Social Market Solutions to Underemployment: Or more traction for the miracle of the market?

By Denis Bright

With youth unemployment exceeding 25 per cent in some regions, bipartisan support should be forthcoming to expand new training and employment programmes.

Existence of the Future Fund of Australia and the numerous public sector business investment funds at state and territory levels provide new opportunities for bipartisan political leadership on the issues which should concern all Australians.

Perhaps national film crews and local media were hoping for this new direction as Prime Minister Turnbull visited the Vanguard Laundry in Toowoomba (featured image above) on 16 January 2017.

Alas, it was another rationale for a restatement of The Miracle of the Market by the Prime Minister within embedded attempts at point scoring against an absent Opposition Leader.

So we all recognise we have a vested interest in continuing to support open markets. Now, let me make another very – this is a very important point of differentiation. Bill Shorten, as I said – Bill Shorten is a shallow populist.

He is a disgrace to the legacy of economic reform that his predecessors as leaders of the Labor Party demonstrated, Hawke and Keating in particular. Now, there are arguments being made for greater protectionism in other economies, but my job as Prime Minister of Australia, and frankly Mr Shorten’s job for someone who wants to be Prime Minister of Australia, is to promote policies that deliver jobs, better-paid jobs for hardworking Australian families here in Australia.

Prime Minister of Australia in Toowoomba 16 January 2017

At least there is still some scope for some national policy consensus from the Prime Minister’s doorstop interview.

Writing for The Wall Street Journal Online (10 January 2017), Vera Sprothen gave qualified support for more private sector involvement in the delivery of future infrastructure. This essential involvement must be tactfully managed.

Overseas infrastructure corporations and even pension funds are staking out new Australian investment niches with the support of the Australian Trade and Investment Commission.

Instead of taking up the challenge of overcoming investment shortfalls in essential infrastructure and community services, the federal LNP is actively encouraging investment by such commercial juggernauts:

Canada Pension Plan Investment Board (CPPIB) is opening a standalone office in Sydney to formalise its existing Australian operations.

A CPPIB news release announced the office will open in fiscal 2017 (to 30 March 2017), stating: ‘With C$7.9 billion invested in the country, Australia is an important market for us. An integrated CPPIB office will enable us to better manage current and future investments.’

Canada’s pension industry continues to be an important investor in Australia. CPPIB is the latest in a series of Canadian pension funds and banks that have established standalone Australian offices in the past three years, including Caisse de depot et placement du Quebec, Borealis Infrastructure (OMERS), OP Trust, Fengate Capital, Royal Bank of Canada, Scotiabank and the Canadian Imperial Bank of Commerce.

(Australian Government Online 29 August 2016).

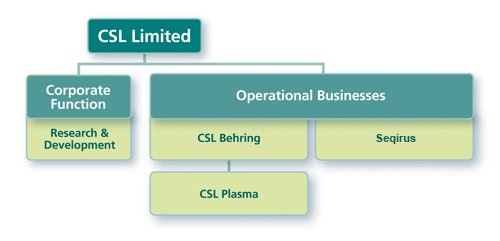

Options available to federal, state and local governments have widened dramatically since the government of Paul Keating privatized Commonwealth Serum Laboratories (CSL) in 1994.

This exercise removed CSL from the government sector through a bargain basement share offer of $2.30.

CSL was highly profitable at the time of its privatization but the federal government lacked both the motivation and capital resources to transform it into a major global entity.

By 2015-16, CSL had sales revenue in excess of $6.2 billion. This represents the equivalent of almost 4 percent of the national economy.

With the vision of hindsight, there are now alternatives to this privatization of productive assets which had been in the public sector since 1916.

CSL produced blood plasma products, antivenom for snake and spider bites as well as a range of vaccines.

Public sector institutes now purchase the life-saving products from CSL Limited at market prices and are missing out from the full benefits of research and consultancy services within Australia and in both commercial export markets and DFAT assistance programmes.

CSL Online 2017

The imperative of privatizing CSL in 1994 has been changed by the formation of The Future Fund of Australia which commenced operations in 2006. Other public sector business investment funds also operate in most states and territories could have invested in the CSL as a Government Owned Corporation (GOC).

Consideration will be given to the existing and potential roles of the Queensland Investment Corporation (QIC).

1 Have Optimum Roles for the Future Fund Been Attained?

Appointed as Chairman of the Future Fund’s Board of Guardians by the Rudd Government, the Hon Peter Costello AC is fully occupied on implementing strategies to support social investment initiatives in Australia’s major national sovereign wealth fund.

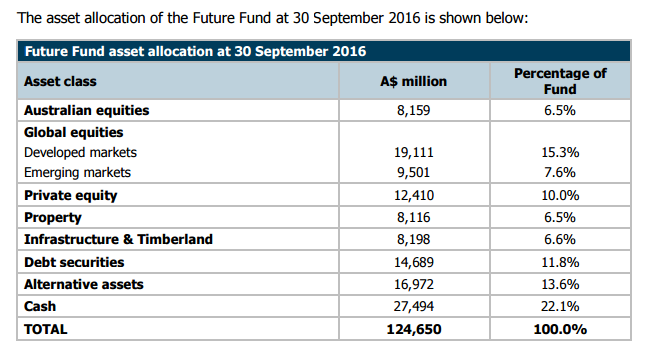

As at 30 September 2016 the value of the Future Fund was an impressive A$124.650bn, meeting its benchmark return over the quarter and showing a return of 7.6% pa since the Fund was established in 2006 against a benchmark return target of 6.9% pa.

Future Fund Online 2017

In the words of Peter Costello Australia’s National Sovereign Wealth Fund has performed the following feats:

The Future Fund invests in all classes of assets – equities, fixed interest, credit, hedge funds, infrastructure, property, private equity. It invests around the globe with around two-thirds of its investments outside of Australia. The Future Fund has invested in water businesses in the United Kingdom, gas pipelines in the U.S., in the Airport in Melbourne, in Perth Airport and Gatwick Airport in the United Kingdom. It has owned stakes in a major Birmingham shopping centre in England and commercial buildings in Brisbane Australia. It has stakes in commercial buildings in Vienna, on the Champs Elysees in Paris and 3rd Avenue in New York. It has recently taken a large stake in the Port of Melbourne. Through its private equity program it was an early investor in Uber, Air BnB and Snapchat. Its private equity portfolio is unrivalled in Australia.

The Future Fund is fiercely independent from the Australian Government. The Government does not tell it where to invest. This independence is respected by both sides of politics. It has been respected by Governments of both Liberal and Labor persuasion, by five Treasurers, and by five Prime Ministers.

(Future Fund Online 2017).

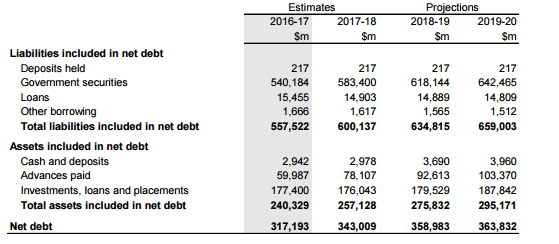

With tax avoidance by major corporations, entrepreneurs and private businesses so rampant, it is most unlikely that this debt situation will change in the medium term future to provide new injections into The Future Fund. As 2017 rolls on, excuses about the current debt levels are still being manufactured as shown in Scott Morrison’s latest Mid-Year Economic and Fiscal Outlook (MYEFO):

Australian Treasury Online 2016

In a currently slowing economy, the prospects for debt reduction are not promising without a return to the austerity programmes initiated in the 2014 federal budget.

Without dismissing the achievements of the Future Fund, it still has a minor role in a $1.6 trillion dollar national economy. Revenue generated by the Future Fund in 2015 amounted to 1 per cent of Gross National Income (GNI) and to the equivalent of about 4 percent of government revenue.

In contrast, the combined assets of Singapore Government’s Temasek Holdings and the Government Investment Fund (GIC) surpass the profile of Australia’s Future Fund by a significant six-fold margin.

Fund Chairman Peter Costello continues to welcome the expansion of the Future Fund. This support offers the possibility of greater national policy concession on the future roles of public sector sovereign wealth funds and business investment funds at state and territory levels:

While it is a matter of regret that the Fund has not had any new capital since its original injection, the Fund has been asked to manage other Funds on behalf of the Commonwealth. It is still administering two of the so called “Building Australia Funds” which were financed out of the 2007/08 Budget Surplus. It has been asked to hold and manage money in a Disability Care Fund to help defray some of the costs of the National Disability Insurance Scheme (NDIS). In September 2015 funds were first set aside for the Medical Research Future Fund which currently holds around $4.5bn. All up, including these other Funds, around $140bn is held by the Board of Guardians.

(Peter Costello’s Address to mark the 10th Anniversary of the Future Fund 7 December 2016).

In the post-resources boom era, investment in the Future Fund could perhaps benefit from the Queensland Investment Fund (QIC) fund management strategies. Although the QIC operates as a state-based business investment fund, it still has accumulated more than half of the Future Fund’s capital under management.

2 The Queensland Investment Corporation (QIC) and Its Business Investment Model

Established by the Goss Labor Government in 1991, QIC operates as a government owned business investment fund with two current shareholding ministers: The Premier and the State Treasurer.

The QIC’s clients are the Queensland Government through the Shareholder and Structural Policy Division of Queensland Treasury itself and institutional investors. The commercial suppliers of venture capital are not listed in detail in the 2016 Annual Report and are probably protected by commercial in confidence protocols.

These investment processes have the advantage of making the QIC independent of new funding from the state government. This assists the Australian and overseas corporate sectors and the Queensland Government as clients of the QIC to become involved in generating social market outcomes.

The suppliers of venture capital negotiate entry into one or more of the QIC’s Investment Funds including Global Infrastructure, Global Real Estate, Global Liquid Strategies, Global Multi-Asset and Global Private Equity.

Despite its impressive returns on equity and cost to income performance in 2016, the QIC is hardly a giant in the Australian or local Queensland economy. Assets under management do amount to an impressive $75.8 billion as stated in the QIC’s 2016 Annual Report.

The net profit generated to the Queensland Government of $88.3 million before tax amounted to about 1.6 percent of state revenue.

An expansion in the profile of business investment funds like the QIC at federal, state and local government is clearly a bipartisan possibility.

At Queensland state level, the QIC could become more involved in supporting start up ventures in the public sector

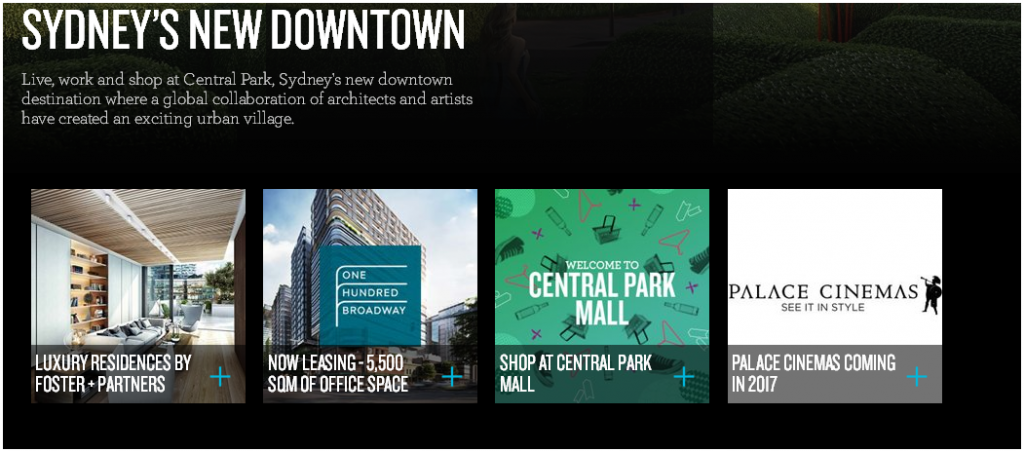

Examples of socially responsible investment by new start up GOCs might include Transport Oriented Urban Projects (ToDs) near underutilised state government land assets. Venture capital could be used to support economic and community development in both private and government sectors. Government involvement could actually speed up the development processes and enable the profits generated to support other social programmes.

Suburban and inner city ToD projects might include new housing blocks, commercial centres, pedestrian precincts, parklands and recreation centres near new integrated or refurbished transport terminals that are incorporated into local commercial precincts.

Best practice in ToD Development? (Central Park Online 2017)

A Catchment and Environmental Management Authority could become an independent public sector corporate entity with a specialization in alternative energy projects, mine site restoration, rural land rehabilitation and restoration of water quality.

Investment from the QIC should be completely compatible with the Queensland Treasury’s Market Led Proposals (MLPs). This offers support to private sector endeavours that are assessed as beneficial to the economic development and diversification of the Queensland economy.

Companies like Genex Power are currently looking overseas for new capital investment and might satisfy current MLP guidelines. The QIC might support such commercial projects in the future if they can satisfy commercial accountability guidelines.

Genex Power plans for the Kidston Gold Mine near Einsleigh, North Queensland

Commercialising Tourism Queensland would replace government spending by self-funding arrangements through online bookings for travel, accommodation, travel insurance, ticketing big events and a range of consultancy services.

Revenue generating booking site?

QIC investment holdings are still mainly in commercial real estate, including major US shopping centres through Forest City Enterprises. New investment acquisitions sometimes make it into the business pages but the main investment activities of the QIC goes on quietly behind the scenes:

Queensland Investment Corporation has finalised another leg of its $US500 million ($655m) deal with US partner Forest City Enterprises, buying a half stake in Ballston Common Mall in Arlington, Virginia, for a price believed to be about $US200m.

The interests in three east coast centres, flagged by The Australian last year, will take QIC’s US retail portfolio to more than $3 billion and its total property holdings to about $16bn.

QIC Global Real Estate managing director Steven Leigh said the US acquisitions — including investing in the New York-listed Forest City Enterprises centres — were a core part of its business strategy.

“We are still acquisitive in the US, our conviction is high,” Mr Leigh said.

“Our existing portfolio is achieving good income growth off the back of robust retail sales, coupled with a sustained low interest rate environment.”

The Brisbane-based fund manager made its first foray into the US in 2013, buying a 49 per cent stake in Forest City’s $2.05bn regional mall portfolio on behalf of super fund investors.

The 49 per cent stake in Ballston Common Mall, which settled on Saturday, is QIC’s 12th US retail investment. In February, the fund manager acquired a 51 per cent stake in the Ridge Hill retail shopping centre in Westchester County, New York. It will also acquire a mall in Florida as part of the latest Forest City deal.

(The Weekend Australian Online 6 April 2016).

A state Labor Government could choose to accelerate a diversification the QIC’s investment funds. This might also be an appropriate investment model for the Future Fund as Peter Costello seeks new business funding models to broaden its social investment programmes.

From the appropriately named Vanguard Laundry in Toowoomba, Prime Minister Turnbull has restated his desire for bipartisan support from the Labor Movement in advancing the unpopular trifecta of Australian politics by offering supporting roles in repeat performances of The Miracle of the Market, Trans Pacific Partnership and Most of the Way with the USA.

Perhaps Bill Shorten could work with the Prime Minister on a more balanced economic agenda to cover the presenting problems of infrastructure and community development shortfalls at a time when the talents of so many Australians are being underutilized by the current policy obsession with market-only solutions.

Denis Bright (pictured) is a registered teacher and a member of the Media, Entertainment and Arts Alliance (MEAA). Denis has recent postgraduate qualifications in journalism, public policy and international relations. He is interested in promoting discussion about progressive pragmatic public policies compatible with currently fluid directions in contemporary globalization.

Denis Bright (pictured) is a registered teacher and a member of the Media, Entertainment and Arts Alliance (MEAA). Denis has recent postgraduate qualifications in journalism, public policy and international relations. He is interested in promoting discussion about progressive pragmatic public policies compatible with currently fluid directions in contemporary globalization.

17 comments

Login here Register here-

michael lacey -

Kaye Lee -

Well Said Michael Lacey and Kaye Lee -

Catherine -

Leila Smith -

jimhaz -

totaram -

Jasper -

Boris -

Pat -

Paul -

Trevor -

gettingstrongweb -

Trevor Newman -

Harquebus -

Mary -

Anonymous

Return to home page“With youth unemployment exceeding 25 per cent in some regions”

This can be solved but they choose not to!

The neoliberal approach to central banking. That is, the idea that the economy is inherently stable, it will inherently reach full employment and stable economic growth on its own, and so the only thing that the macro policymakers have to worry about is keeping a low inflation rate and everything else will take care of itself. Of course, as we’ve seen, this whole neoliberal approach to macroeconomic policy is badly mistaken. Neoliberals reduce the power of government and social forces that might exercise some power within the political economy—workers and others—and put the power primarily in the hands of those dominating in the markets.

A pool of unemployment is a strategy, a leverage! You don’t want them promoting too much employment because that might lead to a raise in wages and, in turn, to a reduction in the profit share of the national income.

Can anyone explain to me why the Future Fund is holding $27.5 billion (over 22% of their assets) in cash?

And perhaps it is time that the government did have some say in how the fund is invested – like insisting that a significant portion is invested in Australia and that it be invested in ethical sustainable endeavours. They only stopped investing in tobacco a few years ago and they still hold significant fossil fuel investments which could well end up being stranded assets.

It is our money and I will never understand why we are sitting on it and hatching it. I know it is supposed to fund superannuation commitments for government employees but, as we are a sovereign currency, that is just silly. We will always be able to meet those commitments. We don’t need money under the bed.

The electorate is ready for a change in direction away from corporate funding of everything! The Labor Movement must talk up such issues as the last election brought it so close to government. A bit more bluster is needed to grab our attention to its alternative approaches.

Definitely time for Bill Shorten to act from opposition to provide bipartisan support to end the politics of debt game and the charade of a TPP without China, our major trading partner

Great article Denis, could not agree more.

We need both sides of government to work in a spirit of cooperation on the big agenda items that will benefit Australia & Australians in the long term.

If the nation is gainfully employed it resolves a and takes care of many social issues and the wellbeing of all

Some ignorable pedantry…which I’m probably only posting as I always find it difficult to respond to the specificity of Denis’s articles.

[Although the QIC operates as a state-based business investment fund, it still has accumulated more than half of the Future Fund’s capital under management]

This made me think they were linked. I’d amend it to something like:

…with its superior growth performance it now has a capital value more than half that of the Federal Future Fund.

===============================================================================================

Interesting isn’t it how these Gov based funds are not viewed by LNP supporters as being a form of socialism – just because they operate more independently.

Lol…I wish one of them would buy the NSW electricity system being privatised by Baird – super funds bought half of it anyway.

Micheal Lacey is right. The coalition is not interested in actually reducing unemployment or even improving the economy. It’s the IPA all the way. That means neoliberal ideology. And given the attitude of the coalition, even if Labor came out with an idea that was not against their ideology, they would reject it, because it was a Labor idea. Yes, the future fund etc. are pseudo-socialist ideas, but they were THEIR ideas and they help the financial markets and the top end of town. You don’t want these funds investing in things that actually benefit the public. THAT is real socialism!

The saga of the politics of ‘can’t’ from the LNP goes on. Let’s work to break this cycle!

The arrival of Donald Trump gives Australians a chance for new directions in economic development, peace and no longer taking sides on territorial disputes in South East Asia. We can change directions and soon.

This is definitely the time to talk about new financial priorities. All avenues that may assist people find work need to be investigated. Employment is essential not just to pay the bills but is also important to a person’s mental and social well being.

Thanks for an awesome article Denis!

A more balanced bipartisan approach the economy is needed! Too much negativity of the other parties policies and priorities helps no one.

Let’s look to the other economies of the world we would like to emulate, which have a similar context to ours (if any) – is there anything out there we could consider?

Not an easy read, but technical and well researched. Denis, I think you might be over estimating Turnbull and the Coalition’s ability to deliver any substantial employment strategies outside of industrial relations structural ‘reform’ whilst erroneously assuming Shorten and the Labor Party would want to work with the LNP on anything non alligned to their own vision or agenda for Australia. Just saying.

The underemployment issue is one that seems to never change. Media releases that claim to state youth unemployment is being resolved, only provide misleading information to a concerning event. However, when the actual truth is properly displayed through reputable statistics, similar to those in this article, people start to realise that something needs to be done. There are countless opportunities for youth to change their employment status from unemployed to employed. Being 18, I know this too well. I went out and attained qualifications to ensure I could work and live a stable lifestyle while ALSO studying. I believe that inadequate parenting skills and guidance is one of the biggest contributing factors to the current ideals, practices and behaviours of today’s youth. A lack of care for the childrens’ well-being and future, are only carried over to the child’s morals and values. There are plenty of opportunities for not only youth, but all Australian residents to attain work that the government already funds. Meaningful and well-paying positions that can be achieved through a CERT 4 in aged care or even a CERT 3 assistant in nursing. Experience is crucial for future employment, and these certificate qualifications provide this experience, and can even act as a stepping stone to find better paying work with another qualification. People need to think twice before they have children! Because I think that the roots to most of this problem, come from inadequate ‘parents’ that just don’t CARE!

“Being 18, I know this too well. I went out and attained qualifications to ensure I could work and live a stable lifestyle while ALSO studying. I believe that inadequate parenting skills and guidance is one of the biggest contributing factors to the current ideals, practices and behaviours of today’s youth.” Are you saying that other people’s experiences are defined by this so-called “inadequate parenting skills” but not yours? You sound like you have managed ok. Or are you saying that you had better “parenting skills” or that you have coped as a result of these “parenting skills” but others might not? I’m confused…

Full employment will place an extra burden on the environment, cause more pollution and deplete essential resources faster. The problem isn’t that there are not enough jobs, it is that there are too many chasing the diminishing number of jobs that our decaying economy can support.

Cheers.

Denis, thanks for your well researched article. The government plays a crucial role in addressing the issue of employment and underemployment in the Australian economy. We can definitely learn from the experiences of other nations who have adopted similar programs to stimulate the economy.

To meet the government’s 2020 Renewable Energy Target, the QIC is investing in AGL’s Renewable Energy Fund to construct alternative energy projects. To meet social welfare objectives by easing high rental costs thereby reducing inequality, perhaps the QIC might invest to expand the supply of affordable housing to provide discounted rental accommodation for low to moderate income households to enable residents to save for a deposit to purchase their own home.