Let’s have some truth

If we are going to have a conversation about taxation reform it would be useful if our Treasurer told the truth.

When asked about using the GST to fund tax cuts, Scott Morrison said “When you have the average wage earner in this country about to move into the second-highest tax bracket at $80,000 next year, you’ve got a problem with the incentives in your tax system.”

The most obvious reaction to this statement is wouldn’t it be easier to just change the bracket thresholds?

But beyond that, Morrison’s statement is misleading for several reasons.

Moving into the next tax bracket means you only pay the higher rate for the portion of your income over the threshold so if you if you are just above the limit it will make very little difference to the amount of tax you pay.

Moving into the second top tax bracket means you would pay an extra 4.5c for each dollar over $80,000. Because of the generous tax free threshold, the effective tax rate for this bracket ranges between 21.9 – 30.3%. This is never taken into account when making international comparisons.

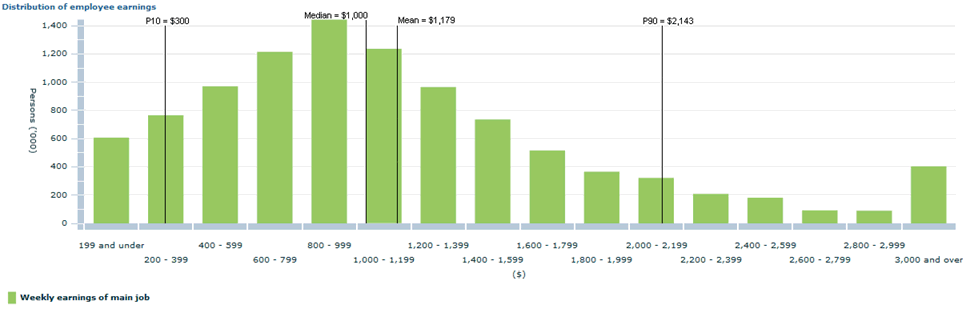

Annual income of $80,000 gives weekly earnings of $1538. According to the ABS, in August 2014, the mean weekly earnings of employees and owner managers of incorporated enterprises in all jobs was $1,189 compared to $1,156 in 2013, nowhere near the $80,000 limit and unlikely to get there any time soon.

What’s more, there is a glaring gender disparity. For males the mean weekly earnings in all jobs was $1,410 and for females it was $948.

It is not until we take the specific subset of ‘males working full-time’ that Morrison’s statement comes close to being true. Mean weekly earnings for full-time workers in all jobs was $1,448 ($1,592 for males and $1,264 for females).

But is using the average even valid?

As any high school maths student can tell you, when you have a skewed distribution, as is the case with income, the median (middle score) is a far more reliable measure of central tendency.

The median weekly earnings in all jobs in 2014 was $1,000 ($1,185 for males and $838 for females) ie 50% of employees earned less than $52,000 a year.

Part-time workers represent 32% of the workforce and understandably, their earnings are lower. Median weekly earnings for full-time workers was $1,200 compared to $467 for part-time workers.

The difference between the mean and the median demonstrates the asymmetric distribution of earnings, where a relatively small number of employees and OMIEs have comparatively very high earnings with some 400,000 earning over $3000 per week.

At August 2014, 10% of people had weekly earnings in main job below $300, while the top 10% had weekly earnings in main job over $2,143.

Income tax has become less progressive in recent times, due mainly to the succession of income tax cuts during the Howard boom years. According to The Australia Institute’s Matt Grudnoff, only 3 per cent of taxpayers are in the top tax bracket now, compared to 13 per cent 10 years ago, so any bracket creep is just redressing the profligacy of Howard’s vote buying.

Whilst progressive taxation goes some way to addressing income inequality, the rapidly rising wealth inequality in Australia is taxed very lightly.

On the latest figures available, the median net worth of Australian households – that is, their assets minus their liabilities – was $1.59 million for the top 20 per cent and $29,600 for the bottom 20 per cent in 2011-12.

The capital gain on the family home is not taxed at all, while that on other assets is taxed at half the rate of savings such as bank interest. Superannuation is taxed at a concessional rate that provides the largest benefit to higher income earners. The combination of the 50 per cent capital gains tax and negative gearing makes investment housing an attractive option for many, particularly higher income earners, while lower income earners are increasingly shut out of the market.

Unlike other developed countries, Australia has no wealth tax, inheritance tax or gift duties, although they potentially provide the most direct means of curbing rising wealth inequality

Most capital investment or entrepreneurship faces a substantially lower rate than the personal marginal rate – either through the CGT 50 per cent discount, or the company tax rate of 30 per cent or 28.5 per cent for small companies. If you sit at home and make $50,000 on trading shares you will be substantially better off than someone who works hard all year to earn the same amount.

The Coalition like to point to New Zealand whose top marginal rate is only 33% (ours is currently 45%+2% medicare levy+2% temporary surcharge) but what they fail to point out is that there is no tax free threshold in NZ – you pay tax on every dollar earned – and the top rate kicks in at $70,000 instead of $180,000.

NZ has a 15% GST, another fact Morrison like to point to, but they have no general capital gains tax (although it can apply to some specific investments), no local or state taxes apart from property rates levied by local councils and authorities, no payroll tax, and a 1.45% levy for New Zealand’s accident compensation injury insurance scheme. They have chosen a higher GST rate to fund government services.

Modelling from the Parliamentary Budget Office has shown that increasing the GST to 12.5% or broadening its base would raise the same amount as a carbon price of $28/tonne but cost households about three times as much hence requiring much greater compensation for low income households.

The solutions seem so obvious but conservative ideology will blind this government to what must be done and once again, those least able to afford it will bear the brunt of the Liberals ‘lower taxes’ mantra.