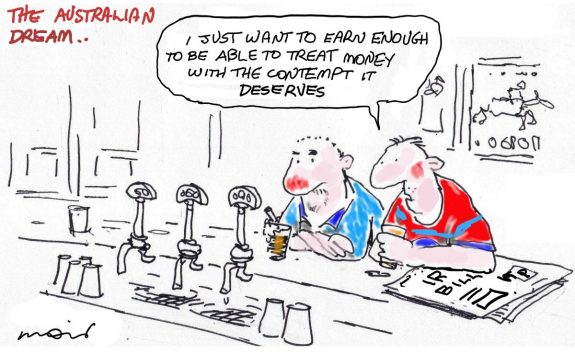

Money, money, money. It’s a rich man’s world.

The headline conveys a tale of acquisition, narcissism, and unimaginable wealth. The world is overflowing with money inherited, earned honestly or obtained through corrupt means. Nevertheless, little is acquired through equal opportunities. It is a world where the rich have a significant advantage. It is a rich man’s world.

Let’s begin our investigation with some sobering statistics.

Last year, before legislation to fix the problem, research by the Australia Institute showed that:

“… the cost to the federal budget of generous superannuation tax concessions was on par with the cost of the entire aged pension and more significant than the total cost of the NDIS as a whole in 2022-2023.”

And Oxfam’s latest report, “Inequality Inc.,” said that the income of Australia’s 47 billionaires doubled in the last two years to $255 million.”

If you are amazed by those numbers, you are not alone. I am, too. Never before have the wealthy been so well taken care of.

Tax avoidance through family trusts is also an industry unto itself.

“Earnings can be allocated to family members with low income from other sources so that the taxable income attracts the lowest tax rate possible.

In some circumstances it is possible to reduce the tax bill to almost zero.”

As if that’s not enough:

“The rich also get rewarded with tax concessions to employ armies of lawyers, financial consultants, and accountants to arrange their tax affaires to avoid tax.”

While Australians face a cost-of-living crisis, billionaires have been raking it in. One report said that 897 self-managed super funds produced $1 million or more in income.

We now have “more wealth in the hands of 47 people than around 7.7 million Australians,” – just absurd.

And the wealth of:

“… the three wealthiest Australians, Gina Rinehart, Andrew Forrest and Harry Triguboff, has more than doubled since 2020 at a staggering $1.5 million per hour.”

That inequality of such magnitude should exist in a wealthy country like Australia should open our thinking toward a wealth tax.

SOS Australia rightly points out that:

“… the rest of the community bears the “cost of these tax concessions. It siphons off revenue that would be better used to fund schools, TAFE and universities, as well as other services such as health care, mental health, public housing, unemployment benefits and so on. As the economists Emmanuel Saez and Gabriel Zucman have observed, tax avoidance is ‘the triumph of injustice‘.”

They add that:

“To compound the injustice, the wealthiest families in Australia also benefit from over $1 billion a year in government funding for the elite private schools they send their kids to. Figures published on My School show that 126 of the wealthiest schools in Australia received $1.25 billion in government funding in 2020. Not only do the rich avoid paying taxes, but they get massive subsidies from the taxes paid by the rest of the community. The sheer scale of the avarice is gobsmacking.”

The Australia Institute also points out that tax concessions for super items “such as medical benefits are $31.3 billion, and assistance to the states for hospitals is $26.6 billion.”

You have to wonder how individuals accumulate large sums in superannuation while receiving such generous tax benefits, not to mention negative gearing, franking credits, and CGT (capital gains) discounts.

When you stop to consider it, the situation is quite scandalous. How did we get here? Is it the result of consecutive conservative governments being too generous while in power? Or is it due to the Labor government’s reluctance to take action? Once you’ve given something, it’s tough to take it back.

I wanted to understand why significant wealth inequality exists in our society. I wondered why both conservative and left-leaning governments tend to reward those who already have a lot of money rather than support those with less. It seems counterintuitive that this pattern persists across different political ideologies.

A conservative philosophy might suggest they should, but it doesn’t say it should be unfair. Conversely, Labor philosophy unequivocally supports the less well-off.

I typed into my search engine, “Why do the rich in Australia receive so many tax breaks?” Google provided a multitude of headlines to peruse.

As I wrote this, news hit the airwaves that the stage three tax alterations would advance more equitably. The Opposition is now up in arms, of course, but logic has won over politics. They will shout broken promises, but Labor can hardly go against its philosophy and still maintain respect with its supporters.

The Australian started its salvo with six stories on its front page about the tax cuts the day after the announcement – none with equality in mind.

Distinguishing a change of mind from a broken promise is often precarious, particularly in politics. It takes courage to change your mind for the greater good.

Another article I read was by Aimee Picchi, from December 17, 2020, for MoneyWatch. Although it wasn’t Australian and a little dated, it contained a thread to what I sought. Picchi wrote that:

“The new paper, by David Hope of the London School of Economics and Julian Limberg of King’s College London, examines 18 developed countries – from Australia to the United States – over 50 years from 1965 to 2015. The study compared countries that passed tax cuts in a specific year, such as the U.S. in 1982 when President Ronald Reagan slashed taxes for the wealthy, with those that didn’t, and then examined their economic outcomes.”

The analysis discovered one significant change:

“The incomes of the rich grew much faster in countries such as the USA, where tax rates were lowered, but instead of trickling down to the middle class, the tax cuts for the rich accomplished much more. Reagan inadvertently or deliberately helped the rich become more wealthy and exacerbated income inequality.”

Although the report doesn’t cover the period of Trump’s Presidency, his tax cuts lifted the ultra-rich’s fortunes even further.

A piece by The Guardian’s Stephanie Convery from 2023 tells us that the:

“Australian data showed that a wealth tax of just 2% on the country’s millionaires with wealth over $7m, 3% on those with wealth over $67m, and 5% on billionaires would raise $29.1bn annually, enough to increase income support payments to the Henderson poverty line of $88 a day for 1.44 million people.”

We inhabit a system with flaws where the principles of capitalism do not guarantee an equitable distribution of economic resources. This leads to a small group of privileged individuals accumulating enormous wealth while most people grapple with poverty in some shape or form.

Tax reform is necessary to generate additional revenue for the government, which can then be used to reduce poverty and improve human services.

We need tax reform to help those struggling with poverty and improve access to essential human services. By generating additional government revenue, we can work towards creating a more compassionate society that supports and cares for all of its citizens.

My last Google search was surprising. I found it hard to believe that more than 250 ultra-wealthy individuals were urging politicians to increase their taxes. It happened at the World Economic Forum in Davos on January 15-19, 2024.

“Our request is simple: we ask you to tax us, the very richest in society,” the wealthy people said in an open letter to world leaders. “This will not fundamentally alter our standard of living, deprive our children, or harm our nation’s economic growth. But it will turn extreme and unproductive private wealth into an investment for our common democratic future.”

Like I said: I was surprised.

My thought for the day Is it feasible for incredibly wealthy individuals with many advantages to comprehend what it truly means to be in poverty? It’s difficult to say for sure, but some of them may have some understanding of the experience.

Like what we do at The AIMN?

You’ll like it even more knowing that your donation will help us to keep up the good fight.

Chuck in a few bucks and see just how far it goes!

Your contribution to help with the running costs of this site will be gratefully accepted.

You can donate through PayPal via the button below, or donate via bank transfer: BSB: 062500; A/c no: 10495969

22 comments

Login here Register here-

John Hanna -

Chris -

Terence Mills

-

Patricia -

Vera -

Andrew Smith -

New England Cocky -

-

Canguro -

Max Gross -

New England Cocky -

Centrelink customer -

Clakka -

Terence Mills -

andyfiftysix -

andyfiftysix -

Phil Pryor -

Clakka -

Phil Pryor -

New England Cocky -

Terence Mills -

Frank Sterle Jr.

Return to home pageIt all started with Reagan and Thatcher and the bum sniffing neo liberal toadies that have followed. All about destroying a middle class that they considered was getting too powerul after WW2.

Good questions, “conservative governments . . too generous ?”, or is it “Labor . . reluctance to take action?”

The last time Labor took on the Libs ‘welfare for the wealthy’ mindset, they got hammered by a media campaign of misinfo. That was Paul Keatings 1987 attempt to roll back negative gearing. Labor learned their ‘reluctance’ lesson – don’t take on the lamestream media unless you’ve overwhelming support for policy change. Walking back Stage 3 tax cuts will work for Labor due to broad public support. Even Dutton is dithering on protesting too loudly.

Now 37 years have passed since Keating tried to make the tax system fairer. The Tax Act has ballooned and anything that would give average workers a break is duck-shoved out of sight as soon as it appears on the radar.

Re negative gearing, Labor could take the high ground and apply it to new builds only, not to the resale over and over and over again of existing properties. That policy change would send a signal that being a creator of something new (eg shelter) is supported by the tax system. I think that is part of the way forward, and I bet very few, if any, politicians agree.

I heard an economist call the Labor changes to the Stage Three tax cuts a ‘necessary calibration’. I looked up ‘calibration, to ensure that I knew what it meant : to make, adjust, or check the settings (of something) to ensure accuracy and maximum efficiency.

That’s what I thought it meant but having listened to coalition talking heads I needed to check : some Liberals (Nationals are generally very quiet on the subject) screech that it’s a Labor trick , it’s a broken promise, it’s a lie and they should not be able to get away with it.

What Labor has done is to ‘calibrate’ a coalition proposal that was introduced by Morrison in 2018 and enacted as an omnibus Bill in 2019 – it’s all or nothing they said as a classic wedge on the then opposition – with stage three scheduled to come in some five years down the track and to benefit mainly the well heeled.

So Labor ‘calibrated’ the tax cuts to adjust the settings so that the benefits were more equitably distributed across the broader Australian community : for this, according to some in the Liberal Party, Labor should be ‘hung,drawn and quartered’ and the original defective plan should be reinstated forthwith.

Anybody visiting from overseas and hearing this nonsense would think they had taken a seat at the Mad Hatter’s Tea Party next to Peter Dutton :

But I don’t want to go among mad people,” Alice remarked.

“Oh, you can’t help that,” said the Cat: “we’re all mad here. I’m mad. You’re mad.”

“How do you know I’m mad?” said Alice.

“You must be,” said the Cat, “or you wouldn’t have come here.”

There is a theory that by increasing the level of poverty, reducing the middle classes, in a country, the wealthy, who live in fear of an uprising against them, know that those who live in poverty do not have the means , the time or the energy to foment rebellion. By reducing the middle classes the opportunity of those who feel aggrieved by the inequality in their society is reduced. Nick Haneur talks about the fact that if inequality continues to grow in societies those left behind will come for the rich with pitchforks, he is not wrong, it has happened before and it will happen again.

Oh dear, how could we have misplaced the reminder of greed Walt Disney’s “Scrooge Mc Duck?” Thank you John for the profound article. The truth!

Made easier by conditioning from our suboptimal RW media cartel channeling Atlas – Koch policies, adopted by the LNP especially.

Presenting single or at best a binary (opposing) of factors to submerge complexity and detail, helped by soundbites and one liners, but precludes those who can walk, talk, fast, chew gum and see all factors, while encouraging simplistic opinions masquerading as ‘analysis’

There are many opportunities to increase the tax revenue while supporting ”needy citizens” yet to learn the financial management skills to create their own wealth.

.

1) International Financial Transaction Tax on all amounts over $1 MILLION sent out of Australia by any means at a rate of $10 per $1 MILLION;

.

2) Deem loan borrowings claimed by as essential business expenses by foreign owned multinational corporations at the annualised loan interest rate received by Australian banks for the purposes of assessing taxation of profits;

.

3) Re-introduce the grandfathered removal of negative gearing, limiting negative gearing to ”new builds” and removing negative gearing from the purchase of ”secondhand” residential premises. Grandfathering was used in 1985 to introduce Capital Gains Tax on property sales and is now accepted as a part of costing investments in residential housing. (Thanks Chris).

.

4) Again, abolish Franking Credits by which the top 10% of tax payers receive about 70% of the about $12 MILLION hand-back money. If necessary grandfather in this tax reform.

.

5) Remove all tax concessions from fossil fuel search, the interstate transport industry and increase funding for renovating &/or upgrading to standard gauge and re-opening established interstate railway lines, while developing fresh alternative routes that better reflect the present distribution needs between cities.

.

6) De-centralise government departments to regional cities to provide a drought-free economic base for further economic development in the regions.

.

7) Introduce a ”voucher” system of equally funding education so that EVERY STUDENT GETS THE SAME AMOUNT OF GOVERNMENT FUNDING regardless of the state or private school that parents choose to send their off-spring.

.

8) Remove the tax free charity status of churches & other institutions shown to have been complicit in the abuse of children by the Gillard – Fox Royal Commission.

.

Just a few ideas on an early Saturday morning.

.

Pingback: Money, money, money. It’s a rich man’s world. - independent news and commentary Australia

The intended consequences of belonging to the wealthier class of humanity – wherever they may call their home on the planet; – the right to continue as they do, shelter from effective criticism or sanction against their unparalleled profligacy and resource consumption, governmentally endorsed penalties for those who oppose their activities, police and private security agencies acting as proxy defenders on their behalf, armies of lawyers and pubic relations firms spending obscene amounts of money on defending their clients’ rights to continue as they do, criminalisation of their critics, utilisation of the media as a spokesbody for their behaviour, trivialisation of their actual impact on society and environment via the confected artifice of employing the society of the spectacle and much much more. It sucks. It has always sucked. There has rarely or never been an appropriate accounting and reining in of privilege and its malevolent impact on society at large along with the massive cost to the environment and its ecosystems.

George Monbiot’s essay in today’s Guardian sums it up with his usual forensic perspicacity.

I have an in-law who is very tight-fisted, owns two houses and a self-contained unit and owns multiple family trusts, in the names of his kids, himself, his wife, but none of them know any details or have any access. I wouldn’t be surprised if he didn’t have trusts in the names of his dog and budgerigar too.

The Scandal of Franking Credits

Greg Jericho@GrogsGamut

·Remember the fight over franking credit? Remember being told by the LNP and media orgs that it was about poor retirees?

The latest figures form Treasury say…

Yeah, they lied.

Check out the graphical data below.

https://scontent.fsyd12-1.fna.fbcdn.net/v/t39.30808-6/424706341_764378445602024_8573993712770024493_n.jpg?_nc_cat=105&ccb=1-7&_nc_sid=c42490&_nc_ohc=AUVu4sHJsTsAX96Sn6o&_nc_ht=scontent.fsyd12-1.fna&oh=00_AfATqaSqAejBx5tMFJbppFYtqcYeohc5mGud6iLgpofWtg&oe=65C2EEAB

Message for Senator Janet Rice,

Dear Senator Janet Rice,

I am a jobseeker robbed by Services Australia. Last September I emailed you a copy of their review decision made by an unqualified person. I remind that the review was conducted by a “delegate or authorised officer” not an authorised review officer (required by law). Services Australia used a fake review decision to force me into significant debts and withdraw money from my payments.

Senator Janet Rice, I asked you for help but received your automated email confirmation only. I ask you again to hold Services Australia accountable and protect other welfare recipients.

“But the meek shall inherit the earth; and shall delight themselves in the abundance of peace.”

There’s a biblical prophecy that would’ve put a shiver down the jelly-like spines of all the not-meek.

Whilst pumping paternalistic righteousness, behind the scenes, they build gallows and dungeons, sharpen spears and build armies whilst engaging prestidigitating clerics, bean counters, lawyers and spruikers to generate ways and means and laws with appropriate built-in guile to ensure the prophecy does not come about.

And so it goes on and on. As John Hanna (above) said, since “Reagan & Thatcher”, greatly accelerated.

The breeding, and the aspiration and the fear. A malignant growth spreading globally such that there will be no earth and peace to inherit, just tomes of abstractions and prestidigitated laws. And the not-meek, and their jelly-like spines, in their sieges eating each other.

Now, as the blinking meek are rendered to dust, the battleground is only between aspirants and the not-meek extant. Upwardly mobile or content, yeah, sure, as beguiled, they hurtle into the abyss. Blown up, maybe, but not to kingdom come, as there’s no kingdom come.

It seems equity has been ossified by the accumulation of complexity and cowardice surrounded by oceans of bullshit. A thixotropic bullshit like quicksand, where any wriggle can lead to an accelerated downward demise by asphixiation. So screams of horror and outrage abound.

Although it all seems at crisis level, and there’s a sense of urgency, whoa, more than a little fiddle may bring on a grizzly end; the end of political complexity. And we couldn’t have that could we.

What to do …. when yer hoist by yer own petard?

With Dutton & Co, ambition paramount, fecklessly screeching, maybe Albo & Co will have to draught a new Oz bible, and globalize it lickety-split.

Or as The Life of Brian noted :

MAN : You hear that? Blessed are the Greek.

GREGORY: The Greek?

MAN : Mmm. Well, apparently, he’s going to inherit the earth.

GREGORY: Did anyone catch his name?

MRS. BIG NOSE: Oh, it’s the meek! Blessed are the meek! Oh, that’s nice, isn’t it? I’m glad they’re getting something, ’cause they have a hell of a time.

Shit like this gives capitalism a bad name. But lets face it, the system was designed by rich people for rich people.

The rich people have pedalled the lie that its a land of equal opportunity.

We even had an enquiry about equal spread of money for education. Schools that charged $20,ooo a year were also able to collect

money because even poor families struggle to send their kids there. FUCK ME, how so outrageous. Here we are all these years later and guess what?

Rich schools are getting richer and poor schools are still poor.

Yet we voted for the elite funding by voting in the arsehole party time after time.

I gave education as one example, but there are so many others i could write a book.

Communism was hit by its own fuckery, we shouldnt be pointing the finger cause we let capitalism fuck us over too.

I have yet to see economic theory thats got grass roots thinking or a modicum of intellectual honesty.

The rules of 1700s slavery havent been changed, only polished up so they appear more palatable.

NEC, your recommendations are totally outrageous. They seem to be based on fairness and fixing distortions in economic activity.

Outrageous , simply outrageous.

But you too seem to be caught in that loop. “….many opportunities to increase the tax revenue …”

Yea well we already have an over burdened agenda to collect taxes …….thats working…….NOT.

What we need is a system that encourages behaviour that is good for society. Sufficient Revenues will follow.

User pays is a fucked ideology. Its used to screw society, not make it better. Like ever more draconian taxes on tobacco isnt creating a new ” industry”…. really?

Its point is to drive certain behaviours but we have seen quite a few tobacco shop fires lately…. i wonder why…..

Another example. Toll roads. Governments could build them at similar prices, borrow the funds at lower rates and charge the tax payer an extra $5 a week.

Compared to $20 a week you fork out in tolls now. Cost of living crisis, yea we can build that into the system.

Efficient use of funds is used by capitalists to beat us over the head so the rich people can make an extra couple of bucks off us.

If capitalism was based on supply and demand only, we would be using the ability of government to do things on scale.

Instead we create another industry that feeds off our good intentions only to overtake our good intentions. ie banks are now THE INDUSTRY. Retirement pension too. SUPER is now THE INDUSTRY. While we rob governments of scale, we squander precious funds that have to be found via higher taxes. Why not privatise everything……

Packer was right… ” you keep squandering our funds, why should i give you more..?”

Equal opportunity to be fair, happy, well off, one of the flock, a “common man” type, is just so absurd a concept here, today. Australia is run by the maggot makers, the getitgrabitgutzit gang, the NEW plantation owners, the techo bludgo usethe moneyo getrichquicko types, patrons of on line scams and scabby outlook, and of course, OLD FILTH in right wing media, business, finance, banking, retail, poltical pushing patronage perversions, to get what the hidden bastards really want, and we can get stuffed, nobodies, nothings.

Although being somewhat irreligious, I do like the model of the Mondragon Corporation.

Although, of course, constrained by the perverted capitalist system within which it has little choice to participate, its growth and international spread is slow but impressive, and is based upon a solid, well reasoned base of social transformation.

Like for everyone else, issues pertaining to the capital costs of transformation away from fossil fuel tech may pose some difficulties for it.

The “promise” bound up in 2019 tax reform proposals was so stupidly inept, unsuited, unfair, unjustified and as days went by totally economically suspect, that one wonders at the brainless boldness of Mad Morrison and later Peter Duckwit-Futton in supporting such utterly unsuitable rubbish. Circumstances change, event occur, happenings happen, and silly promises are good for a few days or so, until legislation to affirm is cobbled up, presented, passed and enacted Quickly. And, none of that was done, Here, in 2024, we have so many people needing relief and support as was not foreseen in 2019. Fancy that, economics fundamentals being so vague…The ALP changes are right, and could be made more right by retaining a high end scale for the well off who can afford to fund the Australia they so keenly distort and rort in so many ways. And, NO advances in fixed inflexible taxes.

@ andyfiftysix: Thank you for your interesting comment on my comment.

.

Without wishing to split hairs, the ”Toll roads” are a state problem rather than a feral responsibility. The last 12 years of COALition misgovernment saw this ”money for jam” source of revenue sold off to a consortium of corporate donors to the LIARBRAL$, just like the sale of the NSW Land Titles Office to a consortium of banks for the benefit of the the retiring Premier a ”man” of little substance but a too big fresh salary package for his efforts.

.

However, ”Capitalism” is already ”screwed” in Australia because the COALition political parties are re-elected far too often for the good of the country, and are only voted out of office when the mess that they have generated threatens the profits of the corporate sector.

.

@ Clakka: The Mondragon Model has much to commend it, especially the known fixed links between pay levels for all members of the corporation, from floor sweeper to CEO. This clearly shows that everybody in the organisation is valued for their contribution (unlike the state DoEs where Head Office desk jockeys believe that they are indispensable to the consumption of coffee, and ”work” is something done by somebody else.

.

The present American model is flawed because pulling a number out of a hat and claiming that “”everybody is getting something like that amount” becomes a self-fulfilling prophecy …. for the ultimate benefit of the corporate recruiters having their remuneration tied as a percentage of the placement.

Cocky

The difficulty in getting any real tax reform in this country is our crazy combative politics.

Take Negative Gearing for instance : the principle is fairly sound – that prospective landlords (i.e. people with the money) invest in housing to rent and in the process the available housing stock is increased and more people are able to rent a home.

As Labor pointed out at the 2109 election, the system was failing as investors were churning through existing housing stock to get the benefit of Negative gearing and capital gains tax concessions but they weren’t building new house so the available rental stock was not increasing but house prices were .

So Labor proposed that Negative Gearing only apply to new builds thus increasing the available rental stock of houses and flats and taking the pressure off the churning and price spiral impacting existing housing.

The coalition screamed ‘blue murder’ , Labor lost the election and Bill Shorten got the flick and we ended up with Scomo and a housing crisis.

Now, the coalition are already starting a fear campaign that Labor will reintroduce their policy on Negative Gearing and the compliant media are demanding that Albanese swear that he will ‘never ever’ change the defective Negative Gearing regime – here we go again !

The only way that Labor could bring about meaningful policy on housing related taxation would be to foreshadow something like a Royal commission into Housing Affordability and then act on the findings of the RC which would, undoubtedly find that Negative Gearing and CG tax concessions given to investors on ‘existing’ houses is not economically or socially sustainable. It would probably also find that stamp duty on housing and land transactions for first home buyers was regressive and other matters that I can’t think of at the present.

But will it happen ?

Ironically, one has to be very wealthy in order to not have to pay income taxes. Especially in corpocratic Canada and the U.S., it seems that the superfluous-wealth desires of the few, and especially the one, increasingly outweigh the life-necessity needs of the many. And our corporate news-media deem that ‘unfit to print’.

It seems the superfluous-wealth desires of the few, and especially the one, increasingly outweigh the life-necessity needs of the many. And our corporate news-media deems that reality ‘unfit to print’.

Perhaps the unlimited-profit objective/nature is somehow irresistible. It brings to mind the allegorical fox stung by the instinct-abiding scorpion while ferrying it across the river, leaving both to drown.

Corporate CEOs will shrug their shoulders and defensively say their job is to protect shareholders’ bottom-line interests. The shareholders, meanwhile, shrug their shoulders while defensively stating that they just collect the dividends and that the CEOs are the ones to make the moral and/or ethical decisions.

The more that corporations make, all the more they want — nay, need! — to make next quarterly. It’s never enough. Maximizing profits at the expense of those with so much less, or nothing, will likely always be a significant part of the nature of the big business beast.

Still, there must be a point at which that inhumane corporate practice can/will end up hurting big business’s own monetary interests. One can imagine that many living and healthy consumers are needed.