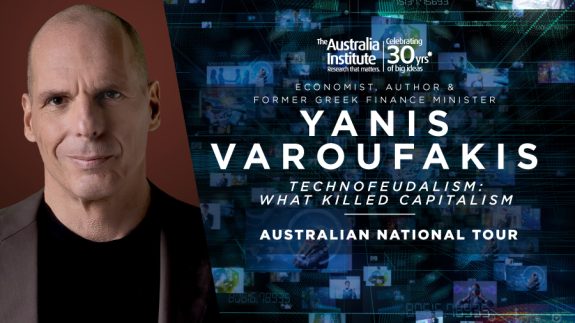

Yanis Varoufakis Australian speaking tour March 2024

The Australia Institute Media Release

Yanis Varoufakis, visionary economist and former Finance Minister of Greece, is touring Australia discussing ‘Technofeudalism’, his boldest and most far-reaching book yet, in which he argues that capitalism is dead and that a new economic era has begun.

Varoufakis is visiting Australia as a guest of the Australia Institute in 2024 to mark the Australia Institute’s 30th anniversary and help celebrate 30 years of big ideas.

Key dates:

- Adelaide Writers’ Week

- In conversation with Senator Barbara Pocock, 1.15pm Saturday 2 March

- Straight Talk panel with Richard Denniss, Tom Keneally and Joelle Gergis, 9.30am Sunday 3 March

- Melbourne

- Melbourne Town Hall, 6.30pm Wednesday 6 March

- Sydney

- State Library of NSW, 6.30pm Tuesday 12 March

- Canberra

- National Press Club of Australia, 12.30pm Wednesday 13 March

“The chief irony of our times is that a historic mutation of capital, cloud capital, has replaced capitalism with something far worse: technofeudalism,” said Yanis Varoufakis, renowned economist, former finance minister of Greece, and author of new book Technofeudalism.

“It explains our collective conundrum: from the Europe’s deindustrialisation, the death of social democracy and the demise of the liberal individual, to the New Cold War. While private equity asset-strip all physical wealth around us, cloud capital goes about the business of asset-stripping our brains. To own our minds individually, we must own cloud capital collectively.”

“Yanis Varoufakis is not only one of the world’s leading intellectuals his unique ability to simultaneously highlight the flaws in modern economics and engage people in conversations about solutions is just the tonic Australian public debate needs,” said Dr Richard Denniss, executive director of the Australia Institute.

“The Australia Institute is delighted to host such a guest at such an important time in Australia’s economic policy debates. We are thrilled Yanis Varoufakis accepted the Australia Institute’s invitation to help mark our 30 years of big ideas.”

Like what we do at The AIMN?

You’ll like it even more knowing that your donation will help us to keep up the good fight.

Chuck in a few bucks and see just how far it goes!

Your contribution to help with the running costs of this site will be gratefully accepted.

You can donate through PayPal or credit card via the button below, or donate via bank transfer: BSB: 062500; A/c no: 10495969

41 comments

Login here Register here-

JohnC -

Steve Davis -

Canguro -

Roswell -

A Commentator -

Steve Davis -

Steve Davis -

A Commentator -

Steve Davis -

Douglas Pritchard -

A Commentator -

Andrew Smith -

Steve Davis -

A Commentator -

Canguro -

A Commentator -

Steve Davis -

Canguro -

A Commentator -

Steve Davis -

A Commentator -

Phil Pryor -

Steve Davis -

Phil Pryor -

A Commentator -

Steve Davis -

Clakka -

Phil Pryor -

Steve Davis -

A Commentator -

A Commentator -

Steve Davis -

A Commentator -

Steve Davis -

A Commentator -

Steve Davis -

A Commentator -

Steve Davis -

Fred -

Steve Davis -

Jon Chesterson

Return to home pageWho?? Never heard of him. How is this news?

JohnC, you could do a search, or you could even read the first line of the article.

JohnC, no issue with you having never heard of Yanis Varoufakis, but given you’re sitting in front of a computer and connected to the internet there’s little excuse for parading your ignorance. The man is a legend and an exemplar of what an intelligent and fearless political mind ought to be.

We’ve written about him before. Kaye Lee did an article on him a few years back. He’s actually quite well-known.

He was Finance Minister in the Syriza government, and walked away from most of the pre election promises.

I’m not sure he realises that the easy/glib/populist proposals the party took to the Greek 2015 elections were doomed to failure.

There was no straight forward way out of the decades of the decades of economic mismanagement Greece had experienced.

In my opinion, the worst economic decision Greece made was to join the Eurozone, the currency made economic adjustment particularly painful

What Yanis Varoufakis was up against — “The euro and the ECB were designed in a way that blocks government money creation for any purpose other than to support the banks and bondholders. Their monetary and fiscal straitjacket obliges the eurozone economies to rely on bank creation of credit and debt. The financial sector takes over the role of economic planner, putting its technicians in charge of monetary and fiscal policy without democratic voice or referendums over debt and tax policies.

The idea that the euro has “failed” is dangerously naive. The euro is doing exactly what its progenitor – and the wealthy 1%-ers who adopted it – predicted and planned for it to do. … Removing a government’s control over currency prevents elected officials from using Keynesian monetary and fiscal juice to pull a nation out of recession. “It puts monetary policy out of the reach of politicians,” Robert Mundell, “Evil Genius of the Euro” explained. “Without fiscal policy, the only way nations can keep jobs is by the competitive reduction of rules on business.” In other words, currency union is class war by other means.” Michael Hudson.

And we could be heading down a similar path here, if Labor gets its way,

From the Guardian — “An alliance between the Greens and Liberal parties in the Senate could force Jim Chalmers to keep a government power that allows treasurers to overrule Reserve Bank decisions on interest rates.

Chalmers announced plans to scrap the veto power in the government response to recommendations from a panel which reviewed the Reserve Bank operations and made suggestions for improvement.

But two of the most controversial changes – the removal of powers which allows the government of the day to intervene with the bank in extraordinary circumstances, and the recommendation for a second governance RBA board made up of academic economists has seen pushback from across the political spectrum.”

Chalmers is in the wrong party.

He’s a liberal.

“What Yanis Varoufakis was up against…” Foolish or dishonest for making naive/clearly undeliverable commitments. His party portrayed their economic policies as a silver bullet.

AC depicts Varoufakis as “foolish or dishonest for making naive/clearly undeliverable commitments”, yet in his first comment AC stated “There was no straight forward way out of the decades of economic mismanagement Greece had experienced.” Which lets Varoufakis off the hook, I believe.

So let’s go with “naive” shall we? Why be nasty?

Economics can be a challenge to get ones head around but Yanis has been a bit of a legend and a treat to listen to.

I did hear some discussion from him on the worlds dependence on the US dollar, and some of the consequences should that change.

Our world could change drastically.

He deserves a much bigger audience for the arguments he promotes, and AC really needs to work on his listening skills.

This country is lucky to have the chance to give him a platform..

GO Yanis Varoufakis.

He’s was prominent economist, an academic politician, that’s not a naive combination.

Plenty of people warned Syriza of their problematic economic policy , but they chose the populist path.

They were elected because they said austerity was unnecessary, that they could reneg on government debt. It was a disaster and a lesson for those that propose easy solutions to deep-seated economic problems .

Had Greece retained the Drachma, the adjustment would only have been painful.

And I’ll add- unlike many others, I read quite widely and not just opinions that reinforce my orientation.

Yanis Varoufakis is an intelligent and engaging speaker/writer but his track record in delivery proves hus proposals aren’t practical or realistic

Think he is an Oz PR and sister is a citizen; he had worked at Sydney University some years ago.

I tend to agree with AC, as Varoufakis blames ECB etc., but ignores the long history in Greece of less than benign influence still apparent from the Ottomans, Orthodox Church, military and patriarchy on society, politics and the economy.

Greece joins eurozone 2001.

Varoufakis elected 2015.

“There was no straight forward way out of the decades of economic mismanagement Greece had experienced.”

And yet, AC blames Varoufakis for a problem he did not create.

“The euro is doing exactly what its progenitor – and the wealthy 1%-ers who adopted it – predicted and planned for it to do. … Removing a government’s control over currency prevents elected officials from using Keynesian monetary and fiscal juice to pull a nation out of recession.”

At least Varoufakis had a go.

The question we should be asking ourselves is — does Labor intend to make us as powerless as Greece to run our economy independently?

I made no such connection, and anyone with an ounce of general knowledge is aware of the dates and history.

Although that may not apply to you.

Anyone with a skerick of economic capacity would also have been able to predict the failure of the populist economic policies of Syriza

There is simply no easy solution to entrenched economic malaise.

Yanis Varoufakis and his party proposed there was.

AC, doing nothing is not an option. Desperate straits call for bold action. At least he had a go. What would you have done, should you have been in his shoes at that time?

re. his Australian speaking engagements, the State Library of NSW, 6.30pm Tuesday 12 March session is sold out. Too bad. I would have gone along to listen to him.

Yanis Varoufakis proposed that austerity measures were unnecessary and that repayment of government debt was unnecessary.

This was irresponsible, it wasn’t “having a go”

It was misleading, deliberately, because there was plenty of advice at the time about the futility of this.

Austerity is the penalty for economic profligacy, and Greece has decades of experience at this via New Democracy and PASOK.

There was no easy option for Greece and Syriza was warned of this.

“There is simply no easy solution to entrenched economic malaise.”

“I read quite widely…” even if you do say so yourself…but,

No you don’t.

AC, the question stands. What would you have done, should you have been in his shoes at that time? You’re generally quick to proffer an opinion, usually critical, but rarely you do suggest better options. Here’s your chance. Have a go. Give it your best shot. Don’t squib on this opportunity to show the readers another side of your fine intelligence. Maybe even Steve Davis will welcome your response.

If there is an easy alternative to austerity, to correct decades of economic mismanagement, why didn’t Yanis Varoufakis apply it?

The economic policy he campaigned on, and sought to implement, failed. Is anyone suggesting that it was a success?

Ultimately Greece applied a range of austerity measures, and the country is now through the worst of the adjustment.

The measures should have been applied earlier.

That’s my proposal.

AC — “Ultimately Greece applied a range of austerity measures, and the country is now through the worst of the adjustment.

The measures should have been applied earlier. That’s my proposal.”

The austerity measures Greece went through were forced by the EU. From 2010 to 2011 six packages were approved by the Greek parliament.When PM Papandreou announced a referendum on the latest package due to protests, Angela Merkel and French prime minister Nicolas Sarkozy issued an ultimatum declaring that, unless the referendum approved the measures, they would withhold an overdue €6bn loan payment to Athens, money that Greece needed by mid-December. The referendum was abandoned. The bankers won.

This was all well before the election of Varoufakis.

So austerity was not applied “ultimately” as AC states, which makes his claim that they should have been applied earlier rather odd.

As for the policies of Varoufakis, he was forced out after only six months, facing the might of Germany, the European Central Bank, the European Union, the IMF and his own party of government, so to refer to his “failure” is contemptible.

Austerity is a tool used by the parasitical class to strengthen its control over the masses, as Professor Clara Mattei explains — “The fiscal, monetary, and industrial measures that make up austerity are not, as they’re typically described, an economic war effort for the greater good. They are simply the crude tools for re-establishing the quiet disciplinary mechanisms that organize modern societies. For some, the short-term cost of a temporary economic recession is worth its structural gain; austerity re-stabilizes class relations and thus refurbishes the conditions for profits.”

And as Michael Hudson explained in regard to the EU “ The financial sector takes over the role of economic planner, putting its technicians in charge of monetary and fiscal policy without democratic voice or referendums over debt and tax policies…Removing a government’s control over currency prevents elected officials from using Keynesian monetary and fiscal juice to pull a nation out of recession.”

So austerity is a tool for domination.

Enabling the economy to be managed for the benefit of the finance sector.

And that’s AC’s proposal.

Well, we’ve learned something about AC.

PASOK the (Panhellenic Socialist Movement) was probably the type of left oriented party that would have appealed to many. But for decades, they and New Democracy took turns in avoiding dealing with the systematic rorting of the public resources and assets of Greece.

During a few decades, public debt increased from about 30% of GDP to over 150% Ultimately PASOK/National Unity governments implemented austerity measures to maintain domestic and international economic confidence and correct the economic malaise.

In 2015 Syriza made a politically driven election commitment to end austerity and said it was able to reneg on debt.

The articulation of Yanis Varoufakis seemed compelling, and a government led by (civil engineer/construction manager) Alexis Tsipras was formed. In office delivery of (the populist) commitments proved difficult and ultimately Syriza again implemented austerity measures.

Syriza is no longer in government, but Greece is in economic recovery and is becoming a more prosperous nation.

The lessons from this are- ~Economic restraint is the only responsible long term policy

~ Economic profligacy leads only to long term decline and increased hardship

~ There is no easy way out of an economic debacle/debt spiral.

Even Syriza came to realise there is no easy option in correcting economic malaise.

But apparently some here know better.

S Davis has outlined much and more can be deduced with professional assesment about the “problem” of the Euro, for that monetary system was devised to allow for Franco-German control and domination of all settings, movements, transactions, accumulations, investments, takeovers, whole nations. The Germans have it all under the thumb, and not a stuka or panzer needed. Germans and French do NOT use or support Greek or Portuguese computers, cars, smartphones, nothing. It is all one way, and the little nations and long suffering little people can only suffer, from recession, austerity, whims and fashions and luck in tourism. The Greeks do not control their actual and wonderful olive industries, so, what hope? The French control the big bridge on the Corinth crossing and the Germans control metros and rail. Invaluable Varoufakis is somewhat “irrelevant” to central points.

Phil, thanks for your input.

When AC said — “Economic restraint is the only responsible long term policy…There is no easy way out of an economic debacle/debt spiral” it sent shivers down my spine.

It was like Thatcher had come back to haunt us. TINA all over again.

There’s a reason AC spoke like that. Once again he is doing the bidding of our cultural managers. Just as when he refused to discuss the propaganda system that keeps the parasites in power. (“Executions – Human Rights forsworn and Wars fought”, July 21, 2023 @ 9.03a.m.)

As Professor Mattei said, the austerity measures AC is so fond of “are simply the crude tools for re-establishing the quiet disciplinary mechanisms that organize modern societies.”

And to say “Even Syriza came to realise there is no easy option in correcting economic malaise” simply hides the fact that they had no choice. Austerity was imposed.

Worse still, the statement is not correct. Austerity is not the only solution as Michael Hudson pointed out — Keynesian monetary and fiscal policies can pull a nation out of recession. Public control of banking services can pull a nation out of recession.

Michael Hudson is a professor of economics, a former Wall St. analyst, and worked for various governmental and non-governmental organizations as an economic consultant in the 1980s – 90s. But apparently AC knows more about economics than Hudson. AC is so sure of his economic expertise that he’s happy to instruct us, as in “The lessons from this are…” I’m speechless. Almost.

In the context of this discussion, it’s interesting that Hudson has noted that the prevailing economic theory, that of the Chicago School in particular, serves rentiers (ie the non-productive elites) and financiers and has developed a special language designed to reinforce the impression that there is no alternative to the status quo.

In other words, it’s all a con, and AC is apparently happy to be part of the con.

We must never forget the warning from Professor Clara Mattei — “For some, the short-term cost of a temporary economic recession is worth its structural gain; austerity re-stabilizes class relations and thus refurbishes the conditions for profits.” In other words the parasites are happy to take some financial losses as long as they retain or strengthen their control of the economy.

This ruthlessness on the part of the parasitical class must be kept in mind as we watch Labor moving to surrender control of the economy to “academic” economists.

Steve, I met an attractive young lady, Uni political activist, on a cruise from Istanbul to Athens, 2012. I had no heart to sound pessimistic. She was to enjoy the Syriza victory and I saw her on T V newsreel in a victory demo. But, within a few months it went back and down. The controls quietly engineered by German financial operators have done their work and are the strongest, nastiest, strictest anywhere, with full control of profiteering despite occasional hiccups. The Greek lady guide was most pessimistic back then and foresaw evils for her beloved Greece, which looked so reduced, resigned. The horrible Chicago “school” (hah) is disreputable. Hayek, their patron saint, never worked or invested in private ways, except for two weeks dishwashing. He always bludged and clamoured for tenured positions with good set pay. (he had a remarkable mind overall)

If anything, the experience of Greece demonstrates that Keynesian economics is probably effective.

Keynes didn’t promote unrestrained rorting of public assets. He proposed balance in expenditure over time, running modest deficits/expansionary fiscal policy during economic downturns.

Then correcting this during economic expansion.

That’s only possible if there is a capacity to run deficits (in the short term).

Syriza was specifically advised that there was no capacity to continue significant deficit spending, but it chose to ignore the advice and go ahead with a populist position.

It failed, because there is no easy shortcut from economic malaise to prosperity.

The longer economic irresponsibility continues, the more painful is the eventual adjustment.

Political parties should never be rewarded for trying to implement poorly planned, poorly executed policy.

To suggest that Varoufakis (and Syriza) should be congratulated for trying is ignoring that they were specifically and repeatedly advised (by experts) against their economic policies.

The Greek population suffered even more hardship than was necessary as a consequence.

Phil, Hayek certainly had an incisive mind.

He once gave a short but excellent history of the development of human society that was basically socialist in outlook. I nearly choked when I read it.

Schumpeter was another with an incisive mind, but those trying to explain the world from a Right perspective can never hide the fact that they have a blind spot. His response to Marx pointing out that workers do not get full value for their labour was that in a capitalist system no-one gets full value! Pathetic.

Thanks fellow commentators. I enjoyed the argy bargy immensely.

Remembering the laissez faire attitude of the bronzed laid back Greeks amongst the air of tycoons, fishermen and donkey cart drivers of the Sar and Rhodopes. Thinking of the neighborhoods of Phoenicians, Delphi, Croesus, Alexander the Great et al. So for millennia everyone wanted a look-in at the place in the sun. Ha haar, and then the 2004 summer Olympics approached, happened and crumbled into reputational limestone.

And I ask myself, “Reform from what, to what, and why?” and ponder if that’s what the Greeks ask themselves. Come fire or brimstone, there’s always endurance, ducking to the shadows or hemlock.

Devices never end, and there will always be basket case times, with all sorts or allegedly curative potions, rubs and snake-oils. As for Oz at present, it’s a basket case of its own kind, and being so young and vulnerable, needs to wend its way to find its own curatives, in a very dangerous, rapidly changing world of sugar-fixes and gut aches.

All that said and done, I’d never pass up an opportunity to listen to Varoufakis.

Just lost a big summary while editing (dummy, old fingers) but, we’ve all done well, scratching. The Greeks had been doomed by seduction, taking on financial instruments for “flexibilty” (Morgan, etc. ) and getting cauight in post Olympic debt, the G FC, tourism downturns, heavy handed European pressures, German led.

AC states that “Varoufakis and Syriza… were specifically and repeatedly advised (by experts) against their economic policies. The Greek population suffered even more hardship than was necessary as a consequence.”

They were never given a chance. The Greek population suffered more hardship than was necessary because the EU made an example of them.

AC continues to blame Varoufakis and Syriza for problems they did not create. Ask yourself why a commenter in far-off Australia would be so persistent on this.

The European Central Bank prevented the Greek Government from raising money cheaply and also forced Greek banks to rely on expensive Emergency Liquidity Assistance funding. In other words, the Eurozone signalled that ‘strict conditionality’ would apply and that Greece would face a banking collapse if it did not comply.

The outcome was inevitable.

The EU cannot allow individual states to pursue economic independence. Why? Because market forces are the only authority these clowns recognise. Apart from themselves of course. They would have seen Greece as a test case and so it was their way or the highway.

This is what happens when un-elected economic ideologues who are incapable of innovative thinking, are given control of national economies.

And that’s where Australia is heading if Jim Chalmers has his way with proposed changes to the operation of the Reserve Bank..

Every step, pressure tactic and negotiation that occurred during the Syriza government attempt to reneg on government debt and continue (unsustainable) deficit spending was forecast and advised to them.

That they didn’t manage to figure out a plan to mitigate, block, resolve or sidestep demonstrates further incompetence.

The Greek economic hardship was deeper and longer as a result of their hubris.

As for my interest in Greece I have lived and worked in several countries.

I have also studied in Greece and at the time I even took the trouble to enrol in a Greek language course.

I’ve returned on many occasions and maintain an interest

AC states “Every step, pressure tactic and negotiation that occurred during the Syriza government attempt to reneg on government debt and continue (unsustainable) deficit spending was forecast and advised to them.”

Of course. Because there is always plenty of loyal servants ready to do the bidding of the oligarchs. As AC well knows.

AC continued “That they didn’t manage to figure out a plan to mitigate, block, resolve or sidestep demonstrates further incompetence.”

And yet it’s been pointed out that they had plans but were not permitted to act on them. How plain can this be? AC’s claimed familiarity with Greece does not explain his persistent support for the undermining of Syriza.

Michael Hudson has written extensively on the history of TINA, the “there is no alternative” school of economic theory that controls modern finances. The tool that is used to control the financial world is debt. Just as debt was used to control Greece.

He points to our lack of historical perspective to explain how this came about. The following is from two interviews he gave.

“Most historians don’t study economics. What they do study is the kind of economics that you’re taught in universities, and that’s neoliberal economics. Neoliberal economics doesn’t study history because if it studied history, it would know that societies polarize as a result of debt.”

“In all earlier civilizations, from the first time we could pick up written records in the Bronze Age, there was always a public override to the market. The role of kings, churches, and the whole ideology that people were taught in their religion and their politics was you have to shape the market in a way that would promote overall economic growth. The primary way in which you have to shape the market is to prevent the debt overhead from leading to a transfer of labor and property from debtors to creditors. You have to keep the economy free enough so that citizens can serve in the army and perform public work. You don’t let a creditor class evolve. They did this by cancellation of debts.”

Interviewer — What do you want to say about the nova libertas, the “new liberty” proclaimed in Rome after the last king was expelled and the Republic was founded? Didn’t Brutus and his wellborn friends boast that they were the institutors of true liberty?

Hudson — “Liberty for them was the liberty to destroy that of the population at large. Instead of cancelling debts and restoring land tenure to the population, the oligarchy created the Senate that protected the right of creditors to enslave labor and seize public as well as private lands (just as had occurred in Athens before Solon). The Roman oligarchy accused anyone of supporting debtor rights and opposing its land grabs of “seeking kingship.” (Or today, seeking socialism. SD) Such men were murdered, century after century. Rome was turned into an oligarchy, an autocracy of the senatorial families. Their “liberty” was an early example of Orwellian Doublethink. It was to destroy everybody else’s liberty so they could grab whatever they could, enslave the debtors and create the polarized society that Rome became.” (As is the case today with the liberty that liberals wrap themselves in. SD)

“We saw a balance of forces in the ancient Near East, thanks to the fact that its rulers had authority to cancel debt and restore land that wealthy individuals had taken from smallholders. These kings were powerful enough to prevent the rise of oligarchies that would reduce the population to debt peonage and bondage (and in the process, deprive the palace of revenue and corvée labor, and even the military service of debtors owing their labor to their private creditors). We don’t have any similar protection in today’s Western Civilization. That’s what separates Western Civilization from the earlier Near Eastern stage. Modern financialized civilization has stripped away the power to prevent a land-grabbing creditor oligarchy from controlling society and its laws.

So you could characterize Western Civilization as being decadent. It’s reducing populations to austerity on a road to debt peonage. Today’s new oligarchy calls this a “free market,” but it is the opposite of freedom. You can think of the Greek and Roman decontextualization of Near Eastern economic regulations as if the IMF had been put in charge of Greece and Rome, poisoning its legal and political philosophy at the outset.”

Look at that final sentence and fast forward two thousand years. The problem Varoufakis faced was that the IMF and its pals at the ECB were in charge of Greece. The mistake Varoufakis and Syriza made was to assume that the global banking oligarchy would have a measure of respect for the democratically expressed wishes of the Greek people.

And we in Australia will be faced with similar problems if Jim Chalmers has his way and puts the Reserve bank under the control of “academic” economists who have no knowledge of economic history.

I prefer governments that plan for the range of known hurdles and barriers, that make contingency plans. That ultimately make the lives of citizens better, not worse.

That appears not to be your preference

AC thought he could come here, talk in vague generalities about matters of global importance, and get away with it. As in his latest comment.

“I prefer governments that plan for the range of known hurdles and barriers, that make contingency plans. That ultimately make the lives of citizens better, not worse.”

This, from one whose preference, his stated preference, is for austerity.

This time I really am speechless.

Luckily, I can still tap a keyboard.

He fails to understand that austerity imposed by the banking oligarchy allows for none of the “contingency plans” for “known hurdles and barriers” about which he waxes so lyrically. And his oh so sincere concern about making lives better is exactly the same argument made by servants of the banking oligarchy when they preach the virtues of austerity. Can there be a connection?

Austerity, the population control measure that has people so focused on survival that they have no time or even inclination to indulge in the finer details of political/economic philosophy.

Austerity, that protects the lifestyle and power of the wealthy while weakening any class consciousness that might threaten that lifestyle and power.

AC has come right out as an advocate for There Is No Alternative. As a defender of wealth and privilege.

And so we must ask, is he also a servant of the oligarchy?

Just from this discussion alone there is a hint that this might be the case.

He’s been given several opportunities, several off-ramps to weigh in on Jim Chalmer’s plan to give more power to the Reserve Bank to act contrary to the wishes of the government of the day. He chooses to not go there. Chooses wisely, I might say.

1/ “vague generalities”

Hilarious, because it seems I specifically address the subject of this post and the experience of his government, while you obfuscate and seek to discuss everything but this. You specifically seek to move the subject from Yanis Varoufakis to Jim Chalmers. In matters that require international knowledge and experience, you’re found wanting, again.

2/ Competent political leaders plan for a range of eventualities, scenarios and barriers. They are elected to fix the problems of their predecessors and not cause further hardship. Syriza didn’t.

“I specifically address the subject of this post and the experience of his government,…”

Exactly. And that’s where the problem lies.

To discuss Greece’s economic problems in isolation is an exercise in futility. Greece does not exist in isolation. The forces working against Varoufakis were not confined to Greece. They were global forces with a history going back thousands of years, as Prof. Michael Hudson explained.

But in AC’s eyes Varoufakis was incompetent because he did not overcome those problems in six months. Context is everything, but to AC, context is merely an annoying complication.

Simplicity, that’s the thing to aim for in ACworld.

Just out of interest, which part of the context of Yanis Varoufakis and the Syriza government of 2015 and the economic crisis of Greece, involves Jim Chalmers?

“which part of the context of Yanis Varoufakis and the Syriza government of 2015 and the economic crisis of Greece, involves Jim Chalmers?”

I’m not sure that AC asked that question in the spirit I was hoping for, but I will respond as though he did.

What we are seeing with Jim Chalmers in his bid to de-regulate the Reserve Bank, is an economist of the type that Michael Hudson warned us about. An economist schooled in an economics that does not study history. An economist who actually believes that the wishes of the people should not interfere with the operation of market forces. An economist who is prepared to turn a blind eye to the manipulations of the market that can and do occur when there is a lack of regulatory oversight.

If Jim Chalmers gets his way, the Reserve Bank will be completely free to use interest rate rises to force mortgage borrowers to do the heavy lifting when things get out of hand. That’s you and me and your sister and your cousin.

How do I know this? Because the Reserve Bank and every other government body in Australia that employs economists, employs economists that see the world through the same microscope.

But more importantly, because this is already what the Reserve Bank has been doing.

This is why the news media is obsessed with speculating about the outcome of the next Reserve Bank meeting.

The Reserve Bank, through interest rate rises, uses mortgage borrowers and the newly unemployed to do the economic heavy lifting. When some go under, that’s of no consequence. The only thing keeping these intellectual wonders in check is the existing power to over-rule held by the government. The consequences of removing that power cannot be calculated, but the question remains — why would anyone think it’s a good idea?

The idea was apparently proposed by a group of consultant economists. Who woulda thought. A group that couldn’t read a road map to find their way from one end of Pitt St to the other. But Chalmers thinks it’s a great idea.

And the connection to the economic crisis in Greece? The connection is the underlying economic dogma that prevailed in Greece, prevails elsewhere in the world.

The banksters who forced austerity on the Greeks come from the same school that uses interest rates in Australia to ensure that the wealthy and privileged do not do the economic heavy lifting. The same school that imposes austerity on working people in the UK as a matter of course, despite the UK being one of the wealthiest nations in the world. UK austerity began in 2010 to the present, with a brief stint of Keynesian intervention during Covid.

So it’s not hard to see that an unrestrained Reserve Bank could do the same here, imposing austerity on the Australian people at the first hint of a threat to the position of the wealthy and privileged.

Economics as a discipline is almost as bad as theology. Belief of fiscal predictions of what will happen in the future based on the study of how populations used money in the past are a mixture of science and faith. There are highly predictable loops but the more change factors involved the less accurate the predicted outcome will be. Ask Mr Lowe.

The equation for somebody on job-seeker or a country is largely the same. If money in = money out, it’s all good. However if money in < money out then a loan is needed to pay debts. If you owe so much the loan interest component of your outgoings is greater than your income, well… you are in do-do. I understand that Greece was heading to that point.

Not sure there is an easy answer to money in < money out.

“There are highly predictable loops but the more change factors involved the less accurate the predicted outcome will be. ”

Exactly right Fred, because economies are ecologies in which there are influences everywhere, all connected in ways large and small, and which act at times of their own choosing.

The value of Michael Hudson’s study of economies in the ancient world is that he shows that way back then the growth of a creditor class led to “debt peonage and bondage.”

We are seeing a similar situation developing now in Western society where legislation favours creditors. Where the rights of creditors are protected, the rights of debtors not so much.

When a debtor goes bust there’s no fallout for the creditor for participating in a risky arrangement. We saw this in the GFC when the banks involved in blatantly dodgy mortgages were bailed out by the taxpayers. No such luck for the debtors.

So we have a system now that protects creditors and encourages financial mismanagement. What could possibly go wrong?

The solution the ancients found to this problem was debt cancellation, which put pressure on creditors to take responsibility for their practices. The ancients found that unless creditors were put on a tight leash, the economy became unproductive. As we witness today throughout the West.

We’ve seen the development of FIRE economies — finance, insurance, real estate. Where production of actual things is off-shored to the Third World, because productive work is for peasants.

In the Age of Individualism making a quick quid is the top economic aim, and the needs of society are secondary if they figure at all.

Technofeudalism is an outcome of ungoverned or ungovernable capitalism, if not a symptom. Interestingly it appears to have the defining traits and behaves as a form of feudalism, as its suffix suggests and label deserves. New era replacing capitalism, not so sure in so much as, when a bird changes its feathers or an emperor his clothes that it heralds a new era or orbit, rather more of the same. But how we deal with this requires adaptation, tweaking approaches to new technologies, responsive if not progressive regulation and legislation to curb those immediate opportunists who ride the wave exploiting and abusing others – yet another battle in the pervasive biblical war on or for our humanity. But technofeudalism is what it is, easily forged weaponry for the super-wealthy, overlords, government and elite, ironically the people who are closest to government, are the government who draft the rules to limit, legitimise or socialise their feuds.

The new governor’s displeasure – off with the commoners’ heads if we disagree, disempowered and irrelevant if we don’t.