Scott’s new targets

In October, Labor voted to pass nearly $3 billion in budget savings with revised welfare legislation which will see Family payments cut and young people on a disability support pension will have their cases reviewed.

The laws will:

- reduce the primary income earner limit for Family Tax Benefit B from $150,000 to $100,000

- limit the FTB – A large family payment to those with four or more children

- review the cases of people under 35 who are receiving a disability support pension

- include untaxed super income in eligibility assessments for the Seniors Health Card

- remove scholarships for students moving between major cities

The most substantial cuts will involve those families who lose entitlement to FTB Part B, worth just over $3000 per year, when their youngest child turns six and is at school, although transitional arrangements will apply until July 2017. Low income lone parents will instead get a payment of $750 dollars a year per child aged 6 to 12 years.

About $10 billion in budget measures, including increasing the pension age, reducing the rate of increases to pensions and freezing family payments, remain blocked. In a bid to woo the crossbenchers, the Government has “repackaged” those cuts and changes to a new series of bills.

The Government proposes to freeze all income-test thresholds for most benefits for three years, and FTB payment rates for two. Freezing payment rates is regressive, since lower-income families bear proportionally higher cuts.

Lone parents earning around two-thirds of the average wage lose between 5.7 to 7.1 per cent of their disposable income. A single-income couple with two school-age children and average earnings loses nearly $90 per week or 6 per cent of their disposable income.

Compare this to the $29 or less than 1 per cent of disposable income paid through the Deficit Levy by an individual on three times the average wage – close to $250,000 by 2017–18. High-income couples could together bring in up to $360,000 per year and not contribute an extra cent.

There will be no transition for unemployed people under 25, who will receive Youth Allowance rather than Newstart. People under 30 will be required to wait for up to six months before getting unemployment benefits and then Work for the Dole.

An unemployed 23-year-old loses $50 per week or 18 per cent of their disposable income. An unemployed lone parent with one 8-year-old child loses $60 per week or 12 per cent.

Senator Abetz backed down from his ridiculous idea of making unemployed people apply for 40 jobs a month which would have led to 30 million job applications a month when there’s not even a couple of hundred thousand jobs on offer.

The Government has also launched a tender process for a new $5.1 billion employment services plan and work for the dole scheme to operate for five years from July 1 next year. One wonders which private companies will benefit from this $5 billion cash splash and whether the money would not be better spent creating jobs rather than providing slave labour for the private sector who will receive generous payments to administer the scheme.

I also wonder has this government done any modelling on increasing the pension age to 70. When they increased the age for females from 60 to 65 in 1995, women with disabilities in this age group increasingly claimed the DSP. The proportion rose from close to zero to about 13 per cent by 2013. But as the number of women receiving the DSP went up, the number receiving the age pension went down by much more.

In 1995, only about 650 women aged sixty to sixty-four received the DSP and 211,000 received the age pension. By 2012, 86,000 female DSP recipients were in that age group, but only 28,000 age pensioners. So the total number receiving one or other of these pensions has nearly halved, and now the majority receive the DSP.

Increasing the pension age to 70 will just force more people onto the DSP and increase the medical and administrative costs to receive their payment. So much for cutting red tape.

I sincerely hope Labor have the number crunchers working out exactly how much people are worse off under this government’s policies. Add in the delay to the increase in the superannuation guarantee, higher fees for university students, cuts to health and education, increased fuel excise, scrapping the increase of the tax free threshold, and every single person is worse off though inversely proportional to their income and wealth.

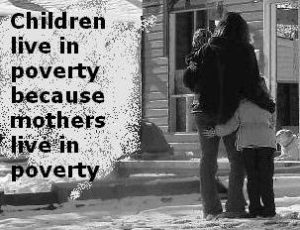

The Australian Council of Social Service released a new report revealing that poverty is growing in Australia with an estimated 2.5 million people or 13.9% of all people living below the internationally accepted poverty line.

The report provides the most up to date picture of poverty in the nation drawing on new data released by the Australian Bureau of Statistics Income and Expenditure surveys for 2011-12 and previous years. It finds that 603,000 or 17.7% of all children were living in poverty in Australia.

The poverty line for a single adult is $400 per week yet the maximum rate of payment for a single person on Newstart – when Rent Assistance and other supplementary payments is added – is only $303 per week. This is $97 per week below the 50% of median income poverty line.

It also emphasises the danger posed by Budget proposals to reduce the indexation of pension payments to the Consumer Price Index only, which is likely to result in higher poverty rates over time than would be the case if payments were indexed to wages and therefore community living standards.

Most at risk groups

- Women – significantly more likely to experience poverty than men (14.7% compared to 13%);

- Children and older people – face higher risks of poverty compared to other age groups (17.7% and 14.8% respectively);

- Sole parents – at high risk with 33% in poverty in 2012 and 36.8% of all children in poverty were in sole parent households;

- Born overseas – Poverty is higher amongst adults born in countries where the main language is not English (18.8%) than amongst those born overseas in an English speaking country (11.4%), or in Australia (11.6%);

- Aboriginal and Torres Strait Islander people – ABS data does not include information to accurately measure this poverty rate, however 2011 HILDA data found 19.3% of Aboriginal and Torres Strait Islander people living in poverty, compared to 12.4% of the total Australian population;

- People with a disability – latest available data does not allow this poverty rate to be calculated, however our previous report found 27.4% of people with a disability were living in poverty in 2009-2010 compared to 12.8% for the total population.

Abbott’s strategy to help these people is “we removed the carbon tax”. Come on Labor, let’s compare that to all the other things they have “removed”.

Morrison doesn’t see helping these people as his responsibility. He views them as his targets, the challenge he must face and subdue.

In the May budget they cut $44 million from the capital works budget for the National Partnership on Homelessness.

Three days before Christmas they axed funding to Community Housing Federation Australia, National Shelter, Homelessness Australia, disability groups and financial counselling services.

In the next budget, Scott Morrison is going to do something about making childcare more affordable. This will be a welcome move if it isn’t just about making politicians able to claim for their nannies.

He will also be trying to sell Tony’s signature Paid Parental Leave Scheme or some sort of renegotiated version of it. If it is means tested, completely unavailable to those over a certain income, then it may be worthwhile though it basically defeats Tony’s stated purpose of encouraging “women of calibre” to breed. It’s interesting that this “workplace entitlement” is being promoted by the Minister for Social Security who wants the government to pay for maternity leave rather than the employer. I guess Tony is desperate to have an answer other than carbon tax about what he has done for women but let’s not let it blind us to the needs of our most disadvantaged citizens.

As this government silences advocates for the homeless, the disabled, the young and the needy, our Indigenous and refugee communities, we, the public, must raise our voices to help protect our most vulnerable and to tell the government which direction we want this country to go.

“…the moral test of government is how that government treats those who are in the dawn of life, the children; those who are in the twilight of life, the elderly; those who are in the shadows of life; the sick, the needy and the handicapped. ” – Hubert H. Humphrey.

Like what we do at The AIMN?

You’ll like it even more knowing that your donation will help us to keep up the good fight.

Chuck in a few bucks and see just how far it goes!

Your contribution to help with the running costs of this site will be gratefully accepted.

You can donate through PayPal or credit card via the button below, or donate via bank transfer: BSB: 062500; A/c no: 10495969