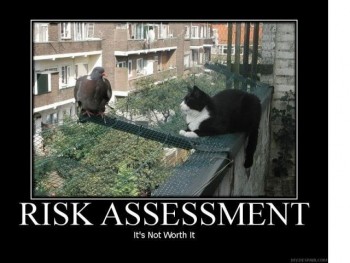

Risk assessment

Life is a series of choices and decisions. Within the constraints of time and finite resources, decision makers must learn to prioritise – to decide what is most important.

If you listen to anyone outside Australia, the greatest challenges facing us at the moment are climate change caused by anthropogenic global warming, income inequity leading to poverty, the Ebola crisis, pollution, peak resources, health and education in developing nations, the growing tide of refugees, providing enough food and clean water, sanitation, overpopulation, unemployment, species extinction, human rights abuses, affordable housing….and a fair way down the list would be a group of some tens of thousands of disaffected testosterone-filled teenagers that someone has been crazy enough to give guns and rockets to.

When faced with these global problems, the response of the Abbott government brings into question their ability to assess risk and respond appropriately.

On climate change, our Prime Minister tells us that “coal is good for humanity” while our Treasurer denies the fact that we are the world’s largest per capita emitter and that does not even take into account our exports. (When you hear the phrase “I deny the premise of your question” that is Coalition for “I can’t hear you, here comes the Party line”)

As reported in the Guardian:

“Australia’s coal is one of the globe’s fourteen carbon bombs. Our coal export industry is the largest in the world, and results in 760m tonnes of CO2 emissions annually. The urgent goal of Tony Abbott’s government, and his environment minister Greg Hunt is to ship as much climate-devastating coal as possible, as quickly as possible.

Every day, this Liberal-National government, led by Tony Abbott, provides new examples of its nastiness, its short-sightedness, and its willingness to destroy livelihoods, communities and the environment to enrich coal barons.”

A new report by The Australia Institute “The Mouse that Roared: Coal in the Queensland Economy” demonstrates that the coal industry’s risks and damage completely outweigh its benefits.

Felicity Wishart the AMCS Great Barrier Reef Campaign Director said that the Queensland Government was prepared to risk the Great Barrier Reef, its international reputation and its $6 billion tourism industry for a coal industry that employs less people than Reef tourism, exports most of its profits and provides just 4% in royalties.

“The Australia Institute report reveals that there are under 25,000 jobs in coal mining in Queensland and 80% of the profits go overseas. This compares with 69,000 jobs in the tourism industry, and almost all the profits stay in Australia.”

When the world’s leaders met to discuss climate change, our leader couldn’t make it due to a prior engagement with Rupert to get his lines about why the war is good straight. Our deputy leader couldn’t make it because he is too busy planning thousands of kilometres of bitumen heat islands to carry millions of fossil fuel burning imported cars. Our environment minister didn’t even seem to be considered or mentioned which is hardly surprising when he points to his plan for the Great Barrier Reef as a success. Ignoring ocean acidification, warming, and salinity while approving the dumping of dredged silt and the expansion of coal ports is considered a success? Oh that’s right, you removed a few starfish by injecting each one by hand. Instead we sent Julie Bishop because she is good at stonewalling and death stares.

As representatives from the Philippines and Kiribati make heartfelt pleas about the damage being done to their nations, we have reneged on our promised contribution to the Green Fund to help developing nations deal with the havoc we cause. As marathon runners in Beijing choke on the pollution, we tell them that burning more coal will make them richer.

Everyone from the Pope to the head of the IMF has pointed to poverty and income inequity being a growing scourge, yet every action taken by this government will have the effect of increasing poverty and widening the gap. Internationally we have slashed Foreign Aid and domestically we have hit the poor with the budget from hell.

Joe Hockey and Mathias Cormann say, because the poor get more government handouts, they have more to give back when looking for spending cuts. Raising revenue will not be considered. The poor, the sick, the elderly, the disabled, the students, the unemployed, single parents, low income families – these are the people to provide Mr Hockey with a surplus to brag about. In the meantime, one in seven Australians live in poverty with that number predicted to rise.

Austerity and trickle-down economics are failed experiments which this government seems intent on pursuing despite the mountain of evidence and advice warning against such measures. As the majority of people get less disposable income, demand will dry up, production will fall, unemployment will rise, and the downward spiral will continue.

While we seem to have endless money to bomb countries, the money to help build infrastructure and provide humanitarian aid has dried up.

Our response to the Ebola crisis is hugely inadequate. The excuse about evacuation of affected health workers just will not wash. We already have in place agreements with the US about medical evacuation of military personnel to Germany should they become critically ill. Australian doctors and nurses are highly-trained and if they feel that they have adequate protective regimes in place then It is unlikely that we would be talking about a large number of people needing evacuation. Considering the urgency of addressing this emergency, I cannot believe that the US or the UK or Germany would deny health workers the same service they offer to our military personnel.

Our Immigration Minister smugly claims success for his quasi-military war on refugees. He tells us this has been the humanitarian thing to do because he cares so much about asylum seekers that he can’t have them risking their lives at sea. Unfortunately, he also cut our humanitarian intake by 7000 and has failed to successfully resettle anyone. He would rather spend billions on OSB and offshore gulags and bribes to corrupt officials of other countries to absolve us of any responsibility at all rather than a cent on helping refugees. All he has done is bottle refugees up in other countries while we sit back and refuse to help.

In response to growing unemployment, this government has removed restrictions on 457 visas encouraging employers to hire people who will work for less than award wages, no workplace entitlements and no job security. They have removed industry assistance from manufacturing to help them during a time when the high Aussie dollar hit the industry hard while giving billions of dollars in subsidies to the mining industry which caused the problem in the first place.

When Toyota, Ford and Holden leave the country for good in 2017, around 50,000 people who work in the automotive supply chain, mostly in Victoria and South Australia, will face the risk of unemployment.

Despite Industry Minister Ian Macfarlane telling us that ”Australians are smart, innovative and creative. We have the ability to remake our industry sector and the time in which to do it.”, according to European Union data from 2011, only 2.3 per cent of materials shipped out of Australia are high-tech – far less than the US, where the figure is closer to 20 per cent.

The OECD found in 2012 that Australia’s investment in high-tech industries was lower overall than other advanced economies yet the latest budget has slashed funding for research and development and decimated bodies like the CSIRO.

Remy Davison, the Jean Monnet Chair in politics and economics at Monash University, says despite the talk little has been done to create a realistic transformation scheme for industry.

”We talk about investing in smart industries and moving into high-tech industries, but nobody actually does it – not state governments, not federal governments, and to be fair the private sector doesn’t really invest in it either.”

When it comes to the war against ISIL, this is where the Abbott government steps up with seemingly unlimited resources to provide military assistance and to conduct over-the-top raids and surveillance at home, but where is the discussion about what led to the rise of this group? Where are the questions about how we are failing members of our own society so badly that they can be lured into this conflict? Where is the strategy to help young people here to feel like they belong and encouragement to help them become productive members of our society? Where is the support for our Muslim community?

Risk assessment is part of life and a crucial factor for all businesses. How much more so for a government when the consequences of their decisions are so far-reaching? We have a government who came to power with a specific agenda to which they are determined to stick. They are deaf to the advice of experts other than their hand chosen sycophants and choose to ignore the risks. On all counts, in the most pressing problems facing the world, Australia has been found wanting.

Before casting your vote at the next election, Australians should consider the risk of allowing the Abbott government to continue down the path of nationalism and corporate greed at the expense of our duty as global citizens and our responsibility to protect the vulnerable.