Longman By-Election: Failed LNP Paradigms Revisited

The federal LNP certainly seized upon Longman as its best chance on Super Saturday.

Cheered on by initially favourable opinion polls, Prime Minister Turnbull persisted with his enthusiasm for the LNP’s Tax Packages. Most of the tax redistribution favours privileged income earners, large corporations and banking institutions.

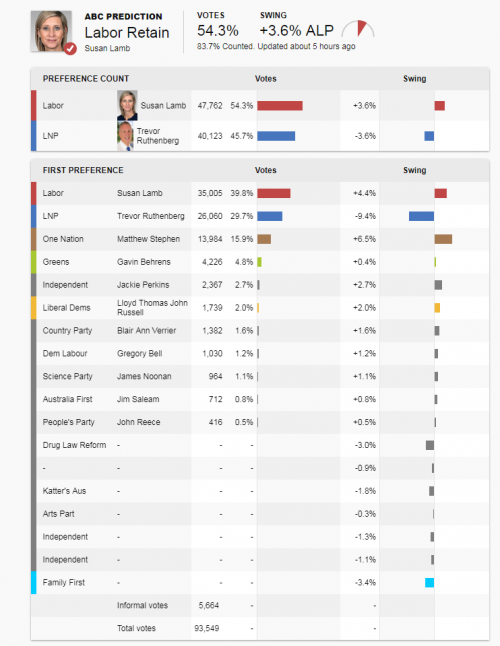

Just a week out from Super Saturday, Brisbane’s Sunday Mail was confident enough to claim victory for the LNP in Longman. ReachTel Polling results from 19 July 2018 were offered without qualifications about the high error rate in automated telephone polling.

Under the banner of Longman Backs Big Trev, the Sunday Mail (22 July 2018) overstated the LNP’s primary vote by 7.95 per cent at 37.9 per cent. This was translated into a two-party result of 51 per cent for Trevor Rutherberg based on assumptions of a disciplined allocation of preferences from One Nation (ONP) and other minor parties.

The close result in the ReachTEL Polling invited great caution from responsible voters in Longman.

Although Susan Lamb ultimately won the seat with a 55-45 per cent margin after preferences, not one of the voters in the Sunday Mail’s colourful photo mosaic of six constituents really supported Labor.

The Sunday Mail’s editorial used the anticipated close result from the literal interpretation of ReachTEL Polling to warn readers about the dangers of a Labor victory in Longman:

Voters have a golden opportunity to reject the Socialist policies of Shorten and put him on notice that his comfortable relationship with sluggish unions is not what we expect in 21st century Australia.

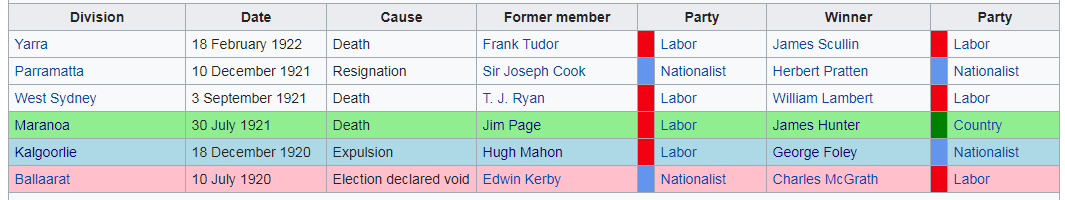

The official line from the federal LNP was less clear-cut. Invoking the LNP’s underdog status, the federal LNP noted that conservatives in government had not clawed back a federal Labor seat at a by-election since two irregular victories in Kalgoorlie and Maranoa in 1920-21 in the 8th Parliament (1919-22):

Buoyed by sensational reporting of ReachTEL Polling, the federal LNP was still confident that it had a good chance in Longman on 28 July 2018. There was a nostalgia for conservative victories in by-elections in Kalgoorlie and Maranoa almost a century ago.

The federal LNP’s Tax Plans to restructure personal and corporate taxation rates carried the possibility of a repeat performance in Longman to excite the electorate with a real paradigm change to a more aspirational Australian society.

Failed LNP Taxation Paradigms in Longman

Longman voters were simply not inspired by the federal LNP’s plans to restructure personal and corporate taxes in the interests of privileged sectors of society.

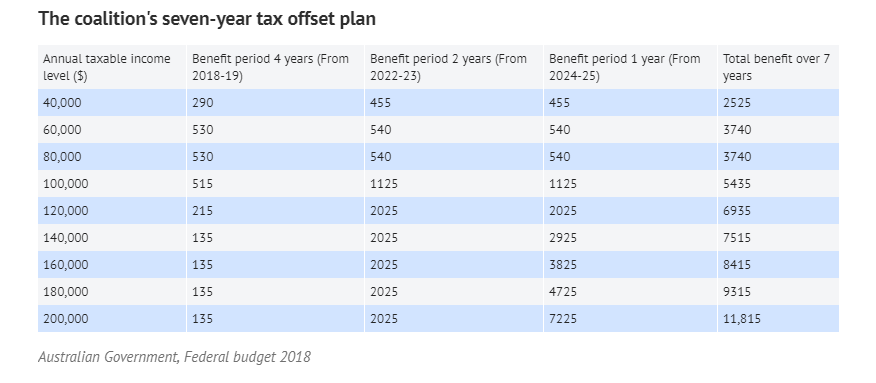

The initial personal tax changes in Phase 1 (2018-22) carried a manipulative short-term sweetener for the most naïve aspirational voters.

For taxable incomes of $50,000 to $90,000 range, the LNP’s tax package offers an immediate $530 per annum or $10.20 a week in tax relief. Short term tax relief was as low as $3.80 per week for income levels of $30,000 and $5.58 per week for taxable incomes of $40,000. The token levels of tax relief for Longman constituents are of course more than offset by the abolition of penalty rates from 1 July 2018.

It was clearly anticipated that more aspirational voters in Longman would not read the fine print of the Tax Plan which gave immediate tax relief for corporations over specific gains for short-term tax relief to wage-earners at all income levels.

The real injustices come years later in Phases 2 and 3 of the Tax Plan. Tax relief for taxable incomes below $80,000 were still in the $200-$540 per annum range after 2024-25. Only a tiny section of taxpayers in Longman will scoop $7,225 per annum after 2024-25. Less than 5 per cent of personal incomes in Longman makes a taxable income of $100,000, let alone $200,000.

The real injustices come years later in Phases 2 and 3 of the Tax Plan. Tax relief for taxable incomes below $80,000 were still in the $200-$540 per annum range after 2024-25. Only a tiny section of taxpayers in Longman will scoop $7,225 per annum after 2024-25. Less than 5 per cent of personal incomes in Longman makes a taxable income of $100,000, let alone $200,000.

For voters in Longman who were still not inspired by such token tax concessions, the second arm of the federal LNP’s election strategy in Longman was the anticipation of more substantial preference flows from the One Nation Candidate, Matthew Stephen. His vote was underestimated by 2.02 per cent in ReachTel Polling and reached 15.9 per cent on polling day.

The ONP preference votes in Longman could have been more decisive if the appeal of the LNP’s tax plan had worked.

However, a federal LNP primary vote of 29.7 per cent was too low to deliver the results anticipated in the ReachTEL Poll.

Apart from the Caboolture South Booth, all major booths recorded a two-party swing to Labor. In the Caboolture South Booth, Labor’s primary vote declined by 1.49 per cent. Here the federal LNP’s vote was a dismal 21.59 per cent. For some local reasons, there were gains by One Nation (+5.11 per cent), a high informal vote of 8 per cent and better than expected results by minor candidates including Liberal Democrats, Labour DLP, the Australian Country Party and an Independent Candidate. All minor candidates scored over 2 per cent and ONP managed 16.22 per cent.

Despite these anomalies, Caboolture South was one of Susan Lamb’s best results after preferences with a 61 to 39 per cent divide to Trevor Ruthenberg.

Across the Longman electorate, voters coped with a field of eleven candidates and achieved a lower informal vote (6.05 per cent) than at the 2016 federal election.The swing to Labor after preferences was remarkably consistent across Longman. The LNP hoped that voters in the Bayside Suburbs and Northern Greenbelt Areas of Longman would warm towards its Tax Packages. For the traditionally Labor-voting suburbs along the Transport Corridors from Caboolture to Dakabin, there was the possibility of a strong ONP vote.

Labor’s Engagement with Longman

Image: ABC News Online

The LNP’s Tax Packages offered immediate gains for businesses of all sizes. Even the most privileged families had to wait until 2024-25 for their promised tax rebate of $7,225 while median salary earners were left to cope with a rebate of $455-540 per annum.

There were no real concessions for retirees. The means test for part-pensions had already been tightened in 2017. Single pensioners with assets of $561,200 beyond the first home and $844,000 for couples receive no entitlement to part-pensions.

For infirm seniors, access to nursing homes required Lump Sum Payments of $250,000 to $550,000. With the approval of the Minister for Social Security, aged care providers can extend the Lump Sum Payment to $800,000.

In aged care facilities demanding a Lump Sum Payment of $550,000, the annual fee amounts to $32,780 plus the standard daily rate of $50.16 per day or $18308.40 per annum. The total amounts to $51,088. In aged care centres requiring a Lump Sum Payment of $800,000, the fees would increase to $65,984 per annum based on the 5.96 per cent levy of $47,680 on the cost of Lump Sum Payment.

Moving into a nursing home facility even for a few short months usually required the sale of a family home. This caused real problems if one partner wanted to continue to reside at home perhaps with access to aged care support services.

Few families could sustain payments to combine a continued homestay with the transition to an aged care facility for the more infirm partner unless resources were carefully tucked away years ago in a family trust or Caribbean tax haven.

Federal Labor’s commitment to improved public health services was undoubtedly well received even in more comfortably off parts of Bayside Longman. Bill Shorten provided the specifics on one of his campaign visits to Longman about the extension of chemotherapy services at Caboolture Hospital (25 May 2018).

The rising cost of private health insurance is an enduring burden. The federal government’s lack of supervision of irregular discounts to private hospitals for the installation of particular brands of pacemakers has received recent media attention (7.30 Report 3 July 2018). These healthcare anomalies come at the expense of policyholders and their funds.

Susan Lamb can now expect heroine status for her commitment to improved living standards and fair wages across Longman.

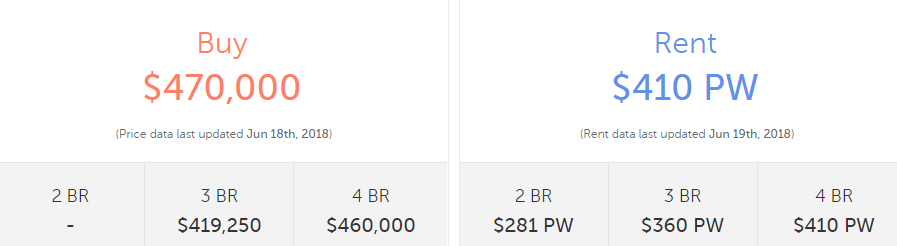

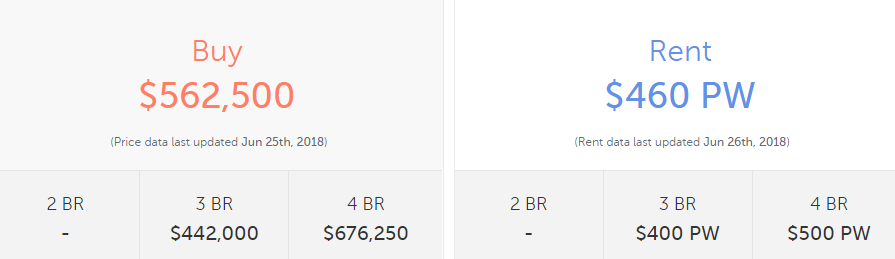

The current going rates for buying or renting houses in Narangba is available from the real estate sector (realestate.com.au):

For retirees and families with more assets, there is always the possibility of moving pleasant localities near Bribie Island with its bridge connection to the mainland. Median property prices have been documented by real estate providers.

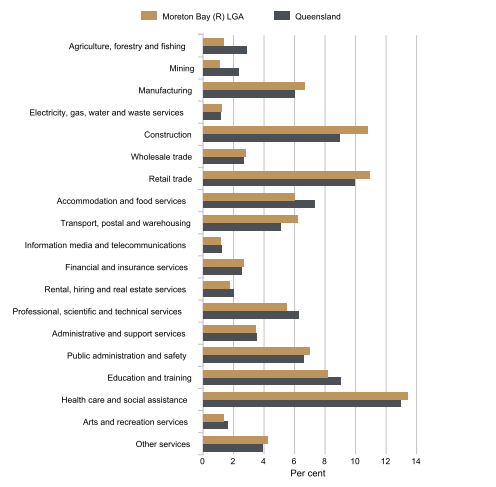

The federal LNP’s campaign was misplaced appeal to small business entrepreneurs. However, most voters in the Longman electorate work for wages and are in some highly unionized sectors in health, education, public administration, manufacturing and construction.

Employment profile in the Moreton Bay Council (Including Petrie and Longman Electorates

Image from Queensland Government Statistician’s Office

Commitment to Top Hat Polities which widen the income divide should be a recipe for the defeat of all LNP members in the six federal seats between Longman and Forde on Brisbane’s Southside in 2019. Continued attention to campaign initiatives such as mobile displays and street theatre can repeat the gains made by Labor in Longman on Super Saturday against federal LNP in its current unholy alliance with the ONP and other far-right minor parties.

Denis Bright (pictured) is a registered teacher and a member of the Media, Entertainment and Arts Alliance (MEAA). Denis has recent postgraduate qualifications in journalism, public policy and international relations. He is interested in advancing pragmatic public policies that are compatible with contemporary globalization.

Denis Bright (pictured) is a registered teacher and a member of the Media, Entertainment and Arts Alliance (MEAA). Denis has recent postgraduate qualifications in journalism, public policy and international relations. He is interested in advancing pragmatic public policies that are compatible with contemporary globalization.

16 comments

Login here Register here-

Alpo

-

Richard

-

New England Cocky

-

etnorb

-

Chris

-

Stella

-

Mia

-

Lalnama

-

Tessa_M

-

James_Robo

-

Paul

-

paul walter

-

Tom

-

Denis Bright in Brisbane

-

Terence Mills

-

paul walter

Return to home pageGreat analysis… Times are changing… and there is nothing that Merdoch and his minions in the Liberal party (LNP in Qld) can do to stop change from happening. The People are fed up with so called Neoliberal “reforms”, they are fed up with the putrid style of social organisation the Liberals (LNP in Qld) are offering for this country.

Vote ALP1/Greens2…. Liberals (LNP in Qld) last, whenever and wherever you can!…. That will do.

Thanks for the article. This reinforces why I have cancelled my Melbourne Age subscription.

Wonderful objective analysis Denis.

The next door in Dickson proximity of Benito Dutton and his xenophobic, racist, inhumane policies for refugees incarcerated on Manus and Nauru without adequate medical, social or security facilities would have been another factor in this bye-election. There are a lot of concerned persons working to rid Australian politics of this black stain on our national reputation, and only a 2% swing is required. However, the MSM kiddie pretend scribblers were NOT prepared to mention those unpopular policies.

Oh, boo f*cking hoo! So the rag Brisbane ‘Sunday Mail’ told everyone that the libs had won or would win. Sadly for these inept, lying libs , they did not win, & yet another “fine” prediction by a Mudrake rag, that was ALL wrong! Hooray for Talkbull & hooray for Mudrake–NOT!!!

Longman was definitely the most challenging of the two key by-elections but it produced a better result than in Braddon.

Thanks for the article, I enjoyed your insights on the Longman By-election.

Thanks Denis for your alternative to coverage of the LNP’s tax packages.The News Corp press should be ashamed of its distortions of the tax packages .

Great article Denis, the LNP are just not listening to the electorate. The electorate aren’t convinced about the trickle down effect of big tax cuts to the corporate sector. There is too much of a divide in the community between those that are reaping benefits of an improving economy & those who can’t even see it in the distance. Labour at least appears to listen . Watch out Peter Dutton.

Bill Shorten has offered a new emphasis on commitment to improved living standards and improved real wages

Falling real wages were always overlooked by the federal LNP in the construction of their awful Tax Packages

Thanks for the article Denis!

Hopefully it’s a sign of a move towards a new way.

Focussing I’m looking after each other and our beautiful planet. Time is of the essence. Let’s bring in the golden age where we leverage technology to better the planet and our people.

Speaking of failed LNP paradigms, have a read of this:

http://www.abc.net.au/news/2018-08-04/huntingtons-disease-ndis-disability-pension-case/10071342

Congratulations to Susan Lamb for her incredible result.

Thanks Paul.

Fortunately we have this ABC Coverage and other critical media reporting to raise empathy for better management National Disability Funding with the full support of Centrelink.

Tonight’s ABC television news bulletin from Brisbane (4 August 2018) gave fair coverage of Brett Kelly’s blight. The editor deserves a an award for the quality of the entire news production.

The LNP Tax Packages will blow billions in essential government revenue.

ONP gained over 20 per cent of the vote in Longman in some disadvantaged polling booths.

This is very ironical as ONP finally supported the unfair changes to personal income taxes and would offer $7,500 per annum in tax relief for taxable incomes over $200,000 from 2024-25.Thanks to the Parliamentary Budget Office, the total cost of the changes is projected to be $144 billion over seven years.

Had Labor not won in Longman, ONP was prepared to review its opposition to the reduction in corporate taxes for the biggest banks and corporations with the support of other far-right senators.

Systematic tax evasion has reduced the potential revenue losses from the corporate tax changes. The precise revenue losses are unknown as there are no forward estimates beyond the 2019-20 budget period. GetUP estimates the revenue losses as $48 billion.

https://www.smh.com.au/politics/federal/revealed-turnbull-government-s-full-income-tax-cuts-to-cost-24-billion-a-year-20180605-p4zjkn.html

https://www.theguardian.com/australia-news/2018/may/23/labor-pressures-coalition-to-take-big-business-tax-giveaway-to-next-election

https://www.theguardian.com/australia-news/2018/may/23/labor-pressures-coalition-to-take-big-business-tax-giveaway-to-next-election

Many middle income earners have not looked carefully at their very limited short-term personal tax gains from the LNP’s tax plans. Current LNP personaliities are not likely to be around in politics in 2024-25 when the most inequitable aspects of the personal tax changes are destined to be rolled out.

Planning for fiscal changes 2024-25 is a political illusion in a volatile global economy.

The worst cut of all was the delivery of $35.6

Thanks for your analysis, Denis.

What struck me was the bold statement by Turnbull that the by-election in Longman was a contest of the leadership between himself and Shorten and clearly the electorate voted Turnbull down.

Admittedly, in staging the by-election in that way, Turnbull was also distancing himself form the very average candidate the LNP had put forward in Longman.

Dennis Bright, we well remember Murdoch’s payoff of a let-off for nearly a $ billion chased by an ATO that that then got told by Abbott to let go of it. Then all the other freebies for “friends” like Rinehart, another IPA sponsor, the IPA plan being the 75 point manifesto for the de-democratisation and looting of our country, so often commented upon here, that brings so much grief to people at the bottom of the heap here in Australia and so much glee to right wing sadists.

The electorate exists in a dumbed down stupour that will only worsen as Fifield’s press and media changes really start to bite.