making radical changes to the superannuation rules which had a huge impact at the time and whose effects we are grappling with today.

The majority of workers could now withdraw their superannuation tax-free upon reaching the age of 60. Most self-employed could claim their superannuation contributions as a tax deduction. In addition, semi-retired people could continue to work part-time, and use part of their tax-free superannuation to top up their pay.

Despite the relatively generous tax treatment of capital gains, the new superannuation tax treatment led to the selling off of some assets, particularly rental housing, as people sought to take advantage of the opportunity to add funds to their superannuation accounts and claim them back later tax-free.

People were allowed to transfer up to A$1 million into their superannuation accounts before June 30, 2007, after which an annual maximum of A$150,000 of after-tax contributions could be made. The effect of this change in the rules was enormous. In the June quarter of 2007, A$22.4 billion was transferred to superannuation accounts by individuals. This compares with A$7.4 billion in the June quarter of 2006. June 2007 was the first time in Australia that member contributions exceeded employer contributions.

In 2010, Abbott went to the election with a superannuation policy that was criticised by the industry as “failing to address retirement income adequacy and the challenge of Australia’s ageing population.”

The Association of Superannuation Funds of Australia (ASFA), the Australian Institute of Superannuation Trustees (AIST) and the Financial Services Council (FSC) said in a joint statement that a failure to increase the superannuation guarantee (SG) to 12 percent, the failure to raise the concessional caps for individuals over 50 and the failure to provide a super tax contribution rebate for low-income earners would adversely impact Australian workers.

In 2011 Abbott did a backflip, reversing the party’s position insisting that the Coalition would not rescind the higher guarantee. This was done without consulting the party room.

In 2012, John Roskam from the IPA wrote

“Compulsory superannuation offends practically every principle of what should be Liberal Party philosophy. If an Abbott government does keep compulsory superannuation it must, at a minimum, make drastic changes.”

Moving forward to February 2013, we were receiving mixed messages from Abbott and Hockey.

In a doorstop interview, when asked if he would cut those initiatives, Hockey replied “Absolutely, you can’t afford them.”

Two hours later, after the PM’s office went into a flurry of denial, Hockey tweeted

“Would be nice if Nine News had checked the facts…Coalition remains committed to keeping increase in compulsory superannuation from 9-12%.”

In April 2013 Tony Abbott said “We will ensure that no more negative unexpected changes occur to the superannuation system so that those planning for their retirement can face the future with a higher degree of predictability.”

One month later Abbott announced he would delay the compulsory superannuation guarantee increase for two years and do away with co-contributions for low income earners so it appears Joe had let the cat out of the bag a few weeks early.

Abbott also promised to do away with Labor’s plan for a 15 per cent tax on superannuation pension earnings over $100,000 saying it was too hard to implement.

According to the chief executive of Industry Super Australia, David Whiteley, this resulted in 3.6 million Australians on low incomes being out of pocket $500 a year, while just 16,000 of the nation’s top earners benefitted from the scrapping of the 15 per cent tax.

After winning government, the Coalition has made further delays in the increase of the superannuation guarantee freezing the rate at 9.5% for seven years after which it increases gradually to 12% by 2025 rather than 2019 as originally scheduled.

For an average worker who has recently joined the workforce, that could reduce retirement balances by about 5 per cent, or $40,000.

For those on lower incomes, the impacts will be magnified if the Low Income Super Contribution (LISC) scheme is shelved, as planned, in 2017. LISC ensures that people earning relatively low incomes do not end up paying a higher tax rate on their super contributions than they pay on their ordinary income.

Abbott is committed to cutting costs for employers and protecting the income of wealthy retirees at the expense of entitlements of workers and those most likely to need a top-up in retirement. Freezing the SG has not led to wage increases despite Abbott’s assertion that this puts more money into the pockets of workers.

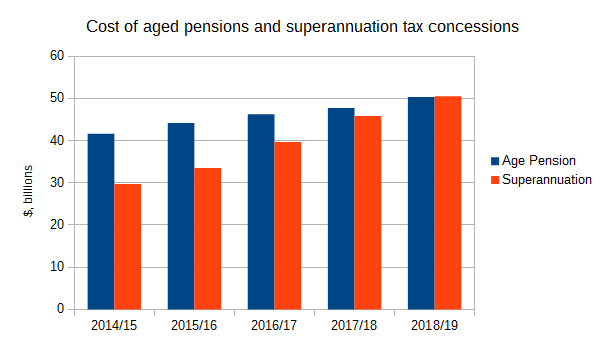

With the cost of superannuation tax concessions set to overtake the age pension, it indeed should be an important point of differentiation between the two parties at the next election.

18 comments

Login here Register here-

Norm in Ngunnawal country -

stephentardrew -

FreeThinker -

John Lord -

Richard Grant -

Edson Masden -

Chris Donaghy -

Michael Taylor -

mark delmege -

John Turner -

Gangey1959 -

stephentardrew -

Edson Masden -

diannaart -

The AIM Network -

Möbius Ecko -

mark delmege -

Harquebus

Return to home pageThis is a classic case of “check what they do, and not what they say”.

Charity to the lifters.

Poverty to the leaners.

My greed minus your suffering equals growth and increased wealth for the 1% nation.

Your careful research Kaye Lee is yet again powerful, this time in uncovering the deceitful history of Liberal Party proclamations and policy backflips on superannuation over the last 3 decades.

Yes she is good Free Thinker.

This article needs to be sent to every Federal Govt Member.

Compulsory superannuation is just another example of the neo-liberal (economic rationalist as it was then known) fetish with reducing government involvement in the economy. And if it ends up mostly benefitting the rich and super rich, well it’s a win-win.

For all the cock and bull we hear now about the wonders of Keating and Hawke as economic managers, they did more than any other government to bring about the neo-liberal revolution which is still playing out.

The Accord together with on-going privatisation has done enormous damage to Unionism and the true labour movement in this country. Imagine if all that superannuation money hadn’t gone into the stock market and other, largely unproductive, investments. We could have the best public health and education systems in the world, better infra-structure, a welfare system that provides a decent income to those in need and still have more money in our own pockets.

An example of the level of damage that Keating and Hawke wreaked upon the majority of Australians is the destruction of manufacturing without providing adequate resources for the displaced workers or their children to find an alternative means of making a living. In fact the public education system is in crisis due to chronic lack of funding (even the limited Gonski reforms were unfunded and not due to really take effect till the 5th and 6th years after implementation).

The groundwork for many of the problems we currently face was laid during the golden years of Keating, Hawke, Kelty, Dawkins,…etc.

I’m confused by this and always have been.

The Right side of politics are always against any welfare payments. Superannuation is designed to allow us to save for our retirement and not have to rely on the state (at least entirely).

Why don’t they support this?

If I could get an answer to better educate myself (and any liberal mates) that would be greatly appreciated.

🙂

Chris, to get to the heart of it I think it boils down to one reason: Labor support it.

Didn’t Labor when it was last in Office say it wouldn’t be making any more changes to super for years or something similar. In other words in Government it was happy with the tax rorts for the high earners.

On other matters I’m with Edison – broadly speaking – though there are some benefits to contracting out services and I disagree with Jammy on Cars. We did make a very good car – I have one – very reliable and any money the govt put in to the industry it got back in taxes, employment, a bigger economy, skills and a better balance of payments. An economy without basic manufacturing industry is suspect.

A Truism of economics is that a few people can save but, if everyone saves the economy slips into recession.

With an ageing population, and the resultant problems ,it must be remembered that the real future problem is the distribution of goods and services between the various age groups existing over time periods in that future.

The problem cannot be solved simply by creating cash savings now. Such savings to date have mainly led to the creation of massive financial institutions manipulating funds in the stocks and bond markets. Competition for assets in this scenario will, and has already, led to inflation of asset values and is one factor forcing the price of homes up out of the reach of ordinary single income families particularly in major cities such as Sydney. (Another major factor is competition from the excess savings of overpaid executives and professionals as these groups seek safe havens for these savings).

The future working population will need to be exceedingly efficient in producing goods and services if the limited working population is to produce sufficient to satisfy their own needs and desires and the products required by the non-working aged and infirm.

Savings now, in the form of superannuation contributions, only make sense if those savings are directed to making future production efficient. This is difficult as the future is mainly indeterminable and we do not know largely what physical products will be required although health, education, police and defence and similar services are probably predictable

.

Future working populations will resort to inflationary tactics if they are not satisfied that their share of then current production is a fair share and that the asset richer older groups are being greedy.

Australia’s main future problem is that our current account is deteriorating. We need to take a leaf out of Norway’s book.

It seems to me that the greatest issue facing us mere mortals is not so much an aging population, but the reducing ‘retirement’ age, largely forced, of our workforce. Australia has a tiny population, both in comparison to its size, and by comparison to our neighbors.

We have huge resource reserves, which are sadly in the hands of too few people with far too much power, and we have had a succession of governments over the last 30 years who have been quietly selling our national soul to our economic competitors at bargain basement rates.

The rates of either compulsory or voluntary superannuation contributions are not wort a pinch of shit if we don’t have people working.

FTA’s, the upcoming TPP agreement, and the low or non-existent trade and production protections, which have been whittled away quietly by all governments since, and including, hawke, have been the death of our development.

Our current pm’s attitude towards any sort of new or improved production and development, as illustrated by his attitude and statements regarding renewable energy, are just embarrassing when looked at from any sort of international viewpoint, but the reality is we need them desperately from an employment standpoint before anything else.

I take exception to JMarch’s comment regarding ‘crappy Holden cars’, but that is not the point. At least we currently make cars, and they are not crappy. They are certainly better than any asian built bmw, toyundaisun or the rest of their ilk.

Getting back to Renewable Energy etc, we have the space to run huge Solar and Wind farms. We can make the required equipment here. If it costs more than imported shit, tough. At least we have a workforce in employment.

Not long ago ms reinhart ordered a couple of billion dollars worth of new mining equipment from the septics, at a bargain interest rate for her loan too by the way. Whilst the Cat dump-trucks are the worlds best, (and that is from experience), there is no reason we can’t build our own version here. Heaven knows there are enough of them here to warrant the exercise.

All we as a workforce need is a little support in the form of protection from imports and we as a collective will be ok. Then we can contribute to our super, and not have to rely on ever dwindling government handouts.

Australia could be building GM’s electric cars for the global market, but our half-witted pm decided that half a billion dollars as setup assistance funding was not spending, regardless of the jobs that will be lost in 2-3-4 years. If GM had stayed, so would have Toyota.

I’ll stop bleating now, I’m getting too worked up, and besides, with the 31/2 grand I have in super since I became self employed in the mid 90s should see me through. Dunno what my kids are going to do though. Maybe I can leave them the room I am renting.

Great comment Gangey I thoroughly concur. Furthermore the more we produce the more we can afford foreign aid to help low income countries improve their social and work conditions. The exploiters, in fact, want to shut down the growth in wages and conditions across the world so they can exploit labour in the sweat shops they are complicit in making. They do not give a damn about social justice or international redistribution that is why the TPP and TPIP so they can avoid sovereign government regulations. The whole paradigm is twisted towards the elites and because they own the media and means of production will use any deception to undermine the rights and privileges of ordinary people. The populace are not taught to think laterally but to repeat the endless irrational sound-bites until they apparently become pseudo facts. It is these pseudo facts that the likes of MMT are trying to challenge.

The point is that pseudo facts appear to have legitimacy through pure force of indoctrination. The idea is to keep people from thinking logically or rationally because they would immediately challenge the oligarchs with the contradictory hard, empirically-provable, facts. The complexities of the financial system is a prime example of keeping the populace bemused by obscure and obfuscating financial and legal jargon.

Is it possible for you to post without quoting and disecting somebody else’s post?

Eh, Jammy?

Same as it ever was…. this fact cannot be repeated enough.

I, like many Australians have no super left at all – mine went in keeping my home during the worst of my illness – not that it was ever enough to retire on – which is why I had no hesitation using it all.

Good question, Edson.

It’s our opinion that he only comes here to criticise other peoples’ comments or the commenter him or herself. The term for such people is a ‘sniper’.

And the profits from the mining industry mostly go to Asian countries and big overseas investors but I don’t see Abbott closing that down.

He/she doesn’t bother me. The point Jammy made was that the auto operation was foreign owned and we had no real control over it. 100% correcto. Just like we have handed control of our resource industries – like gas and so many others to foreigners who realistically don’t give a shit for us. We have a trillion dollars in superfunds. That sort of money revolutionised China into the modern era. We could do so much better (than we have) if we had a government of the people for the people.

Elizabeth South Australia unemployment rate just over 30% and GMH are yet to close. Jus’ sayin’.

Letting some other suckers subsidize their industries means they are selling at a loss.

The loss to us is the knowledge, the supply chain contacts and if needed arms manufacturing which, will be very hard to replace and restart when the suckers are forced to do what we did or conflict disrupts supply.