Morrison heading down the wrong path

Watching Scott Morrison’s interview with Leigh Sales, on 7.30 Wednesday night I was hoping to hear something…anything that indicated that he possessed a better grasp of the economy than his predecessor. Sadly, all I heard was a lot of waffle, a collection of weasel words, the usual spin and a refusal to look at what is 50% of a balanced economy, i.e. revenues.

Raising taxes, he said, was code for increased spending. He did not agree that the economy has worsened despite Leigh Sales listing the comparison figures on unemployment, the exchange rate, GDP growth, the deficit and the debt, all of which clearly identified a worsening position since Labor left office.

He talked about getting people back to work, how good it was to see the participation rate rising. But there was nothing about job creation, where the jobs for 780,000 participants would come from or how the 156,000 job vacancies could be improved. There was no plan.

The Treasurer was already in denial about the comparative state of the economy and he was already looking away from where the real problems are, away from the point where he needs to begin his much anticipated restoration.

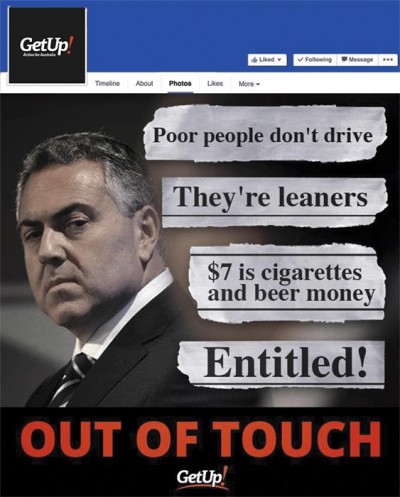

Prime Minister Malcolm Turnbull has made his first serious mistake. He has committed his government to continue with the failing austerity measures introduced by Joe Hockey in an attempt to bring the budget back to surplus.

If he is setting Morrison up for a gigantic fall and using that as a reason to change tack, to move away from this obsession for a budget surplus and embark upon a demand driven economic recovery via a stimulus, it isn’t going to happen soon.

Therein lies the problem.

The focus on government should not be on the deficits but on the prosperity and inclusion that full employment delivers. People are easily frightened by fairy tales of terrible consequences when new ideas are presented. That sense of fright is driven by a lack of education that leaves people unable to comprehend how the economy actually operates.

Deficit budgets will not bring about terrible consequences. Properly targeted, they will increase employment, tax revenue, drive demand for increases in production, higher wages and better living standards.

Neo-liberals magnify the fear of terrible consequences, by demonising what are otherwise sensible and viable explanations of economic matters. They know that by elevating these ideas into the domain of fear and taboo, they increase the probability that political acceptance of the ideas will not be forthcoming. That is what I suspect Morrison will do.

Morrison has demonstrated already he is no more up to the job than Joe Hockey. If he thinks we have a spending problem he is heading down the wrong path. We have a revenue problem clearly identified by excessive tax expenditures.

Morrison’s announced strategy advances the neo liberal ideological agenda: present simple “truths” guiding government fiscal policy and the public will accept it. Neo-liberals have vested interests in ensuring that the public does not understand the true options available to a government that issues its own currency.

They present these simple “truths” by advancing a sequence of myths and metaphors that they know will resonate with the public and become the ‘reality’. Myths such as, “the country will go broke,” or “we simply can’t afford it,” or “we must live within our means.”

They present these simple “truths” by advancing a sequence of myths and metaphors that they know will resonate with the public and become the ‘reality’. Myths such as, “the country will go broke,” or “we simply can’t afford it,” or “we must live within our means.”

That last myth is the most dishonest of them all because it projects the image of a household economy which, in the case of a currency issuing government, is simply false.

Morrison acknowledges the level of Government spending has not fallen during the Coalition’s term in Government. “Expenditure as a percentage of GDP is over 26 per cent, which is where it was at the height of the GFC,” he said. “This is not something that we believe is sustainable.”

Government spending is as high now as it was during the height of the GFC and increasing. And so it should. In the June quarter, government spending was the only reason we avoided a quarter of negative growth. That fact alone should be ringing bells, but it isn’t.

Ideally expenditure as a percentage of GDP should be around 25%. But there are two ways to tackle that. One is to raise revenues, the other is to restrict outflows, which doesn’t necessarily mean spending.

In the current economic climate it seems no government has the courage to increase taxes. However, restricting outflows without cutting direct government spending can be achieved quite easily.

Tax concessions on capital gains, negative gearing, superannuation and mining subsidies are at obscene levels. They blatantly favour the wealthy. This is where Morrison needs to concentrate his efforts. If he fails to recognise this obvious area of savings he will be of no better value to the country than Joe Hockey.

That is why, for the economy to climb out of the mire, Malcolm Turnbull needs to reverse government fiscal policy. He can no longer rely on the RBA to restrict aggregate spending. Interest rates are now so low, going lower won’t work anymore.

He needs to rebalance the scales. Current tax expenditures weigh too heavily against tax revenues. Superannuation is not an economic driver any more than capital gains. Negative gearing inflates both the property and rental markets which in turn reduces disposable income.

Raising taxes is not a code for spending? As a confidence builder, it was not a great start from the new Treasurer.

Like what we do at The AIMN?

You’ll like it even more knowing that your donation will help us to keep up the good fight.

Chuck in a few bucks and see just how far it goes!

Your contribution to help with the running costs of this site will be gratefully accepted.

You can donate through PayPal or credit card via the button below, or donate via bank transfer: BSB: 062500; A/c no: 10495969