Seeking the Post-COVID Sunshine: Risk Taking on the Investment Property Market

By Denis Bright

The combination of record low investment loan rates, high rates for home rentals and housing incentives from the federal and state governments have made for a volatile and more socially divided housing market.

RBA Housing Loan Data always lags behind other statistics but the latest available data to 17 December 2020 shows the balance between owner occupied and investor loans with a temporary upsurge in Owner-Occupied Housing Commencements over Investor Housing.

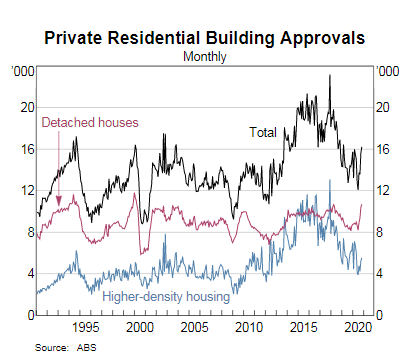

The spike in Owner-Occupied Loans has been assisted by welcome incentives from the federal and state governments which encourage tenants burdened by high rents to join the housing market. The RBA Charts show a temporary growth in preferences for detached houses in this new social market environment in this more government sponsored housing market:

The upswing in housing approvals comes with strong support from both sides of politics but reservations are likely to develop during the current federal parliamentary session about the growing inequities in the housing market. Comfortably off sections of society can afford to splash out on rentals of choice and exotic investment housing purchases with added incentives from negative gearing options and tax saving opportunities through family trusts

The Aspirational Society is the LNP’s New Light on the Hill. Its disciples flock to weekend auctions as the market shows signs of cooling as the date for the return to Normalcy approaches in late March 2021.

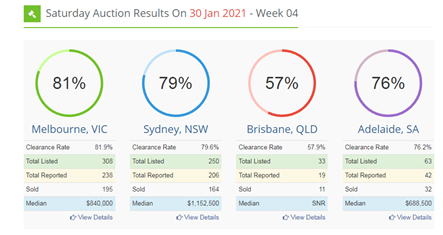

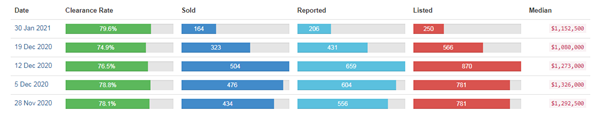

As the date for further curtailment of federal assistance to first home buyers approaches again on 31 March 2021, there has been a lessening of actual Saturday Auction Sales but not housing prices outside of Melbourne (Image: AUHousePrices):

AUHousePrices offers interactive data on clearance rates and prices for capital cities from Brisbane to Adelaide. Even in Sydney, rising housing prices are taking their toll on sales:

The combination of tax concessions for higher income earners and good salaries despite the current economic conditions continues to overstimulate the upper end of the housing market for both buyers and investors. There is real inequity in the housing market. Rental levels remain high in the lower end of the market and this niche will probably extend into the home sales market long after median home prices have passed their peak.

Labor will offer policy initiatives to bring its support base into the modest end of the property market. Using the Commonwealth Bank Calculator, the evidence suggests that there is not too much difference between housing loan repayments and current rental levels. There are some additional administrative charges and built-in insurance provisions which are fully necessary to protect new homeowners at a time of employment insecurity.

Additional support is required to assist people with their deposit thresholds. With added insurance cover, householders without anywhere near the required twenty per cent deposit can be selectively protected.

A loan of $400,000 on the Brisbane market in association with flexible deposits ceilings as well as federal and state government support for first home buyers and sustainable energy packages can deliver quite affordable houses and units in established areas as well as new home and land packages in greenbelt developments. There are some particularly attractive locations on Brisbane’s northern bayside suburbs where a $100,000 deposit can be built up through personal savings, government assistance and some family support for a home or unit in the $500,000 price range in pleasant surroundings.

With an ideological commitment to support for its higher income support base, the federal LNP seems to be deaf to the needs of the housing market and to the possibility of administrative directives from the RBA to stimulate the more affordable end of the housing market.

Instead, the LNP is also headed back to that work choices agendas which nearly cost John Howard his first election in 1998. The Senate’s Inquiry report into workplace law changes is also due on 12 March 2021 just before the end of the current parliamentary session. Such policy errors should make opinion polls more volatile

After a long revival in the fortunes of Scott Morrison the tide of public opinion is now less convincing as noted by The New Daily (1 February 2021):

Federal parliament is set to return from the summer break on Tuesday amid a tight race between the major parties and growing speculation about a 2021 election.

On a two-party preferred basis, the Coalition and Labor are 50-50, according to a Newspoll published overnight by The Australian.

The result is a one point drop in support for the government and a similar gain for the opposition, since polling in late December.

The Liberal-Nationals also dropped a point – down to 42 per cent – in their primary vote support in the poll conducted late last week, while Labor was steady at 36 per cent.

Newspoll showed Mr Morrison remained preferred prime minister, on 57 per cent, down three per cent. Mr Albanese is on 29 per cent, with the remaining pollsters undecided.

Shifts in polling are likely to be a response to the government’s handling of the COVID-19 economic recovery. The JobKeeper workplace support is being cut in March, despite growing calls for its continuation.

Scott Morrison and Anthony Albanese return from summer recess having reshuffled their frontbenches and faced challenges to their authority.

The prime minister heads into parliament following the weekend’s shock dumping of veteran conservative MP Kevin Andrews by Victorian Liberal preselectors in the seat of Menzies.

Mr Andrews, the longest-serving sitting MP, had the backing of Mr Morrison and two former leaders, but could not withstand a contest from ex-SAS commando Keith Wolahan.

There is spring in the steps of the Labor Opposition as federal parliament resumes. Inequality in the current recovery is emerging as a burning issue in 2021. The LNP will have to be very lucky to maintain its dream run on the rhetoric from that Economic Plan for Our Future which worked so well during the worst months of the COVID-crisis in 2020.

At this stage, staff at the Treasurer’s Office in Canberra are anticipating that the 2021-22 Budget will be delivered on schedule in May 2021 although the precise date has not been finalized. A budget delivery on 11 May 2021 will clear the way for the address in reply date into June 2021 with an early election date in August to gain the fullest momentum from a Return to Normalcy Budget.

The mainstream media is still talking up housing boom as the path to the Post-COVID sunshine. The outcomes of the current-trendlines will be written in the next election date long after today’s news pictorials are replaced by new images of change in The Aspirational Society (Image: Canberra Times 2 February 2021):

Image from The Canberra Times, 2 February 2021

The electorate loves the social market directions of Australian politics which is 1946, 1961 and 1983 revisited. It is an electoral cycle that is potentially favourable to federal Labor.

Denis Bright is a member of the Media, Entertainment and Arts Alliance (MEAA). Denis is committed to citizen’s journalism from a critical structuralist perspective. Comments from insiders with a specialist knowledge of the topics covered are particularly welcome.

Denis Bright is a member of the Media, Entertainment and Arts Alliance (MEAA). Denis is committed to citizen’s journalism from a critical structuralist perspective. Comments from insiders with a specialist knowledge of the topics covered are particularly welcome.

Like what we do at The AIMN?

You’ll like it even more knowing that your donation will help us to keep up the good fight.

Chuck in a few bucks and see just how far it goes!

12 comments

Login here Register here-

Ina -

Stella -

Chris -

Leila -

Louise -

Paul -

Andrew J. Smith -

Lara -

rubio@coast -

Elrico -

James Robo -

Ali

Return to home pageThe LNP’s Economic plan is a very fragile commodity in the difficult times ahead post Covid .

Denis, an interesting article on the housing market. The government needs to improve access to social housing and provide more assistance to first home buyers.

There are still some affordable houses in the $500,000 price range near Brisbane lovely Bayside suburbs but they are going fast as investors move into this part of the housing market.

Time to look at the worst house in the best street as my Dad always said and do a bit of ongoing renovation.

Interesting insights into the property market. It’s important affordable housing is available for all and not just snapped up by investors looking to make a quick dollar!

Thanks for being ahead of conventional wisdom and media reporting Denis

One would be very cautious in predicting a stable property market, let alone broader economy, till later in 2021?

Further, one would suggest that data and more indirect indicators available in the public domain regarding the ‘presentation’ of the Australian ‘property market’ are highly flawed (according to statistics 101) and match the ethics of the real estate sector.

The present and future speed bumps are the hit from no temporary resident churn over (which is far more significant than new permanent migration, the latter adding to the permanent population base (not the higher estimated total population inc. temps), the impact of Covid on economy/employment (ability to service mortgages), potential rise in interest rates and the mother lode of demographic transition in our permanent population.

The latter is linked to the now pre WWII generation of oldies departing this planet, now the post WWII baby boomer ‘bubble’ (last generation of high fertility or above replacement rates) is already retiring and downsizing, to be followed by the start of the ‘big die off’ of baby boomers over a generation, starting in five years…. between 2025 and 2045. I will bet that the established property market will at least be stagnant, or treading water.

Million dollar houses do not make a just society and are surely a sign of social division in Australia as in the Philippines

Progressive housing policies could defeat the LNP in Robertson on the Central Coast where the local market is flooded with investors

The federal government relies too much on blunt instruments which erode the affordability of the housing markets on reduced real wages during pandemic times.

The mansion on the hill has replaced the church on the hill as the new symbol of moral authority in an Aspirational Society.

A nice read! Thanks Denis. Ali from Germany