ALP Election Campaign Review: Prospects for a Credible Responsible Economic Focus

By Denis Bright

Labor’s 2019 Election Campaign Review identified some of the negative campaign strategies which were crucial to Scott Morrison’s election victory on 18 May 2019. In fairness, the positive features of the campaign minimised the net loss to just one seat which will be tested by instability between the two coalition parties.

Bill Shorten’s Address in Reply to the federal LNP’s budget on 4 April 2019 was hardly an irresponsible or radical document as noted in the Labor Review:

In his Budget reply on 4 April, Bill Shorten argued the Government had cut funding to schools and hospitals by $16.8 billion, promising to restore those amounts. He announced a range of further new spending initiatives including a $2.3 billion cancer plan that would eliminate out-of-pocket expenses for cancer patients. He also promised bigger tax cuts for those earning less than $40,000 a year, the same tax cuts as the Government’s for middle-income earners, but that Labor would not proceed with the tax cuts for high-income earners the Government promised for 2024, two elections away.

Qualitative research indicated that soft voters gleaned from the Budget that both parties were offering tax cuts, the Budget did not contain any new cuts and was broadly “fair”, and the Budget was returning to surplus. The Morrison Government had largely inoculated itself against Labor’s attack that the Coalition was making big cuts to services, and the projected surplus assisted Morrison to support a contention about a strong economy

This degree of bipartisanship on economic issues was soon blown out of the water by a fierce negativity from the centre-right of Australian politics. Labor agreed with many aspects of the LNP’s tax reform plan and offered better tax rates for lower income households.

The negativity worked as Labor’s tax alternatives generated into non-existent taxes on homes, elderly people and death taxes.

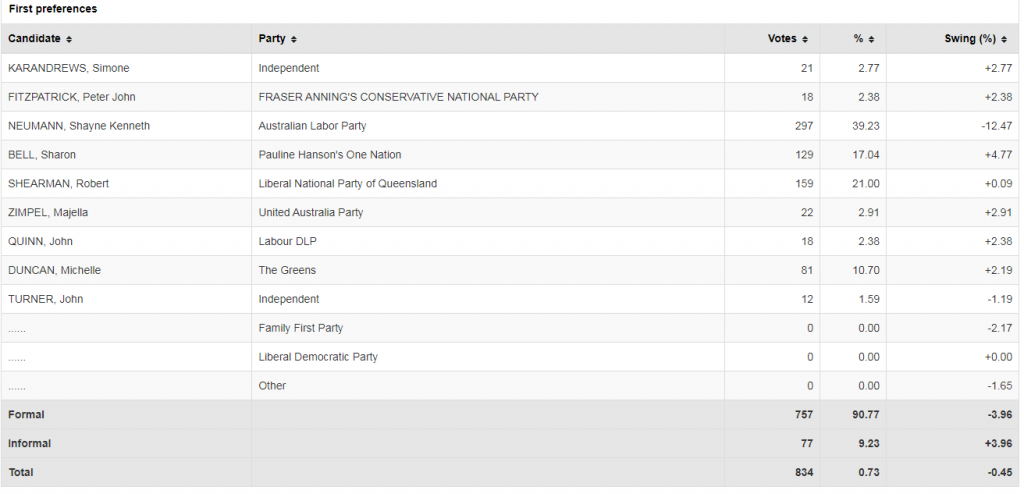

These negative campaigns cost votes in more disadvantaged outer suburban and regional electorates which also warmed to campaigns for more coal mining from the resources sector. In Labor heartland booths like Ipswich North Booth in the Blair electorate, the swing to the LNP came mainly from the allocation of preferences from far-right parties such as One Nation, UAP and the Conservative National Party plus a higher than usual informal vote:

By election day, the negativity had cornered Labor’s appeal in winnable outer suburban and regional seats particularly in Queensland and Tasmania. Initiatives in broadening access to cancer treatment should have had greater mass appeal.

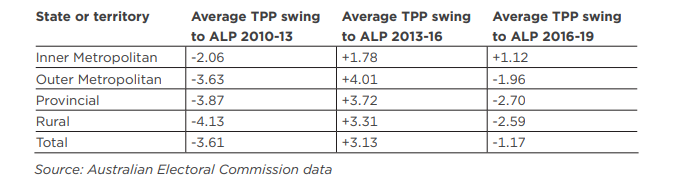

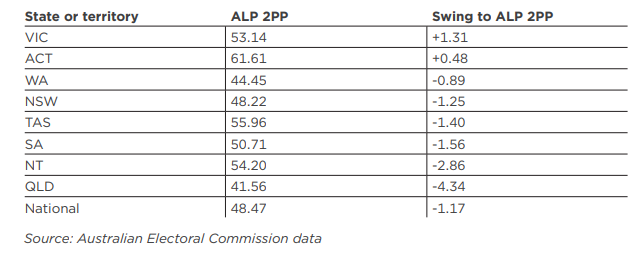

Labor losses in Herbert, Longman, Bass and Braddon were unexpected. Labor gains in Corangamite (Vic) and Gilmore (NSW) and the additional seat in the ACT did not extend to outer metropolitan and regional seats like Capricornia (Q), Robertson (NSW), Forde (Q), Petrie (Q), Dickson (Q) and Hasluck (WA). The Labor Review noted the big picture of these voting patterns:

In government, the LNP is left without a real plan to tackle issues such as energy transition, essential infrastructure and skills development through TAFE programmes. The absence of an investment plan for Australia is particularly distressing.

Greg Jericho of The Guardian notes the current tread-water phase in the federal LNP’s economic rhetoric which still dwells on the old election slogans when new vision is required for future planning for Australia’s middle-sized economy:

The biggest con in Australian politics is the belief that a budget surplus not only matters, but that it demonstrates good economic management.

Our lives would be improved overnight if the political debate in this country could ditch the surplus obsession. The pertinent question at the moment is not whether a budget surplus will be delivered this financial year, but why on earth would you aim to do so?

Why do we need a budget surplus? It is not a question that gets asked too much – certainly not during the election campaign just passed, where both major parties argued over who had the bigger surplus.

The typical answer you get given is some vague notion of living within your means, saving for a rainy day, needing to pay down debt.

It’s all simplistic babble spoken by politicians with next to no economic logic in order to convince voters that somehow, they are good at managing the economy – and for the most part it is taken as given by journalists

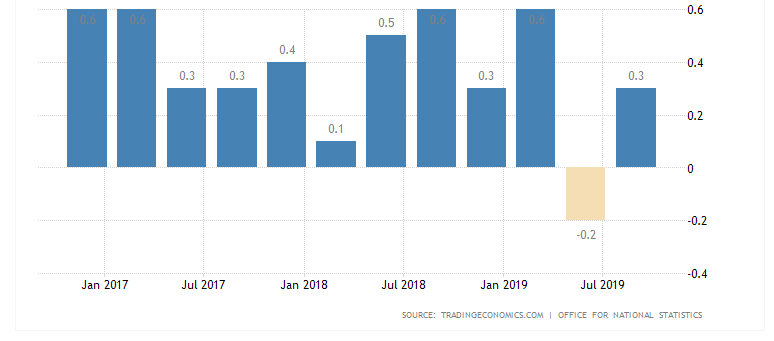

There is a naïve assumption that Australia should be run like Britain on discredited Thatcherite principles. Even in Britain with the financial resources of the City of London at the disposal of a still likely to be elected Johnson Government, the old magic is not working as the effects of the global slowdown become more apparent:

United Kingdom GDP Growth Rate

Britain’s economy grew 0.3 percent in the third quarter of 2019, recovering from a 0.2 percent contraction in the previous three-month period and missing market expectations of a 0.4 percent expansion, a preliminary estimate showed. The service and construction sectors provided positive contributions to GDP growth, while output in the production sector was flat. GDP Growth Rate in the United Kingdom averaged 0.61 percent from 1955 until 2019, reaching an all-time high of 5 percent in the first quarter of 1973 and a record low of -2.70 percent in the first quarter of 1974. source: Office for National Statistics for percentage trendlines.

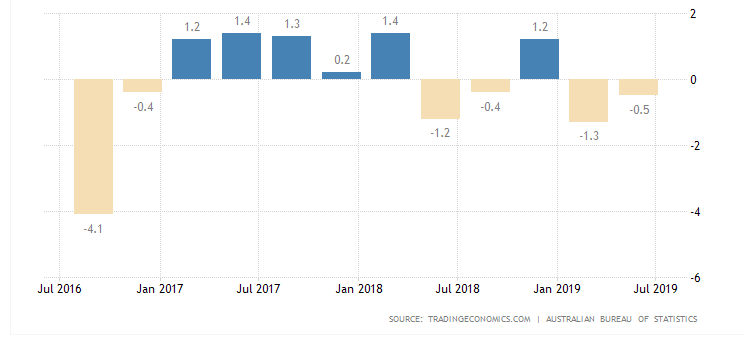

Australia is protected from this malaise by healthy returns for exports of resources as well as tourism and educational services. With the federal LNP in such a complacent phase based on out-dated nostalgia for the unexpected election victory, the long-term reductions in percentages for Australian capital expenditure have gone largely unnoticed:

From far-off Greece, the conservative government of Kyriakos Mitsotakis is offering pragmatic lessons to its Australian counterparts in overcoming warnings from more hard-line NATO countries on the value of economic engagement with China’s Belt and Road Initiatives (BRIs) which are so popular across the Middle East, Eastern and Central Europe (Helena Smith, The Guardian, 12 November 2019):

A landmark visit to Greece by China’s president Xi Jinping has cemented what both countries are calling a “new era” in bilateral ties amid western concern over Beijing’s growing global assertiveness.

Athens rolled out the red carpet for Xi as its centre-right government sought to capitalise on Greece’s burgeoning role as China’s “gateway” to Europe.

“This visit opens a new chapter of decisive importance in the already excellent relations between China and Greece,” said the Greek president, Prokopis Pavlopoulos, addressing a dinner held in honour of the leader Monday night. “[It] fundamentally upgrades our strategic partnership,” he added after the two sides signed 16 trade deals in areas as diverse as banking, tourism and solar energy.

The three-day tour is Xi’s first to Athens. It comes barely a week after the Greek prime minister, Kyriakos Mitsotakis, returned from Shanghai where the Chinese president raised the prospect of Greece becoming “a logistics centre” for the trans-shipment of western-bound Chinese goods.

The federal LNP reluctance to join the economic broad-church threatens Australia’s longer-term stability as a vibrant economy and remains one of the archaic remnants of the Thatcherite era. Consensus-building from the Labor Party can assist in moving our middle-ranking economy out of this dark age in which proactive economic management can be applied to a new globalised era.

It is ironical that Canadian government pension funds are actively involved in Australian developmental projects which could be operated by similar Australian funds to address the current investment drought here (Carrie LaFrenz, AFR, 30 August 2019):

Canadian pension fund Caisse de dépôt et placement du Québec (CDPQ) has invested $300 million alongside Brookfield Business Partners L.P. and its institutional partners in Healthscope. Brookfield won a prolonged takeover battle of Healthscope, finally snaring the nation’s second-largest private hospitals operator in a $4.4 billion deal earlier this year….Healthscope, and its new owners, have been under the spotlight in a NSW Parliamentary inquiry over the opening and running of its new Northern Beaches Hospital in Frenchs Forest which has been plagued with problems since opening last October.

CDPQ invests globally in major financial markets, private equity, infrastructure, real estate and private debt. In Australia, CDPQ acquired a 44 per cent stake in insurance distributor Greenstone in 2016 and is also a shareholder and a long-term partner of Plenary Group, having invested in several Plenary- originated Australian projects since 2012. It also controls about 25 per cent of TransGrid, the electricity transmission network of the State of New South Wales and owns about 30 per cent of the Port of Brisbane.

CDPQ is a long-term institutional investor that manages funds primarily for public and para-public pension and insurance plans. It has about $C327 billion ($365.75 billion) in net assets as of June 30.

The federal LNP’s focus on the resources sector to carry the Australian economy with new coal and iron ore projects is a diversion from essential sustainable investment for the new economy which must cope with a new round of job cutting in a high technology era.

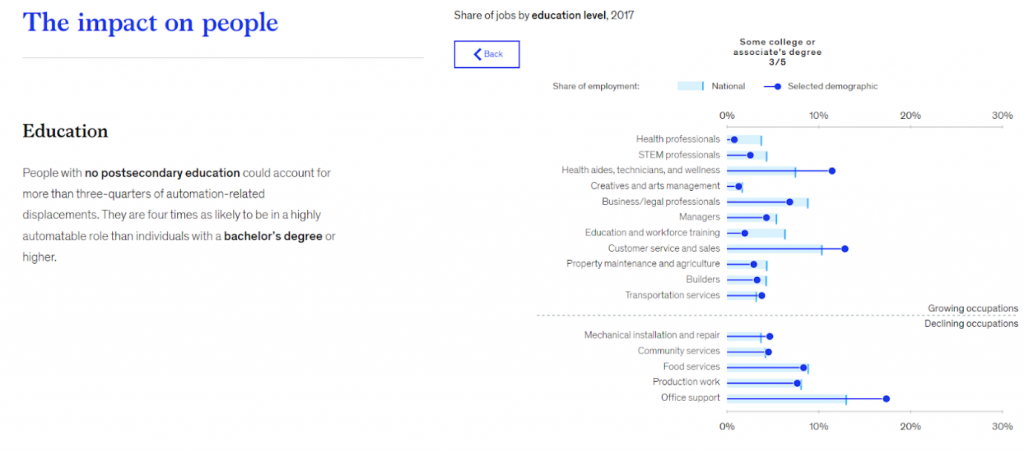

The most innovative sections of Corporate America are anticipating major changes in employment patterns which will challenge earning capacity in currently well-paid middle-income employment (McKinsey Global Institute 2019):

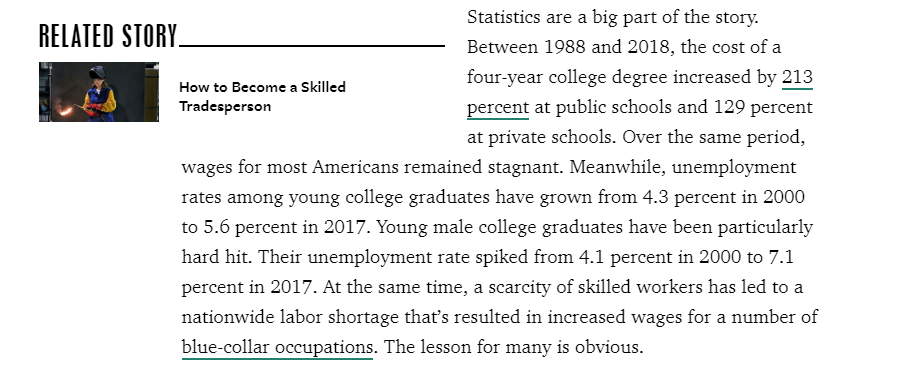

Education corporations are offering a false light on the hill to school-leavers with high fee-paying commercial trade schools which are flourishing across Australia and the USA (Promotion from Academics Australasia and Popular Mechanics USA 13 March 2019):

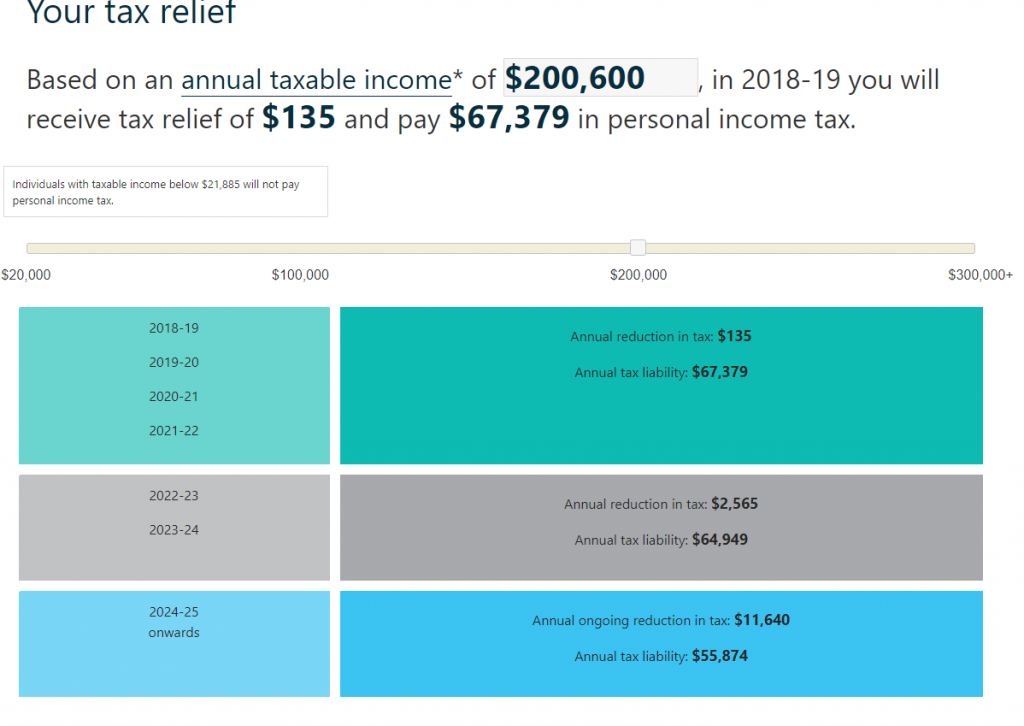

Meanwhile, under-spending in Australia on TAFE Programmes and NDIS initiatives is deferred to offer more tax concessions for the top 5 per cent of income earners. Contrast this with the optimism generated by the MyBudget Web Site with the prospects of more tax relief for high income earners from 2024-25:

The federal LNP may make its cherished budget surplus for 2019-20 by deferring key spending priorities but Phase 3 of the plan to undermine additional levels of progressive taxation is unlikely to remain intact by 2024-25.

Consensus-building debate with the Morrison Government is an essential strategy to encourage the federal LNP to acknowledge the need for changes in economic policy in a slowing global economy in which the trade and investment war with China is a recurrent distraction that is currently bringing instability to Wall Street indicators which soon show up in our superannuation balance sheets in Australia. Labor’s unsuccessful election campaign is hardly the cause of such problems as the release date for the September Quarter private capital expenditure data approaches later this month.

Denis Bright (pictured) is a member of the Media, Entertainment and Arts Alliance (MEAA). Denis is committed to citizens’ journalism from a critical structuralist perspective. Comments from Insiders with a specialist knowledge of the topics covered are particularly welcome.

Denis Bright (pictured) is a member of the Media, Entertainment and Arts Alliance (MEAA). Denis is committed to citizens’ journalism from a critical structuralist perspective. Comments from Insiders with a specialist knowledge of the topics covered are particularly welcome.

Like what we do at The AIMN?

You’ll like it even more knowing that your donation will help us to keep up the good fight.

Chuck in a few bucks and see just how far it goes!