Memo to Mortgagors…get your house in order

Whether you believe it or not, an economic tsunami is coming and if you think we will survive the damage and the fallout, as we did the GFC, you’re dreaming.

The next GFC will make the last one look like a vicarage fund raiser. Why? Because we are not just making the same mistakes as last time, we are making bigger ones.

One simple statistic reveals a frightening scenario. Currently, the big four banks have a combined equity of around $162 billion. Place that alongside their current exposure to domestic mortgage loans of $1.6 trillion and you begin to see the looming threat.

Those mortgage loans have been fuelling an unsustainable housing bubble. But the banks see that as secondary to ensuring their share prices are maintained. What they seem oblivious to, is the plethora of business loans outstanding that feed off household demand. The early warning signs are there.

Stagnant wage growth is restricting spending and slowing demand. Household spending is becoming highly selective, limited to essentials but still relying on credit card financing. Our economy, all economies are reliant on consumer spending. When the consumer stops spending, the economy stops moving.

We have ignored the warnings, we have been seduced by low interest finance, cheap money and banks ever eager to lend at levels well beyond responsible management. As a result we have now reached the point when irrational expectation meets unmanageable debt.

As matters stand today, it’s not so much a case of the economy not moving, soon, the inevitable job losses will start to mount.

As with the GFC, the prime mover is the housing bubble. Let us be clear here. We are not talking about sovereign debt, what our national government has issued in bonds. That is always serviceable.

We are talking about what consumers owe and what is about to happen when it becomes apparent that they can no longer meet their debt obligations. We are talking about mortgage defaults.

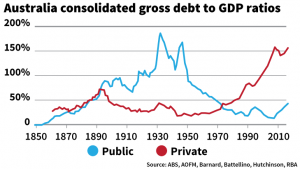

Look at the chart sourced from the Australian Bureau of Statistics, the AOFM, the RBA and others.

Australia’s current household debt to GDP is currently at 123 per cent, the second-highest in the world behind Switzerland. It has a household debt-to-income ratio at an all-time peak of 189 per cent. Mortgage loans to borrowers amount to more than six times household incomes and could wipe out 20 per cent of the major banks’ equity base.

When the banks begin to see rising levels of mortgage default they will react without mercy. Foreclosures will follow, leading to a glut of homes for sale as the banks try to recover their money. House prices will crash. And that is just the start.

Businesses reliant on a strong, stable vibrant housing environment will feel the fall in sales of consumer goods. Unemployment will rise quickly leading to further decline in demand. From there, it’s all downhill.

The question then arises. What will this government do about it? If you think they will react the same way Kevin Rudd’s government acted, forget it. They will not. Their aversion to sovereign debt far outweighs any interest in issuing more debt.

The banks will demand the government protect their equity with guarantees and possibly a round or two of quantitative easing. That will save the banks but it won’t stop falling demand, businesses failing and higher levels of unemployment.

We, the consumers, the lifeblood of the economy will be left to fend for ourselves. That is the way of conservative governments. They look after their own. If we are reduced to soup kitchens and charitable handouts, so be it.

We, the consumers, the lifeblood of the economy will be left to fend for ourselves. That is the way of conservative governments. They look after their own. If we are reduced to soup kitchens and charitable handouts, so be it.

This government would rather give a company a tax break than stimulate an economy with direct debit consumer grants. So here is a warning. Get your house in order. Reduce your debt burdens. Pay down your credit card and look for a cheaper house with a lower mortgage if you can.

When the value of your four bedroom, double garage with swimming pool falls below the level of your mortgage, the bank will come knocking on your door. Better you act first. In situations where the inevitable is all too obvious, you have one option: be first.

If you would like a broader overview of the impending tsunami, read Nassim Khadem’s article in today’s Age. When the spaghetti hits the fan and you decide it’s time to capitalise by selling your home for something less ostentatious, it will be too late.

40 comments

Login here Register here-

Freethinker -

Matt -

havanaliedown -

auntyuta -

TrissyMP -

martin connolly -

Florence nee Fedup -

The Truth -

townsvilleblog -

Peter Davis -

Zathras -

wam -

Freethinker -

Kyran -

Wayne -

Freethinker -

John L -

Michael Stasse -

Michael Stasse -

Roswell -

Meunen U -

Jarrad -

NK -

michael lacey -

John Kelly -

jim -

Freethinker -

martin connolly -

totaram -

nexusxyz -

nexusxyz -

Florence nee Fedup -

Florence nee Fedup -

Andreas Bimba -

Freethinker -

Florence nee Fedup -

Wayne -

Greg -

-

Return to home pageDo you think that we will go to something similar to what USA went trough?

Correct me please if I am wrong, but during the crisis in USA, it is my understanding, that the government solution was to help the banks so, at the end the banks were rescued from a financial collapse.

One of the main factors was the massive default of home loans, the people left the properties which many of them are empty today.

Detroit is a good example.

Today, in USA are thousands of people house less, and their “new house is living in an RV or tiny houses.

On thing that I cannot understand, I cannot see the logic behind it, is why the USA government did not took “ownership” of that houses that left empty as a part of the condition to rescue the banks.

Will be no more sensible for the government taking over of that house loans and eventually recuperate the money when the people are able to find work again?

That not only avoid thousands of families in the streets but also have the option to recuperate the money involved in the banks rescue.

Was that a policy based in ideology or simple bad economics?

What would happens if here 200.000 loans are defaulted?

The banks will be not able to sell them because the interest rates will be higher and people will not have a job or salary to serve the loans .

Interesting article and I am looking forward for a good exchange of opinions.

This has been obvious for ages, I cannot believe that our government has not acted on this ages ago, as if we all didn’t dodge a bullet with the GFC. But it led to no change, business as usual – actually business even worse than usual. It is clear that our institutions of government cannot reset from a growth based, fossil fuel driven (i.e gobal warming) economy. Actually we never learn – Australia had a massive depression the 1890’s following the gold boom, which left people to go broke, hungry, insane and to commit suicide.

It sounds exactly like today:

“Each indicator suggests that the financial system during the 1880s was becoming

increasingly vulnerable to adverse shocks. During that period there was a

sustained increase in private investment associated with extraordinary levels of

building activity and intense speculation in the property market. This was

accompanied by rapid credit growth, fuelled in part by substantial capital inflows

(much of which appears to have been channelled through financial intermediaries).

At the same time, banks allowed their level of risk to increase in an attempt to

maintain market share in the face of greater competition from a proliferation of

new non-bank financial institutions”

https://www.rba.gov.au/publications/rdp/1999/pdf/rdp1999-06.pdf

I think we are caught in a completely moronic system that cannot avoid repeating its mistakes. And the economics and financial disciplines also have much to answer for.

Matt

“One of the main factors was the massive default of home loans” – Bill Clinton legislated that “bad risk” borrowers must be given the opportunity to access home loan finance, with no penalty if they mail back the keys upon mortgage default. Of course the financial sharks had offloaded these mortgages and the rest is history. Our mortgage lending is a lot more robust, and there are few cities here like Detroit. Thankfully.

I imagine it should be possible that the government takes over ownership of houses in case the banks need rescuing. Government should help people that have nowhere to live to move into houses that would otherwise remain vacant.

Just a note on terminology, which also highlights an important element of the laws regulating Australian mortgage lending.

In Australia, Mortgagees do not (very, very rarely) “foreclose” and instead will go into possession of a mortgaged property and sell it. There is a significant and important difference between the “foreclosure” process and the “mortgagee in possession” process.

The modern use of the term foreclosure generally refers to the U.S. process whereby a bank swaps the debt (the mortgage) for the asset (the house). In doing so, the bank takes on the risk of the value of the property not being sufficient to pay out the mortgage debt. The Mortgagor (the borrower) then effectively walks away and starts again.

In Australia, banks go into possession of the security property (your house or business premises) and sell it for whatever they can recover.

However, the risk remains with the borrower and, if the sale of the mortgaged property is not sufficient to discharge the debt, the bank then sues the borrower for the difference – invariably leading to any other assets the borrower has (whether mortgaged to the bank or not) being sold and the proceeds going to the bank, until the full mortgage debt is recovered.

If the borrower does not have sufficient assets they will ultimately be bankrupted by the bank.

Its important to note the differences between the “foreclosures” we saw happening in the U.S. during the GFC, and what will most likely happen in Australia when the circumstances you describe come to pass (and there being no doubt they will).

Australian banks are not motivated to hold onto mortgaged property and in fact benefit from selling these properties as quickly as they can, especially in a falling market, as the risk remains with the borrower. This in turn will compound any fall in the housing market at a much quicker rate than was observed in the U.S. – which was bad enough.

Additionally, it also means that Australian borrowers will be completely, mercilessly and irrevocably financially destroyed by the banks, to a level above and beyond that suffered by U.S borrowers.

By comparison, having a mortgage foreclosed upon isn’t anywhere near as devastating as having your mortgagee (Bank) go into possession & sell your property at a loss, then sue you for every cent you have until they get every drop of blood and leave you bankrupted and destitute.

This is just a freefloating thought … It was my brain’s first reaction to reading John’s article, but I have had it before.

Assuming that a property crash or dive was the reason, instead of the government handing out enormous sums directly to the banks, what if it effectively gave it to the mortgagees, to be used solely for paying down their mortgage immediately by the same amount?

Thus the banks still get the money, but the homeowners aren’t in a reverse equity position – ie screwed..

I know it’s hard to work out how much to give to whom. I know there are all sorts of arguments that this discriminates against renters, homeless etc, but this could be the core of an overall strategy couldn’t it?

It’s fairer than the probable course of action

The debt truck in the last Howard election was private not public debt. Last we heard of it once election over. Under Labor the debt came down. only to rise again under Abbott. One can’t cut incomer of ordinary people without debt rising. When one cuts government spending, it doesn’t go away. Is transferred to mostly workers pockets. That is what user pay means.

To make things worse, under Abbott and now Turnbull there have been no wage growth. Jobs have become part time with no job security.

Freethinker the values of properties are grossly inflated at the minimum 40% over. Ireland has already experienced a mortgage bubble burst and grossly over inflated.

The Banks would not care if they could not sell it they would still kick you out there are plenty examples where they have done this.

In the USA they had 1000’s in some areas handing the keys and walking away then there were those in the same situation as those that walked away but tried to hang in and hope things would change ,but the Banks kicked them out. As they don’t give a stuff about people.

If you look at Graphs on the USA economy and the situation with banks leading up to the Great depression of the 20’s & 30’s then look at Graphs in Australia today and they look like those leading up to great depression and if not worse.

Then you look at the figures above in regards to their exposure to the Mortgage Bubble 1.6 Trillion but that is small compared to their Derivatives Gambling Exposure which is well over 37 Trillion.

The Government have put nothing in place to help the Australian people when we have a complete financial crash. But they have done plenty to look after the banks they had the banks create Bail-in Bonds that were only to be sold to Super Funds and Mum & Dad investors so with these they have milked large amounts from the Super funds as Fund managers did not read the small print. And they have put Bail-in regulations that allow the banks to steel depositor’s money.

They have put draconian legislation in place to stop people taking to the streets and protesting , they put the legislation in place under the disguise of terror legislation , but they can use it against all Australians.

ASIO will be put in charge to protect the Government so the people can’t kick them out. ASIO cannot be investigated and its officers cannot be charged with crimes or taken to court even if they shoot Australians. And if the Federal Police, State Police and Army are operating under ASIO they are untouchable like the ASIO officers.

What we must do now is Demand Glass –Steagall Bank Separation to break up the 4 big banks +1 to stop them collapsing our economy Those in our Parliament’s refuse to discuss Glass –Steagall and the mass media does not inform people about it. The CEC has been fighting for this legislation for decades and they also have been fighting against Bail-in but the Australians have turned a deaf ear to these campaigns and all these minor parties , the Greens and Labor also have turned their back supporting the Banks. http://www.cecaust.com.au

Those of us who are fine tuned because of necessity to the economy knew when the GFC was coming a couple of years before it hit and the same this time, we can feel it tightening. Those of us with loans are going flat out to pay as much as possible while we can. The author is correct, 4 long years of tory government incompetence and mismanagement will certainly take its toll. Perhaps it won’t happen until this time next year but it is coming.

My suggestion, contact the Citizens Electoral Council at cecaust.com.au and ask about their Homeowners and Bank Protection Policy. Yes this is probably a free plug, however, they are the only ones with the economic policies to head off the coming crisis, via the Glass -Steagall Act, or at least have a chance of survival.

The US Mortgage system is not like ours. In the USA, when market prices plummeted defaulters could revert to “jingle mail” which is to send the house keys (and ownership) back to the bank and walk away from the balance of their debt – leaving the Bank with the problem of getting its money back. That’s why their banks suffered so badly.

In Australia our mortgage (meaning “unto death”) system means that you are entirely saddled with the debt until its repaid, unless you declare personal bankruptcy which in turn creates its own new problems. The problem here will be how far our Government will go to prop up our banks.

The danger for us is how big the bubble will get before it bursts and how ugly it will become for us all – non mortgage-holders included.

Beauty Trissie,

I hope Kelly is wrong because those sad facebook friend with mortgages and a love of the rabbott will get creamed because they don’t understand the power and greed of our banks. When you borrow they own and can sell your home from under your nose for a pittance and you have to pay the difference.

In addition if the crisis is like the last one this mob will back the banks not Australian deposits.

It will be a hard lesson for them to learn. Only joking trumball will find a way to get replaced, they will blame labor and these poor buggers will believe them.

ps I am alright jack no mortgage but cash in the credit society may be at risk. Although if the banks sell cheaply then the kids and I may buy??

The 2017 March quarter personal insolvency total is 7900 which it is no problem for the banks, but what can happens if it is 10 times more?

I do not thing that the issue is how the Us Mortgage system is compared with ours.

If a financial collapse happens the social cost will be the same or worse and what will be more sensible economic policy by the government? 1) allow thousand of people declare bankruptcy and finishing homeless, which will bring a very costly social and welfare problem

or

2) the government take over that loans and allow the occupants to live on it and make affordable repayments.

The Australian system is quite unique in the way it protects the banks.

For a start, they are encouraged not to take possession due to our accounting practices. Having a loan on your books is considered an asset. If you declare the loan unserviceable, ie take possession, the loan becomes a liability. Due to the changes in the APRA liquidity levels, post GFC, the banks are very aware that if they take possession of properties they must change their provisions for ‘bad debt’. They have been avoiding this for quite some time by ‘re-negotiating’ loans, extending the term of the loan from the standard 25 years to 30 and even 40 years.

The housing bubble is at its most prevalent (at the moment) in Sydney and Melbourne. It has already gone through the ‘mining states’, Perth, Darwin and regional Queensland being examples.

Here’s how the repossession process works. The bank issues legal proceedings on the default. The mortgagee negotiates a period of time to vacate the property. The bank sells the property. Due to lending practices that are nothing short of scandalous, a loan these days can be negotiated up to 100% of the property value, subject to mortgage insurance. As TrissyMP has already noted.

That mortgage insurance is what makes Australia unique. The borrower, the mortgagee, takes out an insurance policy to indemnify the beneficiary, the mortgagor, the bank. Here’s the kicker. For the Insured (the bank) to make a claim against the Insurer they must ‘realise’ the asset, ie sell it. They must quantify their loss. Mortgage, minus sale proceeds, plus costs. It is a condition on most, if not all, mortgage insurance that the bank must bankrupt the borrower, to complete the claim requisites. Once the Insured (bank) has done that, the Insurer pays out.

There is no imperative for the bank to get the best price for the property. Their only imperative is the claims process. Once bankruptcy of the borrower is achieved, the insurance company pays the bank and take control of the bankruptcy through subjugation clauses in the policy.

That’s why the RC into banks should have been a precondition to bailing the bastards out of the GFC.

As to the ‘knock on’ effects on the economy. Well, that doesn’t matter. Not in the minds of our intellectually and morally bankrupt leaders. If the heat gets too much, they will find a terrorist, or abbott, to distract us. Freethinker pretty well nailed that. The banks are too big to fail. Personal bankruptcies are far more palatable than corporate (government sponsored) failure.

Thank you Mr Kelly and commenters. Regrettably, ‘identifying the problem’ and ‘dealing with the problem’ is simply a bridge too far for our government. Take care

I certainly hope so, the LNP were left a huge debt and a huge budget deficit and have tried to introduce measures to stop spending and pay down the debt but have been blocked in the Senate by Labor and the Greens claiming the cuts are “unfair”. Unfortunately they were not left an economy in gat shape like the Rudd Government inherited. When this hits it will be the idiots who voted Rudd/Gillard who will suffer most, we call that Karma.

Some people never get it and for that reason we have this mob in power.

I work for a medium sized QS office. The warning signs are all there and the first effects are starting to be felt. Some staff have already been laid off and the work outlook is not looking bright……

From what I see, this is the first trickle of the oncoming torrent which will reach us sooner than we would like.

Reduce your debt burdens. Pay down your credit card and look for a cheaper house with a lower mortgage if you can.

Saw this coming years ago, and did exact;y that. trouble is…… only so many of us can do this, there are only so many properties around that you can dowsize to….. Best thing you’ve ever written all the same John.

We need a debt jubilee.

‘Fraid you got me worried, John.

Good to read an article that tells it like it is. Pick up the papers one day and you read “housing boom ahead”, and the next day it’s something like “housing bubble about to burst”. A week later they do it all again. Rinse and repeat.

A 20% increase in the cost of electricity for households and businesses will not help. Consumers will have to cover the increases for both domestic and business.

“The Turth” In your comment above you mention bail-in regulations. Are you able to expand on this a bit further as I don’t know much about it?

martin connolly, ” instead of the government handing out enormous sums directly to the banks, what if it effectively gave it to the mortgagees, to be used solely for paying down their mortgage immediately by the same amount?”

That is a good idea.

First, a background question, just how much delinquency has been show by:

1. govt (Treasury/ATO) & APRA (lending standards) effectively hot-housing levels of private debt;

2. private banks chasing off-shore lenders to underpin our local Hollywood lifestyles & inflated property prices;

3. commercial media spruiking property speculation as sound advice?

The above – govt, banks and media have worked in concert to dupe a whole generation into a debt trap. Should it unfold it’s going to destroy not only recent borrowers but decimate industry and small businesses. Should there be a US style price meltdown then borrowers have every right to go a class action against the 3 entities above. Just do it.

Re the premise of the article, it is unlikely prices here will ever drop much in AUD terms. What could happen however is that the AUD could tank and open up the opportunity for hedge funds, eg Blackstone and numerous small hedgies that would mushroom overnight, to walk all over forced sales in Australia.

Who will preside over the Great Aussie Firesale? MT, TA, PH or the Channel 7 Cash Cow?

Good article! What you say is inevitable! But what concerns me is Ideology masquerading as economic theory that of neoliberalism will that survive! If it does nothing will be learnt.

Michael Lacey, there is an ever-growing awareness of the failure of neo-liberalism. It has clearly served a small section of the community but at the expense of a larger section. Already there are signs it’s future is in doubt.

A R.C. into the Banks with cases going back just ten years don’t go far enough forever? (Banks ordered to pay ozi battlers billions) anyways this will never happen as you’re f’n with the elites.

It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.

Henry Ford

Freethinker – totally agree. And even moreso over the past 3-4 years as I came to understand that Australia is a sovereign currency nation – a currency issuer. The annual federal Budget, the “we’ll go broke”, the wailing and gnashing of teeth around government debt – it’s all a confected nonsense.

A government sector deficit means the private sector has a surplus ie it expands, which is a good thing.

A government sector deficit means the government happens to have spent more into the economy than it has received in tax etc

But the government creates the money it spends – that’s how it comes into being, so it doesn’t need ‘revenue’ to ‘fund’ spending.

Taxation is a control on inflation and it destroys money when the government receives it.

How that balances with ‘revenue’ in any one period is pretty much irrelevant.

This has all been unnecessary for at least 40 years when the gold standard was left behind.

But it’s a handy way to keep us in check and as an excuse for austerity, for privatising public monopolies and selling public assets, to corporate buddies.

We CAN afford better education and health.

We CAN afford to look after the aged, the unemployed, the sick and infirm.

We CAN afford for the government to decide to build renewable energy farms all over the place, as an investment.

(oh and we COULD have afforded the NBN to be done properly from day one)

.

When enough people realise this there WILL be a revolution.

I feel sorry for people like Wayne. He just doesn’t get it. He thinks we are talking about govt. debt. when it’s the private sector debt we have to worry about. It’s the poor gullibles like him who get sucked into voting for these economic kleptocrats.

Australia has, I am sure, a large hidden sub prime problem where mortgages have been based on ‘sexed’ up income levels. When the housing bubble goes its impact will then flow through other sectors other than the banks. Real Estate operations will shrink rapidly, insurance volumes decline, construction bankruptcies, trades go into bankruptcies and State governments revenues will collapse as the tax system is based on juicing up the volume of housing sales. The tax system should have been revised a couple of decades ago. It is now part of the financial bomb built under the Australian economy.

Wayne is detached from reality and lacks any serious understanding of the issues. Sadly he is not alone. The elephant in the room has always been private debt that the perverse economic orthodoxy of the LNP has fostered. This has fueled the massive growth in private debt over a couple of decades while the infrastructure of the country went into decline. Public spending under labor was not out of control. It is both amusing and sad when you look at the LNP imbeciles and the growth of public debt under their ‘leadership’. Sad as they are viciously smashing the lives of those without a voice via cuts in welfare.

I am happy to see this mob go full term. Want to see all their chickens come home to roost before Labor takes over.

They have habit going out before all collapses, coming back is as economy is improving.

“We CAN afford better education and health.

We CAN afford to look after the aged, the unemployed, the sick and infirm.

We CAN afford for the government to decide to build renewable energy farms all over the place, as an investment.

(oh and we COULD have afforded the NBN to be done properly from day one)

.

”

Truth is, we cannot afford not to spend this money.

Seems govt putting energy policy on hold. Once again lacking guts to do anything.

Thanks John for this very important article and thanks TrissyMP and Kyran for explaining why mortgages in Australia are potentially far more destructive for the client than in the U.S.

I agree with Martin Connolly that the plight of the homeowner with a mortgage that exceeds the value of the property is what is important and not the plight of the banks who are guilty as hell with setting up the property bubble scam. The homeowner is also partly responsible by extending their financial risk too far and for not living more frugally but few deserve to lose everything which is what is set to happen.

The best long lasting solution is probably to let the major banks fail and for new state owned housing mortgage banks to take over the mortgages of the failed banks with a proportion of the losses taken by the homeowner. Those in real existential hardship should be prioritised over those losing a portion of their fortune in other words any financial help should be means tested. Other state owned banks could take over other important functions of the commercial banks. Depositors funds also warrant safeguarding while shareholders investments even indirectly through superannuation funds do not as they are the banks owners and so are indeed responsible for any misdeeds or mistakes. At the same time ‘people’s quantitative easing’, as recommended by Steve Keen, which would flow equally to all citizens, could reduce the severity and duration of any recession by reducing private debt levels and by stimulating worthy economic activity and employment growth.

The main drivers of the property speculation bubble – negative gearing, the CGT concession and foreign money being invested directly and through proxies must be substantially reduced as soon as possible to reduce the scope of the eventual property price collapse.

Quantitative easing for the banks represents a reward for the guilty and a waste of real dollars, even if that money is created out of ‘thin air’ by the federal government; that could be used much more beneficially on important infrastructure such as public transport or clean energy or on ‘people’s quantitative easing’ for example.

Steve Keen has also predicted the collapse of the property bubble some time in 2017 due to excessive levels of mortgage and other forms of personal debt and has also offered solutions which have all been ignored by government and the incompetent RBA.

https://www.google.com.au/amp/s/amp.smh.com.au/business/markets/steve-keen-rebel-economist-with-a-cause-20170104-gtluez.html

What could delay the property collapse almost indefinitely is the steady inflow of foreign money and money from our most wealthy, that are subsidised by the negative gearing and CGT concessions, especially into the Sydney and Melbourne property markets which effectively means a steady transition from home ownership to rental for most Australians. This process could continue well beyond the point where housing mortgages become unaffordable for most Australians which is not far off.

Are Chinese investors and the Chinese government, along with our richest few percent complicit in not just the Australian property speculation scam but are they also positioning themselves to be the main property buyers after the eventual crash when all the fire sales begin? Welcome to our new aristocratic overlords?

Rather than implementing an Australian equivalent of the Glass-Steagall Act which is very complex and doesn’t necessarily fix all the core problems, the article below gives a much wiser solution to the excesses of the banks. It is applicable to the U.S. banking system and is from early 2010 but contains very good, even if confusing, guidance on how best to reform the world’s banking systems. The article was written by MMT economist and financial services guru – Warren Mosler.

http://www.huffingtonpost.com/warren-mosler/proposals-for-the-banking_b_432105.html

Will the duopoly deliver suitable policy outcomes so we can avoid a major crisis given our corrupted democracy, the financial resources of the banks and the top few percent, the neo-liberal bias of the mass media and a wilfully ignorant electorate? Labor may trim negative gearing but there is no chance with the bigger solutions, so with them and even more certainly with the Conservatives, we are set to be driven over the precipice.

John is right to warn us to reduce our financial exposure even when he knows with competent policy this mess could mostly be avoided or counteracted.

Florence nee Fedup,

Remember when the Coalition took over and come with policies that affected the Australian old population because the financial mess left by the ALP?

Well have a look what it is happens in WA.

WA Premier Mark McGowan refuses to rule out hits to seniors in first budget

http://www.abc.net.au/news/2017-06-18/wa-seniors-card-could-be-means-tested/8628968

Until we do not have a socialist Labor party and have politicians with these macroeconomics ideology we do have a hope.

If the y do not attack the environment (Qld) they will attack the old the poor and the ones in need.

Full pensioners did it hard under Howard. He did give to the aged, increasing much middle to high incomer earners. Such things as senior card and super/tax rebates.

Rudd/Gillard attempted to better the lot of those dependent on the pension while pulling backpack middle class welfare. Not with much luck as they screamed like struck pigs.

Abbott and co have manage to take pensioners backward.

nexusxyz and the likes seem to think the Government has control over private debt, like somehow they can dictate to me how much I am allowed to borrow, yep let’s blame the LNP for you borrowing to buy a house you can’t afford.

People are very aware of the debt and are very focused on paying every last cent off thier debts instead of spending it on consumption, much to the annoyance of the retail sector. The fact still remains that people need to live somewhere close to where the jobs are, so they will keep squeezing into what ever they can get for whatever price they have to borrow to get it.

The bubble that is always talked about is basicly in Sydney/Melbourne, where there is no land that can be released in the locations that people actually want to live. What is owned that can be further developed, is under the control of property companies and trusts who want to maximise thier gain (no negative gearing changes will ever touch them!). Federal government can do nothing about it.

State government has all the authority, and can raise land taxes on under utilized land/vacant properties, and this appears to be the direction that it is moving in, albeit rather reluctantly.

Federal govenment is basicly hog tied by the situation in the capital cities. The only change they could effect is to start building up new large cities in other locations, to move the employement prospects, this would slow down the escalting pouring in of population to the existing cities. But such a move would be thier end, no votes in it. So we will all keep on complaining, until it breaks, and then complain about that, and around we shall go.

Pingback: Memo to Mortgagors…get your house in order | THE VIEW FROM MY GARDEN

Pingback: Memo to mortgagors