Let’s have some truth

If we are going to have a conversation about taxation reform it would be useful if our Treasurer told the truth.

When asked about using the GST to fund tax cuts, Scott Morrison said “When you have the average wage earner in this country about to move into the second-highest tax bracket at $80,000 next year, you’ve got a problem with the incentives in your tax system.”

The most obvious reaction to this statement is wouldn’t it be easier to just change the bracket thresholds?

But beyond that, Morrison’s statement is misleading for several reasons.

Moving into the next tax bracket means you only pay the higher rate for the portion of your income over the threshold so if you if you are just above the limit it will make very little difference to the amount of tax you pay.

Moving into the second top tax bracket means you would pay an extra 4.5c for each dollar over $80,000. Because of the generous tax free threshold, the effective tax rate for this bracket ranges between 21.9 – 30.3%. This is never taken into account when making international comparisons.

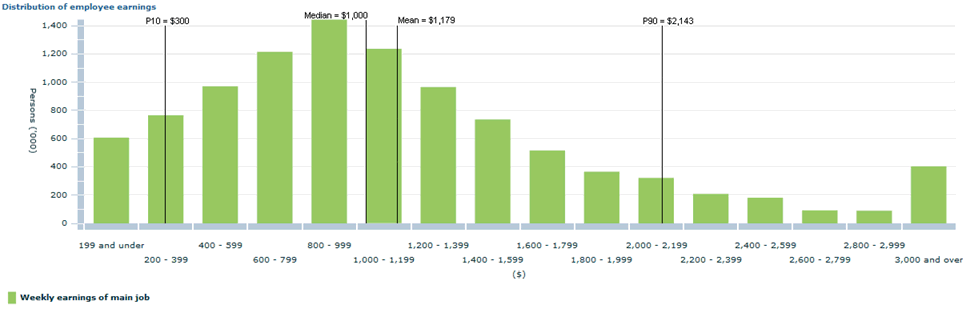

Annual income of $80,000 gives weekly earnings of $1538. According to the ABS, in August 2014, the mean weekly earnings of employees and owner managers of incorporated enterprises in all jobs was $1,189 compared to $1,156 in 2013, nowhere near the $80,000 limit and unlikely to get there any time soon.

What’s more, there is a glaring gender disparity. For males the mean weekly earnings in all jobs was $1,410 and for females it was $948.

It is not until we take the specific subset of ‘males working full-time’ that Morrison’s statement comes close to being true. Mean weekly earnings for full-time workers in all jobs was $1,448 ($1,592 for males and $1,264 for females).

But is using the average even valid?

As any high school maths student can tell you, when you have a skewed distribution, as is the case with income, the median (middle score) is a far more reliable measure of central tendency.

The median weekly earnings in all jobs in 2014 was $1,000 ($1,185 for males and $838 for females) ie 50% of employees earned less than $52,000 a year.

Part-time workers represent 32% of the workforce and understandably, their earnings are lower. Median weekly earnings for full-time workers was $1,200 compared to $467 for part-time workers.

The difference between the mean and the median demonstrates the asymmetric distribution of earnings, where a relatively small number of employees and OMIEs have comparatively very high earnings with some 400,000 earning over $3000 per week.

At August 2014, 10% of people had weekly earnings in main job below $300, while the top 10% had weekly earnings in main job over $2,143.

Income tax has become less progressive in recent times, due mainly to the succession of income tax cuts during the Howard boom years. According to The Australia Institute’s Matt Grudnoff, only 3 per cent of taxpayers are in the top tax bracket now, compared to 13 per cent 10 years ago, so any bracket creep is just redressing the profligacy of Howard’s vote buying.

Whilst progressive taxation goes some way to addressing income inequality, the rapidly rising wealth inequality in Australia is taxed very lightly.

On the latest figures available, the median net worth of Australian households – that is, their assets minus their liabilities – was $1.59 million for the top 20 per cent and $29,600 for the bottom 20 per cent in 2011-12.

The capital gain on the family home is not taxed at all, while that on other assets is taxed at half the rate of savings such as bank interest. Superannuation is taxed at a concessional rate that provides the largest benefit to higher income earners. The combination of the 50 per cent capital gains tax and negative gearing makes investment housing an attractive option for many, particularly higher income earners, while lower income earners are increasingly shut out of the market.

Unlike other developed countries, Australia has no wealth tax, inheritance tax or gift duties, although they potentially provide the most direct means of curbing rising wealth inequality

Most capital investment or entrepreneurship faces a substantially lower rate than the personal marginal rate – either through the CGT 50 per cent discount, or the company tax rate of 30 per cent or 28.5 per cent for small companies. If you sit at home and make $50,000 on trading shares you will be substantially better off than someone who works hard all year to earn the same amount.

The Coalition like to point to New Zealand whose top marginal rate is only 33% (ours is currently 45%+2% medicare levy+2% temporary surcharge) but what they fail to point out is that there is no tax free threshold in NZ – you pay tax on every dollar earned – and the top rate kicks in at $70,000 instead of $180,000.

NZ has a 15% GST, another fact Morrison like to point to, but they have no general capital gains tax (although it can apply to some specific investments), no local or state taxes apart from property rates levied by local councils and authorities, no payroll tax, and a 1.45% levy for New Zealand’s accident compensation injury insurance scheme. They have chosen a higher GST rate to fund government services.

Modelling from the Parliamentary Budget Office has shown that increasing the GST to 12.5% or broadening its base would raise the same amount as a carbon price of $28/tonne but cost households about three times as much hence requiring much greater compensation for low income households.

The solutions seem so obvious but conservative ideology will blind this government to what must be done and once again, those least able to afford it will bear the brunt of the Liberals ‘lower taxes’ mantra.

32 comments

Login here Register here-

David -

win jeavons -

Matters Not -

Kaye Lee -

king1394 -

Friday -

John Passant -

Kaye Lee -

michaelattoowoomba -

zhen -

Kaye Lee -

Matters Not -

Matters Not -

mmc1949 -

Kaye Lee -

DC -

Kaye Lee -

Florence nee Fedup -

Florence nee Fedup -

Dale Piercey -

Sean -

Kaye Lee -

Judith W -

Matters Not -

David -

Wally -

Matters Not -

Wally -

Matters Not -

Anon E Mouse -

Wally -

Divergent Aussie

Return to home pageMeanwhile those receiving by pension or earning under 20K, not a word of how the extra 3000 plus dollars added expense per year will be compensated for. He and his glossy cover PM don’t give a damn.

Time some-one put the maths of this debate correctly . Politicians should be punished for such distortions, as sadly too few of the voting public understands why medians are more accurate for such discussions (I used to teach it in my classes , but perhaps kids don’t see the relevance till too late ), nor is it clearly explained to the general public that higher rates only apply to top dollars. Thankyou!

.

Yes, as you aver, comparing tax arrangements, entitlements and the like across national boundaries is fraught with difficulties. As such, it’s a fertile field for those in the business of ‘misleading’.

While this should be well understood, the evidence is otherwise. The publication of ‘tax tables’ tends to ‘mask’ that progression because they provide only a bottom line. They don’t explain.

Stephen Koukoulas wrote a good article on Friday.

http://www.theguardian.com/australia-news/2015/nov/06/raising-the-gst-is-pointless-if-done-to-cut-taxes-on-the-rich

ME,

I had an employee ask me to not pay her in June because it would put her over $37,000 for the year. I think Morrison is purposely playing on this type of ignorance. Bracket creep is made to sound scary.

Terms like ‘fairness’ are also distortions. It might be fair to give every adult $50 … such a payment would be a nice bonus for some one on Newstart (so-called) but it would be insignificant to high income earners. We know that the GST is ‘fair’ because everyone pays the same amount on the same value purchases – but it is really very unfair. Even children spending their pocket money pay GST. ‘Fair’ has become another weasel word.

Wow what an education! You mob should be teachers??? If bracket creep is a scary concept then shift the bracket by a thousand dollars until we are taught the meaning or, as I heard today, put in more brackets??

As for truth whatever Morrison or turnover says is truth.

ps heard billy this morning sounding strong but on the abc.

pps packer used to boast no income tax and never paid full price for anything. Perhaps he also paid no GST?

Good article. I too was looking at NZ and was going to use the same argument. No tax free threshold. Also it was LaboUr in NZ who introduced the GST. This threw off some opposition to it although Labor did see a bit of a split to both left and right and lost the 1990 election. Almost 70% of those polled in NZ in 2010 before their Budget opposed increasing the GST.

In 1975 the Mathews Inquiry into Taxation and Inflation recommended income tax brackets be indexed to the rate of inflation. This was implemented from 1976, but was abandoned by the Fraser Government which moved to half-indexation after one year, and then abandoned automatic indexation completely in 1981. In 1982 the top marginal tax rate was 60%. It kicked in at 225% of average weekly earnings, very similar to today. Then it went down to 49% in 87-88 then 47%, then 45%. At this rate they’ll end up paying nothing at all. Oh that’s right, anyone with a decent accountant and enough spare money to invest already does pay next to nothing.

Well said as usual K L,clear and concise explanation of income tax details.Off topic,70% of pollies bosses[US as taxpayers]support same sex marriage,yet we supossably have to have an unbinding plebasite at huge expense,using that logic,we should have a referendom re TPP,not a hand picked committee,to decide whether to ratify same..Please keep posting wonderfull posts keeping us informed about facts we all need.Michaelattoowoomba.

Government did get rid of carbon tax a year ago, now they are trying to tax families with raising GST to 15% and widen it to fresh food, I just heard from Green’s that will hit poor families 3 times harder than carbon tax.

I don’t understand why and confused with what is Government supposed to do ?

Is it a real tax reform? Why is targeted on poor? One of the Key principle for tax policy is that any tax policy should designed to narrow the gap between rich and poor, so that will helps to build up healthy society. Is current tax reform against such aspect?

as they are already signal out the trend of reform, is heavy tax to families/householders a real intention of Tax reform?

Back business must based on taxing poor families?

Is that will be a national disaster if Austrians don’t consume enough fresh food to avoid GST hike for saving?

Everyone know that previous PM Tony Abbott has promised that never raise GST under LNP which was issued on behalf of Liberal party at last election, that should still available even the party leader had been replaced. Obligation for GST unchanged should restrains to new leader, otherwise, raising GST now will be a cheat for voters who voted for Liberal party, the promise Tony Abbott made not only on behalf of himself but also represented for the party. Voters do not like to see broken promises again and again without the leader who made promises.

If Australian people have the option to choose , they will choose to keep carbon tax instead of have to bear GST hike because that only one third of the living cost involved.( like Green said ).

Why not welcome carbon tax back instead of been forced to accept raising GST?

Pay less tax,(1/3 of 15%GST tax cost) and solve pollution problem for our environment at the same time, worth to try,

Very good reminding zhen. I just went back and reread the final update on federal Coalition election promises issued by Joe Hockey and Andrew Robb 2 days before the election.

“Today’s announcement also confirms that the Coalition will increase spending on hospitals, schools, defence and medical research – a far cry from the deceitful lies coming from the Prime Minister and the Labor Party that the Coalition would cut health and education.

It confirms once and for all that:

•There are no cuts to education, health, defence or medical research;

•There is no change to the GST;

•There is no “$10 billion fraud” as alleged by Kevin Rudd;

•There is no $70 billion black hole in the Coalition costings; and

•The Coalition will deliver a better budget bottom line than Labor.”

http://www.liberal.org.au/latest-news/2013/09/05/final-update-federal-coalition-election-policy-commitments

Trust Liberal promises at your peril.

So where to from here? While the ‘maths’, the ‘graphs’ and the like resonate with the ‘few’ (when it comes to regressive tax proposals and other forms of inequality), the ‘majority’, including the ‘youth’, play in a completely different intellectual ‘ball park’.

Seems to me that the evidence of ‘inequality’ (how it’s established and maintained) is well understood but the political action required to address (redress) same is ignored by those most affected.

The problem is both political ‘tactics’ and ‘strategy’.

Not sure which concept is most applicable. ‘Alienation’ or ‘Anomie’.

Durkheim or Marx?

Dear oh dear, even the Bolta thinks that Malaware is full of it:

Will the Bolta prove to be the ‘best friend Labor ever had’?

http://www.heraldsun.com.au/news/opinion/andrew-bolt/magic-puddings-a-fairytale-mal/news-story/e435953b2f114da0b4518d77c9fdda93

How do you stop people voting against their own best interests?

For the sake of argument, forget everything but education …. There are still more children (or grandchildren) in public schools than private, attending schools with fewer resources and bigger class sizes. Yet for the LNP to get over the line at election after election, there has to be a significant number of public school parents (and grandparents) who vote for more funding for schools their children (and grandchildren) will never be able to attend, at the expense of funding to public schools.

What hope is there of educating / convincing such stupid people when the issue is as complex as taxation?

The Greens even got a bit of media airtime and print space with their comparison of raising the GST with a carbon price. Malcolm’s ebullience and positivity sooner or later has to be backed up with some policy and some numbers. Their approach seems to be making the premiers take the blame for raising the GST – starve them of funds so they have no choice but to agree – but that’s going to be a tough sell if they intend using the increase to fund tax cuts instead of to make up the shortfall for the states in health and education.

MYEFO is going to be very interesting. Scott can’t use his “operational matters” obfuscation there and he is going to face a lot of tough questions – something he doesn’t handle well. The authoritarian ‘don’t you question me’ attitude won’t wash here and tragics like me will be checking his numbers.

The line “great big new tax on everything” could come back to bite them.

If they can keep hounding them about a carbon price comparison to the gst I have a good feeeling that the shallow Liberal spin will break down. You have Turnbull on record trashing Direct Action back when he was in opposition, and the libs just don’t want a light shone on this, all independent analysis is clearly showing the average family was better off under carbon pricing than they would be with a gst increase, carbon emittions went down under carbon pricing (& up again after the repeal), the economy was doing better under carbon pricing than after the repeal, every prediction the Libs made about the carbon price was wrong and so was their assumption that repealing it & the mining tax would translate to a strong economy. Also they have been lucky to keep getting away with this $550 savings per year figure for too long. It was 9% of a power bill so you would need to be spending $6,111 a year or $1527 a quarter on power to save $550/year/household. The more media attention on this the better. If labor wants to win they should jump on board with the greens on this & keep it in the spotlight

I just saw an interview with Scott Morrison. I really dislike his badgering tone. He sanctimoniously kept saying we want to have a conversation, everything is on the table, we are in a new phase of being consultative and collegial where decisions are based on outcomes rather than ideology, we want to hear ideas…..until someone brought up the carbon price comparison, at which time he immediately ruled it out. So much for no ideology and everything on the table.

Morrison is out spruiking this morning at a million words a minute, that one has no idea of the income tax they pay. Has added Medicare levy to that quote. I thought it would be more likely that one has no idea of the amount of GST in a year.

Long while since I worked, but the amount of tax plus medicare levy was clearly marked on every pay docket. Nothing about the GST I paid in a week.

Now we have to add great big changes to Private Health Insurance and Medicare.

Kaye, I believe he is having that discussion, debate with himself.

What I would like to be told is:

1.What percentage of people are on average wages and above?

2. What is the most common wage?

I think we will find average wage is irrelevant. Most people earn way below average.

I agree we should have some truth. And I agree with win jeavons that politicians that mislead the public should be punished.

Australia is not a highly taxed nation –

http://www.treasury.gov.au/Policy-Topics/Taxation/Pocket-Guide-to-the-Australian-Tax-System/Pocket-Guide-to-the-Australian-Tax-System/Part-1

Dale,

The graph in the article shows that the most common wage is $800 to $900 a week. As also mentioned in the article, 50% of people earn less than (or more than) $1000 a week. The average wage is $1189 a week.

There’s a huge difference between the average wage earner and the earner of the average wage, as you point out. Lies, damned lies and statistics…

This article presents basic concepts pretty simply

.

Even provides examples and exercises.

Judith, it’s not so much the ‘statistics’ that’s the problem, but the way they are (mis)used.

http://www.purplemath.com/modules/meanmode.htm

Sole recipient on the Age pension with no other income is expected to survive on $435 a week.that is existing on the basics just, but take those on Newstart at $250 a week they are below the poverty line, i don’t care what anyone thinks, that is cruel in a 1st world country., nay a bloody disgrace.

An extra 5% GST is a real smash in the face.

But all’s well in the land of the glam snake oil salesman, he offers the comforting words, everything is on the table. Oh I believe that Malcolm I actually do, its what will be swept off the table into the no thanks bin worries me.

We had 3 levels of Math in the last year of secondary school and math was compulsory, the lowest level taught students stuff they needed to know instead of trigonometry and parabolas. One of the main things the lower level taught was how to complete your own tax return and how to calculate/understand your tax liability.

I think learning to complete your own tax return should be compulsory subject, so many people don’t know how the tax system works and many believe that the highest tax bracket your wage puts you into applies to all of your income. Then when you explain that every Australian resident gets the tax free threshold and you explain how the tax system works they look at you in amazement. I guess if they were switched on the amount of tax they pay on their income would make it glaringly obvious.

Wally, I just watched (on a PVR) Morrison in Question Time assert that the average voter didn’t realise how much tax they were paying. In that regard, he’s spot on. Most people are ‘ignorant’ as to tax matters. And I agree that ‘ignorance’ is a real problem re a properly functioning democracy.

Why even those who advocate the wonders of the ‘free market’, advance the importance of ‘knowledge’ (perfect or otherwise) in a ‘market economy’. Who would disagree with voters having access to ‘knowledge’ so that they as citizens can excrete their ignorance and replace it with ‘realisation/knowledge’ and therefore make ‘rational decisions’?

And yet I recall Morrison arguing why ‘secrecy’ at so many levels was so important.

So I look forward to an extensive media and educational campaign explaining how the current taxation system works so that all people are better informed, before any change is contemplated. You know, so they can put their ideas, concerns and solutions on the table.

Can anyone provide me with the means of how I put my ideas on the ‘table’? Do I have to phone them through? Do I use ‘snail mail’, or perhaps communicate through some type of electronic device? Or do I simply attend one of the public meetings which surely will be held across Australia in the weeks and months ahead, which I imagine will be advertised in the immediate future?

Anyone know? Because I am ignorant.

Or maybe ‘ignorance’ is essential to what the current government is all about? Surely not.

Matters Not

Leading up to a recent state government by-election the candidates were asked several budget and taxation related questions, they could not answer any of them. I could not endorse any of them so I did not fill in the ballot paper, most year 12 students would have answered most of the questions and would be better prepared to enter parliament.

Wally, the idea that Local, State or Federal representatives should have expertise re budget, taxation (questions and answers) and the like is a nonsense. At a higher level, the ‘understanding’ that Treasurers such as Costello, Swan or whoever really drove the bus is also a nonsense. While they can be held accountable as to where the ‘bus’ ought to go, (the ideological outcomes) they never had/have any understanding of how to arrive.

The real roles of ‘Treasurers’ (and other Ministers) at the most basic and important level is to advocate for funding in the Budget process and then be the salesperson(s) of same.

Ministers who claim ‘expertise’ at an operational level are a real problem.

Anyone remember Brendan Nelson and ‘intelligent design’?

Tax is the focus of a lot of talk of late but it is all just proposals put up by minor players.

Is the tax talk a smokescreen to stop anyone looking into any further information on the failings of the electoral commission?

I am wondering if the GST talk up isn’t just masking other things, because no one is talking about how the commission stuffed up in the last election, or that they didn’t put in place the checks and balances they were supposed to in 2009 (I think it was).

Matters Not

You are correct but these were fundamental questions that anyone who thinks they have the skills to represent the people should know.

If I recall correctly one question was “What do you believe are budget priorities? A. Haven’t considered that.”

Even a reply such as “Haven’t looked from a budget perspective but my priorities are……” would have been acceptable.

In theory, the carbon “tax”, a consumption “tax”, similar to the GST, should have eventually lead to its own demise as carbon producing entities found less carbon intensive ways of producing the same stuff, electricity, steel, cement etc or there was less consumption of carbon embodied stuff. Thus, it was the perfect so-called tax as it raised revenue in the short to medium term with a long term objective of self-destruction, unlike the GST. The rhetoric now is absolutely and utterly crazy. We will have to have some form of carbon pricing to accelerate a transition away from carbon intensive stuff or we will fry. The bottom line is that holding a position against carbon pricing simply means you don’t believe in climate change. Repealing the carbon price was incredibly poor politics.