Coronavirus Socialism for the Wealthy

When capitalism screeches to a halt and starts its old business of killing off the adventurous but weakened, the enterprising but foolish, those who initially benefited, shed tears. Losses mount, accountants tally up current and future losses. Huge profits somehow do not matter now, as the diminishing balances bite and impress. As this happens, the corporatocrats start to search. Options usually end up at the same spot they always tend to in the last few centuries: the state treasury, the public purse.

Despite the dogma of neoliberalism, one that worships the market that miraculously orders and delivers goods and efficiency, global shocks have found it wanting. When these happen in the international system, binge spending of the Keynesian sort, otherwise known as stimulus packages, is encouraged.

In 2008, the Great Financial Crisis, which sounds like an affliction of sorts, encouraged states to turn to socialism or at the very least, a shade of it. Banks, despite being put into the “too big to fail” basket became partly and, in some cases, fully owned, by the tax payer. Debts were wholly bought over by tax income. The historian Eric Hobsbawn, in writing on the crisis, suggested that a progressive policy needed “a return to the conviction that economic growth and the affluence it brings is a means and not an end.” What was required was a policy focused on non-profit public initiative, a focus on improving collective capabilities in society.

This was not to be. Within a matter of years, it was forgotten. The rugged individualism of capitalism, at best a misnomer and worse, a lie, supposedly prevailed. Predatory capitalism was resaddled, kitted now in the new language of confidence and initiative. In Australia, the banking and insurance sector proved to be rapacious, confident to have weathered the crisis of 2009. Customers, dead or alive, were there to be milked. Speculation was rife. The election of Donald Trump to the White House in 2016 was a signal to bash the idea of equitable distribution on its head and encourage corporations and the wealthy to do their thing. On the back of the public spending undertaken during the Obama years, Wall Street roared with confidence.

Then came the coronavirus. How a pandemic can encourage a mass drive for socialisation is interesting but not surprising. As in 2008, it has seen the private sector withered. The assessments of the impacts vary, but they are generally gloomy. Combined with crashing oil prices and political chaos, COVID-19 was, according to Naomi Klein, “laying bare the extreme injustices and inequalities of our economic and social system.” Robert Reich, Secretary of Labour in the Clinton administration, reiterates the same theme of unveiling. “The coronavirus has starkly revealed what most of us already knew: The concentration of wealth in America has created a health care system in which the wealthy can buy care others can’t.”

Some states have effectively resorted to paying people to avoid going to work. On some level, it showed, as ecological economist Simon Mair puts it, “a shift from the principle that people have to work in order to earn their income, and a move towards the idea that people deserve to be able to live even if they cannot work.” Those on opposite sides of the political spectrum – take Australia’s conservative Morrison government and the labour unions – find themselves in a moment of rare cooperation in terms of covering threatened wages and income, though the business bias in the rescue package remains strong. It remains, as Guy Rundle concludes, a means of preserving “capitalist socio-economic relations in as static a form as possible.”

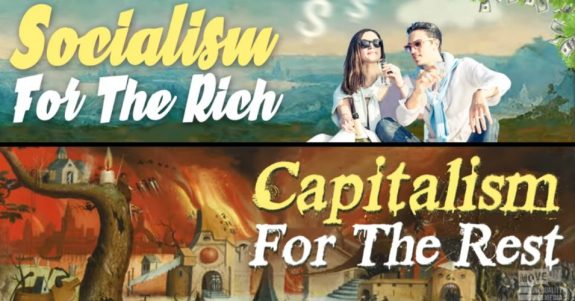

A more invidious form of top-end socialism is evident in other states. In countries such as the United States, the democratic socialist message of Bernie Sanders is being suppressed in favour of a Wall Street form of socialist rescue. The rescue package put together by Congress and the White House focuses on assistance and bailouts of cruise lines, airlines and other companies in a pickle, often the result of heavy leveraging. “So long Bernie,” snort economics John M. Griffin and James M. Griffin. Washington was “only interested in socialism for the connected rich, whose share prices have plummeted.” Both state the fundamental point that such socialism for the rich policies are rewards for myopic planners who refused to squirrel away some security when things were rosy.

The airline industry is a case in point. Their representatives have been particularly apocalyptic in tone. But Richard Squire, a specialist in the law of corporate bankruptcy, is not impressed about airline executives passing around their deep begging bowl. “Without a bailout,” he explains confidently, “the air carriers would renegotiate their terms of credit with their lenders outside court, or they would file for Chapter 11 bankruptcy protection. Either way, they would keep flying.” Squire makes the pertinent observation that airline carriers are rather good at fibbing when it comes to imminent corporate doom, portraying Chapter 11 bankruptcy as a form of financial death. Not so, given that between 2002 and 2011, American, Delta, Frontier, Northwest, United and US Airways all went for the generous provisions of Chapter 11. Flying did not cease. “Most of their customers didn’t even notice.”

But the begging bowl is set to be filled, with carriers able to lodge applications by last Friday for funds to the value of $25 billion. JetBlue, American, United and Delta have made applications to the Treasury Department for generous grants to avoid furloughing their employees or slashing their pay through to September 30. Even with this, the handsomely remunerated Delta CEO Ed Bastian has asked for more, claiming such funds “are not nearly enough. We are expecting our revenue in the second quarter to be down 90%.”

COVID-19 has, briefly, caused a stir of transformation in some circles. “In 2020,” Will Bunch muses, “a liberal is a conservative who’s been exposed to the coronavirus.” But the long convention of socialising losses while privatising profits remains, for the most part, undisturbed. It is a fashion, most conspicuous in the United States, that refuses to go away.

Like what we do at The AIMN?

You’ll like it even more knowing that your donation will help us to keep up the good fight.

Chuck in a few bucks and see just how far it goes!

9 comments

Login here Register here-

New England Cocky -

Uta Hannemann -

Michael Taylor -

David Fitzpatrick -

whatever -

Kaye Lee -

Matters Not -

wam -

Jon Chesterson

Return to home pageYep!!! Socialise losses to the people and privatise profits to the bosses. Yet another example of conservative politicians looking after future political donations to their respective parties ….. DoG help the country because nobody else can.

“Combined with crashing oil prices and political chaos, COVID-19 was, according to Naomi Klein, “laying bare the extreme injustices and inequalities of our economic and social system.”

It looks to me that the conservative ‘liberals’ in the long run want to work towards preserving these ‘extreme injustices and inequalities’. No good, no good at all!

I can’t help but think that when this is all over the govt will strip us to the bones.

God, AIMN drags its dull, snail-like, schoolboy feet to its dull, schoolboy school, tomorrow and tomorrow.

The difference from the 2008 financial meltdown is that the current share market collapse involves primarily the Small Investor (Mug Punter) listings, most of which are stupid and trivial and should not have been listed in the first place.

I mean you would have to be a First Class Mug to invest in something like Godfreys Vacuum Cleaners or Dominos Pizza.

Not sure what you were hoping to achieve with that contribution David.

whatever – Are you aware that Mitsubishi UFJ Financial Group, Inc., is a significant investor in Dominos Pizza (was in the vicinity of 8%) and hardly fits the descriptor of being a Small Investor, given it’s a leading global financial services group and one of the largest banking institutions in Japan?

spot on michael and like all good three card tricksters the workers and welfare will be doing the lifting under the delusion that is is what everyone is doing. ie a flat tax is equal, gst on bread is equal.

They will be falling all over themselves making up a bucket list of privatising. Drooling over wreaking a food voucher no cash system for welfare and the unemployed. Wetting themselves over a new work choices.

ps words and meaning

war cabinet is a winning slogan means effall but shit it sounds good. Did Menzies have labor input????

SOCIALISM NOT JUST FOR THE WEALTHY – AFTER HALF A CENTURY OF DEMONISATION – ALL OF A SUDDEN IT IS THE SOLUTION

Beware the corporate liars who selfishly cry wolf to get their hands on public funds, we’ve heard it before, corporate welfare or socialism for the rich, but not who socialism was meant for. The old neoliberal handshake between brothers, ‘socialise your losses and privatise your profits’, and don’t tell everyone, and if they do find out, tell everybody you were only protecting jobs and first in the queue.