Absolute crap

One thing that has become increasingly apparent about Tony Abbott is that he gears his words to his audience. If that meant explaining policies at a level that the audience could comprehend, that could be a good thing, but in the case of our Prime Minister, it means saying what you think they want to hear even if it is inconsistent with, or even diametrically opposed to what you have told a different audience.

When Tony visited a meeting of 130 farmers and townspeople in Beaufort in September 2009, he called for a show of hands on whether the Coalition should support the ETS. Only a handful voted yes.

Abbott, until that point Turnbull’s main defender on the ETS, quickly donned his sceptic’s hat and played to the room discussing how there had been many changes of climate over the millennia not caused by man, leading to that infamous quote

“The argument is absolute crap. However, the politics of this are tough for us. Eighty per cent of people believe climate change is a real and present danger.”

His comments were warmly received in this rural heartland and that was when Tony realised that he may have a shot at the leadership if he became a climate change denier.

After he staged his leadership takeover, Abbott tried to cover-up his backflip describing his use of “crap” as “a bit of hyperbole” and not his “considered position” and said it was made “in the context of a very heated discussion where I was attempting to argue people around to what I thought was then our position”.

Absolute crap say the people who were at the meeting.

Event organiser Jim Cox said Abbott’s comment was “very well received” and he quickly realised “he was on a bit of a winner”. Vice-president of the Beaufort branch of the Liberal Party Joe McCracken said Abbott looked relieved by the applause.

Buoyed by his success, Tony used the same approach when he attended a luncheon event on International Women’s Day in 2010.

What would women want to hear? I know…we are going to give you universal paid parental leave on replacement wages plus superannuation for six months and we are going to scrap Labor’s $150,000- a-year income limit on the $5185 Baby Bonus.

Instead of being grateful, women, who are in the main smarter than Tony Abbott, realised this fell into the ‘too good to be true’ category. As subsequent actions have shown, Tony’s feigned concern for women and families was absolute crap as was his promise not to introduce any new taxes. (Who could forget that humiliating interview with Kerry O’Brien?)

Not only have we lost the Baby Bonus, and lost the right to claim paid parental leave from both our employer and the government, eligibility for Family Benefit payments has been tightened up and increases frozen. The appropriateness of these measures is debatable but Abbott’s backflip is not.

Going into the last election Tony Abbott promised a ‘unity ticket’ on education. The Liberal Party education policy also clearly stated “We will ensure the continuation of the current arrangements of university funding.”

Absolute crap.

When Tony Abbott addressed the IPA at their 70th anniversary dinner, he spoke of freedom.

“Freedom can only exist within a framework of law so that every person’s freedom is consistent with the same freedom for everyone else. At least in the English speaking tradition, liberalism and conservatism, love of freedom and respect for due process, have been easy allies.

“Do unto others as you would have them do unto you” is the foundation of our justice. “Love your neighbour as you love yourself” is the foundation of our mercy.

..a democratic parliament, an incorruptible judiciary and a free press, rather than mere law itself, are the best guarantors of human rights.

You campaigned against the legislative prohibition against giving offence and I’m pleased to say that the author of those draft laws is now leaving the parliament. Well done IPA! And, of course, you campaigned against the public interest media advocate, an attack dog masquerading as a watchdog, designed to intimidate this government’s media critics and that legislation was humiliatingly withdrawn.”

Abbott sucked up to the IPA telling them what they wanted to hear but where is the due process for citizens returning from the Middle East? Where is the justice and mercy for asylum seekers? Where is the concern for human rights? Where is the freedom to criticise this government? And who is Abbott to speak of humiliating withdrawals?

That speech had more crap in it than Chinese berries.

Tony speaks of his commitment to tackling the scourge of domestic violence and to closing the gap for Indigenous Australians while slashing funding for frontline services. We have seemingly endless funds for defence, national security and border protection. We can even find $40 million to give Cambodia to take four refugees. But we cannot fund refuges, legal services and advocacy groups.

The lip service paid to the protection of our vulnerable has been proven absolute crap by the actions of Abbott’s mob.

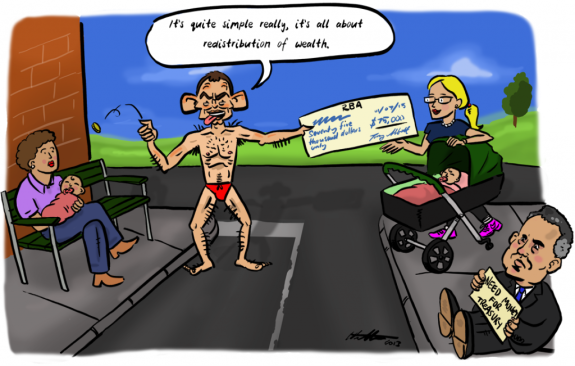

And when it comes to the economy, everything the Abbott government says is crap. Despite significantly increasing the debt and deficit and having to downgrade projections with every fiscal statement, they try to convince us that they have cut billions from the debt they inherited. It makes no sense whatsoever to compare trajectories in ten years’ time and claim credit for things that haven’t happened and aren’t likely to.

After campaigning widely on the supposed “debt and deficit disaster” and trash talking our economy, Joe Hockey warns us now of the irresponsibility of such talk because of its negative affect on confidence. Whilst reining in government spending, he encourages us all to get out there and spend up big to stimulate the economy. Joe, you are full of it.

On many occasions before the election, the Coalition promised to build our new submarines in South Australia. It even appears in their defence policy released on September 2, 2013.

“We will also ensure that work on the replacement of the current submarine fleet will centre around the South Australian shipyards.”

When Tony’s leadership was threatened in February, he promised his South Australian colleagues that would be the case – at least that’s what they thought he promised. Even they must now realise that was absolute crap.

Before the election we were promised “no cuts to education, no cuts to health, no change to pensions, no change to the GST and no cuts to the ABC or SBS” and no adverse changes to superannuation.

Absolute crap.

In his victory speech on September 7 2013 Tony Abbott made the following promise:

“In a week or so the governor-general will swear in a new government. A government that says what it means, and means what it says. A government of no surprises and no excuses. A government that understands the limits of power as well as its potential. And a government that accepts that it will be judged more by its deeds than by its mere words.”

My judgement?

Tony Abbott will say whatever he thinks people want to hear because, far from being a leader, he is a dishonest inadequate man whose only motivation is to keep his job. This makes him susceptible to manipulation. We are in the position where focus groups, vested interests, lobbyists and party donors are dictating policy because our PM is a weak man with no vision whose words mean nothing.

Absolute crap, indeed.

Like what we do at The AIMN?

You’ll like it even more knowing that your donation will help us to keep up the good fight.

Chuck in a few bucks and see just how far it goes!