Greed is the problem, not workers

Of course, The Australian republished Andy Kessler’s ridiculous Wall Street Journal column, “The decline of work in a spoiled society.” Those News Corp bedfellows continue to miss that they are at the core of the problem.

The pandemic drew back the curtain for the workers of the West, casting a glaring spotlight on the fact that they were cogs in a machine churning profit for the power brokers. Billionaires took off on joyrides to space, in rockets built of the workers’ stolen wages. Emergency workers received mere thanks for dying in excessive numbers to keep the upper echelons safely serviced in their beach home escapes. Nurses saw that their dedication had been exploited for unfair pay as their shifts ballooned. Teachers learnt they were actually childminders to allow capitalism untrammelled access to parent workers.

This edifying revelation only built on the growing crisis of 2008’s financial crash. Taxpayers’ money was demanded to refund the financial sector that had gambled away its wealth. In the US, 10 million Americans lost their homes, mostly left sitting empty. In the UK, bankers got their bonuses back as austerity policy savaged the lives and communities of the taxpayers who’d funded their bailouts.

Over the Cold War, a combination of factors kept the gap between rich and poor narrow. Partly the financial circumstances of the era; partly a society that required a large educated and healthy workforce to maintain mass-employing sectors. Partly, though, it was the bowel-clenching fear of the rich and powerful that their own masses could revolt to seize the means of production.

The resultant conditions meant that unionised workers could support their families with some spending money on the side. After capitalism’s collapse in the Great Depression and the nightmare of two World Wars, the bargain seemed worthy.

In the wake of the Cold War, neoliberal ideologues and extremists won the battle for understanding how the economy should operate. Milton Friedman’s diktat that the shareholder was the corporation’s only responsibility became the operating principle. Maggie Thatcher killed “society.” The workers were to be recognised as inanimate parts of the machine. The threat of starvation would keep them obediently clocking in, clocking out, clocking in.

Meanwhile, the Cold War reticence about ostentatiously displaying wealth with the prospect of revolution to chill the peacock urge, was replaced by reality TV where everyone could see just how stupid and venal the wealthy actually can be.

In America, the social contract is broken. The poorest workers slog between several jobs, often on poorly maintained public transport, without healthcare. Teachers drive Uber after hours to pay the rent. In the UK, private school alumni threw the country’s well-being off the Cliffs of Dover in pursuit of defunct imperial grandeur. Both countries’ discontent was channelled against people with a different skin colour, seeking safety. The “revolution” to date has taken the form of electing populist-nativist clowns who made all their problems worse.

Liz Truss was the final straw in this revelation of the cold calculations underlying neoliberalism. There would be unaffordable tax cuts for the rich and further austerity for the rest.

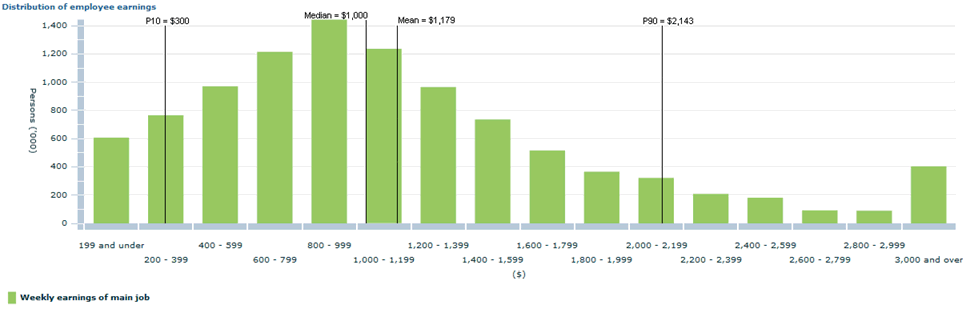

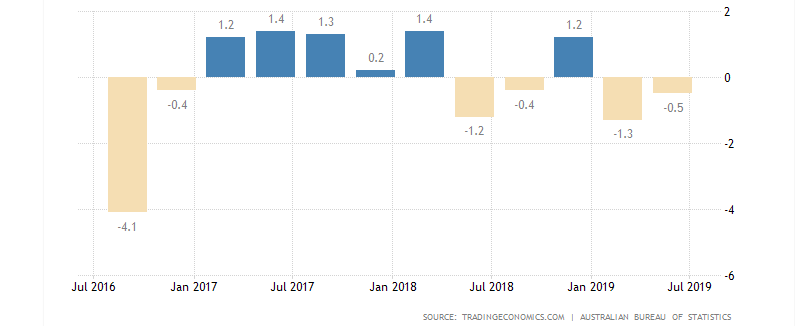

In Australia, the crisis of worker investment is different. Rising prices creating rising profits eat into the wages of those previously getting by. The Reserve Bank is driving up interest rates, again eating into survival funds, instead of begging profiteers to cap their greed. Policy promoting property as an investment rather than a necessity is robbing the next generation of the chance to join in that mode of securing their future. Landlords increase rent because that is “the market,” and renters become desperate.

Australia’s workers are, on the whole, better paid than our American parallels but the same pressures that the neoliberal ideologues have imposed on that nation are grinding away at the readiness of workers to give over most of their working hours to employers.

Signs of poverty are becoming more overt in Australia. The recent story about a mother wanting to keep a pot of yoghurt as a Christmas treat went viral, shocking to a complacent population.

Victorian Premier Dan Andrews has taken some steps in his election promises to address the implications of these factors. One that drew howls of outrage from the Murdoch Dog Line was the promise to make menstrual products available in places where people might not be able to afford them. To any person willing to take a moment, it is clear that being forced to choose between food and sanitary products is a crippling decision.

To the Murdoch commentators, Andrews’ decision was an outrage. Regular Murdoch columnist Gemma Tognini fulminated that the promise was, bizarrely, “sexist” as well as “shallow, populist, cosmetic and desperate.” Then again, she is the columnist that equated accepting Dan Andrews to Chamberlain “attempting to appease a monster.”

In the worldview of the News Corp columnist, and their ultra-free market ideology, anyone not working hard enough is choosing to be unable to afford menstrual products. Pandering to this laziness encourages the slacker life.

Andy Kessler argued that what workers get from the ever-more poisonous bargain is “human capital” which he decodes “as what workers learn on the job is theirs to keep.” But too many jobs now, like the grinding immiseration of Amazon warehouse workers, grant little in the way of skills or satisfaction.

He demanded the American government “please stop paying people not to work.” At a moment in employment history where too many people are working in jobs that barely pay survival salaries because human labour remains cheaper or more precise than automation, the only way to get people to work at all is to starve them thoroughly rather than slowly.

A better option might be to abandon ultra-free market ideology as the destroyer of systems it has proven to be. Clearly, workers need to be and feel valued to sign over their lives to the awful jobs we need done. America’s extremes illustrate the utter failure of their neoliberal religion.

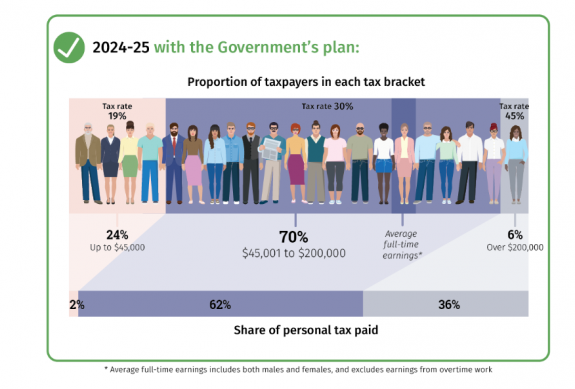

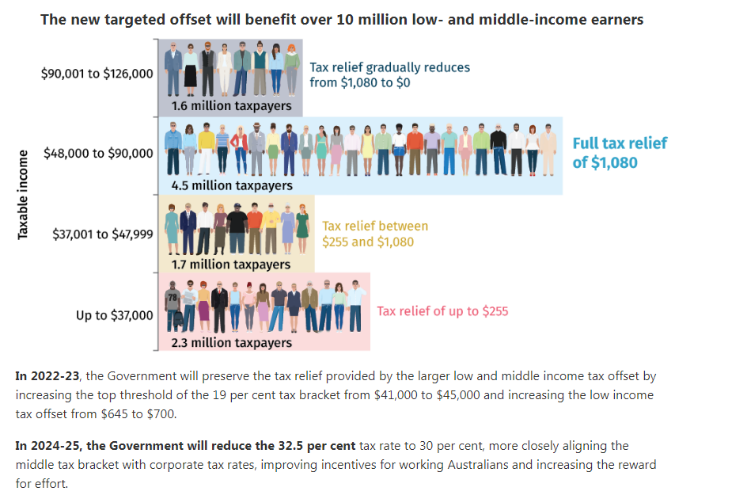

Removing obscene profits for executives and shareholders as the driving force of corporations would be a start. A fairer division of the spoils is necessary to keep society functioning. This might need to be achieved by higher taxes on the top tier, since they don’t seem to understand the crisis their never-sated greed has created.

This was originally published at Pearls and Irritations as Greed and a spoiled society: workers are not the problem

Like what we do at The AIMN?

You’ll like it even more knowing that your donation will help us to keep up the good fight.

Chuck in a few bucks and see just how far it goes!

Your contribution to help with the running costs of this site will be gratefully accepted.

You can donate through PayPal or credit card via the button below, or donate via bank transfer: BSB: 062500; A/c no: 10495969

Denis Bright (pictured) is a member of the Media, Entertainment and Arts Alliance (MEAA). Denis is committed to citizens’ journalism from a critical, structuralist perspective. Comments from Insiders with a specialist knowledge of the topics covered are particularly welcome.

Denis Bright (pictured) is a member of the Media, Entertainment and Arts Alliance (MEAA). Denis is committed to citizens’ journalism from a critical, structuralist perspective. Comments from Insiders with a specialist knowledge of the topics covered are particularly welcome.