Post-Election Trending Issues: Lagging Australian Investment in Both Public and Private Sectors

By Denis Bright

In our predominantly private sector economy, the trend-lines in commercial investment help chart the way forward against the much-publicised headwinds at home and abroad.

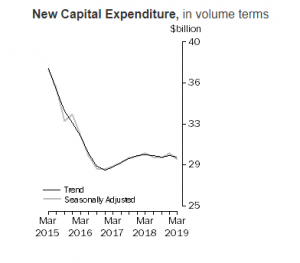

ABS obliged with the release of the March Quarter Data for Private Capital Expenditure on 30 May 2019 based on the usual survey of a representative sample of business ventures, large and small (ABS 5625.0):

The investment trend-lines varied across different sectors of the Australian economy as reported in the ABS notes on the new data.

By asset type, the trend estimates for buildings and structures fell 1.4% while equipment, plant and machinery rose 0.4%. The seasonally adjusted estimate for total new capital expenditure was down by 1.7% in the March quarter 2019.

The bright spot was investment in plant and machinery which was assisted by investment write-offs from the 2018 budget which are to be extended in the current financial year.

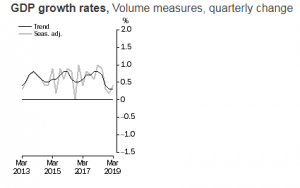

The significance of last week’s data was re-enforced by the release of the National Accounts for the March Quarter on 5 June 2019.

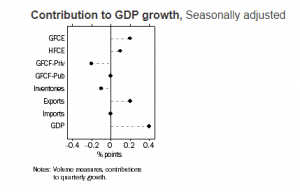

The National Accounts data adds a snapshot of the components of the +0.4 per cent change to seasonally adjusted GDP in the March Quarter. This would have been a good discussion starter if released during the recent election campaign.

GDP data was kept out of negative territory in the March Quarter 2019 positives for both Government Final Consumption Expenditure (GFCE) and Household Consumption (HFCE) and a very favourable growth in the Export Sector on the back of improved terms of Trade which rose by 6 per cent over the previous year in seasonally adjusted terms.

There was scant evidence of the vibrantly strong economy which had been the keynote of the LNP’s election rhetoric.

Public sector investment (GFCF-Pub) had been stoked up in previously published quarterly data.

Public sector investment (GFCF-Pub) had been stoked up in previously published quarterly data.

Ironically, the alleged spending excesses of state and territory governments made their own contribution to the trend-lines in consumer expenditure in the March Quarter. Somewhat concealed in the mix for the March Quarter was the continued decline in private sector investment (GFCF-Priv) which should be the forte of any centre-right government in command of the economic agenda.

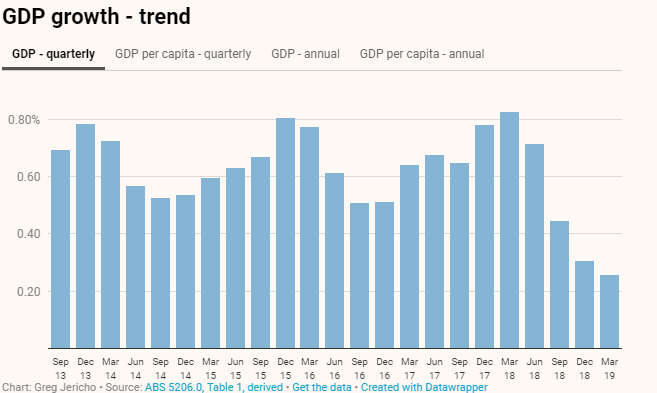

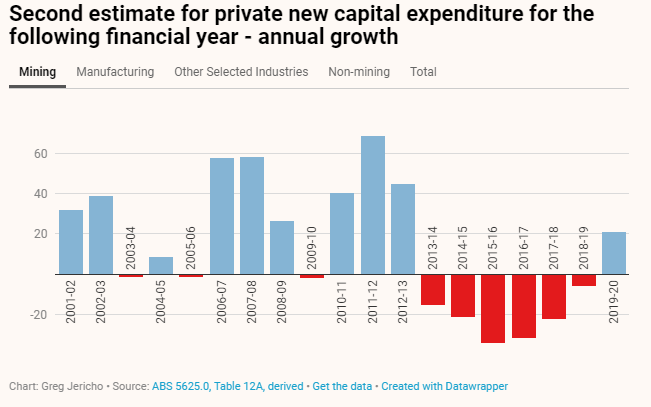

Greg Jericho’s articles in The Guardian (4-6 June 2019) interpret trend-lines in annual rates of Private New Capital Expenditure.

There is a well-argued case for stoking up ailing private sector investment in Australia.

Greg Jericho is positive about new capital expenditure for 2019-20 for 2019-20. Time will tell if the projected 21 per cent increase in new capital expenditure eventuates in this era of trade war between the two global economic superpowers with its inevitable impact on Australia.

Our middle-sized economy has a stake in both sides of the trade war era. China and her key Asian trading partners are our major source of net commodity and service export income. The US is the major source of net overseas investment and the protector of the stability of the existing Australian economic model rather than a dynamic source of sustainable growth and economic diversification which might be fostered by closer ties with Asia.

Speaking from London, Prime Minister Morrison was well aware that a real problem exists now that the election results are almost finalised (Jacquelin Magnay in the Australian Online 5 June 2019):

Scott Morrison has warned trade conflict between the US and China is testing the global trading system and putting prosperity and the living standards of billions of people at risk, just hours before meeting US President Donald Trump at D-Day commemorations in Britain.

Ahead of a series of meetings with British counterpart Theresa May and Mr Trump, the Prime Minister said the global trading system was under real and sustained pressure and the US and China were testing the system as never before.

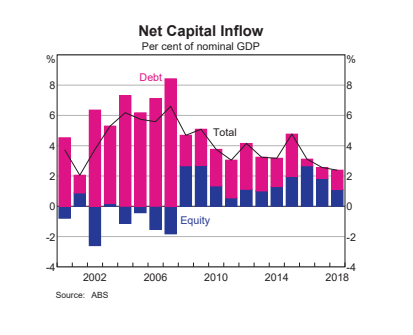

Despite the time lags in the data available on the RBA Charts now available for June 2019, it is surely Net Capital Inflow for new investment which is the emergent weak-spot in the Australian economic perspectives.

Our situation is summed up in The Conversation on 20 May 2019:

Usually, it’s Labor that inherits an economy turning down. This time, it’s the Coalition. And because of regular updates from the Reserve Bank and the Bureau of Statistics strikingly at odds with their public position that the economy is strong, they ought to be finely attuned to it.

Economic growth, the catch-all that is supposed to show us where the economy has been and where it is headed, is frighteningly small.

The Treasury’s best estimate of potential growth – how strongly the economy could be growing over time if things were well managed – is 2.75% per year.

The reality, for the two most recent quarters for which we have data, is 0.3% and 0.2%.

While new overseas investment can make a positive contribution to our investment short falls, a progressive Australian government should be critically aware of the limitations of resource commitments to projects like the ADANI mine or reliance on investment from the US and UK Military Industrial Complexes as agendas for positive change.

Australia will not diversify into a global financial hub by directing more public resources to negative gearing of real estate investment or share market wagers that offer cash-back for retirees and others.

Let’s hope that the current global trading problems foster a more independent spirit from LNP leaders who are temporarily in control of the policy levers.

In his address to the Australia-UK Chamber of Commerce on 4 June 2019, Prime Minister Morrison offered support for investment of $30 million by the Scotland’s Brewdog in a new plant in Brisbane.

Cheers to Queensland’s place in a new beer-led recovery as Brewdog joins Carlton and United, Tooths, Tooheys, Castlemaine Perkins, Tasmanian Breweries – which was Boags and Cascade, Coopers, South Australian Brewing, Swan and Courage.

As Brewdog expands its international operations, let’s hope that the federal LNP will now take-up the firm’s commitment to a living wage for its enthusiastic employees (Brewdog Online 2019):

We are seeking people with a true passion for craft beer and a recognition that their fellow students deserve better. You’ll be the creator of great ideas, amazing activations and will be happy to get your hands dirty to ensure every job is 100% complete and nailed on.

In return, we’ll pay you the Living Wage for your hours worked (plus National Insurance contribution if you are over 21). We will also supply you with merch and clothing to look the part, a discount in our BrewDog Bars, and another kind of study to do – we’ll support you in taking the Cicerone® Certified Beer Server Exam.

Denis Bright (pictured) is a member of the Media, Entertainment and Arts Alliance (MEAA). Denis has qualifications in journalism, public policy and international relations. He is committed to citizens’ journalism by promoting discussion of topical issues from a structuralist perspective.

Denis Bright (pictured) is a member of the Media, Entertainment and Arts Alliance (MEAA). Denis has qualifications in journalism, public policy and international relations. He is committed to citizens’ journalism by promoting discussion of topical issues from a structuralist perspective.

Feedback is encouraged from political insiders with specialist knowledge of the issues raised in the article while I am in Southern Europe for a month or so from 17 June 2019.

Like what we do at The AIMN?

You’ll like it even more knowing that your donation will help us to keep up the good fight.

Chuck in a few bucks and see just how far it goes!

12 comments

Login here Register here-

Myrtle

-

Isabella

-

Paul Davis

-

Stella

-

Paul

-

Chris

-

totaram

-

rubio@coast

-

James Robo

-

Tessa_M

-

Paul Davis

-

Return to home pageWe can only hope that the Coalition government gets down to work quickly and keeps Australia in good financial shape as did the Labor government during the GFC.

Let’s hope the Conservative Government that the people wanted does stoke investment in the public domain & encourages it in the private sector

It will be interesting to see how they deal with a failing economy

The people may be disappointed with their recent decision in voting in a Conservative Government

Are we surprised? The Fair Work Omsbudsman has ruled that Uber drivers are independent contractors and not employees. Unlike Europe, Straya has taken the same view as the USA that the gig economy provides wonderful opportunities for peons to have a go and work hard unencumbered by all that commie red tape rubbish like sick pay, holiday pay, paid maternity leave etc. The punters are relieved as ride costs and food deliveries won’t increase. The FWO found that Uber contractors earned an average of $14.60 per hour which provides ample scope to provide a living as there is no limit to the hours contractors can work. All we need now is a mobile phone app to log our job (ride to the theatre or restaurant delivery) and let the peons bid for the job, lowest bid gets the gig. The market working as it should.

Denis, Thanks for another interesting and well researched article on Australian investment trends.

Great article Denis!!!

Time for some new thinking and innovation by the federal government!

No more brewery led recoveries. I still have a hang-over from the election results.

Paul Davis: You forgot to add that the average earnings of an Uber driver are less than the new minimum wage! Yet this is considered OK because these guys can work 24/7 and earn as much as they like! Well, there are only 24 hours in a day, but still… hurrah!

Labor had a net loss of just one seat to 68 members of the House of Representatives.

Labor should have the capacity to rebuild through a commitment to strategic consensus-building that encourages the LNP to isolate itself from the far-right of Australian politics and from far-right members within the LNP.

As economic conditions deteriorate, the electorate will listen and wonder why income earners above a taxable income of $200,000 need over $11,000 a year in new tax concessions while someone on $25,000 gets a tax reduction of $255 a year in Phase 3 of the LNP Tax Plan.

The LNP cannot manage the economy but the electorate did not trust Labor on 18 May 2019. New approaches are needed to rebuild this trust.

Too many Australians seek to distance themselves from the Political Insiders’ Club. The electorate is frightened of change and this fear is cultivated by the LNP either directly or through a compliant mainstream media.

The LNP has no concern about wage theft, lack of affordability in housing and rents or the extent of sleeping rough on these cold nights.

The fear campaign worked but now the LNP is in change of an ailing economy as the article shows.

The Liberal Party-the Light on the Hill for small-time investors in old houses and share portfolios but nothing for our future

Scott Morrison’s hype offers nothing for our local electorate in Page: A strategic jump to the Left through populist rhetoric before 18 May and then a big post-election swing to the Right

So, according to some pundits, no doubt leftie pinko conspiracy theorists (joking…), the story goes like this….

Believing they wouldn’t win the election, the LNP set some land mines for the supposed incoming Labor gubmint, to wit a) a tanking economy to prove Labor are responsible for a crash in business confidence and investment (we’ll all be rooned) b) the guaranteed surplus evaporating into the ether proving Labor cannot manage a CWA bake sale let alone the strong financial situation left by their betters c) the sudden arrival of a flotilla of people smuggler boats that mysteriously broke through the much vaunted ADF ‘ring of steel’ to prove that Labor is seen by the world to be hopeless on border security d) the sudden and totally unannounced arrival of another flotilla, a Chinese naval battle group ‘on their way home’ from chasing pirates in the middle east (only a 4 thousand kilometre detour, but with the promise of tonnes of baby formula) to show that Labor is a suck up tool of Beijing ….. probably the theorists can name others as well

Wonder how many of those early retirees got panicked…. it was a bit like that old game show The Weakest Link, “time to go Bob and Carol, Ted and Alice”.

Pingback: Can Political Theatrics Deliver the Globalised New Britannia? - » The Australian Independent Media Network