Chomsky, Alanis Morisette and Irony

-

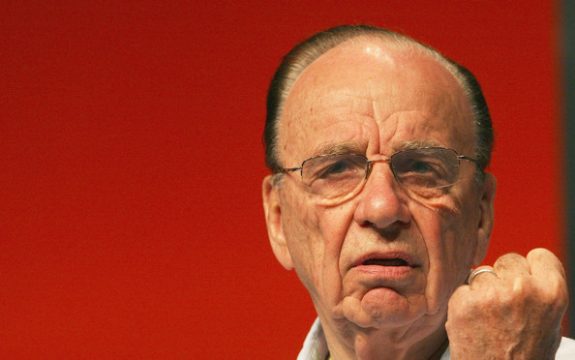

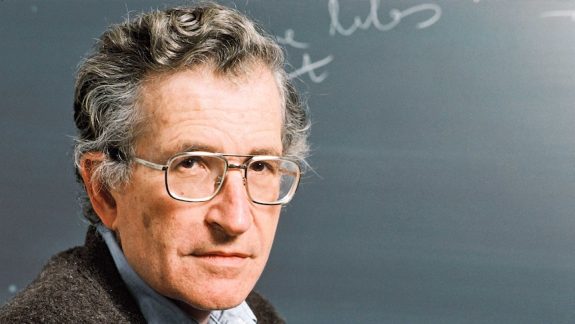

“The political policies that are called conservative these days would appall any genuine conservative, if there were one around to be appalled. For example, the central policy of the Reagan Administration – which was supposed to be conservative – was to build up a powerful state. The state grew in power more under Reagan than in any peacetime period, even if you just measure it by state expenditures. The state intervention in the economy vastly increased. That’s what the Pentagon system is, in fact; it’s the creation of a state-guaranteed market and subsidy system for high-technology production. There was a commitment under the Reagan Administration to protect this more powerful state from the public, which is regarded as the domestic enemy. Take the resort to clandestine operations in foreign policy: that means the creation of a powerful central state immune from public inspection. Or take the increased efforts at censorship and other forms of control. All of these are called “conservatism,” but they’re the very opposite of conservatism. Whatever the term means, it involves a concern for Enlightenment values of individual rights and freedoms against powerful external authorities such as the state, a dominant Church, and so on. That kind of conservatism no one even remembers anymore.” Noam Chomsky

“It’s like ten thousand spoons when all you need is a knife

It’s meeting the man of my dreams

And then meeting his beautiful wife

And isn’t it ironic…don’t you think

A little too ironic…and, yeah, I really do think…”Ironic Alanis Morisette*

Noam Chomsky, the well-known social activist, made two very good points in his book, “Manufacturing Consent”.

The first was that newspaper proprietors didn’t need to tell their journalists what to write or the editors what stance to have. They’ve picked the editors, who set the tone. If Piers Akerman or Andrew Bolt was appointed as editor of “The Socialist News”, I’d be surprised if there wasn’t some change in tone. The need for day to day intervention is unnecessary.

The other point he makes is that, if one wishes to know what’s really going on, the business pages are a good place to start. He suggests that people will accept being lied to in the rest of the paper, but when misinformation might cost them money, they want to know the true state of play.

I have found it interesting over the years to flick between how a story is being reported in the front section of the paper and how it’s being presented in the business section. Try it sometime. True, most of the business pages is about takeovers, floats, changes in directorships and a lot of numbers that have less meaning to your average punter than the mathematics of Quantum Mechanics. (And, just in case anyone who actually understands Quantum Mechanics wants to use up the comments section explaining why I shouldn’t have said that, please just provide a link rather than explaining that once one grasps Planck’s Law, then it’s a simple step to letting Schrodinger’s Cat out of the bag.)

So what’s been the impact of the Carbon Tax? Well, according to the business pages, this “massive tax on everything” which was going to lead to the closing of Whyalla hasn’t quite led to the devastation predicted.

ABOUT half of Australian companies have either seen little impact from the introduction of the carbon tax on their energy costs or are yet to calculate the effects, according to surveys by the Australian Industry Group.

About 49 per cent of businesses in the manufacturing, construction and services sectors reported an immediate increase in prices of at least some of their inputs after the introduction of the carbon price on July 1, the AiGroup report found.

A follow-up survey of 485 businesses in November, however, found that a third of manufacturers and construction firms and as many as one half of service sector respondents ”did not yet have enough information” to gauge the impact of the new tax.

Read more: http://www.smh.com.au/business/carbon-economy/business-counting-carbon-tax-20130128-2dgw6.html#ixzz2gnPn2CTr“While the carbon tax came into force on July 1 its impact is still far from clear. Many companies are taking a ‘wait and see’ attitude, perhaps because it’s very future is still sometimes called into question. But even if the Liberal Party should win the next election, dismantling the tax might well prove too complex and costly. And, in the meantime, failure to accommodate the new environment could put businesses at risk. –

See more at: http://www.aon.com.au/australia/thought-leadership/currency/carbon-tax-impacts-and-outcomes.htm#sthash.fKEyHeF0.dpuf

And finally, a more recent article.

Some wrecking ball that was! Australia’s first year with a carbon tax has ended with inflation so low that it was only the carbon tax that kept inflation from falling out of the Reserve Bank’s target range.

The Bureau of Statistics reports that in the year to June, consumer prices rose 2.4 per cent on the raw data, 2.3 per cent after seasonal adjustment, and 2.2 per cent on the trimmed mean measure, which strips out the biggest price rises and falls to define underlying inflation.

Read more: http://www.smh.com.au/business/the-economy/carbon-tax-inflation-fears-evaporate-20130724-2qj4q.html#ixzz2gtN1GT2F

Removing the Carbon Tax. It was going to be the “first thing” that Abbott did. Strangely, I’m now hearing on the news that he’ll be able to get rid of it after July next year. I seem to remember Kevin Rudd announcing that Labor would bring forward the end date to July 2014#. So the net result of electing Abbott is that the Carbon Tax could be in place for longer. Now, (and pay attention here, Alanis Morisette) that’s ironic!

*Alanis Morisette may be partly to blame, but there seem to be a number of people who just don’t understand what irony means. Nearly everything she describes in her song is just bad luck,

#Yes, I do know that Labor planned to have an Emission Trading Scheme, after that date, but Abbott plans to have a “direct action” scheme, so both have a plan to reduce emissions. It’s just that Labor’s is a sensible, market-based policy, whereas the Liberals are planning an inefficient, socialistic “tax us, then subsidise” program. And yes, Alanis, that’s irony, too.

P.S. The Image of Treasury milking the taxpayer 59, comes from the Liberal booklet on Labor waste, which listed 60 things where Labor was “throwing your money away”. I hope that the outrageous waste of supplying Treasury officials with milk has been stopped. That $110,000 a year will go a long way toward putting the budget back in the black.

Like what we do at The AIMN?

You’ll like it even more knowing that your donation will help us to keep up the good fight.

Chuck in a few bucks and see just how far it goes!

Your contribution to help with the running costs of this site will be gratefully accepted.

You can donate through PayPal or credit card via the button below, or donate via bank transfer: BSB: 062500; A/c no: 10495969