Plutocrats and Pitchforks

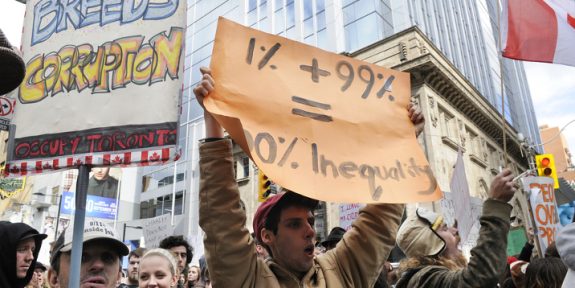

The word ‘revolution’ has throughout history been synonymous with the cry for equality and social change. The French Revolution of 1789, the Russian Revolution of 1917, the Cuban Revolution of 1959 to name a few, all began because the divide between the haves and the have nots became intolerable. In the examples above, social inequality was at historically high levels and getting worse by the day. Something had to happen and it did, much of it violent and bloody.

Revolutions were generally born of peasant unrest, dissatisfaction, a sense of betrayal by once revered heroes who were seduced by their own power and their accumulation of vast wealth. When that peasant dissatisfaction reached a tipping point, revolution became the only recourse.

Today the wealthiest 1% in our society enjoy a lifestyle that much of the 99% could not even imagine. Furthermore, the gap continues to widen such that the line between middle and lower class workers is now blurred, while the gap between middle and upper income levels grows wider and easier to see.

While any high functioning capitalist economy will always have inequality to some degree, the divide as it exists today is so geared toward greater wealth for the fewer that the middle class is in danger of disappearing altogether. The message for all those living in their gated compounds and ivory towers is, it cannot last.

Statistics are not needed to reinforce these claims. They simply confirm what the 99% already know. But, for the record, in 1980 in the USA, the top 1% controlled about 8% of the national income while the bottom 50% shared about 18%. Today, the top 1% share 20% of the national income while the bottom 50% share just 12%.

In Australia, similar comparisons are difficult to find but in measuring wealth by quintiles, the ABS found that in 2011 the top 20% of households owned 62% of the wealth while the bottom 20% held less than 1%. In fact the top 20% held more wealth than the rest combined. The conclusion was that wealth inequality was rising fast.

Free market capitalism in its present form is no longer a recipe for a sustained, prosperous, happy, healthy society. Today, capitalism is synonymous with inequality, unfairness and discrimination. With today’s capitalism we are drifting toward feudalism.

Inequality has grown so dramatically over the past thirty years that our once great egalitarian Australia of the 1960s and ’70s has all but disappeared. And to quote Joseph Stiglitz, “one of the major culprits has been trickle-down economics—the idea that the government can just step back and if the rich get richer and use their talents and resources to create jobs, everyone will benefit. It just doesn’t work; the historical data now proves that.”

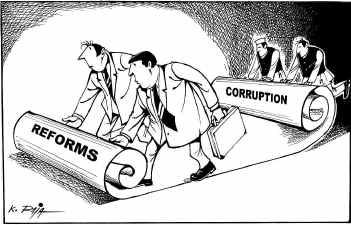

If ever world leaders had an opportunity to revolutionise capitalism it was in the aftermath of the Global Financial Crisis (GFC). Just six years on from that incredible opportunity, we can see they have failed and have done so, spectacularly.

Bank bailouts without conditions will be a dark legacy for Barack Obama in an otherwise reasonable presidency and now the opportunity has all but passed. The US stock market has not just recovered but surpassed pre 2008 lows. The rich are richer and the poor are poorer in far greater numbers than before. For the 1%, the plutocrats, it’s business as usual.

The Reagan trickle-down effect is back with a vengeance and is now the hallmark of the present Australian government despite a plethora of information, data, and recent history to demonstrate its failure. They still expect business to lead a national recovery with investment in goods and services. What they don’t get, is that an underutilised workforce cannot afford it. Business knows this. That is why they will not commit.

The government cannot see that a vibrant, active, well-educated workforce is an essential component of a strong, robust economy; a component that creates demand that results in stronger growth, stronger investment and stronger taxes.

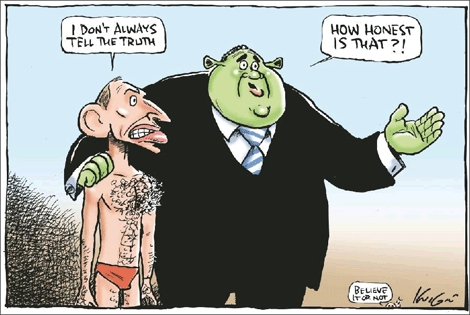

Blinded by the advice from bankers, investment houses and those whose fortunes are derived from manipulating stock markets and overvaluing mortgage stocks, Tony Abbott and Joe Hockey are no more than a mouthpiece for the 1%; the plutocrats. They are victims of their own self-serving ideology. While they are in power nothing will change, no improvement for the 99% will ever eventuate.

Any realistic observer can see that this trend is unsustainable and its future unpredictable. While the plutocrats continue to build their wealth, billionaire Nick Hanauer thinks they might inherit pitchforks.

While the 1% enjoy their wealth, blind to the signs of desperation around them, a single act of defiance by someone desperate and destitute enough could mobilise thousands in support and roll across the country like a tidal wave. The 1% could be caught like the frog in the saucepan unaware the water has reached boiling point. But by then, it will be too late.

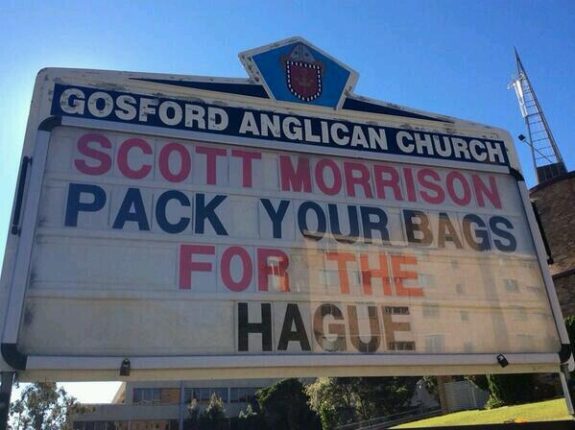

I don’t think anyone in government, least of all Scott Morrison, anticipated riots leading to murder and self-immolation when he embarked upon his ruthless policy of deprivation detention on Manus Island. That crept up without warning. And now, I don’t think either he or his party foresee all the possible outcomes if they embark upon a policy of reducing welfare at a time of fiscal contraction.

He may not even care but he could well be responsible for creating a new underclass that has no respect for law and order. He could well extend existing poverty further into the realm of the middle class, bringing welfare agencies to their knees trying to cope. This is where that one defiant act could likely emerge.

History is littered with such circumstances and the consequences of doing nothing. The 1% won’t see it coming, but governments should. And they should do something to stop it, or they too will feel the pitchforks. They can plead ignorance but that won’t save them.

They can say their hands were tied but their complicity will be all too obvious. The plutocrats will never change voluntarily. The government is running out of time to do it for them.

Like what we do at The AIMN?

You’ll like it even more knowing that your donation will help us to keep up the good fight.

Chuck in a few bucks and see just how far it goes!

Your contribution to help with the running costs of this site will be gratefully accepted.

You can donate through PayPal or credit card via the button below, or donate via bank transfer: BSB: 062500; A/c no: 10495969