The LNP’s Banking Royal Commission: Enhancing Market Ideology?

Do the Terms of Reference in the LNP’s Banking Royal Commission challenge the growth of market ideology in federal LNP politics? Denis Bright reports.

The Turnbull Government has delivered some tame terms of reference for the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry. Expect some tidying up of malpractices within existing financial structures but little more as foreshadowed in the Royal Commission’s terms of reference (AFR Online 30 November 2017).

The positive outcome might be clarification of the responsibility of banking institutions in relation to the cyber-crime even if customers are required to pay an appropriate insurance levy.

The most serious short-comings of the Australian financial sector are likely to be left untouched by the Royal Commission. The oligopoly of the Big Four Banks may be opened to new players in Australia’s lucrative domestic banking market.

Systemic problems of household debt and a real shortage of public sector investment in public infrastructure and community planning at all levels of Australian Government are of course the responsibility of our political leaders.

Since the fall of the Berlin Wall, the federal LNP has been able to espouse its true Thatcherite ideology.

The Royal Commission can extend the parade with a rhetorical commitment to greater competitive forces in the banking and financial sectors away from the regulatory controls in the Reserve Bank Act 1959.

How Real are the Achievements The Mirage of the Market

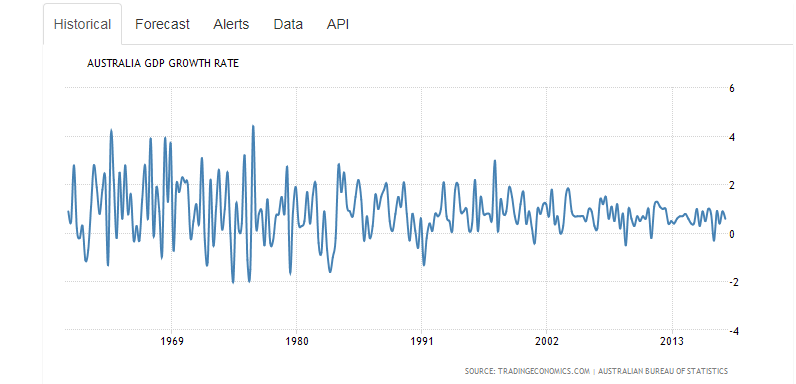

Population increases have greatly deflated the long-term economic growth data. Real changes in in per capita GDP between 1959 and 2017, average out at 0.89 per cent.

The boom bust cycles have certainly been tamed since the 1991-92 recession.

Negative levels of economic growth in per capita terms have since been confined to a single quarter.

The intensification of market forces since Australia’s recovery from the recession of 1991-92 has exposed every household to the effects of real estate booms in housing prices and rents. Should the global economy falter, householders will be locked into unsustainable debt levels on currently over-valued real estate.

The Need for a More Inclusive Economy

Earlier generations of wage-earners were protected from these debt levels in a more interventionist economy with by progressive industrial awards, commitment to full-employment and generous housing support programmes.

My deceased grandparents and their neighbours in Torch Street, East Ipswich lived in quite comfortable houses on single income salaries from Queensland Rail. Despite having a career for life, workplace accidents would take their toll which could be ameliorated through Work Cover Processes.

The market value of this house (see image below) at 7 Torch Street East Ipswich is now at least $400,000 which is at least seven times median Australian salary levels.

Image and valuation estimate from real estate.com.au

A spare neighbouring allotment at 9 Torch Street was able to be used by my grandparents’ first married daughter. Perhaps this was an example of social democracy extended to the family members after the ravages of the Great Depression.

Today’s problems of household debt are far more serious than Australian Government Debt levels which are constantly on the mind-set of LNP leaders.

Australian government debt levels are modest by world standards. They represent one third of total household debt levels in GDP terms and one sixth of all private sector debt. At a time of record low commercial interest rates, it is highly appropriate for business to expand with the support of the banking sector.

To its credit, the Australian banking system has refused to underwrite investment in transport infrastructure to support the Adani Carmichael Mine.

Recent press releases from the North Australia Infrastructure Facility (NAIF) still uphold the advantages of federal government largesse to business corporations involved in the resources sector.

There are no specific references on the NAIF site to the progress of the proposed federal government loan to support transport infrastructure to the Adani Carmichael Mine. Instead, there are new statements of the value of federal support to corporate entities (NAIF Online 4 December 2017):

“NAIF CEO Laurie Walker said due diligence was underway on 11 projects with an additional project in the execution stage.

‘The NAIF pipeline continues to expand and we’re excited about the opportunities that are coming for northern Australia,’ Ms Walker said.

‘It’s only a matter of time before many of these projects join the Onslow Marine Support Base in the execution stage, which occurs after an Investment Decision has been made.’

The projects in due diligence include:

- Five projects in Queensland, three in Western Australia and three in Northern Territory

- Three in the renewables industry, four in transport, three in resources and one in tourism.

- The median value of potential NAIF finance is $70 million with a total value of $1.9 billion

- The total project size for all 11 deals is $5.6 billion”

In this corporately driven society, Australia is a falling star in global ranking in PPP terms (PWC Online 2017).

The federal LNP’s old recipe of both reduced government spending and real wages have not translated into brilliant levels of corporate led economic growth.

As a banking specialist, Prime Minister Turnbull would be fully aware of these challenges. Offering substantial reforms, would threaten the long-standing rhetoric of the federal LNP with its commitment to old style corporate capitalism.

However, globalization has changed the old assumptions that market capitalism will always forge a better future for all if the role of the state is controlled by prudent federal LNP leaders.

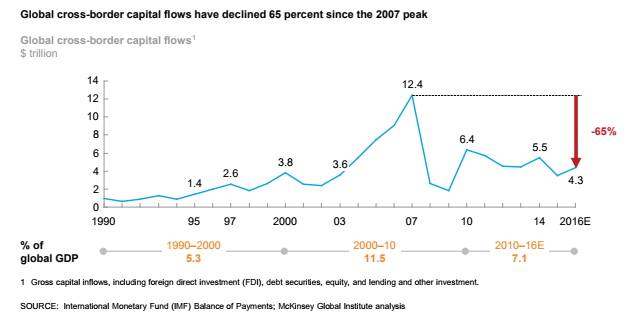

Reduced global capital flows now seek out lucrative financialization sectors internationally. Multinational investment in Australian commercial infrastructure and community development comes with more outrageous demands for corporate influence in the post-GFC era.

Global capital flows have declined by 65 per cent and moderately sized economies like ours are not in a good bargaining position as shown by the data from the McKinsey Global Institute in one of its latest papers in August 2017.

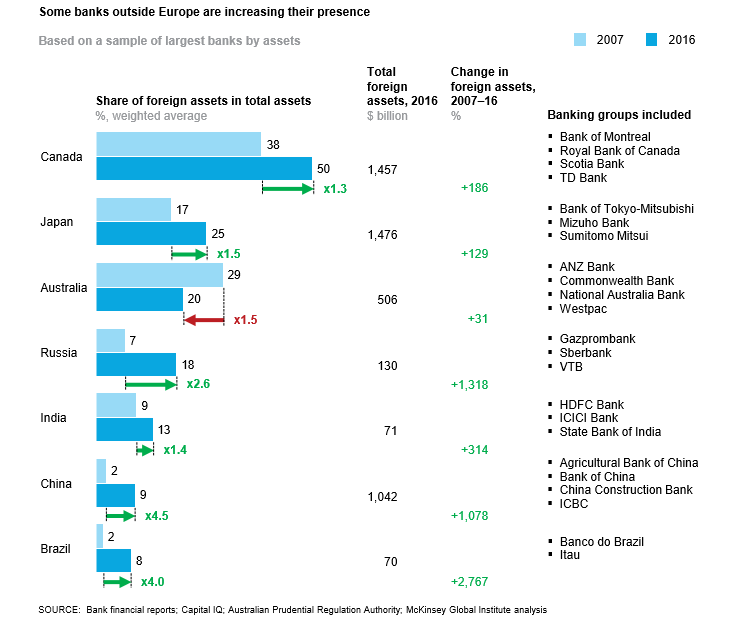

McKinsey Global Institute data also points to a more inward looking Australian banking sector. The share of foreign assets has declined from 29 per cent to 20 per cent since the GFC.

Pumping up a local real estate market and attempts to resuscitate the mining boom through support for projects like the Adani Carmichael Mine point the way back to yester-year in financial public policy when the National Party administered Queensland as a majority government.

Capital Investment Shortfalls and Political Consequences

Since the privatization of key sectors of Australian banking and financial sectors almost 30 years ago, new approaches are needed to fund initiatives in public infrastructure and community planning.

Since the 2014 federal budget, LNP leaders have not provided shortfalls for the funding of state and territory initiatives which do not deliver advantages to the corporate sector.

This ideological blindness extends to the funding of the vital TAFE sector which provides an excellent career path for school-leavers:

“Funding for vocational education has plummeted yet again, with data released today showing that government funding for the sector has been slashed by more than 31 per cent since 2012.

Figures released by the National Centre for Vocational Education Support (NCVER) today show a sector in financial crisis, with the TAFE system hardest hit by the cuts…. Under the Turnbull government’s watch, funding for TAFE has been slashed, the sector has been ravaged by the operations of for-profit providers, and billions of dollars of additional government funding have been channelled to the private sector. The activities of dodgy private providers have damaged the reputation of the vocational education sector, undermined TAFE, and left students with debts”.

The career prospects of new TAFE graduates are also eroded by cut-backs in federal funding for major infrastructure projects.

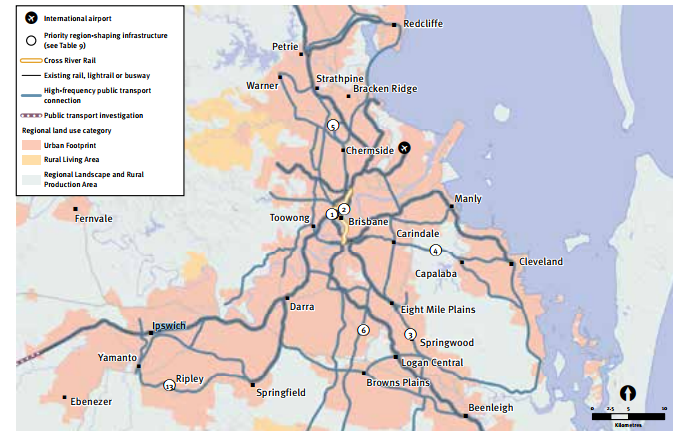

The Queensland Government must rely on its own limited financial resources for the Cross-River Rail Delivery Authority’s efforts through partnerships with private construction firms. As 2018 approaches, the project may yet be implemented on a reduced scale without the full possibilities available through federal funding.

Across Metro Brisbane, a divide has emerged between more affluent suburbs with a high Green vote and peripheral Struggle Streets.

Map Image from the South-East Queensland Plan: SEQ Plan 2017

In Brisbane’s peripheral growth corridors, One Nation intruded into Labor’s heartland vote at the recent state election. There were no political causalities this time in Metro Brisbane, just warning signs for future elections.

However, there were some real pockets of One Nation support. In the end, Labor retained the seat of Logan despite a challenge from One Nation which secured a primary vote of 30.9 per cent. There was a similar unsuccessful challenge in Ipswich West from a One Nation Primary vote of 28.2 per cent.

Legitimate goals in the SEQ Plan were left to be delivered by private sector developers due to curtailment of federal funding and the development of alternative investment capture funds to attract more global capital flows to support state development.

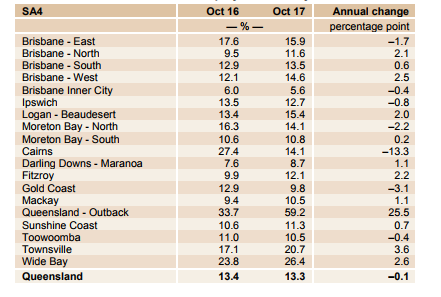

Double-digit youth unemployment prevails in all peripheral areas of Metro Brisbane. It is an even more serious problem in regional areas such as Outback Queensland, Wide Bay and Townsville (Queensland Government 23 November 2017).

The federal LNP’s opportunistic concerns about educational standards should be evaluated against both the decline of federal TAFE funding and ongoing cut-backs to federal-state infrastructure and community development funding.

Market ideology cannot offer real solutions to these problems. The wealth generated by corporate-led economic growth is a recipe for social divisions and a real challenge for Labor’s policy review committees before National Conference in July 2018.

Progressive alternatives must be owned by the strong support base of heartland communities as outlined in a previous article on the language of progressive politics (The AIM Network 7 July 2017).

From the close results of the state election in Queensland, it is certain that responsible alternatives to market ideology and trickle-down economics are urgently required in the lead up to the federal election. Real political risks must be taken to extend the Labor heartland with real solutions to household debt, falling real wages and underemployment.

This means challenging charades like the Banking Royal Commission on its existing terms of reference. Assuring federal LNP rhetoric is always good theatre but the rules of the rules of the political game now need to be changed to accommodate the extent of social disadvantage.

Denis Bright is a registered teacher and a member of the Media, Entertainment and Arts Alliance (MEAA). Denis has recent postgraduate qualifications in journalism, public policy and international relations. He is interested in promoting discussion to advance pragmatic public policies that are compatible with contemporary globalization.

Denis Bright is a registered teacher and a member of the Media, Entertainment and Arts Alliance (MEAA). Denis has recent postgraduate qualifications in journalism, public policy and international relations. He is interested in promoting discussion to advance pragmatic public policies that are compatible with contemporary globalization.

10 comments

Login here Register here-

Mia -

Lalnama -

Peregrine McCauley -

Paul -

Tristan Ewins -

Stella -

Tessa -

Jim_Rob1979 -

Chris -

Toby

Return to home pageMuch more reporting on this important issue is necessary .

Great in-depth article Denis, we can only hope for a change to Labour at the next Federal election

Even then what sort of social policies will they incorporate.

At least there is some hope the Royal Commission can be enhanced if there is a change in government & their terms of reference extended

It comes as no surprise the Banking Cartel has set the terms of reference for the upcoming , plastic Royal Commission , to investigate – Misconduct in the Banking , Superannuation and Financial Services Industry . Thirty minutes after taking directives from his former associates , our Prime Minister , Malcolm Turnspit , Moriarty

s servitor , publicly announced the Commission and its terms . A tried and trued stratagem successfully employed in Democracies , here and elsewhere . Travel back to 1913 in the U.S . Impending regulatory legislation loomed on the horizon . The Banking Autocracy seized the initiative , meeting in secrecy and drafting their own – reformist bill – , they created the Federal Reserve Act . Passed into law , a bill that enshrined absolute power over Government Sovereignty . A bill of right , to issue the country`s money supplies . A right to create money from thin air , and offload at interest , to an subverted nation . Eight men , war profiteerers , criminals , hold the bottom 50% of the planets wealth . Women and children in the tens of millions , bear the brunt of that wanton cruelness . Maybe the hard earned wealth of those said , will trickle down , and salve the evilness of the greedy poor .Thanks for the article Denis!

It will be interesting to see the outcomes of the royal commission.

I’m curious to see the impact of interest only loans on the housing market over the past few years. It’s a tricky situation now. Property is so expensive and this impacts of quality of life.

Thanks for sharing.

Thanks Denis ; I enjoyed reading that ; I would say, though, that part of the answer is to re-establish a public sector savings and loans bank. Imagine if the CBA had remained public and there was an additional $10 billion in revenue! But also a public sector savings and loans bank could involve a competitive charter which would result in better outcomes for consumers ; countering any collusion. Also consider the options for progressive cross-subsidies for disadvantaged consumers… If credit unions were supported, also, it could one day result in ‘the democratic sector’ becoming dominant in banking, finance etc.

Denis, thank you for an interesting, well researched article on the banking Royal Comission and implications for Auatralia.

The Old Australia produced the Commonwealth Bank with a vision for the future in 1912. Time for new creativity in today’s financial sector.

Transferring debt from the Australian government sector to households is is the enduring hope of neoliberals and should be challenged by Labor at every National Conference.

Malcolm Turnbull may be a banking specialist but his ideas are very ideological and wants every household to an agency of high finance

Let’s hope the LNP receives a real wake up in Bennelong this coming Saturday