The RBA’s Interest Rate Call: From Bland Headlines to a Burst of Friendly Fire from Critical Journalism

By Denis Bright

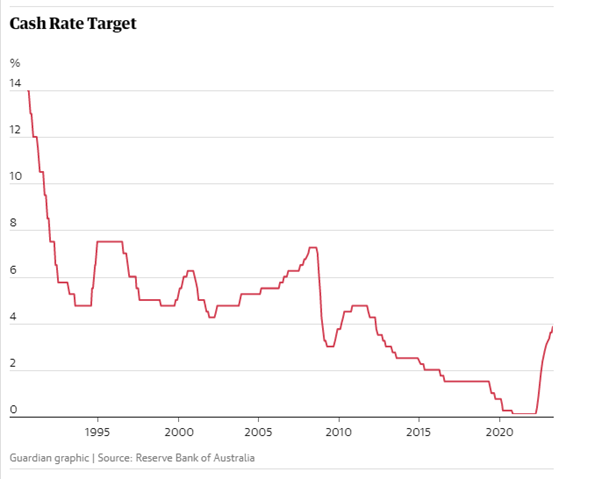

It is no consolation to mortgagees that the eleventh interest rate increase from the RBA in a year still leaves Australians with a lower interest rate than most comparable developed economies.

Knowing that current interest rates in Australia are still low by historical standards is also a vacuous perspective. The sheer cost of affordable housing extends to outer metro fringe zones and regional whistle stops. Even at Rappville (NSW) in the Cowper electorate where the trains no longer stop, the local real estate agency has just one modest house that is a notch under $400,000 in price.

Closer to the metropolitan centres of power and influence, there is more acute immediate pain for applicants for new rental contracts as landlords cash in on shortages of accessible and affordable housing options.

The contractual binds faced by mortgagees who were enticed into home purchases by low interest rates in a competitive property market under lower interest rate regimes is now unbearable. Many householders were attracted to properties that they could not sustainably afford after recent interest rate changes and the termination of interest rate ceilings.

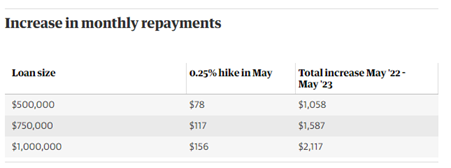

Peter Hannam of The Guardian (2 May 2023) shows the extent of the financial burden on mortgagees in the battle against unacceptable levels of inflation:

Although Australian home loan rates are low by our own historical standards, the sheer cost of the original property purchases are extracting a terrible financial toll. In the early 1990s under a more severe interest rate regime, comfortable houses were available for less than $200,000 in a wage regime where incomes were adjusted for inflation despite record levels for post-1945 unemployment rates.

Pet galahs were said to be sprooking economics in the lead up to the recession we had to have in the early 1990s. That squawking about the potential of J Curves to turn the economy around did not eventuate. The Australian dollar had dipped to below 50 cents to the Greenback in the mid-1980s, but all that pain produced no positive results.

The Australian economy needed an optimum dollar and an optimum rate of interest. Journalists should have advocated diversification through the harvesting of capital flows into key sectors through government investment funds which had not yet eventuated to respond to the structural challenges within the economy. The graphics from The Guardian chart the consequences of interest rate hikes.

More interest rate pain can be expected in Australia as major neoliberal financial markets in the US and Britain from higher interest rates as the conventional counter-inflationary measure. Even in Australia, unemployment rates of around 5 per cent can be expected at the end of the Albanese Government’s first parliamentary term.

Conservative Britain is even more right-wing than the Australian LNP in economic management. Unlike Britain, Australian governments have a bipartisan commitment to viable investment funds like the Future Fund and the various state and territory investment funds. These should be opened up to private sector capital flows offering entry into the Australian economy for overseas investors who could be attracted by the long-term stability of the Australian dollar without the need for guaranteed dividends as in the days of the old government loan schemes. Superannuation funds attract our savings under similar conditions and warn of the possibilities of downturns in dividends in difficult times.

Also missing from the discussion of interest rate hikes in the mainstream media is the impact of overseas induced pressures on local interest rates. There are legitimate overseas components of this problem like the impact of COVID-19 on supply networks for very basic items. Then there is the added impact of additional spending by national governments for strategic commitments mainly to the US Global Military Alliance in the vast networks of NATO countries through direct membership commitments and support from associate countries like Australia which joined up in the Gillard years through our commitment to the US troop surge in Afghanistan.

As mentioned in previous articles, major economies like the US and Britain have structural weaknesses and are no longer at the cutting edge of economic innovation outside their vibrant military industrial complexes which are hosting Prime Minister Albanese after the Coronation on his state visit to Britain:

“I’m honoured to represent Australia at the Coronation of The King and The Queen Consort, a historic occasion. I am proud to join a group of remarkable Australians who will also attend the Coronation, showcasing our truly diverse and dynamic nation.

“This will be the third occasion that I meet with Prime Minister Sunak. We will discuss the Australia-United Kingdom Free Trade Agreement, which will shortly enter into force, and will deliver benefits for Australian exporters, Australian workers and our economy more broadly.

“I will meet with the highly trained and skilled workers at the Barrow-in-Furness shipyard, who will be an important part of helping Australia acquire nuclear-powered submarines through AUKUS.”

The Barrow-in-Furness Shipyard is of course operated by BAE Systems as a commercial investment with a global turnover of AU$40 billion. It is the world’s seventh largest military construction site on 2021 data. BAE Systems has strong commercial ties with US military industrial complexes as noted by BAE Promotions:

BAE Systems, Inc. is a Delaware corporation that has mitigated our foreign ownership through a Special Security Agreement between the U.S. Government, BAE Systems, Inc. and BAE Systems plc. That agreement calls for the appointment of outside directors who, in conjunction with other U.S. based board members, comprise a Government Security Committee. The Government Security Committee has the responsibility for overseeing the company’s compliance with U.S. Government Security and Export regulations, and meets regularly with U.S. Government oversight agencies to provide feedback on that compliance. Our long history of successful compliance with the SSA allows BAE Systems to supply products and services to the Department of Defense, Intelligence Community and Homeland Security on some of the Nation’s most sensitive programs.

Both the Bank of England (BoE) and the US Fed Reserve keep their interest rates a notch higher than Australia. The onset of recession in the Anglo-American financial markets is deflected by the vacuuming of capital flows. Corporate tax exceptions are also available through charging up revenues to tax havens.

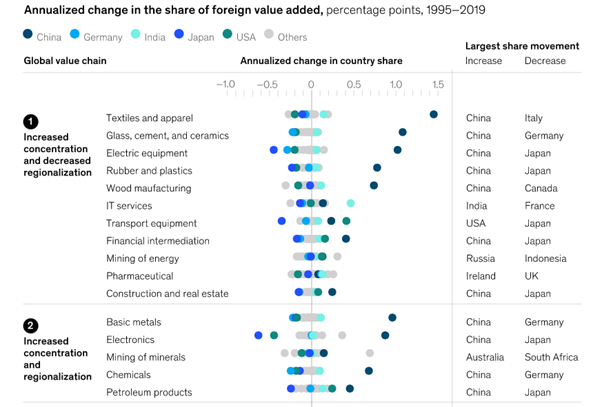

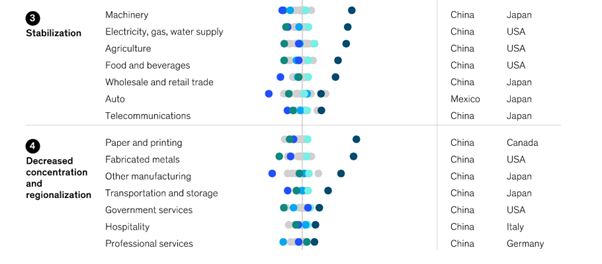

This plasters over the real cracks in the Anglo-American economies as identified by the McKinsey Global Institute in New York which is always committed to pragmatic interpretations of neoliberal values (15 November 2022).

Corporate, media and government sites like DFAT, Treasury and Finance would have access to more up to date data and projections for economic trendlines which are far-beyond the resources available to AIM Network commentators like myself.

More openness on sharing this material with the general public is an absolute imperative as apologists for the federal LNP are blaming the interest rate increases on the Albanese government and not their own failures over generations in proactive diversification of the Australian financial sector and their insistence on the need for generous tax breaks for small time investors. The tax exemptions extend to major multinational corporations like Cubic Transport and Cubic Defense Holdings which paid no company tax during the decade of federal LNP rule after 2013.

Expect further increases in British interest rates on 11 May 2023 when the BoE meets to review current rates and places new pressures on global increases in interest rates to protect local currencies in the middle-sized economies like Australia with their weakly developed and somewhat colonial financial sectors. Too much conventional wisdom is prevailing again with an over-reliance on monetary policy corrections to inflationary pressures as in the 1980s.

The bright spots on the world scene are no longer in London or New York. The diversion of trade and investment away from the thriving Asian-Pacific Region on security grounds is probably our greatest strategic risk which purchases of AUKUS submarines will not address.

The new generation of pet galahs may now live in ivory towers as they while away the hours producing responsible press releases for an adoring mainstream media. Our youth should stay fit, get involved in political issues and avoid the diversions so popular with the Woodstock generation of the 1970s. Ironically the markets for these psychedelic diversions were strengthened here by the arrival of GIs on R&R leave in Sydney for relief from the war in South Vietnam.

Surely, it’s time for a movie on the antics of the Nugan Hand Bank which was covered in this SMH article by Damian Murphy (9 November 2015).

So enjoy the lyrics from the appropriately named Inner Circle as young and old maintain their rage against new variants of neoliberalism and interest rate pain in the Whitlamesque traditions:

Denis Bright (pictured) is a financial member of the Media, Entertainment and Arts Alliance (MEAA). Denis is committed to consensus-building in these difficult times. Your feedback from readers advances the cause of citizens’ journalism. Full names are not required when making comments. However, a valid email must be submitted if you decide to hit the Replies Button.

Denis Bright (pictured) is a financial member of the Media, Entertainment and Arts Alliance (MEAA). Denis is committed to consensus-building in these difficult times. Your feedback from readers advances the cause of citizens’ journalism. Full names are not required when making comments. However, a valid email must be submitted if you decide to hit the Replies Button.

Like what we do at The AIMN?

You’ll like it even more knowing that your donation will help us to keep up the good fight.

Chuck in a few bucks and see just how far it goes!

Your contribution to help with the running costs of this site will be gratefully accepted.

You can donate through PayPal or credit card via the button below, or donate via bank transfer: BSB: 062500; A/c no: 10495969

22 comments

Login here Register here-

Benjamin -

Stephengb -

TuffGuy -

Benjamin -

Clakka -

Tessa_M -

James Robo -

Leila -

Canguro -

Sarah -

Burleigh waters -

Ivy -

Terence Mills -

Sinn Fein in Galway -

GL -

andyfiftysix -

Florence nee Fedup -

andyfiftysix -

Terence Mills -

Burleigh waters -

rubio@central coast -

andyfiftysix

Return to home pageThe RBA AREN’T independent, the board members did what ever the LNP told them to, by raising interest rates

and when Philip Lowe said that the RATES won’t rise until 2024, as soon as a Labor government came in

he decided to play dirty politics and raise the interest rates, to make Labor look bad and he’s still kissing the LNP’s arses.

Is it any wonder, why there’s no relief in sight and now they’ve installed another LNP arse kisser, at the top job.

How much more worse can it get ?

LOTS, APPARENTLY, we don’t need more likes of Philip Lowe and other LNP ilks on board the RBA.

Section 11 of the RBA Act specifically requires that the Treasurer and the Governor of the RBA are in constant consultation.

There is absolutely no way that chalmers (lower case intended) can twist himself for culpability over the hardship being imposed on ordinary people.

This is NEOLIBERAL AGENDA 101.

@Benjamin – damn straight, Lowe is nothing more and nothing less than a card carrying Lieberal stooge. And despite all the experts predicting no rate rise this week……….I fear Lowe is determined to have his last say by raising rates as much as he can before he loses his powers.

@TuffGuy – Absofuckinglutely, with every government agency, the LNP stacked with their lackeys to do their bidding, it’s unDemocratic, unAustralian and the LNP should treated as sabateurs and traitors and be locked up for life and pay back ALL of OUR money, they stole from us taxpayers.

I’d also like to know, HOW MUCH, the dirty RBA CEO bastards, are getting paid, capitalism has brought hell to all of us except for the 1%er’s

It’s a vast system of maintaining corruption of all regulatory systems by free-marketeers, gangsters and militarists. Under the cover of psycho-babble, since the 90s recession & globalisation, the fall-guy cogs; Gov’ts & Central Banks entered wild frontiers of monetary & fiscal policy, must now retreat from madmen’s ‘whatever it takes’ measures to ‘region of stability’ to GRADUALLY return liquidity & rein inflation.

Everyone wants everything NOW, but it won’t come. The bombshells of the 2008 GFC, the Covid-19 pandemic and Putin vs Ukraine can and do come unannounced, and cause global wreckage. Across the globe, we’ll all feel the pain of past excesses and the madmen’s ‘whatever it takes’ measures for quite some time. It’s a death-defying balancing act to return to a region of stability – gradually.

https://www.theage.com.au/business/the-economy/leaving-the-region-of-stability-monetary-and-fiscal-policies-at-a-crossroads-20230503-p5d558.html?fbclid=IwAR3L4J_KlXHrpI6ktvAEZ1XgAJSIAtbEwTDUnhlTaB2M76xc02fyxPjkn0A

But the biggest problem of all is bringing to heel the corruption wrought by free-marketeers, gangsters and militarists. We certainly couldn’t rely on any efforts of msm nor the churches. What do we do? Let AI wrap its chips around that one?

Wow-Take me to inspect that house in Rappville where I can hear the honks of the freight trains and the XPTs as they zoom past

The scope of planning needs to be extended from building new cul de sacs to a national planning agenda as in Norway with its Sovereign Wealth Fund to collect some of the kroner generated from the oil and gas industries.

Let me take up the offer to thank Denis for this topical article.

The phrase ‘Going to hell in a handbasket‘ comes to mind.

Unaffordable housing along with a real lack of housing infrastructure, job insecurities along with the emergence of the gig economy and the casualisation of a large sector of the workforce as well as a yet to be robustly framed national policy that meets the demands of the challenges presented by the emergence of new technologies etc., unmet responses to environmental disasters like fire & flood, cost of living crises, medical & health infrastructure failures along with shortages of professionals in that sector, less than best practice education of children & teenagers, welfare shortfalls across all sectors – unemployed, disabled, aged, along with the current unhealthy focus on upramping of military expenditure of eye-popping magnitude on systems that may well be obsolete at the time of their delivery – when considered in totality it’s pretty gloomy and somewhat surprising that the current federal government still garners the degree of support that they do… any objective report would suggest…could do better. I fail to see what their hesitation is… grab this once in lifetime opportunity to enact the changes necessary to put this country on a best-practice footing and ready to meet the very real challenges that sit before us as we speak.

Did someone say that the days of conventional wisdom are numbered? His name was Jim but his electorate was a long way from Logan City. He also gained a doctorate in political economy. Dr Jim Cairns (1914-2003) became identified with a commitment to peace and a concern for the disadvantaged. His doctorate was about the need to improve the coverage of the Australian welfare state.

Thanks Denis!!! Great article and so quick after the announcement.

I think to say the global and domestic economy is tinkering on the edge is an understatement.

Keep the good content coming.

Denis, thanks for a well-written article. Interest rates are just one of the tools to manage the inflation. The government needs to improve its strategies to address affordable healthcare, housing, childcare and education.

While the cash rate has no direct impact on home loan interest rates, and banks and lenders are not obliged to follow the decisions of the RBA, most will typically pass on RBA increases to existing variable rate loans.

So, we know that they don’t have to pass on the RBA increases but they do. Why do they do it ? Because it makes more money for the banks and their shareholders.

In the US, some ninety percent of home loans are on fixed interest rates for a typical loan term of thirty years. Why are banks in Australia reluctant to grant fixed rate loans for more than three to five years ? Because they can make more money on variable rate loans.

Interest rate decisions have a big impact in geopolitics. Britain is one of the weakest economies in Europe. Britain kept its own sterling currency independently of controls from the European Central Bank. The British pound dipped to just 1,074 to the US Dollar last autumn and has now risen back to 1.26. Interest rate increases have been a big factor in protecting the pound.

The British economy is so desperate for capital injections that it specialises in multi-billion pound arms sales to some of the world’s worst dictatorships.

British companies are adept in tax avoidance through Caribbean tax havens and also through Ireland where company tax rates under our current Irish conservative coalition are low.

The British and global property giant Knight Frank avoided Australian taxation for most of the federal LNP years after 2013.

Albo will be treated like a king when he visits BAE defence manufacturing sites after the coronation but Australians will be on the receiving end of the consequences for two generations ahead as that is the life of a new nuclear powered submarine.

Ireland is likely to have a Sinn Fein Government after the next election. Here the Greens joined the conservative coalition but anything could happen before the next scheduld election date before March 2025.

On a side note: Anyone else get the feeling of corruption at the highest levels of WA state government with this?

https://www.theguardian.com/australia-news/2023/may/03/wa-police-seized-photos-from-home-of-journalist-who-took-images-of-ancient-rock-art-being-removed

yes, lets keep pulling on the chain. We screwed up the first time and got no blowback so lets have another go. Instead of tightening money supply for housing, ie save people from themselves, lets screw everyone. Surely, incompetant people should get the sack no? Because interest rate rises will save us from government bills rising.

Something drastic has to be done for a period of years to get housing coasts down considerably. For very good reasons we need to save people from themselves and ween the economy away from assets into more productive industry that employs people and generates wealth. Interest rate rises are very primitive weapons of mass destruction. I dont understand how mass incompetance is tolerated. In the age of computers, we seem to be getting dumber and dumber with our application of informed decisions.

Maybe the answer to high housing costs is for people put off buying, allowing housing costs to fall. The answer could be in the buyer’s hands in not buying overpriced homes until they fall to a manageable price. The situation we have now is not good for the people, economy or nation.

Florence, money used to be tight and that was a controlling feature of that system. When it was all opened up, warnings were given short shift. Oh how the chickens have come home to roost. For the life of me , i cant understand how hard it is to teach people not to borrow more than they can chew. Its now part of the system, let them borrow as much as two generations worth and then play russian roulette with their mortgages.

With interest rates increasing, the repayment on Liberal debt will cost the federal budget $112bn over five years, or $60m a day.

That’s how capitalism works, folks !

https://www.theguardian.com/australia-news/2023/may/04/federal-budget-2023-soaring-interest-payments-australia-debt-eclipse-cost-of-family-tax-benefit-childcare-or-infrastructure

Interest rates have always been part of the housing crisis.

As a middle-sized economy with a weak financial sector, our government should have a better tool kit in place for the inevitable global recession. This is better than another global armed conflict as in 1914.

Where is your sharp marxist analysis, andy56?

Recession might bring a left-leaning USA but a different generation will need to be in charge of the policy levers to steer the changes away from militarism and Donald Duck fascism.

Good to see Andy and Florence on a United Front as the Drums of War are playing at Barrow-in-Furness shipyards for an Australian leader who was once committed to socialism.

Andrew Fisher also moved into revisionist circles in Britain during the Great War as High Commissioner in London-a long road from being a mine worker in Scotland and Gympie.

So Albo is being flattered by British elites from BAE Systems in the same manner as Ramsay MacDonald (UK Labour Prime Minuister in the 1920s) when false rumours of radical tendencies from the Left were promoted in the Zinoviev letter by the populist press?

Burleigh, you can call me what ever you want but i aint no marxist. I am just suggesting that doing the same things over and over aint going to change anything. I dont see a trend for longterm asset price reduction, just a hick up.

Where as we currently only allow 2 units to replace a house in developments, we should swing 180 degrees and mandate 3-4. They should be mixed sizes too. We need to do radical things to bring the situation under control. increasing interest rates just slows construction at a time we need much more. We place unnecessary constraints on our economy by not being agile where needed. For too long NYMBY has ruled the roost in all facets when really, neighbourhood looks is pretty much a “do as i do” fantasy. Sure light envelopes are important but shit like mandating it looks like everything else or looks edwardian is pure BS.

As I keep saying interest rates are weapons of mass destruction. As Ukraine has shown us, smart bombs are more effective. Its 2023 and we still think economies are like baron controlled estates. We then come up with all sorts of esoteric formulas like KPIs trying to describe whats happening. Even inflation is a rather quaint measurement. If housing takes 50-70% of your salary, a 10% rise is devestating to say the least yet only registers a minor blip in RBA thinking. Because killing you by a thousand cuts is more humane than just killing you outright.

I say we are living in a box and cant see that outside the box things can be different. No decision should take more than 30min because computer power is everywhere and just doing data analysis once a month is pretty much a recipy for actions that defeat their intended purpose. Just like cancer treatment requires us to kill half the body and then hope the other half survives, by not using our noggins, we equates job losses with an economic stability lever.

Insanity, its everywhere I look. And the liberals were the headmasters at the school of insanity. Lets at least learn what we are doing thats crazy so we can change coarse.