Forestry Plantations in Queensland and Victoria: From the Government Sector to Corporate Boardrooms

By Denis Bright

Until The Guardian noted the failure of HQPlantations (HQP) and HVPlantations (HVP) to pay any company taxes to the Australian Government between 2013 and 2020, old controversies about the privatization of forestry plantations in two states had simply faded from the political radar. The Guardian list should invite further investigations of corporate privilege from that long era of federal LNP tax largesse (The Guardian, 10 December 2021).

In Queensland, the ABC and the commercial media gave extensive coverage to the privatization of long-term management of state forests (ABC News, 6 March 2012). That was a long time ago.

Victoria was the first to sell the management rights to its forest resources to Hancock Victorian Plantations (HVP) in 1998 under the LNP Government of Premier Jeff Kennett for a negotiated price of $503 million.

The Queensland Labor Government followed a similar path in 2009 at a negotiated price of $603 million to Hancock Queensland Plantations (HQP) under a 99 year lease arrangement.

HVP is the administrative headquarters of both companies from the World Trade Centre in Melbourne. Let HVP try to explain the situation:

“Melbourne-based HVP is one of Australia’s largest private timber plantation companies. The company is owned by a combination of Australian, Canadian and US superannuation and investment funds.

Manulife Investment Management’s timberland group, based in Boston, acts as overseeing manager on behalf of investors. Senior management from Manulife Investment Management’s timberland group also represent U.S. investors on the HVP Board.”

The Manulife Financial Corporation in Toronto is not coy about self-promotion. This does not extend to an explanation of its Australian taxation exemption status which would be endorsed by the best advice from the company’s legal and financial experts. In the traditions of the Sheriff of Nottingham, Manulife could taunt critical opinion and the highest echelons of the Australian Tax Office with its exemption credentials.

Manulife’s Australian entities do retain many of the features of the pre-privatized public sector enterprises. Both groups maintain environmentally friendly web sites which rallied to support the inaugural National Forest Day on 30 August 2022.

Interested readers can obtain full profiles of HVP and HQP from Ibis World. Here is an extract from the profile of HQP:

“Hancock Queensland Plantations is managed by Hancock Timber Resource Group on behalf of a number of institutional investors. It is operating through its wholly owned subsidiary HQPlantations Pty Ltd, Queensland’s largest plantation timber company. HQPlantations manages a total of 328,849 ha and comprises 299,195 hectares of plantation license land. The company’s major products include: The company focuses on growing and milling southern pine, araucaria and hardwood.

Hancock Brothers’ Sawmill at North Ipswich was also supported by a rural sawmill at Kilcoy and smaller private forestry reserves. The background to the sale of these timber reserves seems to have slipped below the news radar during the privatization debate.”

In Queensland, HQP, acquired the management rights to the state’s forest resources into the next century under those 99 year lease arrangements.

Although FPQ recorded a loss of almost $600 million in the last year of its operations, this was not the usual situation.

FPQ’s final annual report explained this anomaly in accordance with Australian Accounting Standard (AASB). It included a $906M write down to fair value for plantation timber assets immediately prior to transfer to the department of Environment and Resource Management.

FPQ paid income tax to the Australian Government in those far-off days of corporatized public ownership of the state forests in two states.

Ironically, Manulife’s operations in Australia through HQP and HVQ places both entities on The Guardian Newspaper’s list of major companies which paid no company tax between 2013 and 2019. There may be a perfectly good explanation of exemptions from Australian company tax by multinational companies like the Manulife Financial Corporation. The company chooses not to respond to the taxation exemption list from The Guardian Newspaper.

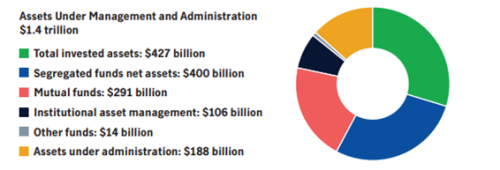

There are few signs that the new owners of our forest resources lack the financial capacity to pay taxation on their Australian operations. Critical profitability analysis by Infront makes the following conclusions about the Manulife Financial Corporation:

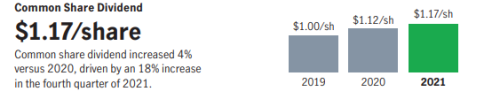

Share dividends from Manulife seem to be in a very healthy state in the latest company returns (Annual Report of Manulife 2020-21):

The LinkedIn profile for Manulife Investment, Management, Timberland and Agriculture (formerly the Hancock Natural Resources Group) provides more details of Manulife’s link to a global network of forest industries:

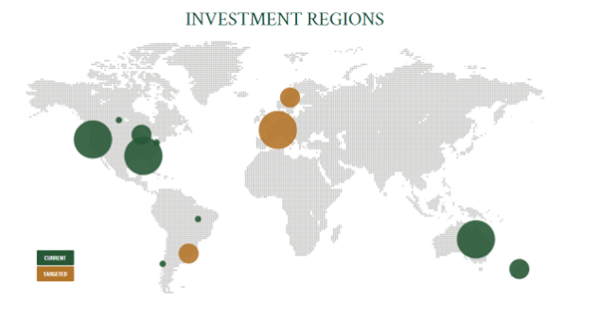

“Manulife Investment Management manages a diversified global portfolio of timberland and agriculture with forests covering 5.6 million acres across the United States, Australia, Brazil, Canada, Chile, and New Zealand, and farms covering over 400,000 acres of prime farmland across the United States, Australia, Canada, and Chile as of June 30, 2021.

With over 30 years of experience building and sustainably managing global forests and farms while contributing to the environment and local communities, we’ve become one of the world’s largest managers of timberland and agriculture. Our commitment is to the stewardship of our land: we operate in a way that improves our environment and nourishes communities.

As of November 15, 2021, Hancock Natural Resource Group adopted the Manulife Investment Management brand. Manulife Investment Management’s comprehensive private markets strategies include private equity and credit, real estate, infrastructure, timberland, and agriculture.”

Boasts about the profitability of Hancock Timber and Resource Group continue on the company’s web sites:

“Manulife Investment Management’s timberland business was founded in 1985 by foresters and investment professionals who believed that timberland provided investors with an attractive asset class to further diversify their portfolios.

We specialize in developing and managing diverse timberland portfolios on behalf of our clients. We offer a variety of investment products including individually managed accounts and commingled funds. Our investment services seek to provide investors with excellent capital preservation, portfolio diversification and attractive risk and return characteristics.

Our clients have assets located in Australia, Brazil, Canada, Chile, New Zealand and the United States. Assets under management total approximately $10.8 billion. Effective November 15, 2021, Hancock Natural Resource Group adopted the Manulife Investment Management brand.”

The company shares its plans for the expansion of its forestry operations in Europe where neoconservative government are likely to sell state assets as in Australia some two decades ago. With its new far-right government, Sweden might be a great target for the expansion of Manulife’s operations in Northern Europe and perhaps Russia in the future if longer-term plans for regime change gain momentum.

Australians might wonder just how the profitability of operations by the HQP/HVP Group are now lost in the forests and the farmlands under the control of the Hancock Timber Resources Group within the Manulife Financial Corporation. Let’s hope that the truth is out there and not permanently lost in the global corporate woods.

Denis Bright is a financial member of the Media, Entertainment and Arts Alliance (MEAA). Denis is committed to consensus-building in these difficult times. Your feedback by using the Reply button on The AIMN site is always most appreciated. It can liven up discussion. I appreciate your little intrusions with comments and from other insiders at The AIMN. Full names are not required when making comments. However, a valid email must be submitted if you decide to hit the Reply button.

Denis Bright is a financial member of the Media, Entertainment and Arts Alliance (MEAA). Denis is committed to consensus-building in these difficult times. Your feedback by using the Reply button on The AIMN site is always most appreciated. It can liven up discussion. I appreciate your little intrusions with comments and from other insiders at The AIMN. Full names are not required when making comments. However, a valid email must be submitted if you decide to hit the Reply button.

Like what we do at The AIMN?

You’ll like it even more knowing that your donation will help us to keep up the good fight.

Chuck in a few bucks and see just how far it goes!

Your contribution to help with the running costs of this site will be gratefully accepted.

You can donate through PayPal or credit card via the button below, or donate via bank transfer: BSB: 062500; A/c no: 10495969

10 comments

Login here Register here-

Phil Pryor

-

Pete Petrass

-

Indigo

-

James Robo

-

Norma

-

Tessa_M

-

Leila

-

Bella

-

rubio@central coast

-

Sinn Fein

Return to home pageThere appears to be monumental, huge, institutional thieving and plunder organised within legalised frameworks as the normal approach of cunning corporate raiders, predators, connected insiders. The people (who?) need levels of government income for essential national goals, including infrastructure, health, aged care, education, social services support, policing, etc. Why are the predatory parasites getting goodies and paying nothing except to investor groups. usually interconnected and conversant?

We used to be known as the lucky country, except now we should be the LOSER country. It would seem ALL of our natural resources are now just literally stolen (for free) by big international corporations.

What I don’t understand is why ANY government would just give them away. That is a monumental amount of tax that could benefit our country greatly.

Seriously, we need someone, some government to step up big time and cancel all these old contracts and at least make them all pay a fair amount of tax. The entire “system” is screwed because there are all these government, legal loopholes and other tax avoidance things that seem to be totally legal……………..and they should not exist at all. The rich get richer because of all these legal tax avoidance loopholes and it is high time they were all shut down.

I noticed that EU President Ursula von der Leyen referred to the social market concept five times in her recent state of the union address. This is a cherished concept which brought post-1945 recovery tio Western Europe. Hopefully, it will not be degraded by the return of high capitalism and militarism to middle powers globally at a time of heightened international tension.

Our forests are part of the spirit of the dreaming and should have been kept in government hands!

Having our forestry plantations being steered by overseas enterprises is a bit of a threat to our national sovereignty .

What do others think of this ?

Urban sprawl from Noosa to Coffs Harbour does not make for good planning. Higher standards are necessary and keeping our forests in public hands is so important.

Is our national identity lost in the woods? What’s wrong with government control of our forest reserves?

All companies need to be more transparent and accountable for paying taxes.

A good investigative piece. Public enterprises like the forestry reserves should not drift into foriegn hands. Directors are following the tax avoidance route against our national interests.

Animportant topic for the new treasurer and his staffers