Seeking the Post-COVID-19 Sunshine: Consolidating the Slender US Progressive Mandate from Georgia

By Denis Bright

Early returns from the special senate vote in Georgia on 5 January 2021 do suggest that Vice President Kamala Harris may have the casting vote in a deadlocked US Senate.

The result is so close for the second contested spot in Georgia that NBC News has not called the final seat in race between John Ossoff (Democrat) who is narrowly in the lead against David Perdue (Republican incumbent) by less than 18,000 votes across a divided Georgia.

Having control of the Presidency and the Congress is essential for Joe Biden to implement the national mandate he received on 5 November 2020.

The slender Democracy Now mandate must be seized on so many fronts.

The urgency of the COVID-19 challenge rages in every community.

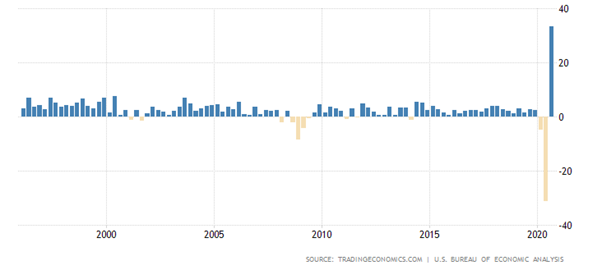

Beyond the health emergency are the deep structural problems in the US economy which is facing its second recession in ten years (Image Trading Economics of US GDP Growth Rates by Quarter):

United States GDP Growth Rate

To Trump supporters, the economic rebound in the September Quarter of 2020 is proof of the absolute wisdom of the President Trump.

Social reality shows a grimmer picture of high trade deficits and a fixation on China as the source of the US economy’s structural woes when the rise of China as actually a lifeline to the stability of the US and global economies. Chinese investment in the US economy would have rectified a negative trading balance and contributed to new productivity in the US economy in the medium term.

The Trump Administration locked the US into an old economy in which coal, oil and arms sales were cheered on by its Republican support base. Now the US might venture into a new world of commitment to zero net emissions by 2050 to control global warming with the support of Japan, Britain and the EU Countries.

The Biden Administration needs a senate majority to move the US economy in these new directions with commitment to national health as its prime short-term objective.

To neoconservatives globally, the Trump wisdom is based on old perspectives about the moral superiority of an unregulated corporate ideology with its veto over sound environmental initiatives particularly in the transport and electricity sectors and efforts to restore authenticity to globalizing processes and international diplomacy.

There is a woeful education divide embedded into the challenges posed by Republicans on the streets of Washington to protest against the transition to the Biden Administration on 20 January 2020.

The folly of the retreat back to tariff barriers under the Trump Administration and the increasing use of tax havens like the Cayman Islands, Ireland and Luxembourg to protect US corporations from their commitment to social restructuring is simply not reported on Murdoch’s Fox news or other populist outlets who stoke up support for market ideology as the way forward.

Although the Harvard Business School (HBS) is a key training ground for US political elites, its academic staff are keen to advice students of the folly of market ideology at a time when US capitalism needs a remake.

Data about the weaknesses of the fundamental corporate structures has a time lag as shown by the months taken to develop the essential argument for change in this outstanding paper which is available online from the HBS at no cost to readers.

Alfaro, Laura, Ester Faia, Ruth Judson, and Tim Schmidt-Eisenlohr. “Elusive Safety: The New Geography of Capital Flows and Risk.” Harvard Business School Working Paper, No. 20-099, March 2020. (Revised September 2020.)

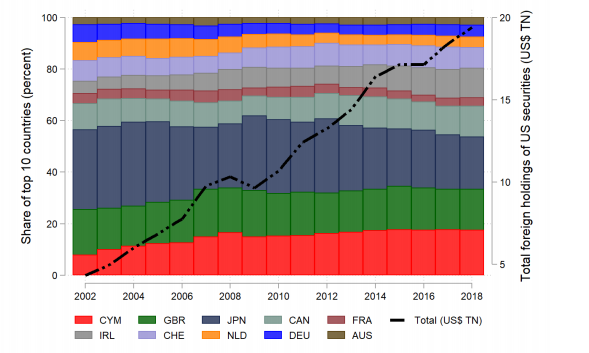

The data presented is largely from the US Treasury’s Treasury International Capital System (TIC) which is at the very heart of the financial establishment in Washington.

Trillions in US corporate wealth are embedded in tax evasion scams in the Cayman Islands (CYM), Britain (GBR), Ireland (IRL) according to the data presented in the HBS paper with its two year time-lag on new data.

Profile of US Corporate Liabilities

The folly of lowering corporate tax rates here in Australia to attract more corporate tax avoidance was indeed sufficient for our senate to reject the LNP’s offer with the support of Labor and key cross-bench senators.

As those final votes are counted in the second senate race in Georgia, our own future lies in going with the changes that might come out of the campaign miracles which commenced in 2018 when the Democrats gained control of the US House of Representatives.

Contrary to the advice offered by Trump’s outgoing ambassador in Canberra, Australians should be embracing to opportunities to go with the change and to avoid more lost trillions in the future on more US strategic communication and space warfare projects directed at our more profitable trading and investment partnership.

Denis Bright is a member of the Media, Entertainment and Arts Alliance (MEAA). Denis is committed to citizen’s journalism from a critical structuralist perspective. Comments from insiders with a specialist knowledge of the topics covered are particularly welcome.

Denis Bright is a member of the Media, Entertainment and Arts Alliance (MEAA). Denis is committed to citizen’s journalism from a critical structuralist perspective. Comments from insiders with a specialist knowledge of the topics covered are particularly welcome.

Like what we do at The AIMN?

You’ll like it even more knowing that your donation will help us to keep up the good fight.

Chuck in a few bucks and see just how far it goes!

12 comments

Login here Register here-

Frankie -

Phil Pryor -

Elfrida -

Chris -

Leila -

Paul -

wam -

Denis Bright in Brisbane -

Lara -

DrakeN -

James Robo -

Tessa_M

Return to home pageDenis, thanks for an interesting article about the US senate.

The article is well researched, informative, broad and deep enough for future followup interaction, and, is part of a need for information that so many seem to avoid, whether by indifference, laziness, lack of opportunity, comprehension skills, will to foresee. Shame.

Australia should not have to be so much in the shadow of events in Washington. Some sections of Australian politics seem to like a colonial status – be it that of the U.K. or the U.S.

What is the weather like for Donald Trump’s golfing safari to Scotland for Inauguration Day?

Oh what a difference four years can make in US Politics: Thanks for your update Denis

Cheers for democratic renewal. Hope it catches on here. Good research Denis.

A beaut read, denis,

Only trump’s bribes to a democrat or two from kamala getting policies through the senate.

Trillions in US corporate wealth are embedded in tax evasion scams in the Cayman Islands (CYM), Britain (GBR), Ireland (IRL)

vs

‘to attract more corporate tax avoidance’ in Australia

the former is illegal and criminal but the latter is acceptably crooked and used by, probably, all of our pollies.

It is time for medicare to be levied on gross incomes then all welfare, frankers, avoiders, paper sellers and charity CEOs will pay. How delicious would it be to see the likes of little joey paying thousands from his multiple salaries and the irishman pay $50000 from his userers qantas salary

Thanks wam.

My article was submitted a few hours before those stormy events in Washington. Senator Jon Ossoff’s win in Georgia was so close against incumbent David Perdue on initial counts. Now the margin is up to 45,000 or 0.5 per cent. Had the Republicans retained control of the US Senate by winning the second senate spot in Georgia, the practical challenges to constitutional precedents for the transfer of power might have been more substantial.

I agree that proactive but legal tax avoidance is part of the appeal of conservative politics globally. Its impact of Medicare funding here is appalling.

Fast food outlets here are turning their tax avoidance into advertising which promotes their makret share against struggling outlets which offer a more stylish surroundings.

Mainstream media hardly discusses such issues with its emphasis on short-term events rather than underlying challenges.

I wrote this article a year ago about the competition for retail markets in Brisbane with its pressures on the welfare of workers and commercial tenants: https://theaimn.com/race-to-the-bottom-in-the-retail-and-service-sectors/#comments

Yesterday, I noticed that a fast food outlet is to be squeezed into the breezeway at the main entrance at Southpoint Commercial to the peril of established food oulets: https://theaimn.com/race-to-the-bottom-in-the-retail-and-service-sectors/#comments.

Management of Southpoint Commercial is at least partly in the hands of the multinational firm Knight Frank whose annual Wealth Report 2020 makes interesting reading: https://www.knightfrank.com/wealthreport

Despite the array of assets at the site, customers are sent upstairs to use the public toilets on Platform One at South Bank station as the public toilets in the food court have been locked for over a year. Escalators available are often closed for repairs which does not assist with disability access to those facilities. A lift is available but it is not well sign-posted.

Our capitalism needs a more social perspective as Australia follows old style market ideology.

Prior to COVID, Australian firms often used overseas student as a loyal workforce, often with cash wages to undercut award wages. Crony capitalism is not confined to the Philippines it seems.

Lara, if you read fully into the history of the British occupation of Australia you will recognise that crony capitalism is the foundation upon which Australian governance was built and it is still the same processes which enrich the already wealthy and empower the already potent.

Let’s ride the waves of political change.

The Trump era was in part about building a new Anglo-speaking empire with nostalgic ties to Britain and Scotland. Trump was a great fan of Brexit to enable corporate funds to be moved across the Atlantic away from the prying eyes of the European Central Bank and its President Christine Lagarde.