Dear Mr Murdoch

By Bob Rafto.

Dear Mr Murdoch

Life’s good for an old fella it seems and may you live long to enjoy it. However, there is a growing chorus of voices who would prefer that you don’t.

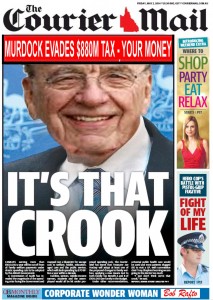

What I wish to write to you about is my disgust towards your attitude that Australia is a mere entry in a balance sheet: one where paltry tax is paid but where your yields and power are great. One where you are able to squeeze $882 million from a Murdoch friendly government. One where you can be seen in the likes of Google, Apple and Microsoft (to name a few) and collectively benefit from the ‘legitimate’ evasion of what denies Australia an alleged $10Billion in taxes.

The Australian tax system has been designed with its current rates to generate sufficient tax revenue to help meet Australia’s many needs. Yet you, Mr Murdoch, are our country’s greatest risk as you endeavor to avoid paying your share of this tax. This all adds up to not only derailing our economy but denying services to any number of Australians.

The Australian tax system has been designed with its current rates to generate sufficient tax revenue to help meet Australia’s many needs. Yet you, Mr Murdoch, are our country’s greatest risk as you endeavor to avoid paying your share of this tax. This all adds up to not only derailing our economy but denying services to any number of Australians.

So in effect, as the society becomes less affluent it will impact on demand for goods and services and undoubtedly it will impact on your own profits, as it will on any corporation with business in Australia. It’s commonsense. On the other hand, if you paid your taxes you are helping to build the economy which in no doubt will increase the profits of your goods and services, yet you choose to be a corporate leaner on 23 million Aussies.

Australia is the country that catapulted you to become one of the richest and influential persons of your time and your thanks to this great country is to rip off its citizens with a behaviour that I compare to that of a common corporate thief.

I believe there was once an admiration of your achievements by the Australian public, however this sentiment has been changing rapidly over the past few years and the sentiment emerging is now one of hate.

In simple words, Mr Murdoch, you are a burden on the tax system. In my eyes you are stealing from us.

Keep this in mind, Mr Murdoch, if you and the others keep on taking and taking there will be a point when there will be nothing left to take.

Yours in contempt

Bob Rafto

22 comments

Login here Register here-

Kaye Lee

-

stephentardrew

-

Kaye Lee

-

donwreford

-

kerri

-

bobrafto

-

Michael Taylor

-

Jexpat

-

Matters Not

-

Sir ScotchMistery

-

paul walter

-

Mark Needham

-

Roswell

-

kevin hatt

-

kevin hatt

-

kevin hatt

-

Matters Not

-

Kaye Lee

-

Mark Needham

-

Matters Not

-

Sir ScotchMistery

-

Mark Needham

Return to home pageThe Coalition have just voted against their own bill cracking down on multinational tax avoidance because the Senate passed a transparency amendment which would make private companies of rich Australians disclose how much tax they pay. It seems they would rather have a deficit than let us see how little tax Gina pays.

Apparently a Liberal Senator is against it because companies could be “shamed into paying more tax than they are legally obliged to”. Yeah….right. According to the ATO, one in five of the wealthiest Australian private companies pay no tax.

http://www.theguardian.com/australia-news/2015/nov/12/protecting-tax-privacy-for-the-uber-rich-is-a-strange-thing-to-take-a-stand-on

Thanks for a great article Bob expressing just how many of us feel. As usual you contributions are informative and enlightening Kaye.

The Guardian does a good job of keeping us informed Stephen. Rereading that story it occurred to me that the government makes me pay too much tax most years and I have to pay it in advance. They never give me any interest on their overcharging either. But hey, we people in small business must carry our weight.

All part of the Mafio Zionist affiliation.

Bob Rafto you are a man after my own heart! I detest Murdoch with every fibre of my being! I regularly post Facebook comments asking people to shun any media that may in any way benefit the old turd.

I have christened my speyed dog’s empty scrotum Rupert in Murdoch’s honour!

For your reference dear reader

https://en.m.wikipedia.org/wiki/List_of_assets_owned_by_News_Corp

Oh dear, I had the theme to this story and a highly respected chap by the initials of MT cut out the defamatory pieces and gave it a good polish, thanks Michael.

You can never be too careful, Bob.

Murdoch doesn’t care, and most Australians are too lame to even acknowledge their role in creating the monster, much less consider doing anything responsible to reign it in.

Quite the contrary at present.

When houses are sold, the financial ‘history’ is available, at least for the last two decades. This link shows how.

http://house.ksou.cn/

Same with companies.

Why not with individuals when it come to taxation records?

We know that tax records are ‘available’ in electronic forms, so why can’t we search same to see who pays what?

What’s up with transparency? What’s up with full disclosure?

After all everything is ‘on the table’ when it comes to tax reforms these days? Or maybe not?

@Michael T – you also can’t be too defamatory.

That is to say, the more the better.

But I respect and value your right to be able to afford a Sunday roast.

Thanks Bob Rafto. That skulking individual is the single most persistent cause of grief this country has had.

People wonder why Australia can’t progress and much of the reason is the way Ebenezer Scrooge has kept it paralysed so he and his mates can parasite off it.

As Packer said years ago, minimise his tax? Be an idiot not to. All fair enough.

But the chances of getting someone with some guts and ticker into the Federal Parliament, to write the correct legislation etc, is bloody impossible.

The woman or man, who will sort out all the Perks and Benefits of Politicians, the Tax of Companies, will get my vote.

Hopefully,

Anonymous.

Mark, you’ve reminded me of something regarding Packer.

Howard gave him a state funeral. So in effect the tax payers were funding the bill for the funeral of the country’s biggest tax evader.

Oh the irony.

Isn’t Newscorp a publicly listed company that you and I can buy shares in? It was last time I looked. I bet they pay more tax every day than Bob does in a decade

Very vindictive comments Kerri. What has he done to you apart from having a different opinion? Amazing!

Are you serious Matters Not? Taxation records should never be disclosed to other people. The first thing a lot of people would look up is celebs. Get real. It is none of your business what they do!

kevin hatt – Why are tax records not available? Please explain?

Why do you think people would be interested in ‘celebs’?

And it is my business when my taxes are raised because others ‘avoid’.

As for buying shares in this publically listed company, one can buy but not ‘voting’ shares. Did you know that?

kevin,

Rupert Murdoch’s 21st Century Fox pays 1 per cent tax. The Australian Taxation Office has only one company in its highest risk category for tax avoidance – Rupert Murdoch’s News Corporation.

And perhaps you are unaware of the BRW rich list if you want to look up how much “celebrities” are earning.

http://www.brw.com.au/lists/rich-200/2015/;jsessionid=9CC6C4AC10AFCBF0B19527CCE6D9C1B7

Again, as packer said.

“If you want me to pay Tax, or more Tax, then write the laws to do so. Otherwise, piss off and leave me alone”

It really is, that simple.

Tax records being made Public. Not a real fan of that, a bit “iffy” is the word. The public would drool over the “celebs tax records”. I mean look at the drooling of Kardashians, Paris bloody Hilton et al.

Pass the Legislation,

Anonymous.

I am appalled that Shane Warne’s privacy is invaded.

But why pick on Warne?

And who is paying for that ‘tax expenditure’? But it gets worse.

While there was no response from Warne et al I have no doubt that kevin hatt will be along to assert it’s none of our business but the GST needs to be increased by 50%. There’s much more detail here.

The ‘lifting’ must be done by the ‘poor’ while the ‘rich’ can do as they please. Provided it doesn’t involve the paying of tax.

http://www.smh.com.au/business/shane-warnes-charity-under-investigation-20151113-gkylcn.html

Little kev must have been getting drunk.

This is an excerpt from the Matters Not web link above.

“But the foundation does not release its financial records and is not listed with the national regulator, the Australian Charities and Not-for-profits Commission, which has stringent public disclosure requirements.”

Matters Not. You are spot on showing the little rooster to be part show pony and…but I digress.

Warnies charity, should be forced to be listed under the above regulatory acts. If not listed, then no charity.

All charities, fighting funds and not for profit organisations, should have the strictest, accessible regulations to ensure compliance to minimise ”scamming and skimming”.

Change the Legislation, so that this is nipped in the bud.

It will be well known in the ATO, ACCC, the Australian Charities and Not-for-profits Commission, the bastards who are being bastards who are milking the system and how they are getting around it.

So, change the laws.

Purely an aside, but having collected the Taxes, the Governments then tend to piddle it up against the wall. A few Private and Listed Companies, have had in place in their businesses, a Shrinkage and Waste department, measuring, recording these losses and then putting in place measures to reduce same. This is what is needed in Government, at all levels.

You know, you are right. We should be pushing for “change” at all levels. Hopefully someone will listen and bring in one or the other and correct the anomaly. Has to be more than one way to skin a cat.

Also Annoyed,

Anonymous.