Fancy a flutter with Sir Michael? – The hedge fund hegemony and their dystopian vision for the world.

By Hungry Charley

The Empire

The rise and rise of the financial services sector, following the catastrophe of the 2008 financial collapse and bailout has been remarkable. This is particularly so for those firms known as ‘hedge funds’ which have seen a massive growth in value since the ‘crisis’.

None more remarkable than the empire of Sir Michael Hintze. His firm, CQS founded in 1999, is currently listed as the third largest hedge fund in the UK. Hintze is reported to have added £120m to his fortune over the last year, with a personal wealth of £1.5bn.

He trails BlueCrest Capital Management, the leading hedge fund in the UK and owned by Mike Platt, whose wealth now totals £3.7bn. Second is Robert Miller and Princess Marie-Chantal of Search Investment Group, with £2.2bn.

But CQS has done very well, distributing some $87.5m in profits to its 36 partners in the 12 months leading up to the end of March 2019, according to recent accounts filed with the Companies House register. The highest paid director was handed $14.3m (£11.1m), up from $13.8m (£10.7m) in 2018. Though not specifically stated, this was probably Sir Michael.

The rise of CQS has indeed been remarkable, who now has a presence around the world, with offices in London, the offshore centre, the Cayman Islands, Hong Kong, New York and Sydney. CQS Australia was headed by ex-Liberal Party pollie John Alston between 2010-14. The company is a privately listed entity, registered in the Caymans and in the City of London, with Sir Michael the CEO and Richard Lockwood a Fund Manager.

A key player in CQS, Richard Lockwood had forged a successful career in funds management and mining investment and was the founder of New City Investment Management, with investments in uranium, gold and other mining ventures in Europe, Australia and Africa. He merged this firm with CQS in 2007. Lockwood also currently runs Kestrel Energy, which has acquired interests in developed and producing oil and gas leases and conducts exploratory and developmental drilling in the United States.

Hintze’s CQS investments in Australia are primarily in the agricultural sector, buying his first farm in 2007 near Goulburn in NSW, building up a portfolio of properties on the south west and north west slopes of NSW, managed through his company MH Premium Farms, mainly for beef, chickpea and cotton production.

His only publicly listed fund, the CQS Rig Finance Fund, Hintze invests in bonds sold by companies to build and upgrade offshore oil rigs. The bonds are secured by the rigs, which can cost $500 million. There are another seven CQS funds listed on London’s Alternative Investment Market (AIM) and about 30 listed in the Caymans.

The current board of CQS reads like a who’s who of the elite corporate world in the UK, the Chair of the Board is Sir Michael Peat who also serves as an independent non-executive on the Board of Deloitte UK. He was also the Principal Private Secretary to Charles, Prince of Wales and Camilla, Duchess of Cornwall between 2002 and 2011.

Non-Executive Directors on the Board include, Catherine Cripps (Non-exec Dir Goldman Sachs – also a non-executive director of the Nuclear Liabilities Fund and a trustee of the Nuclear Trust, which invests funds on behalf of the U.K. government to cover the cost of decommissioning Britain’s atomic power plants), Richard Hayden, former Australian foreign minister Alexander Downer, former UK City minister Lord Myners, former Chief of the Defence Staff of the British Armed Forces General Lord Richards, and chief executive of Rockefeller & Co, Jeffrey Reuben III.

Hintze, often thought of as Australian, having spent formative years in this country is actually born of British parents from China, his parents fleeing the threat of Communism in that country in 1949.

Today he is a key player in the City of London’s offshore empire. You only need to look at his awards and connections to gauge his significance, not only in the financial sector but within the British elite.

His awards speak for themselves. In 2005, Pope Benedict XVI made him a Knight Commander of the Order of Saint Gregory, in 2008, he was awarded the title Australian of The Year in the UK, in 2009, he and his wife Dorothy received the Prince of Wales Award for Arts Philanthropy, and in 2013 he received his knighthood from the Queen. Not too bad for the boy from ‘down under’.

Hedging Your Bets

But hang on, what is a hedge fund anyway and how are they different from more typical financial service organisations?

Betting for or against securities, particularly on the short-term market, is not a new phenomenon, though became prominent during the 2008 financial crisis. Even when it was obvious that the CDO (Collaterised Debt Obligation) derivative market bubble was going to go bad, in 2006, the leading Wall Street financial institutions (Morgan Stanley, Goldman Sachs, Lehmann Bros and CitiGroup) started buying up the insurance policies (credit default swaps or CDSs) that guaranteed the securities, off the leading insurer, AIG. This made AIG liable for any default on the securities, and when the market burst in 2008, it could not withstand the loss, taking the whole market down.

At hearings in 2010 it was revealed that Goldman Sachs alone, “peddled over 60 billion in securities, while secretly betting for a sharp drop in house prices.” They bought over $22 billion in CDS from AIG and then proceeded to bet on those securities it didn’t own. Essentially, the more money their customers lost – the more they made.

Hedging your bets today can take various forms. A definition would be that a, “hedge is an investment position intended to offset potential losses or gains that may be incurred by a companion investment”. It can use different types of financial instruments, including stocks, exchange-traded funds, insurance, forward contracts, swaps, options, gambles, many types of over-the-counter and derivative products. But what characterises the modern rise in hedging is the use of the ‘futures market’ and now includes futures contracts for hedging the values of various commodities, including energy, precious metals, foreign currency and interest rate fluctuations.

Today, a speculator seeks to buy investment protection to hedge the risk of default, a type of insurance, regardless of whether the speculator holds an interest in or bears any risk of loss relating to the bond or debt instrument. Also, investors can buy and sell protection without owning debt of the reference entity, known as “naked credit default swaps”. In this way, CDSs can be used to create artificial long and short market positions. Naked CDS constitute most of the market in CDSs today and they are still not subject to regulations that govern traditional insurance.

CQS is said to have a ‘credit-risk’-focus. This type of risk, normally the business of banks, is also a commercial liability for market traders. A market developed between banks and traders that involved selling obligations at a discounted rate.

At the forefront of this move and in an attempt to provide some sort of transparency to the emerging hedge markets, the Hedge Fund Standards Board was formed, which later became the Standards Board for Alternative Investments Ltd (SBAI) a company registered in January 2008, just prior to the Wall Street collapse. It is stated that the aim of this organisation was to “… develop industry standards in areas such as disclosure, valuation, risk management, governance, and shareholder conduct.”

But the Board is comprised of hedge and investment funds with founding firms including Marshall Wace, Cheyne Capital Management, Man Group, and of course Sir Michael and CQS. As of 2016, other Australian operators of note appointed to the SBAI Board include Chris Gradel, founder of the Pacific Alliance Group (PAG) and David Neal as Chief Investment Officer, who also is the managing director of the Australian Future Fund. While SBAI was a public attempt to bring transparency to the hedge fund sector, in reality, it was like putting a fox in charge of the hen house.

Relax, it’s a risky world

Hintze has shown he is not afraid to make significant hedges on the market, as his intervention in the Australian currency showed in 2013. He later told the Business Insider it was part of his “patriotic duty” as his friends in the banks were worried about the high $US-$Au exchange rate.

CQS lists Brexit uncertainty as a key risk for its business in its account documents according to Business Insider. The company said it “ …actively monitoring political developments to counter the risk”. Hintze however likes to play down the significance of world events, as he told the Australian Financial Review in October this year.

“Brexit feels important here [in London], but in the world as a whole it doesn’t really matter”.

But recent levels of short-term bets backing a no-deal Brexit has shown the hedge funds are taking sides and the implications of Brexit are likely to felt well outside the borders of the UK. In October this year it was also reported that £4.6 billion of “aggregate short positions” on a no-deal Brexit crash-out have been taken out by hedge funds. These are the same hedge funds that have directly or indirectly funded Johnson’s recent political campaign, including CQS.

In fact, Hintze’s (and other hedge funds) donations to the Conservative Party and support for Brexit are well known.

Sir Michael likes to promote debate on one issue in particular and that is climate change. He has done this through supporting various think tanks and organisations and sponsoring Chairs at various Trusts and University centres in the UK and in Australia. Two of these here are the University of Sydney UK Trust and the Centre for International Security Studies, also at the University of Sydney, for which he established a chair in 2006.

On the issue of climate change, it seems Sir Michael is taking a bet each way on this one. While supporting climate denying think tanks such as the Global Warming Policy Foundation in the UK, his financial backing of the CISS at Sydney University has seen firstly the appointment of Professor Alan DuPont who advocated strongly for action on climate change. Then the appointment of Prof. James Der Derian in 2012, who holds the directorship to this day. His projects have painted a dystopian future unless we grapple with some key issues in a timely manner.

Project Q is the Centre’s current focus and has received over $1.6 million in funding from the Carnegie Corporation in the last few years. ‘Q’ stands for Quantum and the project may be described thus:

“Project Q is our coda to Einstein’s fears, hopes and ultimate lament, which will be distributed to world leaders as well as the general public through multiple media. Project Q will engage peace and security scholars as well as physicists and philosophers, diplomats and soldiers, journalists and filmmakers, historians and futurists in a critical dialogue on the peace and security implications of a quantum age”.

A video outlining the areas of research can be found here.

Project Z was an earlier work that Prof Der Derian initiated prior to his employment at the CISS and focussed the implications of impending global catastrophes, and our readiness to deal with them. While recently taken down from the CISS website, the trailer to a 70-minute video can be seen here.

Key future dystopia identified were pandemics and climate change refugees, also referred to as a ‘zombification’ of the world population. Ok this is weird.

Hintze is generally seen as a well-informed risk taker. But he sees himself as more than that, and despite his public modesty, he clearly thinks of himself as a player in international affairs. Having an influence in world events and shaping opinions is an important strategy that Hintze sees will place his firm at a distinct advantage. Whether it is currency or the property market, political events, political donations and elections to global catastrophes, it seems Sir Michael has some very good ‘inside knowledge’ and given his connections within the UK and Australian elites, one to follow for a little flutter on the future.

Perhaps more concerning however is the relentless expansion of the tax haven and offshore financial sectors not just in Australia, but globally. Most hedge funds in the UK operate out of offshore entities, like CQS. As CQS is registered in the Caymans, Hintze pays little tax here, after all he advised the Abbott Government on how to manage the financial system in 2014 though was found guilty and fined in the UK for tax avoidance in 2013, amounting to some $43 million in a settlement with the UK taxman, apparently after his companies were found to have used ”employee benefit trusts” as a means to avoid tax. However, in 2011 it was reportedly that CQS generated $154 million but only paid an apparently modest $55,000 in corporation tax. The tax fine was merely a blip.

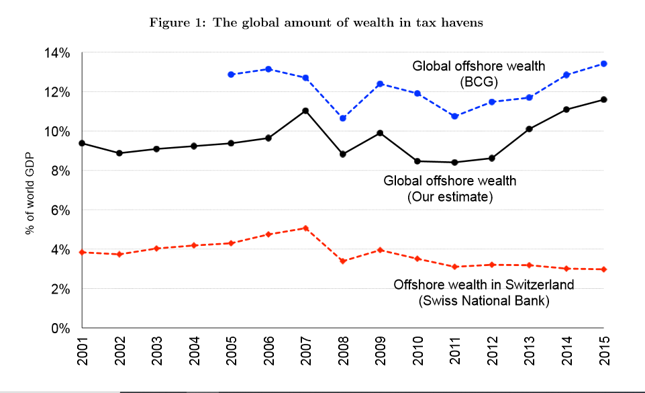

The growth of the offshore financial sector, together with increasing trends for tax avoidance and money laundering as a result is perhaps the key economic issue of this century. A 2017 study on the extent of national wealth contained in the offshore havens globally, backed by the City of London was estimated to be about 10% of world GDP or about $10 trillion. While levels of wealth contained in offshore havens varies from country to country, this figure rises to about 15% in Continental Europe, and to as much as 60% in Russia, Gulf countries, and in a number of Latin American countries. In Australia it is about 7% of GDP.

But because offshore wealth is concentrated at the top, it increases the top 0.01% wealth share substantially, even in countries that do not use tax havens extensively. The 2017 study found that offshore wealth has a large effect on inequality around the world, particularly countries like the U.K., Spain, and France, “… where, by our estimates, 30%–40% of all the wealth of the 0.01% richest households is held abroad.”

Some observers contend that a Brexit deal is not only desirable for big finance (as it will avoid looming EU restrictions) but will open up opportunities for the offshore unregulated market to expand. Not the least because the City of London, which backs the unregulated offshore system, is at the centre of ‘spider-web’. And the City has its eyes on Australia, one of the largest foreign investment destinations in the world. After all, Sir Michel has done so well already.

As the Lord Mayor of the City of London, Peter Estlin, said recently while visiting Australia,

“The UK’s relationship with Australia is already very strong, but there is still so much more that we can achieve. For example, our unrivaled Fintech and green finance expertise can help remove barriers to international investment and business, creating jobs and prosperity and unlocking opportunity.”

As Prime Minister Tony Abbott said, “We’re open for business” and there is little indication that the current government leadership sees things any differently, As the sharks circle, there is little reason to think the ongoing flight of capital, as the #watergate fiasco exposed, into the ‘dark economy’ will subside, unless we as a nation decide to take the necessary measures to ensure wealth generated in this country is taxed and stays in the country. Measures being developed by the EU could provide some opportunity for public accountability, given a little political will here to do so.

“The Spider’s Web – Britain’s Second Empire” documentary 2018.

Like what we do at The AIMN?

You’ll like it even more knowing that your donation will help us to keep up the good fight.

Chuck in a few bucks and see just how far it goes!

4 comments

Login here Register here-

FundHedgehog

-

paul walter

-

Hungry Charley

-

Hungry Charley

Return to home pageA+ outstanding work.

Fascinating and raises so many subsequent questions you don’t know where to start.

CQS now has 50 companies listed in the Caymans https://en.datocapital.com/_search?q=CQS&dirf=0&country=KY&list=1

Reference missed detailing how Goldman Sachs helped drive the Wall Street market to the bottom in 2008. Goldman Sachs still leads one of the largest hedge funds in the world. https://www.mcclatchydc.com/news/politics-government/article24561376.html