The Jobless Did Not Ask For This!

Who is responsible for jobs? Should we punish the jobless? Is welfare a right or a privilege? These are the questions the Government is too gutless to ask. By accepting the Government’s answers to these issues without question, it may be shaping a future we haven’t asked for. The Jobless didn’t ask for this!

The term “welfare” is often touted as synonymous with the word “problem”. The question we are not asked is, “Is welfare a problem?”

The Government is asking us to argue vehemently over answers to a question they are too gutless to ask. We should ask the Government questions.

Welfare Reform is a complex issue. However, the wider narrative has a huge impact on how we address reform in this space.

Welfare ‘Reform’

The Welfare Reform Bill currently before the house, is focused on using punishment as a blunt force to solve the ‘welfare problem.’ The Government is quite brazen in no longer hiding punishment as a measure.

One system of punishment is a demerit point system. Another is drug testing. Therefore, the Government has predetermined, that the jobless ‘do the wrong thing’.

The Liberal National Coalition have successfully chipped away at society, along with the opposition in some respects. That is, to create a sub-human welfare class who society appears comfortable to punish.

Punishment sits well with a large section of society. This is due to continuous stigma aimed at the jobless. In the words of Erving Goffman, we have actively inflicted upon the jobless a ‘spoiled identity.’

The Labor opposition opposes these measures. However, since the late 1980’s the Labor party has joined with the Liberals with the same mantra.. That is, the onus is on the jobless to find a job, rather than the responsibility of Government to sustain an economy offering jobs for all.

In short, the narrative over the last 30 years is that jobseekers need a paternalistic guiding hand to motivate them. Therefore, the Government shuns the notion of the jobseeker’s own intrinsic motivation.

Who is Responsible For Jobs?

The answer given to us over the last 30 years is that the jobless are a problem. The Government(s) place the burden on the jobseeker to find jobs, although these jobs may not exist. Where jobs do not exist, the Turnbull Government believes the jobless should create their own job. For ideological reasons, the Government shuns Government intervention and job creation.

The Government(s) have given us answers without asking any questions. They assume that we, in society, simply agree that the jobless are a problem. The Government assumes that we agree that the Government is blameless. They assume we are completely happy with the amount and types of jobs available.

The questions the Government(s) are too gutless to ask is:

“Is the Government doing enough to ensure there are enough jobs for the people?”

“Is the Government skilled enough to implement the right solutions to increase available jobs?”

“If the Government does not believe it is their role to create jobs, is self-determination to create our own job by starting our own business, a practical solution for all?”

“Do we aim for a society where large pockets of ghost towns exist, along with a number of over-populated vibrant cities for workers to transition to, or do we aim for a society where the Government places the same commitment to develop all regions equally?”

Should We Punish the Jobless?

The answer given to us over the last 30 years is the we should punish the jobless. The punitive approach intensified during the Howard era, particularly financial penalties. The level of punishment today is very paternalistic and draconian.

The problem posed is that the jobless lack motivation. The assumption is that inaction by the Government is acceptable. However, the Government does not ask us if we agree.

Over the Abbott-Turnbull period, the level of punishment aimed at the jobless is unacceptable. From the jobless starve for six months policy, to the demerit system, to restrictions on volunteer work for over 55’s, cashless welfare and drug testing are aimed to develop a society, I do not recognise as an Australian society. This causes me a deep level of concern.

The questions the Government(s) are too gutless to ask is:

“Is it fair to punish the jobless, if the Government fails to provide enough jobs?”

“Should the Government punish the jobless, if they do not have the skills or capital to start their own business, if they cannot find a job?”

“Is it fair to punish the jobless if the Government has not provided an adequate jobsearch system to support the jobless to match them to available jobs?”

“Although studies show that extrinsic motivation factors such as punishment, affect psychological well-being, hinder job search and not assist it, is it acceptable to punish the jobless?

Is Welfare a Right or a Privilege?

The punitive approach of successive Governments aim to reduce spending in the welfare space. It is evident that the Abbott-Turnbull Government’s aim is to reclassify those on welfare into a sliding scale. This scale appears to bracket those on welfare from ‘acceptable citizens’ to ‘bludgers’ to ‘drug addled sub-humans.’

The Government had one other criteria “genuine jobseekers”, prior to this bill. However, all jobseekers now fall into the realm of bludgers. Every measure in the current bill, is underpinned by a suspicion the jobless individual may be prone to deviant behaviour.

The punitive measures in the current reforms are very much focused on financial penalty. They seek to exclude or restrict access to unemployment benefits. This is done by classifying welfare recipients into normal behaviour (reward) and deviant behaviour (exclusion).

In short, to save money on the welfare bill (which we all pay for, including the jobless), the Government has provided us with the answer of normals and deviants.

They haven’t asked us the question. However, it is clear their answer is ‘normals and deviants’.

The Government knows that Australians will always apply the ‘fair-go’ to normals, but not deviants. In short, it is a simple equation.

Jobless+30 years of stigma = Deviants

Normals-Deviants = Less welfare spending

This question I have left until last because it is crucial to how we see our future as a society. Most importantly, I ask readers to please ponder upon this question. This is because the Government tells us everyday who we are. We need to stand up and tell them who we want to be.Therefore, it is crucial to argue if welfare is a right or a privilege. This is intrinsic to who we are as a society.

The question the Government(s) are too gutless to ask is:

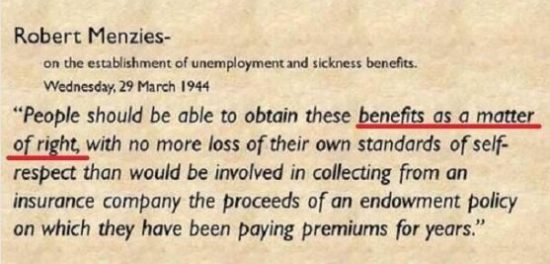

As you can see from the excerpt above, unemployment and sickness benefits were introduced in Australia as a right, not a privilege. Three generations later, the Abbott-Turnbull Government speaks of welfare as a privilege and not a right. They have changed the definition whilst we were not looking. Additionally, they again, provided us with an answer without asking us a very important question.

“Should Welfare continue to be available as a right to all people in society, from the recently redundant to the most disenfranchised in society, or do we aim for a society, where the poorest class are further divided by the Government into entitled humans and excluded sub-humans?”

Real Reform

Real welfare reform will begin with asking confronting questions and shifting away from arguing over the answers the Government provides without them posing an actual question.

If the Government took on the burden instead of the jobless, our conversations around the dinner table, would be very different. Importantly, these tiny conversations are powerful enough to shape public policy.

It is evident from some of the emotive speakers within the Labor opposition and crossbenchers, speaking to this bill, that the punishment regime has gone way too far. However, after 30 years of placing the burden on the jobless and praising punishment as a motivator, why is anyone speaking to this welfare bill, angry or shocked?

Real Welfare Reform can only happen when a leader dares to stand apart from the pack. This leader will remove the burden from the jobless. They will lead us by being brave enough to take ownership and responsibility for job creation. Most importantly they will not stand idly by and allow the jobless in our society to suffer from stigma in silence. They will unite us and not divide us.

They will look back over the last 30 years, look back to us and with true emotion say “Under a Government I lead, the jobless will never be punished again.”