Universal Basic Income: How to do it right

By John Haly

The threat of Artificial Intelligence effectively doing jobs has raised fears that tomorrow’s world will be increasingly jobless. There are competing proposals to resolve the societal fallout of a jobless world.

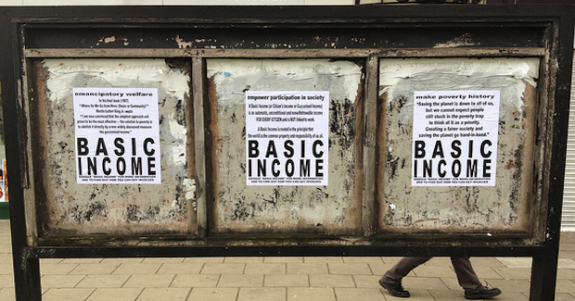

One proposal is a Universal Basic Income (UBI) which entails the provision of a consistent and unqualified monetary allowance to every member of a given society, irrespective of their financial standing, employment situation, or any other relevant considerations. It has had several well-known advocates, from Democratic presidential hopeful Andrew Yang to tech billionaire Elon Musk. Variations on the UBI have been trialled, such as in Finland recently from January 2017 to December 2018, where 2,000 unemployed people in Finland received an unconditional monthly payment of €560 ($634) instead of their usual unemployment benefit. The results were mixed and not the solution people were expecting. The Organisation for Economic Co-operation and Development (OECD) research on Basic Income holds significant value due to its nuanced and comprehensive analysis of nations that have implemented this policy.

The other proposal is a Federal Job Guarantee. The concept of a job guarantee (JG) is where the federal government provides a publicly financed employment opportunity to individuals willing and able to work but unable to secure employment within the private sector. The government assumes the role of the “employer of last resort,” guaranteeing employment opportunities for all individuals seeking work. The program’s primary objective is to achieve both full employment and price stability to provide a sustainable solution to the dual problems of inflation and unemployment. This is accomplished through the establishment of a buffer stock of employed individuals who receive only the minimum wage. These individuals are engaged in a range of socially beneficial activities, which are determined and organised at the Federal, State and Local levels. Examples of such activities could include infrastructure projects, community services, and environmental initiatives.

This article does not delve into the intricacies of a job guarantee. Instead, it critically evaluates the UBI as the labour market policy of choice. Ten vectors of evaluation are presented within this article.

1. Lack of Inflation Controls and Productivity Enhancement

The absence of inflation controls in a Universal Basic Income (UBI) contrasts with the counter-cyclical nature of a job guarantee. The job guarantee is highly effective in mitigating the adverse effects of deflation and inflation. Therefore, it has been maintained that a UBI inherently contributes to inflation due to its injection of funds to consumers, which is not productivity linked to the economy. An equivalent increase in the production of goods and services does not accompany a UBI. The primary recipients are low-income individuals, as the existing capitalist system has already generated significant inequality. These individuals are more likely to spend the additional funds in the economy but may not contribute to producing goods and services. The prominence of financialisation in economic crises has already led to a rise in debt obligations without effectively enhancing the real economy’s production capacity in sectors that can be used to service the mounting debt. This phenomenon is particularly evident among affluent individuals who accumulate and horde income in offshore facilities. The provision of income to individuals with low incomes that do not effectively enhance productivity, unlike a Job Guarantee program, compounds these failings. Consequently, this approach may result in inevitable economic price increases, as corporate entities will likely exploit the increased income. This was evident in price gouging long after pandemic supply shocks abated.

2. Reinforcement of Structural Under-Class and Inequity Issues

Universal Basic Income (UBI) fails to promote job preparedness effectively and may contribute to prolonged unemployment. Protracted unemployment presents challenges due to the social and psychological consequences associated with extended periods of unemployment. Peter Warr outlines the detrimental effects on mental well-being, “typically described in terms of increased anxiety, depression, insomnia, irritability, lack of confidence, listlessness, and general nervousness” (Warr et al. Pg. 53). Clinical depression can manifest as early as three weeks, and individuals experiencing it for an extended period may exhibit declining and suboptimal psychological functioning.

It is worth noting that the government does not explicitly commit to achieving full employment, and even when it does strive for “full employment,” it does so within the confines of the flawed concept that restricts it to the Reserve Bank of Australia’s NAIRU (A predetermined level of acceptable unemployment purported to offset inflation). Parallel to the prevailing circumstances observed in Western societies, this phenomenon forms a hierarchical subpopulation dependent on a governing body’s benevolence, akin to individuals’ reliance on NewStart/JobSeeker in Australia on the “benevolence” of federal governments. The government and media often stigmatise individuals who rely on welfare as NEATS (Not in Education, Employment, or Training) and dole-bludgers, implying that the unemployed have willingly chosen not to seek employment. Universal Basic Income (UBI) aligns with the prevailing neoliberal discourse by acknowledging the existence of structural unemployment and insufficient salaries, thereby perpetuating ongoing inequality.

3. Subsidy for Private Businesses and Wage Deflation

Implementing a Universal Basic Income (UBI) does not exert any pressure on the private sector to enhance wages for the limited number of available jobs. The Job Guarantee compels the private sector to engage in competitive wage offerings to attract workers. On the contrary, a UBI could be perceived as a form of government assistance provided to private enterprises. Companies may reduce their labour expenditures due to the government providing a ‘basic income’. Implementing a UBI can result in wage deflation since companies may exploit this policy to justify decreasing employees’ compensation. Corporations motivated by the objective of increasing profits may promptly reduce remuneration to the labour force to minimise costs associated with their factors of production. Wage stagnation poses a significant concern in numerous Western nations, as the growth of wages has become disconnected from productivity advances over an extended time. Implementing this policy could potentially expedite the “Uberization of jobs” phenomenon since it would substantially subsidise companies. Consequently, employers may experience diminished incentives to provide a salary that ensures a decent standard of living relative to the inflation a UBI would trigger.

4. Insufficient Poverty Reduction and Neglect of Specific Needs

The effectiveness of a Universal Basic Income (UBI) in reducing poverty is not guaranteed, and the potential inflationary consequences discussed earlier could diminish the purchasing power of the income provided. In most nations, social welfare programs are often designed with means-testing mechanisms and are specifically aimed at assisting specific disabled individuals who are determined to be in need. Governments will typically treat Universal Basic Income (UBI) as a financial welfare replacement for targeted welfare programs that specifically cater to individuals requiring costly disability mitigating measures.

The unemployment rates among individuals with Downs syndrome are typically above 80%. A UBI does nothing to encourage them to seek employment opportunities where they so desire actively. A UBI could exacerbate their disability because it is insufficient to deal with needs inherent to mitigate their physical or social disadvantage. The UBI fails to adequately address the intrinsic needs that are more expensive. Inadequate payment will result in a heightened level of relative poverty for the receiver without the alleviation that an individual without disabilities could experience as an improvement to their standard of living. The long-term sustainability of an inflationary Universal Basic Income (UBI) is doubtful, even for those without disabilities. The UBI is not a poverty buffer stock like a Job Guarantee. Although not as significant, it can have implications for some income groups since it may result in a movement of individuals within higher taxation thresholds.

5. Lack of Dignity and Meaningful Engagement

Universal Basic Income (UBI) is characterised by treating individuals solely as consumption units. This reflects a perspective reminiscent of neo-liberal ideologies. In contrast, a Job Guarantee program offers a more dignified approach. It expands our societal understanding of what constitutes a paid occupation and assigns social significance to those now deemed unemployable by the private sector. The implication is that a UBI can be considered discriminatory since it creates divisions within society based on individuals earned or supplied income. The media often employs derogatory labels such as “Dole Bludgers,” “Welfare Queens,” “Freeloaders,” or “Lazy Bums” to refer to individuals receiving unemployment benefits. However, it is essential to note that the current economy does not offer adequate private job opportunities to accommodate the unemployed population, let alone those who are underemployed. There is a lack of evidence within societal and media contexts to suggest that these attitudes will undergo any transformation for the better.

6. Unconditional Income and Its Effects on Job Market

Universal Basic Income (UBI) is disbursed to individuals without any stipulation for employment or the need to be willing to work. The absence of conditions attached to UBI may result in certain persons declining employment opportunities due to its assurance of financial stability. The circumstance above may not necessarily be considered a drawback in workplaces with inadequate wages or workplace dysfunctionality. However, it is essential to note that implementing a minimum wage job guarantee exerts pressure on companies to offer improved salaries and working conditions. This motivation is comparatively diminished under a UBI system. Consequently, the economy may see a decline in productivity, potentially leading to inflationary pressures. This decline can be attributed to a subsequent reduction in the labour force and a fall in the availability of goods and services, resulting in a diminished social surplus within the market.

7. Psychological Benefits and Social Well-Being

Psychological benefits can be associated with active participation in a Job Guarantee program, which entails providing community-based employment opportunities sponsored by the federal government but deployed at the state and local levels. It can be tailored to the talents and preferences of the individuals involved. A paid, personally rewarding and socially appreciated job offers psycho-social advantages that a UBI cannot supply. When individuals are left to rely solely on their own resources and have minimal financial means, even though it may enhance their ability to survive, it may not enhance their willingness. A UBI without work can also contribute to a social disconnection that increases the likelihood of engaging in a lack of self-worth and drug and alcohol misuse. Engaging in regular job duties within a professional setting mitigates these challenges and fosters an enhanced perception of personal value, a facet that is not achieved through implementing a UBI.

8. Hobbies vs. Contributions to the Community

The concept of work pertains to activities performed on behalf of others, while hobbies refer to activities pursued for personal fulfilment. The proposition of utilising Universal Basic Income (UBI) to finance one’s pastime is argued by some proponents. It can be contended that this approach fosters self-indulgence without necessarily providing individuals with sufficient compensation for their societal contributions. Implementing a job guarantee program involves individuals in significant community initiatives, as the employment opportunities are specifically designed and executed within the local community context. Work is a contribution that has the potential to offer meaningful work opportunities, even to individuals who may face disadvantages. Various social enterprises, like Anglicare, Big Issue, Endeavour Packaging, and Clean Force Property Services, among others, exemplify these opportunities. The effectiveness of a UBI in facilitating socially inclined individuals to participate in beneficial community activities in a financially feasible manner will be contingent upon their capability, stability (both financial and otherwise), and inclination. The convergence of these characteristics to promote the societal benefit of UBI is expected to be more limited than normalised.

9. Dependency on Government Goodwill to address Inequity Issues

A Universal Basic Income (UBI) relieves the central government of its need to ensure substantial work opportunities, instead relying on the government’s benevolence to sustain fair payment levels to alleviate poverty. An analysis of the NewStart/JobSeeker program, pensions, and other social payments reveals a lack of willingness among Western governments to adopt these measures. The UBI has limited efficacy in addressing social and financial inequities due to its constrained potential for productivity growth, inflationary implications, and the potential for social exclusion. Moreover, there is a significant probability that the UBI may be implemented at a level below the poverty line, as evidenced by numerous existing welfare programs.

10. Universality versus Dignity-based income.

One of the primary contentions against implementing a UBI is providing financial resources to individuals who don’t require it. Instead of advocating for universality, it is argued that the provision of any basic Income should be subject to limitations. By implementing a “Dignified Basic Income” (DBI) primarily aimed at individuals who are physically or psychologically unable to engage in employment, the program can effectively prioritise assistance for those most in need of a social safety net. This focused strategy guarantees that resources are allocated to individuals with authentic requirements, hence diminishing income disparity and augmenting the overall effectiveness in mitigating poverty. By directing attention towards a Dignified Basic Income aimed at persons unable to participate in the workforce, it becomes possible to enhance the program’s cost management efficiency and ensure that resources are allocated to those who require them the most. Implementing this focused strategy enhances the program’s long-term sustainability by allocating resources towards individuals with distinct needs. This category encompasses those who experience severe disabilities, chronic illnesses, or other problems that impede their ability to engage in conventional forms of employment.

The proposition of a Job Guarantee or “Employer of Last Resort” (ELR) program is frequently advocated by heterodox economists to achieve complete employment. A DBI program designed for individuals who are physically or mentally unable to engage in employment can be a valuable addition to such a scheme. An accompanying focused DBI acknowledges each person’s inherent worth and significance, encompassing those unable to participate in employment. One potential benefit is the mitigation of social stigma commonly linked to receiving unemployment or disability benefits. The promotion of inclusion and compassion within society can be achieved by providing a decent income to individuals who cannot engage in the job market owing to actual constraints. Job Guarantee is for involuntary unemployment. It is imperative to establish a clear distinction between incapacity and unwillingness. A social welfare program such as a DBI should not be designed to support those who, of their own volition and without any mental internal or external constraints, opt in a parasitic manner (as might be typical of the leisure class) not to seek employment. This is yet another reason it should never be “Universal”.

Conclusion

Numerous esteemed individuals have passionately advocated for the potential benefits of introducing a Universal Basic Income as a viable remedy for the inadequacies of Newstart/Jobseeker and other subpar welfare initiatives. The objectives for these actions are rooted in progressive agendas that aim to address poverty and uplift individuals from the lower echelons of society. The objectives and devotion to the larger societal welfare are deserving of applause. There is a valid argument in favour of advocating for the augmentation of Newstart/Jobseeker allowances and social welfare payments and the reduction of substantial subsidies provided to wealthy people to foster a more resilient labour market. Nevertheless, asserting that a Universal Basic Income is how these objectives may be securely accomplished is a formula for disillusionment.

Journal References:

Warr, Peter, et al. “Unemployment and Mental Health: Some British Studies.” Journal of Social Issues, vol. 44, no. 4, Jan. 1988, pp. 47–68.

This article was originally published on AUSTRALIA AWAKEN – IGNITE YOUR TORCHES

Like what we do at The AIMN?

You’ll like it even more knowing that your donation will help us to keep up the good fight.

Chuck in a few bucks and see just how far it goes!

Your contribution to help with the running costs of this site will be gratefully accepted.

You can donate through PayPal or credit card via the button below, or donate via bank transfer: BSB: 062500; A/c no: 10495969

26 comments

Login here Register here-

Lyndal -

Marcus Champ -

New England Cocky -

Steve Davis -

Max Gross -

leefe -

Marcus Champ -

S. P. Borden -

Alastair -

Alastair L -

Marcus Champ -

andyfiftysix

-

Marcus Champ -

andyfiftysix -

Fred -

John Haly -

Steve Davis -

leefe -

Harry Lime -

andyfiftysix -

Marcus Champ -

Tom Foster -

Tom Foster -

andyfiftysix -

Alastair Leith -

John Haly

Return to home pageOne thing that seems lacking in this essay is that there are many Jobs that will soon disappear with new technology and transitions from things like mining and forestry, yet people are asked to stay till redundant. There are quite horrible jobs, that cannot be described as dignified work, such as chicken processing – currently very low paid and low-status, and soon likely to disappear with automation of factories. These jobs offer no future, and a UBI would help people to live comfortably rather than being impoverished when private employment closes down. Their towns and communities can also continue.

At the same time, scurrently, many people work very hard for nothing, particularly within families, and sometimes are on call day and night. I know a man on unemployment benefits who is the unpaid driver for his elderly mother, disabled brother and children’s chauffeur for another family member who works full time. He has been breached by his job search provider for missing an appointment although he told them he had to pick up his brother from hospital. A UBI would help this entire family.

A UBI could free many people from time consuming and basic jobs to study or volunteer doing very worthwhile activities in the community. Artists and musicians could be freed to pursue and develop their talents, whether valued or not.

Hello John,

An excellent discussion and this one is definitely “a keeper”. The only minor embelishment I would make is to reinforce that unlike a JobGuarantee which is counter-cyclincal and acts as an automatic stabiliser to the economy, a UBI does precisely the opposite. As you note, UBI is a massive stimulus injected into the economy…in boom or bust, which is both destabilising and will inevitably flow through to prices.

Inflation is fundamentally driven by the gap between the supply of goods and services in the economy and the demand. As you note UBI unarguably stimulates demand, without doing anything concrete for supply. I will add, I have found very few who advocate for UBI have actually done the sums on even a modest income level, and the vast sums of money involved which they generally wave-away as inconsequential. Which it is not.

The sooner we recognise the illusionary promise of UBI the sooner we can debate real solutions to real-world problems.

Marcus

UBI was trialled in Canada with results Nnalysis delayed about a de ade during Harper Conservative government. These are now available in book format.

However, this article ignores this Canadian research.

The cost of Canadian UBI trial was LESS than the savings made in health care.

Thanks NEC, I thought I had read of other trials that were more positive.

An article that reached conclusions should have covered every trial, or acknowledged that other evidence existed.

I can understand the author wishing to appear clinical and impartial, but it almost came across as AI generated.

If something along the lines of a UBI is not put in place, a lot of people will suffer so that a few can continue to profit. This is a topic that requires commitment and passion, not clinical negativity.

“The program’s primary objective is to achieve both full employment and price stability to provide a sustainable solution to the dual problems of inflation and unemployment.” Unfortunately, the government – whether Lib or Lab – adheres to the NAIRU fallacy: maintaining a permanent pool of jobless workers of something like 5% in order to keep interest rates low. Unemployment is government policy!

I also was wondering about the lack of mention of various successful trials, particularly the one in Canada.

But with regard to the options presented here, why not both?

There is a lot of socially beneficial work that is labour intensive and badly needed. Things like weed and feral animal eradication in reserves or walking track construction, improvement and maintence. That sort of thing is not viable for everyone but it would be for many people and those who can’t cope with the physical labour can be part of the necessary support staff.

There have been several comments on various trials of UBI style programs that have been conducted over the last few years. It should be noted NONE of them come close to a true UBI program, either in terms of the amounts provided and or the number of participants a true UBI would encompass. The policy that comes closest is the distribution of dividends to residents in Alaska, but even that comes nowhere near the level of what is usually pitched for a UBI.

It should also be noted another policy approach that has been discussed for some time is to integrate a Basic Income with Job Guarantee as they can be complementary, and provide a comprehensive support package. Another option that has been suggested is Universal basic Services, and again that option has some interesting elements worthy of further consideration.

Fundamentally, the problem with UBI is the “U” part of it which has many downsides without anything positive to contribute. Furthermore, the higher the level of the “BI” component the more harm the “U” component will cause…and the level would need to be considerable in order to be at a level someone could live on….which only increases the harm it will cause.

Lastly, while the comments lament not mentioning any of the UBI trials, none of them mention various JobGuarantee programs some of which have operated for years, involved much larger numbers of people and have been very successful. It should also be noted, a JobGuarantee could recognise studying/training as a job, community support, or creative activities such as performance arts, which was a feature of a very famous JobGuarantee-type program as part of FDR’s New Deal in the USA.

In every respect JobGuarantee is by far the superior policy option and there is a wealth of readily available information on how such a program could operate, some of which was developed by researchers here in Australia.

This is an excellent and comprehensive consideration of the Job Guarantee. Would you mind commenting on its possible implementation, especially whether you see this as federally financed but locally implemented or whether implementation might also be targeted at regional, state, and/or federal domains?

@Lyndal there are already next to no jobs in forestry compared with 40 years ago thanks to automation. coal miners are going out of work everywhere including Collie in WA, but there’s a shortage of miners in WA in the Pilbera and jobs can be found for even unqualified labor with a little workplace training.

yes many jobs will disappear or be reduced from 10 workers to 1 with the aid of AI/ML tools. just like buggy whip makers and night watchmen are no longer to be found in the economy of today. that doesn’t mean there will be no repurposing of humans into more human-centred work. and what better way to do that than through a JG that is federally funded (since they have theoretically infinite spending power) and locally administered by communities at the local or municipal govt level?

@Marcus Champ

I agree with most of your comments, but this one is only one side of the story: “ Inflation is fundamentally driven by the gap between the supply of goods and services in the economy and the demand.”

The recent spate and winding back of inflation around the world demonstrates clearly that inflation can be pull driven, the kind you are talking about or it can be push-driven, or a mix of the two.

Push-driven inflation is when enough corporations and businesses decide to lift their profit margins, most than any productivity gains they’re seeing, and this means retail prices are increased. Energy prices spiked way more than any shortfall, it was largely based on speculation about the Cold War getting hotter and war tends to always drive speculation about energy prices.

@Alastair Agree with the addition of cost-push inflation, was making a high level summary and on spur of the moment didn’t make mention of that component. Thanks for the reminder however.

let me start by saying the whole article is a CROC OF SHIT.

Its such a narrow view based on assertions and assumptions. Its a take it or leave it open ended false definition of a UBI.

The biggest shit is the statement that nobody has done any calculations and then FAILS to provide any itself. Its a belief that UBI only comes in one flavour without even the willingness to discuss different models.

here is my model.

everyone over 18 gets it, say 30,000 a year. 20m people equates to about $600,000,000,000, $600B

Funding.

we currently pay $200b into super, keep that as payment. You want to call it a new tax, well fuck you too.

when people earn over a threshhold, say $80, ooo a year it becomes neutral, so net zero payment

the tax scale could start at the UBI of $30,000 at say 15% NOBODY WOULD BE WORSE OFF but some people at the lower end of employment may see some minor tax reductions.

Government savings to the tune of $40b due to massively reduced burden on the bearaucracy chasing people to provide proof.

Government savings of $50b in pension payments and another $15b in dole payments. So i have found $100b in government savings.

ASSUMPTIONS.

30% of people will choose this path. so total cost will be 30% of 600b this equates to about $200b. And thats being way way over generous.

No centrelink involvement in pensions , dole and no robodebt. The government can still fund its welfare for those who have special needs.

All money can be distributed or retreived via the tax system.

People will still want to work, we are an ambitious and edgy lot.

benefits of a UBI

there will be no need to fear retirement. There will be no need for greed fueled property speculation to provide in retirement.

We wont be forced into jobs we absolutely hate because of Fear. There will be no fear of unemployment. Governments will be forced to do their FF2’3’4g jobs instead of chasing some poor sod for $50 over payment.

now i am not saying my model is perfect, but as a starting point, it shows that the financials DO STACK UP.

Tell me that the smartest people in government cant modify and improve on my ideas. My analysis is purely going on available data on the internet. I am sure there are nuances that can be tweeked. The figures i quote are not absolute but rather a starting point for the discussion. So again I say, the article is full of shit. How many of the ten points are based on assertions and assumptions of human behaviour? We certainly got that wrong over the last 200yrs……..

@andyfitysix putting aside the means by which you have communicated your opinion on what was a decent discussion, what you have described is NOT a UBI, which greatly reduces the potential damage as its the “U” in UBI that’s the problem.

However, even your assumption of injecting $200 billion into the economy EVERY year is a stupendous level of stimulus of around 39% of GDP (based on 2021). To put that into perspective the stimulus package for the GFC…one of the biggest financial crashes in history was around $55 billion, and that was a one-off. The claim this will have no impact on price stability, let alone all the other effects described above doesnt stack-up.

I might add the $200 billion being paid into super is peoples wages, that was how super was originally set-up so already your suggestion is asking everyone to take a 10% pay cut. On a side note, I dislike the super scheme and would be very happy to see it end, but there are much better ways to do that than what has been proposed.

As stated previously here are far better alternatives that don’t require this level of profligacy and all the knock-on effects that have been described, which are also not “work for the dole” or any of the other horrendous policies that have been foisted onto the Australian people over time.

Lastly, the 10 points are nowhere near “assertions” or “assumptions” and largely well-grounded in empirical literature, or well backed economic impacts that have been observed in other ways and extrapolated to a UBI context.

marcus, i disagree with your analysis. And those ten points are just slanted away from UBI in an obvious way. I can get to every point and tare it apart but i wont. I only wanted to point out that its doable. your thinking is based on expected human behaviour, my thinking isnt.

And even your assumption that $200b will flood the market is an assumption that no other measures will be introduced at the same time. . Hiding all that money in super has done us a massive diservice. It hides an aneamic economy. Hiding all sorts of distortions and losses. It can be argued that it has strangled the economy by $200b a year. ( lets not discuss the tax levied on super that gets spent too) Because you only see things as they are, doesnt mean thats the only way to skin a cat. Law of the jungle has had its day, its time we imagined a different future. Or the future will fix things in its own way.

All i hear is ” you can’t because…”

“paid into super are people’s wages”, are you for real? Its a tax and the money cant be touched for yrs and yrs, thats not my money anymore, not until i get to 70. Why on earth do you think its a good idea to try to accumulate as much wealth as possible in super when the government then wants its cut? It just appeals to greed with no direction home. With us working into our seventies, we wont enjoy it that much before we croak it. Make no mistake, they want us to work till retirement day and die the day after.

Andy56: Go get them…

JH: If a true UBI was implemented, it would be accompanied by a restructure of the income tax tables. Yes, Gina would receive the UBI, but she would be expected to pay higher tax on the other “however many” billion non-UBI income. Most of the aid programs run by the govt have substantial administration cost overheads due to “entitlement” management and deliver outcomes always less than that needed, i.e. “JobSeeker” at $693 a fortnight ($49.50 per day) is still insulting and a lot struggle to live on the minimum wage of $883 per week ($112 per day)..

Beating up on the disadvantaged is a continuing theme. The normal income tax rates in 2000, with CPI =71.5 were: $5,400 20.0% $-

$20,700 34.0% $3,060

$38,000 43.0% $8,942

$50,000 47.0% $14,102

vs 2025 with stage 3 and expected CPI =140

$18,200 19.0% $-

$45,000 30.0% $5,092

$200,000 45.0% $51,592

Based on CPI, if you had a job paying $60K in 2000, then an equivalent 2025 earn would be $117.5K (forgetting super, medicare etc). Tax on $60K in 2000 was $18,802 = 31.3%, whereas tax on $117.5K in 2025 will be $26,842 = 22.8%. .

Compare that with a low income earner of $20K in 2000, tax = $2,920 = %14.6 and $39,200 in 2025 with tax = $3,990 = 10.2%.

Clearly this would need a rethink with a UBI. Bring it on.

There are many comments to address here, but I will focus on S. P. Borden’s question for now.

The notion that a Job Guarantee (JG) is locally managed and federally supported has existed for a long time. The article’s embedded link to Bill Mitchell’s Blog entry elaborates on that concept. You can see that this is the framework’s limit, according to many advocates of the Job Guarantee.

The idea of an Employer-of-Last-resort has been around for decades. In those decades, the neoliberal agenda has decimated unions, fragmented labour markets and deprived workers of agency, rights, skills, engagement and purpose. Reading David Graeber’s book “Bullshit Jobs” is all it takes to realise how dysfunctional the modern capitalist workforce is contemporaneously. The notion of localising the Federal Job Guarantees’ organisational structure needs to change to deal with the collapse of labour markets. The job guarantee’s main goal needs to be to address sustainable employment. Maximising the job guarantee is necessary. To achieve sustainability, the job guarantee must be designed to maximise employment options for individuals rather than to address mismatches between individuals and jobs during periods of low unemployment. The objective of the job guarantee is to address employment sustainably. That’s the critical point. So that means structuring the job guarantee to maximise opportunities for people to participate in what is traditionally the “non-job guarantee segment” of the labour market that you pay a subsistence wage. While that function of providing work at a minimum salary for misallocated people still needs to be served, the Job Guarantee needs to lift its game.

Due to a lack of a strong skills base, integrated career plans, and ongoing investment in training, Australia is severely retarded compared to other countries in its adoption of renewable technologies and participation in much-needed mega projects. Consider if we did limit JG to only locally-based initiatives and created it differently from the National Qualifications Framework? That prevents people from learning STEM (Science, Technology, Engineering, and Math) skills. If we keep it local, we wind up with insufficient dinky little bush regeneration projects. In the face of catastrophic climate change, biodiversity loss, water shortage (unless it floods), land degradation (especially when it burns), pollution, and waste, we must make the more extensive adjustments sufficiently required to maintain our existence as a species. Dinky is insufficient.

The foundation for job guarantees must be expanded. It must be a component of the plan for a sustainable economy. That means it has to play nationally, statewide and locally. Because the projects to face the aforementioned threats are typically delivered at the federal and state level. Due to the vast geographic distances among Australians, these and other initiatives are paramount to Australians. We absolutely need, for example, functional National Broadband. We absolutely need functional national transport systems. We absolutely need mega-projects for the generation of sustainable energy.

This failure of labour markets arises as a consequence of policies that have presented the government as incapable, fallible and not worthy of being able to make the expenditures that government needs to create or run industries in the way that the government has traditionally run them decades ago. Back when we used to produce that critical trade workforce. Deregulation of the financial industry is to blame for the pitifully ill-structured job market that we endure. It means that businesses in Western democracies struggle to acquire stable and long-term financial resources necessary to finance lifelong employment, integrated career paths, and ongoing investment in training. So this needs to start with reregulating the finance sector, putting it back in its box, and assigning it to its proper role in society.

Gone should be the days of participating in work-for-the-dole programs — a la Tony Abbott — where employees were required to complete menial tasks like raking leaves in the neighbourhood park or removing playground graffiti. A significant wholesale investment is required to develop deep-level skills and integrated career trajectories to achieve this national wholesale economic transition to sustainability. We must encourage many people to pursue STEM-related careers, skill development, and employment. We are in this situation as a result of the governments over the last few decades fighting against the development of an integrated labour market. The goal is to create a fragmented labour market that leads to a McDonaldisation of employment, where young people waste the first decade or so of their working lives in hospitality and service jobs that offer no opportunity for upward mobility and are poorly paid. We need to reverse that McDonaldisation and fragmentation of our labour markets. You want to show participants in the employment guarantee program where their local, state, or federal level work participation can fit with the national framework of qualifications that Australia operates under. By doing this, people’s capacity to transfer their skills and credentials is maximised, which frees them from being confined to a single local community. People who are trapped in one local community are more vulnerable to the vicissitudes of exploitation and nepotism, which can occur in any local community.

Then there’s the idea that you don’t want people trapped in the job guarantee. If you don’t articulate those linkages with National Qualifications framework, you are increasingly trapping people in cleaning graffiti off playgrounds. People need genuine professional options that will increase their chances of life success. We must change and stop being tied to one static theoretical framework for what a job guarantee ought to be.

We require technically oriented, integrated career routes that start on the shop floor and end in the boardroom. In order to improve the odds of successful collaboration, we aim to establish a common language for labour involvement that is technical in nature. When everyone has received the same training, they can relate to one another’s concerns. This training lessens your technical employees’ marginalisation, alienation, and frustration.

A job guarantee must be robust and flexible if it is to solve the problem of sustained unemployment. It must offer possibilities for deep and articulated skills along recognisable career trajectories and provide many access points to an integrated labour market. Just keeping it local severely restricts people’s alternatives. Job guarantee opportunities must be present at state and federal levels where significant infrastructure and economic transition projects are routinely done.

From J H — “We must encourage many people to pursue STEM-related careers, skill development, and employment.”

That would take serious government intervention in research AND development, a complete reversal of the liberal nonsense of leaving everything to the private sector because according to the text books “they do it best.”

It sounds like socialism to me. I’m all for it.

John Haly:

Your comment should be an article in its own right.

Splendid and sensible little essay,John Haly,…which is why it will never work when you have dumb arse politicians on both sides captured by neoliberal bullshit.We can observe the results of more than forty years of destructive economics in the US,the UK and now here, in the ‘lucky country”We’ll be killing each other for food, shelter and water,while all those fat,tax avoiding ‘elite’ sit giggling in their high security enclaves.

JH , job guarantee is a non starter. For the reasons you quite clearly articulate and also from a financial point.

There needs to be extra moneys available for it to work. We know from bitter experience that no government initiative is safe from the bean counters. And no government is keen on rocking the boat. Its also a more expense option than my UBI model. You have to factor in 40% over heads per job. For it to get over the line, you have to have some figures to back it up and i dont see any government of any persuasion being game to even contemplate it. Well not in a way that isnt punitative or mean.

I dont want to go socialist because then you work for money with an absolute moral decay, TRABANT anyone. Thats what job guarantee looks like to me.

The whole debate is couched in terms of “we cant afford the extravagance”. We need to break down the barriers to clearer thinking. We have to win over the Marcus Champs of this world. Dont let the debate corner you into thinking its either or. It isnt. And neither is sitting on our hands and waiting for the revolution a smart thing to do. Question all assumptions because you will quickly learn most of them are full of crap.

I saw an article the other day that said clearly we need to tax the robots that take away jobs. We cant allow the Musks of this world make trillions of dollars while most of us eat cake. (tesla will be a trillion dollar earner, dont you doubt that).

We cant all become “basket weavers”. To think that we can is total BS. A UBI gives us freedom to decide what we want to do , without a stick on the end. Job Guarantee ties back to the whims of government, and we know what they think of us.

If capitalism is the greatest since sliced bread, lets see how it works when workers are not scared of unemployment. Fear of not having enough to live on only works so far as a stick. And lets not misunderstand, fear IS the driver of capitalism.

@andyfiftysix you know NOTHING about me. JobGuarantee would cost nowhere near a UBI & suffers from NONE of the deep flaws of UBI which you just wished away, rather than actually faced. I made no comment about affordability, as that is an irrelevant question in our monetary system. Furthermore, you clearly don’t understand how a JobGuarantee works, perhaps try doing that before criticizing it.

UBI doesn’t give “freedom” it does precisely the opposite, and would destroy the monetary system upon which we all depend. I made no reference to “affordability” of UBI, I referenced it would massive destabilise the economy and undermine our monetary system. A monetary system I might add, that would be needed to pay for a UBI.

There is a reason several billionaires push UBI, while resisting a JobGuarantee. One provides them what they want…endless consumption & profit, the other takes away their power. Not hard to figure out which one does what. You speak of a desire to disrupt the system, yet at same time push a policy option that would only extend it. The saddest thing of all, you cannot even see it.

I’m curious about supporters of the UBI, which the article states include billionaires & millionaires, not being concerned billionaires & millionaires are also recipients of UBI?

In his article John Haly has clearly gone to substantial effort to research the topics of UBI and Job Guarantee (JG). His analysis of UBI is compelling and concurs with the concerns of those who view such proposed fiscal policy solutions through the lens of macroeconomics and concurrently also recognise the benefits of true full employment (nil involuntary unemployment) brings to our society and individual workers.

And whilst I share common cause in enjoying living in a society where we all benefit from true full employment including the solution of a Federal Job Guarantee (FJG) program, his analysis of the JG lacks the same rigour, in particular the FJG program.

There are two primary issues:

The first is Haly has compared UBI with a JG, this is a common mistake made by many proponents of the JG. The actual debate is between UBI and true full employment. Two key developers of the modern Job Guarantee and FJGs, Prof William Mitchell (Australia) and A/Prof Paulina Tcherneva (US) always come from this context, and the JG is one of a suite of (fiscal) policy solutions they propose to achieve this goal. A JG program is not a stand-alone solution and is not meant to be. This context is even described In the blog post from Mitchell that Haly cites in the article.

This leads to the need to point out the second, found in both the article and the comment Haly posted here on August 4 2023. A number of Haly’s issues with the Mitchell/Tcherneva FJG models are revealed to be Haly’s misconceptions of their models, as an examination of the cited Mitchell blog post shows these are addressed. For instance, in the cited blog post, Mitchell provides a summary and link to a research report his team produced titled “Creating effective local labour markets: a new framework for Regional Employment Policy”.

The table of contents for the report’s “Solutions for Regional Development”, which incorporates spatial Keynesian, illustrates my point:

Having received my feedback I feel if Haly was to revisit his article he’d address the issues I’ve highlighted and we’d see an enthusiast for the model Mitchell proposes for Australia to cure our nation of the scourge of involuntary unemployment.

Sorry Marcus if it sounded like i was having a dig at you. I was only questioning your rational. From my perspective you are looking at things from inside the box.

“JobGuarantee would cost nowhere near a UBI & suffers from NONE of the deep flaws of UBI which you just wished away”.

“UBI doesn’t give “freedom” it does precisely the opposite, and would destroy the monetary system upon which we all depend”

Such a rich trove of assertions and assumptions. Clearly you never question.

As for billionaires pushing for a UBI, i aint really into the politics of envy. In fact i couldnt care less what they think because i would make it impossible for them to keep that much money in the first place. Couldnt spend it in multiple lifetimes, so sod them.

Maybe we need to start from scratch again. Lets define what assumptions we make and then test them. What do we want from a UBI or Job Guarantee? What can we realistically deliver? What other changes do we need to implement to compliment our wishes? Can the current economic and social environment facilitate change? Clearly any scheme we chose will radically modify the “system” as so wildly exclaimed by Marcus. Is doing nothing a viable option? I and many others think that exponential decay is upon us, disruptions are occuring all around us as we sit and wait. The rich are getting richer and cake seems to be getting harder to get.

As JH articulated about a job guarantee, so many IFs that need to go right. In engineering terms, too many points of failure. As Dutton is showing us clearly, you only need one arsehole to screw up the works. UBI streamlines the public service by reducing the complexity and its reach into our bedrooms. UBI has no ideology of human behaviour. You have your living standard and your off to do as you wish. How is that the opposite of what we want? Job guarantee continues the ideological “mastering” we are conditioned to accept. Yes Marcus , you are looking at things through the box of FEAR.

We introduced super and sucked out $200b from the economy per year. How has that improved our lives? How has that improved our economy? How has that improved the government’s bottom line? I would argue its screwed us even harder. So dont give me the BS about destroying the economy we rely on, thats an assertion with pretty weak assumptions behind it.

@andyfiftysix

Universal literally means everyone gets it, not the 30% you assert who “will choose it” over employment. UBI is regressive in the extreme in the sense that it is not wealth or income tested, not even self-selected as you falsely assert it is. Universal literally means everybody gets it.

the rest of your rhetoric is just more of the same confused rambling.

To reiterate, “This article does not delve into the intricacies of a job guarantee”. References to a Job Guarantee were made in the context of alternatives to a UBI. (For example, A UBI does not achieve “X”, whereas a JG would achieve “X”). This was primarily attempting to address the issues of two proposed solutions to alleviate poverty from increasing reasons for job market failures. AI is one example, but there are many more. I picked one as an opening to the discussion, and that was all there was to that. This was primarily a rewrite of a 2019 article I wrote about “the prognosis of technology replacing jobs,” which was less structured in its list of ten flaws for a UBI. This was my rewrite of that article, which is still on Auswakeup but only partially satisfied me as a structured attempt to cover UBI faults. The focus was on the UBI, not so much the Job Guarantee. Not so much trying to compare Job Guarantee with a UBI but as a counterpoint for the structural weaknesses of a UBI. Of course, if the reader wanted to learn more about a Job Guarantee (which was not the purpose of the article), there were links to help them do so.

In an earlier comment, I expanded on what the Full Employment Model should entail (though I didn’t call it that) beyond the scope of a Job Guarantee. “The general idea of a Job Guarantee (JG) is that the government offers employment to everybody ready, willing and able to work for a living wage in the last instance as an Employer of Last Resort” (Tcherneva’s working paper 902 – Levy Institute, 2018). It is a component of a larger employment solution. Mitchell, among others, discusses and elaborates on this. Again, if you’re curious, look it up. I provided hyperlinks. Again, I didn’t want to “delve into the intricacies of a job guarantee”. But it appears that too many people here want to make it about a job guarantee.

This article was about Universal Basic Income. This was not a job guarantee article! Job guarantee was tangential to my analysis, but insofar as it served as a counterpoint to what a UBI could not achieve, it was that counterpoint. Yes, there is a larger debate about Full Employment; my article was not about a Full Job Guarantee. It only mentioned the basic model/”the general idea of a Job Guarantee,” as Tcherneva put it, as a counterpoint. Is this clear to a few of you, or do I need to laboriously explain myself again?