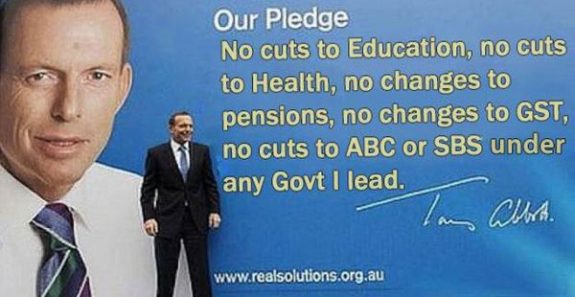

No changes to the GST – trust me

TONY ABBOTT has delivered a strong message to colleagues pushing for a change in the GST: it won’t be happening anytime soon. Speaking in the Middle East, the Prime Minister insisted there “will be no changes to the GST in the first term of the Coalition Government” and there are currently “no plans” to tinker with it.

This was eerily reminiscent of his comments in February about a GP co-payment

“Nothing is being considered; nothing has been proposed; nothing is planned,” Abbott said. “I think I have knocked the scare campaign on the head. This is all the Labor party has got. Nationally or locally all they’ve got is a scare campaign and I think that the people of Griffith and the people of Australia are bigger than that.”

It seems apparent that we are being prepared for a change to the GST. Whether it will be increased, or the base broadened, or both, remains to be seen but it is coming, regardless of Tony Abbott’s assurances of “there will be no change to the GST.” We know how much his word is worth.

Broadening the base to include fresh food, health and education would hit low income earners hardest so, considering the statistics about poverty in Australia, other alternatives should be considered.

Recently I suggested that we could have a differential GST where luxury items attracted a higher rate. Pappinbarra Fox rightly pointed out the logistical and administrative problems with this idea.

On another thread, Carol Taylor made the following suggestion:

“In a user-pays world cease all funding for all things ‘private’ such as schools and health care. If anyone wants something more than what the public purse can afford, then they should pay for it themselves. Likelihood: zero.”

This reminded me of my father, a public school teacher, who, whilst lamenting private school funding, would say “We have a public transport system. If they choose not to use it does that mean we should buy them a car?”

Whilst we may not be able to go so far as stopping funding private schools, I was interested to read the latest research from the Australia Institute which suggests that broadening GST to include private school fees and private health insurance could reap $2.3bn a year predominantly from well-off households.

Modelling done for the institute by the National Centre for Social and Economic Modelling (Natsem) found only 9% of the $2.3bn a year raised by the extension would come from the poorest 20% of households, 34% would come from the richest 20% of households, and 60% of the revenue from the richest 40%.

The move would also shield rural and regional areas, with 71% of the revenue raised from capital cities.

Increasing the GST seems the lazy option to me. Businesses bear the brunt of repricing all stock and reprogramming tills, collecting the money, accounting for it and passing it on. Business Activity Statements are basically privatising the tax office with no recompense for the hours spent collating all the paperwork to complete them.

If you are looking for an easy way to find $50 billion dollars why not cancel our order for 58 fighter jets that may or may not be ready sometime next decade and what on earth do we need 12 new submarines for?

Cutting back on hosting $50,000 dinners all around the world would also make the “end of the age of entitlement” sound a little less hypocritical. Don’t you people have offices you can meet in during business hours?

Stop always looking to hit the poor, the weak, the vulnerable. Stop telling us there is no choice – we know better.

“If you care about other people, that’s now a very dangerous idea. If you care about other people, you might try to organize to undermine power and authority. That’s not going to happen if you care only about yourself. Maybe you can become rich, but you don’t care whether other people’s kids can go to school, or can afford food to eat, or things like that. In the United States, that’s called “libertarian” for some wild reason. I mean, it’s actually highly authoritarian, but that doctrine is extremely important for power systems as a way of atomizing and undermining the public.”

– Noam Chomsky “Business Elites Are Waging a Brutal Class War in America”.

Like what we do at The AIMN?

You’ll like it even more knowing that your donation will help us to keep up the good fight.

Chuck in a few bucks and see just how far it goes!

Your contribution to help with the running costs of this site will be gratefully accepted.

You can donate through PayPal or credit card via the button below, or donate via bank transfer: BSB: 062500; A/c no: 10495969

48 comments

Login here Register here-

rangermike1 -

Rossleigh -

rangermike1 -

Kaye Lee -

Lyle Upson. -

rangermike1 -

Tony Rabbit -

Kaye Lee -

rangermike1 -

OldMate -

David K -

Kaye Lee -

Graham Houghton -

l -

Kaye Lee -

Jexpat -

Working poor person -

Kaye Lee -

paul walter -

bobrafto -

Kaye Lee -

Jennifer Meyer-Smith -

Working poor person -

Mike -

Kaye Lee -

Working poor person -

Bacchus -

Working poor person -

Jennifer Meyer-Smith -

Working poor person -

Bacchus -

Jennifer Meyer-Smith -

Working poor person -

Working poor person -

Bacchus -

Terry2 -

Loz -

Sally K -

Kaye Lee -

John Fraser -

steve -

Kaye Lee -

Terry2 -

Kaye Lee -

Jennifer Meyer-Smith -

JohnB -

Jennifer Meyer-Smith -

Harquebus

Return to home pageI am waiting for the Day that Uncle Tony Rabbit speaks the truth. I am of the opinion that Tony is suffering from some mental fracture. I am not being factious, just being honest about my observations of the man. As Paul Keating said, God Help Us. Keating was no mug, and knew Abbott much better than I did.

If they removed the GST exemption for education, does that mean parents of private school students would be hit with an extra ten percent. Gee, that’s class warfare, but I guess they could have it given back to them in the form of greater funding!

facetious Sorry. Damn auto correct.

I think it would be a fairly safe bet that people from private schools earn more over their lifetime on average than their counterparts from public school – not because of a better education but because of financial assistance from the family to get started and employment from the old school tie network. We can use the Pyne justification to make them pay more.

i think the issue here is GST on fresh foods versus collecting corporate taxes. If corporate taxes remain uncollected, then GST on fresh food it will be … i note that Silent Shorty remains silent on the uncollected corporate taxes problem, so there is little chance this problem will be resolved anytime soon, so not only GST on fresh foods, but the GST rate will also need to increase

@ Rossleigh,

One thing is certain with this mob of IQ down rated Bimbos, They will take as much as they can from the poor to feed the rich. It is in their DNA.

I seriously believe we should go back to more direct taxes. i.e. Income Tax. It is far more efficient to collect, is not affected by people’s changes to spending habits, allows people the choice to spend or save and hits those that can afford the most – assuming the tax is applied on a progressive scale.

Do away with all the indirect taxes – the cost of compliance is enormous. Something that this government is supposed to care about.

Bill Shorten is like that uncle that you only ever see at funerals.

As you Guys and Girls well know, when the polls go down, Abbott heads for O/S. Forget the struggling people in South Oz and Victoria, A photo shoot in Iraq is more applicable to the bone head who should be here looking after this Country. IRAQ = Boost in the polls. What eventuated was Zero. Sorry Tones, You require a Holiday at Manus for 2 or 3 Years.Learn how other people live.But Jingeez, It is his way to take a free trip to France. Nice work if you can get it.

Likelihood that the Abbott government will turn to the busted piñata that is the middle class and the poor for more candy? Pretty good I reckon.

Transaction tax.

On the GP co-payment and medical research fund…..

Abbott was saying at the end of February that there had been no suggestion of one. Less than three months later it is in the budget. That is a very short time to consult the experts, do the modelling, do the costing, do a risk assessment for consequences, debate it within the party, and come up with a detailed policy.

The Department of Health revealed in Senate Estimates the Medical Research Fund was a last-minute addition to the budget with policy work beginning in April, just weeks before the budget was delivered.

Sienna Cancer Diagnostics has just launched a new urine test for bladder cancer based on Australian research that is being developed by US pathology companies.

The test eliminates the need for a painful scope being inserted into the patient’s waterworks to diagnose the cancer and slashes the cost of diagnosis from $2,000 to $150.

The new test was bought to the commercialisation phase with the help of an $800,000 government grant from Commercialisation Australia that funded clinical tests, manufacturing and negotiations with pathology laboratories.

That program was abolished in the May budget.

Australian drug company Benitec has just started clinical trials of a breakthrough one jab treatment for hepatitis C that turns off the gene that causes the disease suffered by 170 million people worldwide.

The gene treatment is based on research by the CSIRO and could also be used to treat other diseases such as lung cancer and macular degeneration.

Benitec chief Dr Peter French came to Canberra seeking government support to see the research translated into a treatment but was given none.

The Chinese government gave him a very warm welcome with all sorts of offers.

I despair at the short-sightedness of Abbott’s band of many men plus maid Julie.

How about politicians paying for the privilege of representing us. Watch the scurrying rats then. https://www.communityrun.org/petitions/stop-this-government-s-madness

the medical research fund came way after the initial tantrum against science and the scientists … an amazing after-thought

ooops, the post button jumped ahead of me before my name (Lyle.)

Health Minister Peter Dutton has raised the ire of researchers by ruling out using money from the $20 billion medical research fund to commercialise Australian medical breakthroughs.

So what DOES he want to use it for. Actually I guess that is now the job of the scullery maid Sussan who has been brought in to do the dirty work and make it appear squeaky clean.

I was amused to hear Peter Dutton say, of his move to Immigration, “The Prime Minister told me it was a promotion.”

Yeah, he’s done the same thing to us Peter.

Broadening the GST in a time a stagnant wages and falling government spending would further weaken aggregate demand and likely lead to a recession that would be none too kind to small business owners, retailers and various other sectors that rely on discretionary income.

Moreover, it would hit the LNP’s own constituencies as well as swing voters directly in their wallets, making them very cranky indeed.

People with private health insurance aren’t necessarily wealthy. There are poor people who are not on Centrelink benefits, are not bulk billed and can’t afford to go to the Dr., but struggle to pay for health insurance. I am one of those people and there are many of us.

That’s true Wpp, the modelling showed that 9% of the money raised would come from the lowest 20% of households. Perhaps that could be addressed through the private health insurance rebate.

“No changes to the GST”.

Ok.

Next question.

How much time have we before it’s instigated.

A vote against Newman is a Vote for the REEF. ~ GetUp

A little longer than the “no cuts to health, education, ABC, SBS and no change to pensions” promises lasted. He will try to make the states beg for it.

@Kaye Lee

I am interested in your differential GST, which I presume is treated as some sort of incremental GST depending upon one’s socio-economic and immediate economic circumstances. As some demographics have more immediate capacity at deriving paid and sustainable employment, it is important to decide on policy that reflects the differential component most seriously.

This is crap. I have a very low income, but because I’m not on benefits, I pay through the nose for everything. My Dr charges $80 for a 5_minute consultation and $140 for anything longer and the Medicare rebate is already minuscule. Last month I had a prostatectomy that left me $12,000 out of pocket, even with private health insurance. I don’t mind paying tax on my income, but the measly 2% interest I get on any ‘savings’ I might have in my savings account is also taxed at the end of each financial year. I’m a socialist, but I’m sick of being treated as a ‘wealthy’ person just because I’m not on welfare. As for the private health insurance rebate, I don’t really notice that come tax time.

“No changes to education & no changes to pensions”

Hmm I missed the bit “Unless your a disabled full time student teen” that struggles, Inc socially, especially with the likes of tones deceit or any pensioner F/T student for that matter come 1st Jan 2015 you will no longer receive the education supplement to the tune of $1,622 P/A

If you don’t notice the private health insurance rebate then I doubt you would notice the GST

I don’t get it. I pay $66 a fortnight on health insurance and I would notice if I had to pay GST on that. I’m PAYE and at tax time, I don’t get a refund, I just pay a lump sum on any interest I may have accrued on my savings account. I earn less than $50,000 a year. Maybe the $66 includes the rebate? Anyway I would certainly notice if I had to pay GST.

Perhaps you need financial advice Wpp – it seems doubtful you are making good financial choices, given your circumstances…

Well, this year I got H & R to do my tax return, which is pretty basic, no deductions, and it still came out the same. I’ve had health insurance since Medibank’s inception and I don’t want to discontinue that.

WPP,

take the reins yourself. If you have a basic tax return, consider all the dimensions of what you can claim. They can be several when considered.

Otherwise, please don’t denigrate others who benefit from their portion of meagre taxes, coz our society is built on providing for everyone.

Don’t let the tory losers, divide and conquer us Aussies.

I haven’t denigrated anyone.

Wpp,

My “friend” until a couple of years ago was working, earning $90K+, was being bulk billed by the GP, being bulk billed for consultations and charged “pensioner prices” for procedures by the specialist (although that was a case of who you know), and had never paid for private medical insurance.

You need financial advice…

Good on you for having a job, WPP.

Hopefully it is a job that represents your full capacity and gives you a future you and I have grown up to believe is possible.

As far as the taxes are concerned, think about your work entitlements, expenses and other deductions such as donations that will all help to reduce your tax contribution.

Taxes are great because they help our Australian revenue flow circularly around. But no decent person wants the poorly paid worker to be burdened with the greater proportion.

Let’s ask Twiggy, Gina or Rupert what they think about contributing more to the economy!

I’m coming to the end of my working life and have not worked in my ‘career’ for seven years. My only possible deductions are union dues and my monthly donation to UNHCR and some other charities. I have never in my life complained about paying tax. I was merely pointing out that a lot of people struggle to pay health insurance as it is, without the imposition of a gst.

Bacchus, bulk billing rates vary enormously across Australia. I am unfortunate in that I live in a region where it is impossible to find a Dr who bulk bills. I know that the situation can be completely different in other parts of the country, but it sure ain’t here.

Fair enough Wpp, but why the private health insurance?

A fellow I used to work with told the tale of his father, a blue collar worker without health insurance, and his father-in-law, a retired doctor with health insurance. Both suffered heart attacks – his father received the best of treatment at no cost whatsoever and recovered and last I heard, was still living an active life. His father-in-law likewise received the best of care, but at an out of pocket cost of thousands of $$. He also recovered, but has since died, being somewhat older.

In both cases they couldn’t fault the treatment, but the one who paid many thousands of $$ in insurance premiums also had thousands more in costs for effectively the same treatment.

Some years back, my Mum had an operation while she had health insurance. Likewise, she was faced with quite large bills over and above what was covered by her insurance. Last year she had a hip replacement in the public system. Cost to her? $0.

Are you making wise choices for your circumstances? You need financial advice…

We are being subjected to a cynical process of the federal government increasing taxes via the mechanism of the GST but blaming it on the states and territories and while Mr Abbott wrings his hands he will reluctantly bend to the demands of the states and territories next year i.e. not in this term of government.

The normally silent back benchers who wouldn’t dream of making a public statement for fear of the Credlin wrath are now happily trotting out to make profound statements about the need for an increase in the GST and the necessity of a dialogue with the public.

This man Abbott is now unashamedly recognised as a pathological lier and those who manage him will continue to send him out to tell lies to the Australian people to get their way.

How gullible are we ?

WPP I agree that many who pay for private health are not well off. Baccus – I too have thought about cancelling my private health contributions due to the high costs. But there are certain physical conditions that require hospital treatment where people have to wait many months and sometimes years, for treatment.

That the tax base is primarily on labour and capital (eg income tax and GST) is the reason capitalism leads to extreme inequality, such as the top 3 wealthiest Australians having as much wealth as the bottom 1 million.

The “economic rents” of land and natural resources and government created monopolies are privatised leading to extreme wealth and associated political power for a small proportion of the population. They could be used as an efficient tax base.

This report from Prosper Australia identifies 27 such sources of economic rent, which it says are equal to 23.6% of GDP:

http://www.prosper.org.au/?s=total+resource+rents

The Henry Tax Review had steps towards this with the MRRT and substituting stamp duty with a broad based land tax. I think the MRRT was the reason the ALP lost the favour of the mining and media moguls.

Trade Minister Andrew Robb says the goods and services tax should be extended to products like fresh food and education, making him the first cabinet minister to echo three Liberal backbenchers who this week called for the big shift in taxation policy.

“I think there’s general agreement that the broader the base, the better, obviously,” he told The Australian Financial Review.

Liberal MP Dan Tehan and Coalition senators Dean Smith and Ian Macdonald went public in the last week with calls to remove those exclusions in a bid to raise more revenue.

Other cabinet ministers, including Education Minister Christopher Pyne and Finance Minister Mathias Cormann, were strident in their statements about the tax on Thursday.

“There will be no change to the rate or base of the GST. None. Just because someone floats an idea doesn’t make it Party policy,” Mr Pyne tweeted.

I hope that is “crystal clear” to everyone now.

And in yet another travelling circus, Mr Robb leaves for a week-long trip to India on Friday, at the head of a 450-strong Australian business delegation.

I wonder how much we will be charged for “non-portfolio related hospitality” THIS time. Those billionaires are costing us a fortune. I also wonder how much more we will offer Indian billionaires in the way of government subsidies for their commercially unviable coal mines and how much a free trade agreement with India will cost us – the one with Japan is costing us a $1.6 billion revenue write-down over the forward estimates.

<

Getting GST information from the drinks waiter is like signing a Free Trade agreement that you haven't read.

Put a 10% GST on shares transactions

If a 0.05% FTT was collected on Australian “over-the-counter” and exchange traded market transactions between 2005-06 and 2008-09, it would have raised $48 billion (calculations Professor Ross Buckley, University of NSW, Jan 27 2011).

The exact amount levied from a FTT depends on the size of tax and exclusions. However, a number of estimates exist: The UN Secretary-General’s Advisory Group on Finance (the AGF) reports that between US$2 and 27 billion could be raised by a FTT annually by 2020. The Austrian Institute for Economic Research estimates that a mid-range tax rate of 0.05% on financial transactions would raise annual revenues of $US650 billion. Schmidt (2007) estimates that a 0.005% Currency Transaction Tax on the four major currencies (US$, Yen, Euro and Pound Sterling) would raise over US$33 billion per annum. Another US study has estimated that between US$117 and $353 billion could be raised annually through differentiated tax rates for different markets. The IMF (2010) has stated estimates of $200 billion could be raised annually by a 0.01% FTT.

http://www.jubileeaustralia.org/page/work/ft-tax

A Financial transactions tax is the least regressive tax I can think of as it targets those who play the financial markets in particular share trading, currency speculation and derivatives.

It is easy to collect and very hard to avoid as, unlike the GST it is collected mainly through the banks and other financial institutions – you can’t buy a derivative from a bloke in a pub !

The big end of town would prefer to see a GST on fresh food, health services and education : I wonder why ?

Australians are usually more amenable to “levies” when they know what they will be spent on eg the medicare levy and increase to pay for the NDIS, the flood levy, the gun buyback levy.

If the world introduced 0.01% FTT (that’s 1/10,000th or $100 tax per million) and it raised the $200 billion a year suggested by the IMF in 2010 then we would have no excuse not to act on climate change and we could eradicate poverty and many diseases while we were at it.

@Kaye Lee

These are the figures that need to be understood and advocated world wide by listening governments.

Isn’t it great to have a Labor Premier in Victoria!!

“PREMIER Daniel Andrews has essentially crushed any chances for the broadening of the GST, saying there are no circumstances where he would support an increase in the tax or applying it to fresh food…..”

http://www.thecourier.com.au/story/2806964/premier-wont-support-any-increase-to-the-gst/

People in Queensland ….take note!

@JohnB,

excellent point.

People of Queensland,

protect yourselves from another term of neo-conservative politics by thy name of Liberal National Party. They do NOT represent you.

I believe that, sooner rather than later, shop shelves will become bare. The GST only works in a growing economy and we can not shop our way to infinity. Talk of ever increasing taxes and not just in Australia, is another warning sign saying our that the capitalist growth ideology and our current lifestyles are “Not Sustainable”.