Turnbull’s Australia Tax

You may have heard of “the Australia Tax”. The term comes from the apparent difference in the price of a seemingly identical product sold apparently cheaper in another country than the retail price in Australia. Computer software and Apple products are frequently mentioned as being subject to this tax and while it really isn’t that simple, the impression that you pay more because you live in Australia is certainly there.

The problem in the comparison of prices across two countries is in the detail. While on the face of it, the price of, say, Apple products is cheaper on their ‘domestic’ US site despite coming out of the same factory, Australian Consumer Law requires the full price, including taxes and fees, to be disclosed on advertising material – the same concept is not enforceable in the USA where sales taxes vary by location. The payment of tax by large multinationals is a topic for another day.

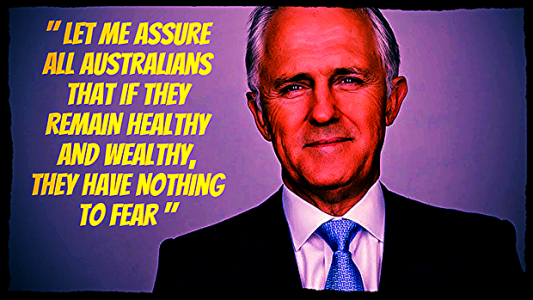

The Turnbull Government also imposes an Australia Tax – and this one is far less justifiable. The Abbott Coalition Government froze Medicare rebates as a part of the ‘budget repair’ measures introduced in the 2014 budget, Turnbull’ Coalition Government extended the freeze until 2020 in the recent Federal Budget.

The recommendation of the AMA (Australian Medical Association AKA the doctors union) is a standard consultation should cost around $80 (paywalled). The Medicare rebate for a ‘standard consultation with a General Practitioner’ is has been under $40 for the past two years and will be for the next four years. Clearly, this is a large gap. Before you say, so what – it’s for overpaid doctors – let’s have a look at the facts.

For their $40 or so that the Government has decreed is a fair price, the doctor has to discuss your condition with you, what results the treatment should provide and ongoing health care. At the same time they are supposed to screen you for a host of related conditions as well as assess your general health and wellbeing. While they work on seeing 4 or 6 people an hour, circumstances often conspire to ensure that doesn’t happen.

On top of that, the doctor has to maintain an office; usually involving the employment of a Receptionist to manage the appointments, potentially a nurse to administer treatment, attend professional development events (or lose their accreditation), keep the power, phone and water connected, as well as complying with a host of other rules and regulations generally relating to the operation of any business as well as the specific regulations surrounding medical businesses. So for the purposes of discussion how about we accept that two thirds of the cost of a doctor’s visit is swallowed in the on-costs listed above?

Regardless of the relentless claims by Turnbull and Morrison regarding ‘average’ incomes, the Australian median income (the ‘middle’ number in a series of numbers) is around $52,000 per annum. There are two uses for this value here.

The first is that doctors probably deserve to be recompensed for their years of study and practical experience, so say a doctor spends 5 hours a week on professional development (attending seminars, reading medical literature and so on) and 35 hours a week seeing people at 15 minute intervals, they would earn $5,600 should they charge everyone at $40 per consultation for the week (there is an additional payment made if a doctor chooses to bulk bill some patients so it has been discounted here). We have already assessed two thirds of the income is swallowed in the costs of running the business – so the doctor gets $1729 gross per week. Should the doctor work 48 week per annum (and takes the traditional 4 weeks leave), their gross annual income is $89,600 per annum. Given that a federal backbencher is paid $199,040 plus allowances for the ‘skills’ (usually no formal training except joining a political party and ‘playing the game’ will ensure success) required to enter Parliament expecting someone who has studied and trained for almost a decade to earn the right to practice a profession (not to mention the continual study required to keep the accreditation) to accept under half as much really isn’t equitable, is it?

The second use for the median salary/wage is that someone on the median wage already pays $780 per annum towards funding Medicare – through the Medicare levy collected with income tax. So we are already paying to go to the doctor. If you don’t use your contribution directly – celebrate as you are reasonably fit and healthy.

Doctors are finding it increasingly hard on a purely financial basis to bulk bill patients and financial pressures will only increase the number of practitioners that have to charge a fee greater than the ‘bulk bill’ rate’ to remain economically viable.

Abbott and Turnbull’s Coalition Governments are effectively making you and I pay twice for going to the doctor. We all pay the Medicare Levy. To make it worse, when Abbott tried to introduce the $7 co-payment on consultations with the doctor, a considerable amount of the resistance to the measure was based on facts generated by BEACH (Bettering the Evaluation and Care of Health program) managed by the University of Sydney but funded by the Federal Government. The resistance was successful; the co-payment was dropped.

Now with the rebate frozen, only those that can afford to pay over and above the inadequate rebate offered by the Government will be able to afford to see the doctor. This is the $7 co-payment all over again by stealth, only this time around, the Coalition Government is stopping the resistance before it starts – it has removed funding from BEACH. The Fairfax article, written by Jenna Price argues

General practioners save our lives. If you don’t believe me, ask Matt Grudnoff, senior economist at the Australia Institute. He’s not considering the emotional or social aspect of the funding for health – he’s just looking at the numbers.

“Australia has excellent health outcomes when compared to other countries and we have one of the most efficient health systems in the world.

“It tends to be that the more efficient your health care is, the more involved the government is.” But what’s more surprising is this – in the US, where health spending per capita is three times what it is in Australia and the system is highly privatised, the health outcomes are measurably worse. I’ve spoken to so many rural GPs about the freeze – and from Western Australia to Tasmania, from Queensland to South Australia, the GPs speak with one voice. They will be forced to stop bulk billing entirely.

‘Jobs and growth’ means nothing if you’re too crook to work.

Disclaimer – The writer is not a medical professional and does not work in the health industry.

What do you think?

Do you like paying twice for doctors visits?

Will the ALP re-introduce indexation for Medicare rebates?

This article by 2353NM was originally published on TPS Extra.

Also by the 2353NM:

9 comments

Login here Register here-

Clean livin -

etnorb -

Jexpat -

you can't be serious -

Mic the Heretic -

jimhaz -

Marilyn Riedy -

@RosemaryJ36 -

Bacchus

Return to home pageGood points, and let me add a few to the expenses and revenue. 4 weeks annual leave, PLUS 2 weeks in public holidays, PLUS, say, 5 days sick leave for the Doctor and again for staff.

Plus indemnity insurance, medical association fees, time, travel AND professional fees for conferences, etc.

Of course the fees must go up, but what we all must remember, when they do, is the cause is of the current governments doing!

Just mentioning the obscene salaries ALL our politicians get–in the good old USA, even the President does not get even half what our incumbent gets! And this is reflected also in the much lower salaries paid to all the “ordinary” politicians! I think our right wing, tea party Liberals are hell-bent on “attempting” to make Australia’s Health system follow the “great” (obviously, NOT!!) American-style system.The realisation that we ALL pay Medicare levies already–which really is a quasi “bulk-billing–ALL our Doctors need to be able to keep up with rising costs etc, so why is it that this incompetent mob want to take us into the “American” model? unfortunately just another of the growing list of “insanities” that this mob are trying to inflict on the people of Australia. As for this “Australian tax” (sic), I thought this was what they meant by “allowing” all these companies etc that are in this country, from having to pay ANY or very little tax! Bugger!

For profit health care and pharmaceuticals probably provide more textbook examples of market failure than any other sector of the economy.

The hard right/coalition (interchangeable terms these days) want to follow the US model because 1) it it is about private enterprise making money out of health care ie doctors, private hospitals, big pharma, the insurers and all private enterprise that is related to those fields and 2) that model is about minimal to non-existent government provision of health care justifying less taxation of the well off.

The conservatives hate public healthcare and this is their way of further undermining it.

It is ideological pure and simple. What could not be achieved by the GP tax is being achieved by another means. The Libs are tricky liars. I never believe a word they say or that anything they do has any purpose other than to benefit them and their party’s electoral interests first, the big end of town and their donors and cronies. Their objectives in government have nothing to do with making Australia a better place for the most Australians possible.

Medical aside, bear in mind also that rural dwellers pay extra GST because of increased shipping costs to remote locations.

Also, remember that we are all paying GST on State-levied excises as well — that’s double taxation!

Yes, good point. We do need to consider the LNP destruction attempts towards our health care system as being stealth taxes.

So to is the rise in public transport costs in NSW.

Just look at that salary for back benchers! When I first started teaching in 1969 my salary was equivalent to that of a back bencher. Teachers have had to fight for every single miniscule pay rise and are now overwhelmed by government requirements for data, data, data, which the department ignores anyway. Politicians are not earning their inflated salaries. Where are the performance reviews? Politics is a gravy train at public expense.

General practitioners earn their fees. Good health is essential for personal well being and for productivity of the workforce! Unfreeze the rebates and increase Medicare levy if necessary. The Federal government is determined to privatise Medicare and in doing so will set up a two tier Health Care System that is inferior to what we now have.

Privatisation does not work for the Public. We end up paying more for services and we have many examples of this from Electricity to Health Funds. Privatisation sells off public assets to wealthy investors to make more wealth for companies. Consumers suffer as a result. The other aspect is that it also reduces revenue to Treasury because corporations have many loopholes to avoid paying tax.. There is no sense in this.

Leave our Medicare alone!

A generally good article but one minor flaw. I think there is a massive over-statement of the time spent on professional development for a practising doctor.

Fair comment @RosemaryJ36 – 2353NM did acknowledge that they aren’t a medical practitioner and don’t work in the health industry.

This doesn’t distract from the gist of the article though – cutting doctor’s incomes to achieve your budget aims is counter-productive in the long run. 😉