Comedy without art (part 14)

By Dr George Venturini

After a year of front pages filled with the evidence of scandalous wrongs, rip-offs and greed in the banking world and financial services institutions, one kept wondering whether the Royal Commission’s Final Report could be seen as a guide on how to solve the financial sector’s ills.

Things had developed in a way of their own, inexplicable most of the time, and like tragicomedy always.

One may be permitted for comparing the disclosures – some of them of criminal nature – with the advent of what came to be called théâtre de l’absurde by Albert Camus in his 1942 essay Le mythe de Sisyphe, The myth of Sisyphus.

The work opened the way to a new philosophical theory or approach which emphasises the existence of the individual person as a free and responsible agent determining her/his own development through acts of the will.

Advanced mainly by European thinkers and playwrights after the second world war, it was systematised by European playwrights in the late 1950s.

The théâtre de l’absurde, theatre of the Absurd, is a post-second world war designation for particular plays of absurdist fiction written by a number of primarily European playwrights in the late 1950s. Their work focused largely on the idea of existentialism and expressed what happens when human existence has no meaning or purpose and therefore all communication breaks down. Logical construction and argument give way to irrational and illogical speech and to its ultimate conclusion: silence.

The theatre of the Absurd was systematised by one Pereszlényi Gyula Márton, born in Budapest, but ‘reconstructed’ as Martin Julius Esslin OBE after his escape in search of freedom from the invading Nazis. In his book, Theatre of the Absurd, written in 1962, he defined the subject as follows: “The Theatre of the Absurd strives to express its sense of the senselessness of the human condition and the inadequacy of the rational approach by the open abandonment of rational devices and discursive thought.”

Though layered with a significant amount of tragedy, the theatre of the absurd echoes other great forms of comedic performance, according to Esslin – from commedia dell’arte to vaudeville. The Absurd in these plays takes the form of a person’s reaction to a world apparently without meaning, or a person as a puppet controlled or menaced by invisible outside forces.

Morrison would not even begin to understand what this is all about, Turnbull would be too busy with his loadsamoney to care.

So,

- A) On 1 February 2019, right on schedule, the Commissioner, the Honourable Kenneth Madison Hayne AC QC, submitted his Final Report to the Governor-General. The Report was tabled in Parliament on 1 February 2019. Responding to 10,323 submissions – 61 per cent on Banking, 12 per cent on Superannuation, and 9 per cent on Financial advice, divided into three volumes, the second containing case studies and the third appendices, the Final Report runs for 1,133 pages and carries 76 recommendations.

Some of the main recommendations are:

- that the mortgage brokers be required to act in the best interests of the borrower

- that the mortgage brokers should charge borrowers rather than lenders

- that insurance providers be required to ‘take reasonable care’

- that funeral insurance be subject to financial services laws

- that there be a cap on insurance sales commissions for car dealers

- that there be a reduced cap on life insurance commissions

- that cold call selling of financial products be banned

- that ongoing fee arrangements be reapproved annually

- that ‘grandfathering’ of fee be stopped

- that banks no longer charge dishonour fees on basic accounts

- that banks no longer provide overdrafts on basic accounts without consent

- that there should be a national scheme fpr mediation of farm debt

- that there be an industry-funded compensation scheme of last resort

- that super fund trustees not be employees of the super fund owner

- that Australians be defaulted into one super found, once

- that A.S.I.C. employs court action as a ‘starting point’ for considering how to take action, and

- that an external body be appointed to oversee both A.P.R.A. and A.S.I.C. (A. Linden and W. Staples, ‘Hayne’s failure to tackle bank structure means that in a decade or so another treasurer will have to call another royal commission,’ theconversation.com, 5 February 2019).

The Final Report is generally available in electronic edition – too inconvenient to permit careful handling and cross checking of the information – while the hard copy is not available at the time of writing.

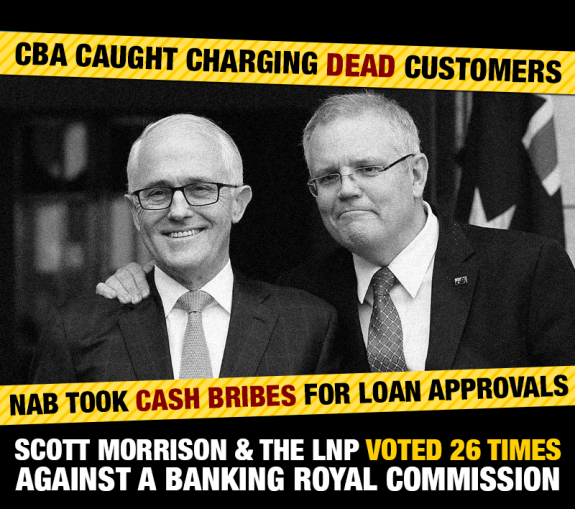

The Report was actually to a government which had voted twenty six times against setting up the Commission.

On 4 February 2019, with a view to ‘Restoring trust in Australia’s financial system’, the Australian Government issued a ‘Response to the Report’, in which it said:

“The Government has agreed to take action on all 76 recommendations contained in the Royal Commission’s Final Report and, in a number of important areas, is going further.

Commissioner Hayne’s recommendations and the Government’s response advance the interests of consumers in four key ways:

- Strengthen and expand protections for consumers, small business, rural and remote communities.

- Raise accountability and governance standards.

- Enhance the effectiveness of regulators.

- Provide for remediation for those harmed by misconduct.

In outlining its response to the Royal Commission, the Government’s principal focus is on restoring trust in our financial system and delivering better consumer outcomes, while maintaining the flow of credit and continuing to promote competition.

Today, the Government is announcing it is taking further action by:

- Establishing for the first time a compensation scheme of last resort and expanding the remit of the Australian Financial Complaints Authority (AFCA) so that they can award compensation for successful claims going back 10 years, consistent with the period examined by the Royal Commission.

- Compensating those individuals who had a prior unpaid determination in their favour by the predecessor bodies of AFCA, which will see almost 300 consumers finally receive compensation totalling around $ 30 million as a consequence of prior misconduct.

- Extending the jurisdiction of the Federal Court to cover corporate criminal misconduct, which will expedite cases that are considered by state courts and commonly take over two years to be heard.

- Commencing a capability review of the Australian Prudential Regulatory Authority (APRA) to be led by Graeme Samuel AC and conducting further capability reviews every four years.

The Government is confident that the actions announced today will put in place the necessary legislative framework, providing regulators with the power and resources to hold those who abuse our trust to account.

The Coalition Government, through both its actions to date and its response today, is demonstrating its commitment to ensuring a financial system that is working for all Australians and is one they can trust.

The Government would like to thank Commissioner Hayne for the outstanding manner in which he has conducted the Royal Commission and express its gratitude for the tireless work of those involved. We also wish to acknowledge all of those individuals who provided submissions and came forward to give evidence.” (Prime Minister, Treasurer, 3 February 2018, Media release).

But the ATM government knew much more than it was prepared to make available to the public.

And it is shown as follows.

- B) On 29 November 2017, the day before Prime Minister Turnbull appointed the Royal Commission, Dr. Ken Henry wrote on behalf of the four banks, presenting a draft letter to Treasurer Morrison.

Copy of the letter was obtained by the Australian Council of Trade Unions through a Freedom of Information request, and was disclosed on 4 February 2019, the day the Final Report became public.

The letter was part of a series of communications which show that the ATM government worked closely with the heads of the big banks – including former Treasury Secretary and then N.A.B. Chairperson Dr. Ken Henry – in the days before the announcement of the Banking Royal Commission.

The documents reveal that Dr. Henry provided then-Treasurer Morrison with a draft of a letter than the bank heads intended to send him effectively conveying consent to a Royal Commission, and outlining the terms of reference and timeline which best suited their needs.

The letter, signed by the heads of each of the big four banks, recommended a short inquiry with “thoughtfully drafted” terms of reference that “reports back in a timely fashion.”

After a minor change in wording, the letter was sent on 30 November 2017, reversing the long-standing opposition of both the banks and the Coalition Government to a Royal Commission.

This happened only after it became clear that the Coalition would lose a vote to establish a Royal Commission on the floor of Parliament. (‘Letter shows Morrison and banks worked together’, actu.org.au, 5 February 2019).

Here is the letter:

“30 November 2017

The Hon. Scott Morrison, MP Treasurer Parliament House CANBERRA ACT 2600

Via Email

Dear Treasurer

We are writing to you as the leaders of Australia’s major banks. In light of the latest wave of speculation about a parliamentary commission of inquiry into the banking and finance sector, we believe it is now imperative for the Australian Government to act decisively to deliver certainty to Australia’s financial services sector, our customers and the community.

Our banks have consistently argued the view that further inquiries into the sector, including a Royal Commission, are unwarranted. They are costly and unnecessary distractions at a time when the finance sector faces significant challenges and disruption from technology and growing global macroeconomic uncertainty.

However, it is now in the national interest for the political uncertainty to end. It is hurting confidence in our financial services system, including in offshore markets, and has diminished trust and respect for our sector and people. It also risks undermining the critical perception that our banks are unquestionably strong.

As you know our banks have acknowledged that we have not always got it right, and have made mistakes. Together with the Government and regulators, since 2014 we have been taking action to fix issues, and improve what we do and how we do it. We have collectively appeared before, or taken part in 51 substantial reviews, investigations and inquiries since the global financial crisis, 12 of which are ongoing. We continue to demonstrate our commitment to doing the right thing by our customers and seeking to ensure those genuinely affected by these mistakes are appropriately compensated.

A strong, well-regulated and well-governed banking system is in the interests of all Australians and is critical to job creation and fairness. The strong credentials of the banking system ensured Australians were spared the worst of the Global Financial Crisis, and have been fundamental to the ongoing performance of our economy despite global and domestic political turmoil.

We now ask you and your government to act to ensure a properly constituted inquiry into the financial services sector is established to put an end to the uncertainty and restore trust, respect and confidence.

In our view, a properly constituted inquiry must have several significant characteristics. It should be led by an eminent and respected ex judicial officer. Its terms of reference should be thoughtfully drafted and free of political influence. Its scope should be sufficient to cover the community’s core concerns which include banking, insurance, superannuation and nonADI finance providers. Further to avoid confusion and inconsistency, the inquiry must to the most practical extent replace other ongoing inquiries.

It is vital that the terms of any inquiry consider the many reviews and inquiries that have been conducted into the banking sector in recent years; the significant government and industry-led reforms that have been and will shortly be implemented; the 44 recommendations made in the Financial System Inquiry in 2014; and the broad and positive contribution that banks make to the Australian economy and to millions of customers and shareholders.

It is also important that any inquiry reports back in a timely manner so that we can have certainty about the findings and move forward to implement any recommendations.

We will work hard to ensure our contribution to any process helps to further strengthen Australia’s financial services system.

Throughout this, our focus will remain on our customers. We are proud of the work our people do every day to support them. That work continues.

Yours faithfully.”

The letter was signed by ANZ Banking Group’s chairman David Gonski and CEO Shayne Elliott; Commonwealth Bank chairman Catherine Livingstone and CEO Ian Narev; National Australia Bank chairman Ken Henry and CEO Andrew Thorburn; and Westpac Banking Corp chairman Lindsay Maxsted and CEO Brian Hartzer.

At the release of the letter and relative documentation, Ms. Sally McManus, Secretary of the A.C.T.U., commented:

“These documents show just how closely the [Turnbull Government and later] the Morrison Government was working with the big banks to shape the direction and limit the time available for the Banking Royal Commission.

The fact that the banks even provided Morrison with a draft of their letter to vet before shows the extent of this collusion. The banks must have believed they had an opportunity to influence the way the Morrison Government set up the Royal Commission – and they took it.”

Ms. McManus had a few, measured words about the Final Report:

“In light of the underwhelming final report from the Royal Commission’s report, it raises serious questions. Would a longer, better-resourced inquiry have led exposed even more deeply entrenched wrongdoing and recommended greater reforms? Would more resources have enabled the establishment of a law enforcement task force separate from the failed regulators ?”

The answer belongs to Mr. Jeff Morris, the whistleblower who destroyed his career to expose the behaviour at Commonwealth Bank and the abject failure of the Australian Securities and Investments Commission. He told The Business on ABC TV that we got a “quick and dirty royal commission … you don’t get that weight of evidence that leaves the condemnation beyond any doubt at all.”

“Professor Elizabeth Sheedy, a banking risk expert at Macquarie University, told ABC Radio she was disappointed with the royal commission. She conceded that there was a vague mention of criminal referral “but no one’s named”. She said, “This in itself is quite extraordinary. I would have thought it fairly normal for royal commissions to name names. The taxpayers who funded this royal commission have a right to expect that.”

[Actually Ms. Rowena Orr, Q.C., counsel assisting the Commission recommended criminal charges on several occasions, remarkably for A.M.P. over Clayton Utz report – but in vain. And other life insurers, such as Clearview, CommInsure, and general insurers such as IAG, AAMI (Suncorp), Allianz and Youi dolefully trooped in to the Commission and were also torn to shreds. The one thing one could say for the insurers is that they made the banks and super funds seem not too bad!]

In his report, Hayne wrote a powerful essay on the ethics of banking, the failures that were prompted by rewarding staggering misconduct and elevating greed above serving customers. But he has left it to ASIC and the Australian Prudential Regulation Authority to follow up on the 24 references for possible prosecution. These are the very regulators he found completely wanting.

He is calling on them to be properly funded so they can carry out the task. It’s here the government is complicit in the failure, despite its claims it has been acting from the day it was elected in 2013. In its first five years it ripped 200 million from the regulator’s budget, causing 200 lawyers and other staff to be sacked. It is now playing catch-up and boldly claiming leadership.

Economist and former Coalition staffer John Adams says the royal commission was “a whitewash”. He says it did nothing to change anything, leaving in place the “moral hazard” of not demanding the Big Four be forced into structural separation of their lending and advice arms. Adams points out that it was the same sort of malpractice on display in our banks, especially in credit practices, that led to the global financial crisis of 2007-08.” (P. Bongiorno, ‘The beginning of the end game’, 9 February 2019)

Ms. McManus continued:

“This is another piece of evidence that the Morrison Government is protecting the big end of town.

Scott Morrison has to come clean with the Australian people and disclose the full extent of their dealings with the banks in the lead up to this Commission.” (‘Morrison colluded with banks to water down Banking Royal Commission,’ msn.com, 5 February 2019) see also: (ACTU: ‘Henry, banks, Scummo colluded to shape Hayne,’ macrobusiness.com.au, 6 February 2019).

The correspondence was a revelation which underscores the close relationship between the major banks and the ATM government.

- C) After a year of front pages filled with the evidence of scandalous wrong doing, rip-offs and greed in Australian banking and financial services institutions, one may believe finally to have a roadmap – by courtesy of Commissioner Hayne on how to solve the finance sector’s ills. His Final Report may appear bold, full of commonsense and clear solutions.

Continued Wednesday – Comedy without art (part 15)

Previous instalment – Comedy without art (part 13)

Dr. Venturino Giorgio Venturini devoted some seventy years to study, practice, teach, write and administer law at different places in four continents. He may be reached at George.venturini@bigpond.com.au.

Dr. Venturino Giorgio Venturini devoted some seventy years to study, practice, teach, write and administer law at different places in four continents. He may be reached at George.venturini@bigpond.com.au.

Like what we do at The AIMN?

You’ll like it even more knowing that your donation will help us to keep up the good fight.

Chuck in a few bucks and see just how far it goes!

Your contribution to help with the running costs of this site will be gratefully accepted.

You can donate through PayPal or credit card via the button below, or donate via bank transfer: BSB: 062500; A/c no: 10495969

1 comment

Login here Register here-

paul walter

Return to home pageBerthold Brecht also… perhaps Herman Hesse, also in her own way Hannah Arendt and her observations regarding the banality of evil.

The last few years and months have been Theatre of the Absurd, full on, as blood and meanness flow in equal measure, forcing a person to laugh so as not to cry. Just reading Kay Lee as an example of someone with a good mind and human sensitivities and I could almost weep for her for her guts in toughing the unpalatable Attwood/ Orwell world it seems to be becoming. Me, Ive become sensitised to much of it, just numb.

As for the banks, it has been like resources policy, as criminality on a monumental scale is shepherded through by lunatics like Morrison and Angus Taylor at the behest of unnamed influences elsewhere.

Should we think of Franz Kafka also?