Scare Campaigns Hide an Economic Void

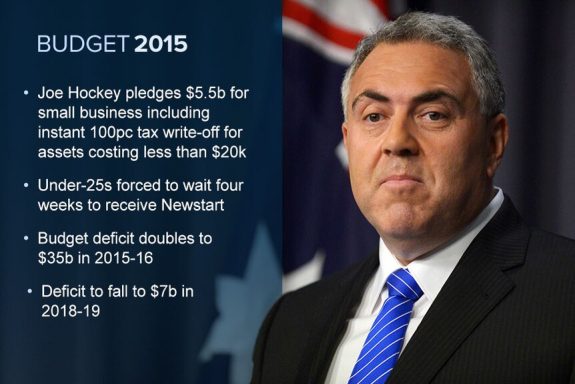

Just eight weeks after the release of the 2015-16 Federal Budget, one that the MSM will tell you was well received, serious doubts are now beginning to emerge not just with growth estimates generally, but also with revenue targets; doubts that are coming from a variety of qualified sources.

If we are able to look beyond the recent scare campaigns being waged, we see the current trend in overall growth is well below the level necessary to bring unemployment down. Wages growth is stagnant, business investment is sluggish and household spending is restrained.

By now, Joe Hockey would have realised that dramatic spending cuts are not the smartest way to manage an economy particularly when those cuts take money away from people who actually spend it.

Having spent most of his time in opposition bagging the economy, then taking a machete to it at the first opportunity when in government, Joe Hockey’s scare campaign has achieved the opposite of a boost in spending and investment.

One part of the domestic sector is saving or paying down debt, the other is postponing expansion and development plans. Both private sector components hold little confidence in the long term future.

But it gets worse. Both Hockey, Tony Abbott and the rest of those charged with managing our economy, simply don’t know what to do. They have no idea how to stimulate growth, or if they do, they refuse to acknowledge it. They listen to people who don’t know and turn a deaf ear to those who do.

The ABC’s business editor, Ian Verrender describes their position similar to that of an ostrich with its head in the sand, while IPA Research Fellow, Chris Berg just pleads for a better understanding of the importance of growth. We can add to these, Reserve Bank Governor Glenn Stevens who, in his customary deadpan way, is trying to alert them to the real nature of the problem.

These and other comments from seasoned economists like Bill Mitchell who are not stricken with the neo-liberal approach, but simply state the bleeding obvious, ably represent the chorus of people who see our economy heading toward the abyss.

At a recent address to the Anika Foundation, Glenn Stevens said, “In the interim, the somewhat more restrained attitude to debt and spending by households, combined with a similar attitude by the government sector, has meant that there has not been quite enough domestic demand to achieve full employment, in the face of the fall in business investment.”

He warns that households are moderating their spending patterns to offset mortgage commitments. They are preferring to de-leverage rather than spend.

ABC’s Ian Verrender says, Joe Hockey’s self-proclaimed credible path back to surplus, “was to be achieved by way of a magic wand, through an unexplained sudden return to trend growth. From 2.5 per cent last year, the economy would gather momentum this year, expanding by 2.75 before rising to 3.25 per cent next year and then to its long-term growth trend of 3.5 per cent.”

Such estimates fly in the face of Glenn Stevens’ earlier statements that record low interest rates can only do so much and that trend growth could settle below 3%, well under that estimated in the budget.

To further illustrate the dilemma, when a senior fellow at the IPA begins to question the coalition’s performance, you know something must be wrong. Chris Berg says, “That the Government can propose higher taxes and proclaim its desire for lower taxes in the same breath isn’t a failure of messaging, it reveals an absence of purpose.” Berg complains that the government has no central economic agenda.

In the end it matters little that the MSM doesn’t highlight the failings of this government. In terms of the economy it is the people who feel it first; the unemployed, those who are reduced to part time work, those whose wages are suppressed, those whose debt levels become unmanageable, those who suddenly find buying essentials is as much as they can afford.

Politicians who enjoy entitlements the way ours do, don’t seem to notice these things even when they are staring them in the eye.

But when they fail to listen to experts, pretend they know better and create fear campaigns to deflect our attention, their lack of credibility becomes all too obvious to the voters and even to members of the IPA.

49 comments

Login here Register here-

Harquebus -

keerti -

Rosemary (@RosemaryJ36) -

Zolbex -

stephentardrew -

Neil of Sydney -

John Kelly -

Michael Taylor -

kizhmet -

babyjewels10 -

Harquebus -

John Kelly -

John Kelly -

Harquebus -

Andreas Bimba -

Harquebus -

Lachlan -

Neil of Sydney -

Roswell -

Neil of Sydney -

Möbius Ecko -

Neil of Sydney -

Möbius Ecko -

Neil of Sydney -

totaram -

Michael Taylor -

mark delmege -

Andreas Bimba -

Möbius Ecko -

Harquebus -

Michael Taylor -

Neil of Sydney -

Möbius Ecko -

Harquebus -

Möbius Ecko -

Harquebus -

John Kelly -

Neil of Sydney -

Kaye Lee -

Neil of Sydney -

Möbius Ecko -

Neil of Sydney -

Christopher Brooks -

The AIM Network -

Harquebus -

lawrencewinder -

-

Möbius Ecko -

Return to home pageGrowth is the problem and not the solution. It is destructive, polluting and unfair. The fools in charge still can not see the grotesque errors of their ways.

“Four decades after the book was published, Limit to Growth’s forecasts have been vindicated by new Australian research. Expect the early stages of global collapse to start appearing soon”

http://www.theguardian.com/commentisfree/2014/sep/02/limits-to-growth-was-right-new-research-shows-were-nearing-collapse

Note the forecast increase in the death rate. As I keep saying, it won’t be pretty.

Search criteria: limits to growth

Agreed Harquebus! Finite resources can never support infinite growth, that is unless maths is a problem for you.

When it comes to MSM, “In the world of the blind, the one-eyed man is king”.

To grow an economy you do not necessarily need to use ever more resources.

Great article John. Says it all.

What utter incompetent despicable idiots.

Even the evidentiary facts are beyond their irrational dogmatism.

It’s like an offhanded ho-hum who cares about peoples suffering we could never be wrong.

What with global warming denial, complicity in TPP, TPIP, TISA and ISDS clauses that undermine national sovereignty and the appalling idiocy of current trade agreements, destruction of manufacturing (the list is endless) this government will go down as the most incompetent in this countries history yet there is more damage to be done by these evil theocratic totalitarian fools.

Both Hockey, Tony Abbott and the rest of those charged with managing our economy, simply don’t know what to do.

This may or may not be true. But labor has no idea. The Labor Party solution to every problem is government spending

unemployment high, debt increasing the solution is always spend spend spend according to Labor

NOS, only Labor governments are not afraid to spend. Government spending increases employment opportunities, not the other way round. This is what the LNP don’t get, and you also. Remember the 2008 stimulus? That is exactly what we need now. As for debt, don’t wind me up. You won’t win.

John, Neil never wins. His kicks at goal keep hitting the post.

I think we need to qualify government spending John! This government IS spending, profligantly one might argue, evident by the increased deficit ‘-) Spending by creating jobs and bolstering our economy is positive, sending money overseas enriching other countries’ coffers is another matter entirely.

I hear ya!

You can not solve a debt problem with more debt. Someone or something has to pay. At the moment is our environment that is paying the cost and that is not sustainable.

TANSTAAFL There Ain’t No Such Thing As A Free Lunch.

How long will it take for people to realise that “debt” for a sovereign currency issuer (e.g. Australia), is not the same as you and I borrowing from a bank. We have to pay it back with interest from money we earn from external sources (our place of work). A sovereign currency issuer doesn’t and does not.

By a wonderful piece of technology known as “interbank electronic transfer” (actually, I just made that up), our government, via the RBA, can and does simply create the money by crediting a bank account. There, no debt, no nothing.

The “debt” people think we have is the total of government bonds issued. Financial institutions (mostly commercial banks) buy them like you and I buy shares. If you own any shares, do you regard them as a debt carried by the company that issued them?

Because I can assure you the company that issued them and took your money doesn’t regard them as a debt. They regard them as liquid reserves. They like them so much they pay a dividend on them. You can sell them any time you like on the share market.

Likewise those who buy government bonds can sell them on the bond market. The government like them so much they pay a dividend too, except we call it “interest”. But, guess what? The interest is new money created by crediting accounts too.

So, the next time someone tells you we are deep in debt tell them they don’t know what they are talking about.

Kismet, yes, the government is spending more, evidenced by the deficit, but it is wasteful spending, not income producing, not job creating. I don’t agree that they are spending money overseas unless you are talking about imports (i.e. Cars) in which case it is we the consumers who are doing that. Overseas sourced government purchases, such as for defence, medical equipment and the like, does deplete our foreign currency holdings but isn’t debt in the real sense.

Throughout history, all fiat currencies have failed. Every one of them and for the first time in history, all currencies are fiat.

John, you might like this one. Five episodes about 1/2 hour each.

http://hiddensecretsofmoney.com/videos/episode-1

John the point you and the other Modern Monetary Theory economists make that governments should stimulate the economy with moderate deficit spending to enable the economy to employ the unemployed and underemployed is so important that this along with the lie of the past 30 years of neo-liberalism economics ARE THE TWO BIG ECONOMIC ISSUES WE FACE.

We also face the global warming crisis and many other serious concerns such as overpopulation, world poverty and disease, war and conflict, destruction of the natural world, resource depletion and so forth.

Many are happy that the Labor Party have proposed to tackle climate change more aggressively but as for the rest of their policies they also fall well short and are really just neo-liberal team B.

Even the Greens still cling to the contractionary policy of balanced budgets and have so far failed to appreciate the huge merit of what the MMT economists say.

Modern Monetary Theory is also known as neo-charlatanism.

“Keynesians are not good writers. When it gets down to explaining economic cause-and-effect to the average person, the Keynesians are helpless. The average person cannot follow Keynesian logic. There is a reason for this: there is no logic to it. The General Theory is illogical.”

http://www.zerohedge.com/news/2015-07-27/bucks-stop-here-why-keynesian-economics-will-get-blamed-crash

Andreas Bimba

I totally agree. Over population compounded by resource depletion is the root cause of most of our problems including economic and environmental and is not being publicly addressed by any main stream media outlet nor political party. Not even the Greens.

Is anyone really surprised that this current government hasn’t a clue about how to set the economy right? Look at what they are made up of, the dross of the Howard Government led by a man who has admitted his utter disdain for economics. Let’s face it, most of us who knew before 2013 that Abbott was simply not up to the job are quite gleefully saying “We Told You So”.

Lachlan

In 2007

unemployment = 4.3%

Federal govt debt = ZERO

economy = booming

kids in detention = ZERO

asylum seekers in detention = 6

Labor get elected and in 2013

unemployment = 5.8% and increasing

Federal govt debt = 10% of GDP and exploding

economy = so so

kids in detention = 2,000\asylum seekers in detention = thousands

The ALP always produces debt and unemployent

Neil, are you trying to say that everything that is wrong with the Abbott Government is Labor’s fault?

Now, I have a little task for you. I want you to tell us one thing that is bad about our current government. Just one thing, if you can. And your not allowed to blame any previous government either.

One thing bad about the current govt?

Bronwyn Bishop. The Coalition should get rid of her as soon as possible. And if public floggings are still law, Bronnie should be flogged.

Neil who has gone on in the most condemnatory manner about Labor debt for so long it is now impossible for him to justify this: http://pbs.twimg.com/media/CLEYGoRUYAApbcC.png, yet he will still go on about Labor.

That is nearly all the Liberal’s debt. It belongs to Hockey’s fiscal ineptitude and wasteful spending, a record debt that Neil will not address or acknowledge, absolutely proving he’s a hypocrite.

Worse is that Labor’s debt was to get us through a GFC and was in large part spent on infrastructure. What has this government to show for the largest debt in our history of their own making. Certainly no visionary infrastructure, jobs, better national health, education, social construct, living standards and a cleaner environment.

Worse is that Labor’s debt was to get us through a GFC

No, this is normal for the ALP. Name me one Labor govt either State or Federal that has paid off any debt since say 1980?

Told you. His answer is Labor and with an arbitrary date to boot whilst ignoring the context of the post. Nothing has changed, still disingenuous. What a hypocrite.

I asked a question. Name me one Labor govt either State or Federal since 1980 that has paid off any debt?

NOS:

“Labor get elected and in 2013

unemployment = 5.8% and increasing”

You always ignore the fact that there was a GFC in 2007 which Australia weathered far better than any other OECD nation. If unemployment was 5.8% in 2013 do you know what it was in other OECD countries? I’ll bet you do know but don’t want to talk about it.

Unemployment was indeed increasing. Do you have any idea why? I will tell you. Because the clever Mr Wayne Swan thought he would show “good economic management”, and tried to “produce a budget surplus”! That contraction in spending, particularly on the lowest paid, pushed unemployment up.

Oh, and in spite of this government’s wasteful spending, unemployment is trending higher and growth is slowing. So what has the coalition done in two years? Only made matters worse and in terms of their own yardstick (government debt) also made matters much worse.

I don’t think anyone should give NoS even the time of day. He repeats certain talking points in the hope that by “Goebbel’s Hypothesis”, people will begin to think they are cogent arguments. That is how the neo-liberals took over the “economic narrative” and its “framing” in the Reagan-Thatcher era and most of the world has suffered since then. But the rich 1% continue to get richer by leaps and bounds and people like NoS are just paid foot soldiers, who one day will discover how they were taken for a ride, like turkeys voting for Christmas in the vain hope that they will be “pardoned”.

Neil, you’re becoming a real bore. Again.

Don’t mention, Neil, how when we have recently had the Lib in Govt housing prices have risen so high that young people have no chance to buy a home. I won’t mention the racism, scare tactics or lies that make your eyes water.

Well said totaram. If neo-conservative Neil from Sydney was capable of independent thought he would sieze onto your second paragraph to wip Labor with, but government surpluses are good and deficits are bad in the simple world of conservatism and one does not need to think further.

4 legs good! 2 legs bad! Baahahahaaah! Baahahahaaah! Vote for Tony. Bahahahaah! Bahaahaha!

And note Neil’s well worn out tactic of not addressing questions asked of him or about Liberal failings, but demands his diversionary Labor questions and statements be responded to.

Becoming a hypocritical bore Migs. He’s always been one and always will be one.

I have no problem with Neil’s comments, not that I often agree with him. They are not abusive and he is entitled to them. If he is one eyed then, he is not the only one.

Cheers.

Harquebus, Mobius and I have known Neil for ten years. In that ten years he has made the same comments over and over. True, he’s not abusive, but you too will get sick of his repetitive rants in due course.

when we have recently had the Lib in Govt housing prices have risen so high that young people have no chance to buy a home

What to say? I purchased a property in Western Sydney in late 2008. Prices did not change much in 2009 or 2010. They then started to take off in 2011 and then exploded in 2012 and 2013. This all happened before the Coalition won govt in late 2013. Not that long ago.

And i want to ask the question again. Name me one Labor govt either State or Federal since 1980 that has paid off any debt?

Harquebus the problem with Neil is that he says the same things over and over and has been for years with the sole aim of derailing topics away from the subject of his beloved Liberal party’s failures. It’s not that he’s one eyed, that’s self evident, it’s that he’s so mind numbingly repetitive.

Michael Taylor.

I read ’em and if I don’t like ’em, I forget ’em. Comments like Neil’s are important to me otherwise, how would I know what people like him think. He is providing us ammunition for our arguments and not necessarily to be used against him but, against the mindset that is like concrete in the conservative world.

I think that he highlights some of the absurdities on both sides of politics.

Jus’ my opinion.

See demanding we answer his arbitrary question when he ignored the one on Hockey’s record debt. He’s engaging in a lame diversion away from this governments considerable economic failing.

Neil won’t answer what happened to Abbott’s and Hockey’s dire debt and deficit emergency or address Hockey’s all time ballooning record debt.

Mobius Ecko

It seems that NoS is getting to you and some others. Have you considered that, that might be his aim. I bet he chuckles every time someone responds negatively and is only encouraging him.

I also am accused of being repetitive and admit that I am so, I know where he is coming from on that part at least.

A quest is a quest, whether it is considered by some to be worthy or not.

Cheers

NoS, for the record, every single State and Federal Labor government since Federation has, at some time during their administration, paid out both interest and principle on bond and treasury notes issued. So too have Liberal governments. No Australian government has EVER defaulted on a bond payment. I hope that satisfies you.

Hockey’s fiscal ineptitude and wasteful spending, a record debt that Neil will not address or acknowledge, absolutely proving he’s a hypocrite.

We will not know the results of Hockeys first budget until September this year. I believe the forecast is for a $30B deficit. Only then will we find out whether Hockey has doubled the deficit.

I find these discussions about government debt quite bizarre. I have, several times in my life, been debt free. Every time I have chosen to go back into debt, using the equity in my assets to further invest. The size of a debt means nothing out of context. It’s what you are investing the money in that is important as well as your ability to service the debt. Why would Gina Rinehart borrow billions to fund her Roy Hill mine when she already had the money to pay for it? She obviously feels the interest on the loan is money well spent on a project that will bring her a far greater return. Even without the advantage of being able to create money and access to a never-ending revenue stream (governments don’t have to fund their retirement), we as individuals realise the benefit of investing in things that bring a return. It may not be immediate financial gain. Investing in a home has provided an environment in which my family is safe, healthy and happy, investing in a good education for my children – even donating to charity is an investment that brings a social return.

I very much doubt there would be any large companies who have no debt. No Australian government has ever been debt free regardless of what NoS says. The gross debt at 30th of June 2007 was over $58 billion. As we know, Costello wiped out the net debt by selling assets. Why you would sell a profitable asset just to get rid of a debt is beyond me.

No Australian government has ever been debt free

The Federal govt became debt free in 2006

The gross debt at 30th of June 2007 was over $58 billion

This was because Costello decided to keep the bond market open

http://www.smh.com.au/federal-politics/its-the-debt-not-the-spending-why-the-budget-is-bleeding-20140502-zr3mo.html

In 2002-03, when the Howard government no longer needed government debt, it commissioned a review into whether it should bother continuing to issue government bonds.The review concluded that financial markets need government bonds in order to price private sector loans. Without them, interest rates would be higher. And financial institutions are required by regulators to hold some of their capital in extremely safe assets. Without government bonds they would be struggling. So the Howard government undertook to ensure it always borrowed at least $25 billion whether it needed it or not. It invested what it borrowed in shares and the like, allowing it to boast that it had no net debt while maintaining a gross debt

As we know, Costello wiped out the net debt by selling assets. Why you would sell a profitable asset just to get rid of a debt is beyond me.

Costello sold assets because we needed to reduce debt to get our AAA credit rating back which we lost under Keating. It was not until debt was reduced to 5% of GDP that we got our AAA back.

And Costello wiped out debt by a combination of asset sales and surplus budgets not asset sales as you proclaim.

Ha ha what a joke Neil. So now he’s are going to be pedantic over whether it’s doubled or not, something he would never do if this was Labor increasing debt to record levels. Yet again proving himself a hypocrite.

———————————————————

Crikey Feb 2015

Figures released Friday night on Australia’s finances are grim reading for anyone seeking respite for the embattled Abbott government.

The Coalition that promised in 2012 to reduce Australia’s debt by $30 billion delivered in 2014 an increase of more than $60 billion. Clearly Prime Minister Tony Abbott and Treasurer Joe Hockey have failed spectacularly to reduce Labor’s “skyrocketing debt”.

Outcomes for the full calendar year 2014 are now online at the Finance Department’s website. Commonwealth monthly financial statements show year-to-date net debt and the projection for the full financial year. Hence it is simple to calculate the debt incurred — or repaid — each month.

Australia’s net government debt — that is, money borrowed minus money loaned out — was $239.16 billion at the end of December. This was a hefty increase over the level a month earlier of $224.35 billion. In just one month, the debt rose almost $15 billion, or 6.6%. Compounded, that rate would double the debt in less than a year.

At the end of 2013, the actual net debt was $177.74 billion. Hence the increase over the full year was $61.42 billion ($239.16 – $177.74). That’s a rise of 34.6%.

That December 2013 actual figure is pretty close to the level that can reasonably be attributed to Labor. As Crikey explained last October, the best measure of Labor’s debt is the projection for the end of the full year 2013-14 at the September 2013 election. At that time, projected debt at year end was $178.1 billion, although actual debt then was marginally lower. That year-end projection of $178.1 billion was affirmed in Finance’s statements for October and November 2013. It did not shift until well after Joe Hockey had taken control of the levers.

———————————————————

As they nearly always have, Labor in government are fairly honest in their budget revelations and projections, even following rules put in place by a Liberal government. It is the Liberals that are dishonest and who distort and abuse even their own rules, changing them or refusing to abide by them as Hockey has done.

This is one of Neil’s memes. Labor debt is always bad and to be lambasted forever. Liberal debt is either good or can be excused. Going to be interesting to see him excuse at least 20 years of Liberal debt. For mine I’m not concerned about the debt, just how it was incurred and how it is utilised. In this government’s case it’s due to recklessness and exorbitant spending purely for political gain and it’s being wasted with little to no strategic infrastructure, environmental or social spending.

As they nearly always have, Labor in government are fairly honest in their budget revelations and projections

What is that supposed to mean? Projections are put into the budget. They are not hidden. Swans projections were always wrong. Swan projected a $20B surplus for his first budget and it ended up being a $20B deficit. A $40B turn around.

And I do not believe in MMT. It will take 5-10 years to clean up the mess Rudd/Gillard left. However i suspect there is no party that will reduce the debt. It will just getting bigger and bigger. Swan created a runaway debt truck. Voted for by everybody who voted for Rudd in 2007. But believers in MMT do not worry about debt that is why Labor always trashes the budget.

I see little prospect of improving the honesty and integrity of our economic life while party power factionalism dominates the discussion.

Australia needs an intellectually based alliance of critical thinkers that focus on the bedrock of our problems which lies in formulating and describing all economic elements and possibilities with honest and plain language.

I could not nominate an MP in Australia who has demonstrated they understand how money, debt and wealth relate.

There is a growing number of Australians who clearly comprehend the “money” and “debt” question is a critical part of the solutions for achieving more satisfying results in life.

Humanity is challenged and nourished by our cultural and tribal attitudes which test our ability to recognize where our team loyalty clouds our capacity to actually make essential compromises to join with others to grow the very critical university of common knowledge that is the driver of progress.

When I make my petitioning representations to MP’s, academics or journalists, the problem is not achieving answers and explanations of why our banking and money policies are framed to benefit the policy of monopoly, the problem lies in breaking through the wall of obfuscation, tedious red tape and avoiding tactics plied to escape my challenge.

This conduct is often a mix of conditioned fear and partly willful ignorance but the result is that the concepts and possibilities of a “sovereign money” future have limited traction or momentum that an idea requires to become a commonly acceptable proposition.

What strikes me is there are many capable minds with the political and social abilities across Australia that are motivated by genuine purpose but unable to find a common path where mutual objectives could be advanced.

Compromise and discussion are essential at every level of human relationships and associations, generally reflecting success in proportion to the attained maturity and character of those involved in the undertaking, when striving to respect differences and genuinely cherish and exploit common purpose and benefit.

The “printing press” can protect itself from danger by fueling conflicting dogma and wrapping common community ambitions in tricky multiple flavors that focus the mob on the trivial or lesser issue while the architects of monopoly and their money trick are kept invisible from any forum where the unsatisfactory condition of human affairs are contemplated and debated in search of solutions.

When the condition of the world is reviewed it is impossible to refrain from describing it as the tragedy of human effort.

Christopher, Neil has a habit of doing that. Introducing party power factionalism, that is.

“Most deny it, but we live in an energy economy, not a money economy. Without the continually increasing forward thrust of energy input, no economy can exist in the context that we have become used to.”

WOW!

Did Bunter Berg nearly put a coherent thought into a sentence? Amaaaazing! I saw his effort on education in “The Age” was roundly swiped by three letters to the Ed…. Funny idea the IPA … have all the answers and are always looking for a question to frame it!

No wonder the economy is becoming a shambles…. it’s the IPA blue-print!

Pingback: Scare Campaigns Hide an Economic Void. When in opposition scare wasn’t prominant now in government it’s the center piece. | olddogthoughts

Wow in a supposed economic emergency and budget crisis Abbott announces $89 billion for ship building in Adelaide. That’s an awful lot of pork barrelling to keep Pynes doomed seat.

Then we have this. By measurement Abbott’s is probably the worst government in Australian history, worse than McMahon’s. And he brings in the worst Trade Deficit since records began on it 45 years ago, up 168% on the same period last year. Market economists are saying it’s a pretty horrible figure.

There’s a deficit you won’t hear the right wingers go on about as Howard also bought in record bad trade deficits, and that was during and economic boom.

Pingback: Scare Campaigns Hide an Economic Void | THE VIEW FROM MY GARDEN