Conservative Distortions: Images of Corner Stores from the Thatcher Era to Brexit

By Denis Bright

For neoconservatives, the quasi-religious devotion to corner stores might invite nostalgia for Margaret Thatcher’s modest family home above the corner store and post office in North Parade in the pleasant regional city of Grantham in Lincolnshire. Even Margaret Thatcher’s childhood dwelling has moved on to become an outlet for natural therapy medicines and has ceased to become the political metaphor for our global future.

Australia’s John Howard was a devotee of Margaret Thatcher (1925-2013). His thoughts were captured in an interview with Tim Stanley of The Telegraph to coincide with his attendance at the Thatcher Conference on Liberty in 2014 just a year after she joined the metaphysical spirits:

Mrs Thatcher was an early inspiration to Mr Howard, both as a radically conservative Treasurer struggling to get his way in a cautious Liberal government and as an intermittent opposition leader in the 1980s and 1990s. “Her great reforms were in what you might call the freedom areas,” he says, particularly in the labour market where both she and Mr Howard preferred the “freedom of contract” compared to the “corporate state” arrangement that was prevalent in Britain and Australia (“beer and sandwiches and all that sort of thing”). In her willingness to take on unions and the state, he argues, “she was the guiding light”.

Alas, debate continues in the town of Grantham in Lincolnshire on whether promotion of Margaret Thatcher’s heritage is beneficial for local tourism:

Rejected by London because of fears about vandalism and disorder, a controversial £300,000 statue of Margaret Thatcher will be erected in her home town of Grantham after a council planning committee voted unanimously in favour of it.

Standing at just over 20ft high, the bronze sculpture was originally supposed to be placed in Parliament Square in Westminster.

But now the tribute to the former prime minister, which will stand on a 10ft granite plinth because of fears of a “motivated far-left movement… who may be committed to public activism”, will be placed on St Peter’s Hill in the Lincolnshire town.

Ecofriendly corner stores are also fading from the scene despite the political nostalgia for the personalized service at the corner store. Householders in Grantham can avail themselves of supplies from British Foods, an Amazon subsidiary from one of its dark automated warehouses where robots don’t complain about wage theft in the packing departments.

Boris Johnson has moved on too but still likes the endorsement from the UK Federation of Small Businesses (FSB).

Boris Johnson has little or no affinity with the values of small business entrepreneurs. He is a confident career politician with strong establishment connections. This leadership style attracted a strong endorsement from President Trump who sniffed the mutual advantage of a Britain freed from financial ties to the European Union.

The late Professor Peter Gowan (1946-2009) of the University of London noted the close links between the financial establishment of the City of London and Wall Street.

The drive for scale and for increasing leverage leads on to another basic feature of the New Wall Street System: the drive to create and expand a shadow-banking sector. Its most obvious features were the new, entirely unregulated banks, above all the hedge funds. These have had no specific functional role—they have simply been trader-banks free of any regulatory control or transparency in their speculative arbitrage.

Private equity groups have also been, in essence, shadow trading banks, specializing in the buying and selling of companies. Special Investment Vehicles (sivs) and conduits are similarly part of this system. In the words of the director of regulation at Spain’s central bank, these sivs and conduits ‘were like banks but without capital or supervision’.

Yet, as a Financial Times report noted: ‘In the past two decades, most regulators have encouraged banks to shift assets off their balance sheets into sivs and conduits.’

The Brexit ideal which has been championed by both President Trump and Boris Johnson seeks to sever Britain’s more ethical financial ties with the European Central Bank (ECB). Since my first reading of Peter Gowan’s article, I have been intrigued by the need for an update on data which is now more than a decade out of date. This motivated my research for the current article.

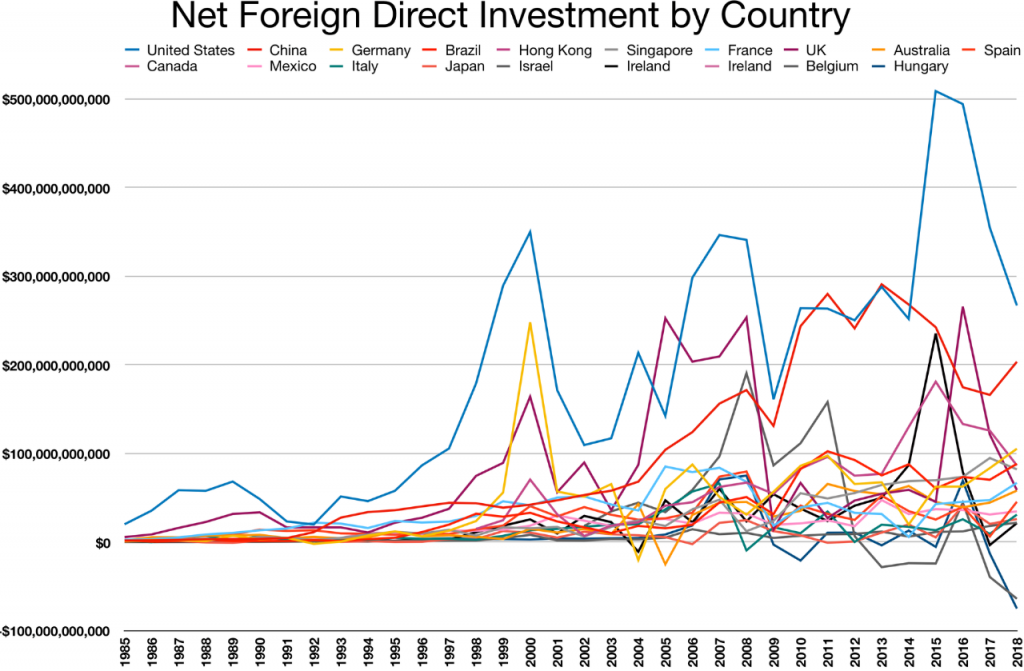

Conventional data for Net Foreign Direct Investment (FDI) highlights the financial power of a rising China in global investment. The combined FDI tallies for China and Hong Kong are indeed impressive. Likewise, Britain and the US appear to be in real decline as generators of real global investment (World Bank 2019):

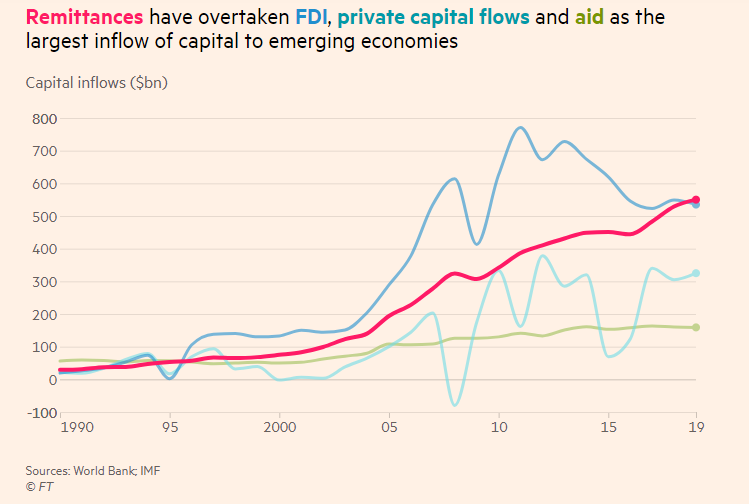

Prior to the GFC, assets to the value of 12-13 per cent of the global economy was on the move each year in global capital flows which extended far beyond FDIs. Even these FDI flows have tightened so much that overseas remittances by immigrants from developing countries to the First World have just overtaken FDIs (FT Online 15 August 2019):

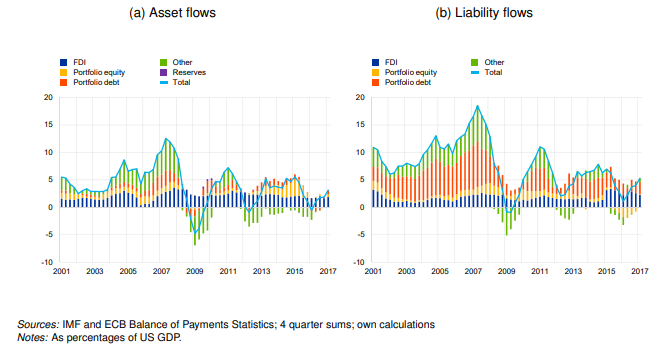

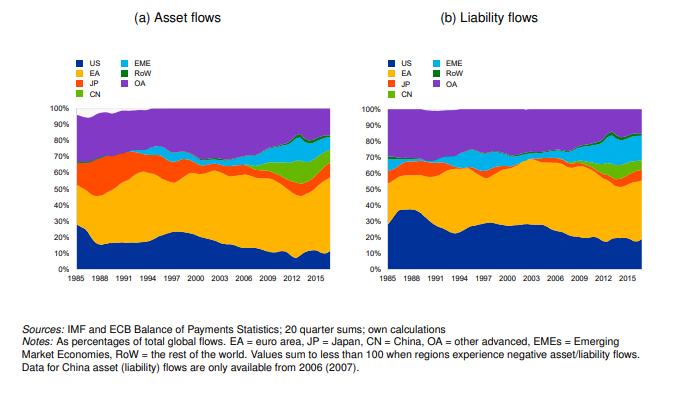

Thanks to the ECB, data is available on the fuller picture of global capital flows (ECB Working Paper 2238 in 2019):

Barracking for Brexit by President Trump and Boris Johnson removes the UK from the big swathes of asset liability flows which are centred on the European Union. It makes nonsense of the fable that China is about to overtake the US as the key generator of asset and liability flows.

There is a significant time lag in the availability of new data even for an article published in February 2019 by the ECB. There is a similar time lag in public data issued by the McKinsey Global Institute. Perhaps more up to date data is available through subscription to leading financial institutes. I do not have access to this data. This makes me more appreciative of what is available from the ECB web site through its Working Papers.

The message for Australians is to seek ways of diversifying our own economy with new sources of trade and investment. Just responding to the appalling June Quarter GDP investment data by calling for stimulatory spending is a reflexive response which invites new scare campaigns from the federal LNP.

Likewise, no amount of wage theft or tax relief and legalized tax avoidance for wealthy Australians or earnest commitments to balanced budgets from the federal LNP will turn the ship of state around.

One thing is certain. Complex and internationalised economies have little in common with the Robert’s Family grocery shop and post-office in the historic regional town of Grantham (UK). Even this piece of conservative nostalgia has a new life as an outlet for Living Health. This logo can hardly be applied to the British and Australian economies.

Denis Bright (pictured) is a member of the Media, Entertainment and Arts Alliance (MEAA). Denis is committed to citizens’ journalism from a critical structuralist perspective. Comments from Insiders with a specialist knowledge of the topics covered are particularly welcome.

Denis Bright (pictured) is a member of the Media, Entertainment and Arts Alliance (MEAA). Denis is committed to citizens’ journalism from a critical structuralist perspective. Comments from Insiders with a specialist knowledge of the topics covered are particularly welcome.

Like what we do at The AIMN?

You’ll like it even more knowing that your donation will help us to keep up the good fight.

Chuck in a few bucks and see just how far it goes!

Your contribution to help with the running costs of this site will be gratefully accepted.

You can donate through PayPal or credit card via the button below, or donate via bank transfer: BSB: 062500; A/c no: 10495969

14 comments

Login here Register here-

Michaela

-

Jon

-

Leila

-

James Robo

-

Tessa_M

-

Stella

-

Paul

-

rubio@coast

-

Denis Bright in Brisbane

-

Myles

-

Rob

-

Dave

-

Liz

-

Lara Gonzales

Return to home pageThanks Denis for your research which resulted in an easy to understand coverage of our times and a new take on issues like Brexit .

Labour must co-operate with the Liberal Democrats and the Scottish National Party to get Britain out of the Brexit mess.

Interesting perspective Denis, yes I agree we do need to trade with as many nations as possible and keep our options open in times of a downturn in specific economies.

Australia does not need to be dependent on one nation we need to determine our own values and trade agreements that benefit us not go against core values of the Australian people

Great work Denis

Progressives should not be comfortable with capitalist values. Google for example is short-changing the French government in billions of unpaid tax.

Spare a thought for the victims of wage theft and piece work. I see Pizza delivery couriers on bicycles who are paid $6-7 for a single delivery and are not covered by work cover as they are independent couriers. How low does Australia have to go down the spiral to appease multinational food outlets and in quest of the nostalgia for a corner-store led economic recovery?

Denis, Thanks for an interesting article about trade and investment and Brexit.

Thanks for the interest article Denis!!!

The complexities of the global economy are important to understand and it’s a a shame that politicians hijack it’s important with popular slogans.

Thanks for bringing to light these facts. Brexit is such a waste on the UK economy and no one is better of.

Keep up the great work of bringing these matters to our attention. I really appreciate it.

A challenge to the conventional viewpoint which sees small business as the wider for politics and the wider economy: Why do voters cling to such illusions?

A good article from the Guardian on the need for strategic alliances between Labour and pro EU parties as Labour may lose seats to the minor progressive parties in current polling trends.

https://www.theguardian.com/commentisfree/2019/sep/13/boris-johnson-win-general-election-polls-say-otherwise

Thatcherism has brought a race to the bottom in working conditions.

It is a mean spirited market ideology in Britain and Australia.

Very relevant to our situation in Canada where we live in the shadow of wall Street: The major source of global capital flows

We want a more Independent Canada that’s is not under the shadow of Margaret Thatcher and Queen Victoria.

Canada has had great success with its pension funds nationally and in Quebec which invests in infrastructure and community development here and overseas.

What hope is there for developing countries like the Philippines if Wall Street and the City of London prefer betting on hedge funds, derivatives and currency trading to real investment as shown on the declining FDI graphs.