Can Australia really afford the ‘luxury’ of a Coalition government?

By Terence Mills

Call that a debt explosion … This is a real debt explosion!

Over the weekend Australia’s gross debt reached a record $500 billion – that’s half a trillion dollars – representing a massive loan repayment obligation for future generations of Australians and highlighting the monumental hypocrisy of the Coalition.

When gross debt reached $250 billion in 2012 the then opposition were howling about Labor’s ‘Debt and Deficit Disaster’. Joe Hockey – at the 2013 election – was bemoaning the massive imposition on future generations due to Labor’s debt catastrophe which he considered would put at risk the sovereignty of the Australian economy. But look at what’s happened since the Coalition came to office: gross debt has been increasing by $1.66 billion a month faster than under Labor and has grown by $381.7 million a week or $54.5 million a day quicker under the Coalition.

Before the 2013 election, Coalition MPs were scathing on Labor debt levels, paying no heed to the challenges of the global financial crisis (GFC) — the worst economic downturn in 80 years.

Tony Abbott and Barnaby Joyce were apoplectic about the interest payments of $6 billion a year depriving the people of Australia funding for schools and hospitals due to Labor’s delinquent and uncontrolled borrowing and drunken sailors were allegedly everywhere in Labor’s ranks when it came to profligate spending by a debauched government.

Interest payments are now $16 billion for this financial year and will be even higher next year and if global interest rate move upward, as it seems they may, the situation could be even worse.

But haven’t we been told constantly by our mainstream media that the Coalition are much better economic managers than Labor? Just last week, Turnbull said – when avoiding questions in Question Time – that the Coalition were committed to fixing Labor’s legacy of debt and dysfunction. This falsehood would soon be exposed if our major media outlets were doing there job but today’s Australian doesn’t even consider the debt explosion worthy of mention and the usual suspects who would be front and centre screeching doom and destruction if Labor were in office have nothing to say.

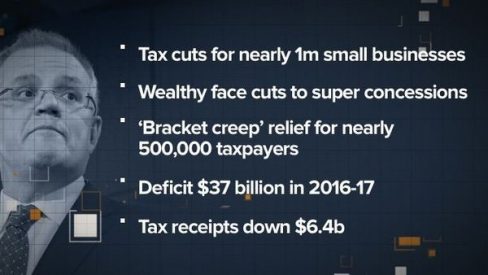

The debt ceiling has had to be lifted to make room for the record debt and yet the Coalition remain committed to their big-business tax cuts which, in May last year, Treasury secretary John Fraser told a Senate hearing would cost $48.2 billion over the 2016-27 period. But Mr Morrison has revised that figure to $65.4 billion for the decade (2017-28). This means that it will cost Australians $5.4 billion in extra interest for the government to borrow the money required to pay for its huge tax handout — the equivalent of $220 for every man, woman and child in the country.

Can Australia really afford the ‘luxury’ of a Coalition government?

18 comments

Login here Register here-

townsvilleblog

-

economicreform

-

Clean livin

-

Ricardo29

-

economicreform

-

passum2013

-

Mark K

-

David Bruce

-

Chris

-

Jack Straw

-

guest

-

helvityni

-

economicreform

-

helvityni

-

king1394

-

DisandDat

-

ace Jones

-

Andreas Bimba

Return to home pageWe have ordinary people who have been paid starvation wages for a lifetime of hard work, then on to the pension which continues the living below the poverty line style of life afforded to ordinary people in this country while the foreign corporations are free to plunder our economy and excused by this LNP government from having to pay income tax. If they pay anything in income tax at all its from 5% down to naught while the workforce continues to suffer. Unless you have the luxury of both partners working life is pretty difficult and we can feel another Great Depression coming due to this LNP government union bashing while giving the wealthy a huge tax cut, it can not end well.

” Australia’s gross debt reached a record $500 billion – that’s half a trillion dollars – representing a massive loan repayment obligation for future generations of Australians … ‘”

Wrong, wrong wrong!

Anyone who believes this narrative has no real understanding of macroeconomics, i.e. is simply an economic illiterate. Federal government borrowing from the private sector is largely undertaken in association with its deficit spending (and amounts to almost all of its borrowing). This borrowing is not carried out in order to raise revenue, as popularly supposed. Conventionally, there are three reasons why the borrowing takes place: (a) to provide the central bank with a mechanism for carrying out its open market operations via the buying and selling of Treasury securities, (b) to provide large institutional investors (pension funds, superannuation funds, insurance companies, etc) with risk-free financial assets for the purpose of balancing the risk profile of their investments, and (c) to provide a means of stimulating the economy, boosting aggregate demand and creating employment by injecting net financial assets into the real economy — which assets are needed by the private sector in order to promote its saving, spending and investing, thereby enabling the economy to operate in a healthy manner.

It should be understood that (monetary sovereign) central governments possess natural advantages over commercial banks and lower levels of government, in regard to raising the financial assets needed for funding capital works and infrastructure projects – and especially large-scale projects. One of these advantages is that a monetary sovereign always has the ability to meet its financial obligations. Always! Putting it another way, state governments and banks can be bankrupted if they borrow and spend unwisely, however a sovereign central government – the issuer of the nation’s currency – never faces that prospect.

Federal government borrowings can be rolled over at maturity, or easily replaced with new borrowings if necessary. And the aggregate of such borrowings never needs to be repaid. Indeed it is foolish to do so, because the Treasury securities play a vital role in the healthy operation of the national economy. The historical evidence clearly reveals that attempts to reduce the federal budget deficit with the intention of running a balanced budget (or a surplus) are inevitably followed by recession. Federal budget deficits are good and necessary. Surpluses are unnecessary and bad.

Future generations will never need to repay federal government debt. That belief is not grounded in reality, and has done much damage to the operation of our economy in the past and continues to damage it in the present.

A more constructive way to think of Treasury securities (bills and bonds) is not as “debt” but rather as a form of “broad” state fiat money. For this reason the shorter term securities (with terms of three months or less) are often described as “near money” or “cash substitutes”. An analogy is term deposits made by the public in commercial banks, which have some of the properties of borrowings and some of the properties of money. Whichever interpretation is chosen depends upon the context and circumstances.

Well, that’s all very interesting economic reform.

Perhaps you should tell the current mob on the treasury benches just that, including ABBOTT!

It may have alleviated the “Debt and disaster” that we were / are living through!

Look ER, I have really been trying to get my head around this MMT stuff but I can’t help thinking of magic puddings. If we can just print more money, isn’t that going to affect the value of the currency? I know there are those who think a lower value dollar is good, but see how much your dollar buys when you travel to, say England, Germany, Switzerland, or the US ( though why you would want to go there at the moment Is beyond me). So, ok a low exchange rate benefits exports but those who benefit aren’t the producers, they are the exporters and the profits they are making are based on exploitative prices to the real producers, which is one reason wages are stagnant, and why profits go offshore without proper taxes being paid. I would really like an explanation of how MMT can actually help the ordinary Australian, pensioners etc because if big deficits are ok, why aren’t we seeing the benefit of them?

” ,,, if big deficits are ok, why aren’t we seeing the benefit of them? ”

The answer Ricardo, is that we ARE seeing the benefit of the deficits. Because without them we would be in permanent recession. The history of federal budgets in this country, and almost all other countries shows that federal budget deficits are the rule and federal budget surpluses are the exception. Germany (and a couple of other countries) excluded, because it has always enjoyed strong exports and foreign sector income to compensate the nation for any budget surpluses. However it should be recognised that as a matter of simple arithmetic – in what is a zero sum game – it is impossible for most countries to be net exporters.

In Australia, federal budget deficits have been with us for over 80% of the time during the past century, and in the U.S. it is over 85% during the past century. A very large part of those deficits have been structural, rather than discretionary.

Part of the reason our economy is in trouble is that the current federal budget deficit is too small, as a percentage of GDP. It needs to be increased.

Eco you need to ask a Liberal National that one but be sure the answer will be a lie followed by many more lies till your convinced its the truth according to the Liberal nationalists

This article is so wrong

If you guys don’t want govt deficits then go and spend all of your money.

Howards 9 years of surpluses have indebted the private sector so household consumption cannot drive the economy.

Add the low wages growth, shrink noting bank credit and any trade deficit and you have a recessions n in the making.

Thanks for your briefing ER. When Malcolm Turnbull announced last year that the Australian Government would borrow $100Bn per year, each year for 3 years “just to keep the wheels of government turning” he wasn’t kidding. No one in the MSM at the time saw fit to publish nor comment. Since then we have had additional expenditure on Defence assets, and deployments in places we should never be fighting. At the end of the day, failing another windfall resources boom, it is the Australian tax payers who will be on the hook for repayments, either directly or indirectly. Our current money system is a farce based on usury and lies. Industry will be spending their money on automation, robotics, AI and other assets to streamline their operations and reduce costs. If your argument is correct ER, the Australian Government could fund a Universal Basic Income for every adult Australian, to ensure we do not enter another recession! As the trend in USA and other parts of the Western World already indicate, automation, robotics and AI will eventually replace 90% of jobs in the Finance Sector, and lesser percentages in all other sectors, including medical. Don’t even mention the Adani Coal mine project and their plans for automation!

Agree with EconomicReform to some extent as the author has the belief that taxes fund federal government spending. Wrong.

The entire welfare bill could be paid without reference to taxes or borrowing, simply by crediting the recipients accounts. The Federal Government issues its own currency and can never ever run out of it.

Banks create almost all of the new money when they lend to borrowers. It is the private debt overhang that is the worry, (not the $500 Billion owed on the Government’s balance sheet) with almost $160 Trillion in mortgaged backed debt supporting a total bank equity of $160 Billion. That’s some leverage, and when the economy and the government (austerity – we must balance our expenditures…) reduces their spending, there is a trickle down effect and other factors which are going to crash most of the real estate markets on the eastern seaboard – just a matter of when.

All politicians either believe the lie that taxes fund expenditures, or they know it is false. And, there are a whole lot of smart public servants and advisers who support the lie – perhaps in the belief that a government that is unconstrained by a budget would have too much power – there’s some truth in that I think.

Modern Monetary Theory (MMT) is the concept supported by many economists and truth sayers around the world. The author here should read up about it.

NO

So, when The Australian (June 17-18, 2017) says: “BER Waste Revealed: Labor’s $36m for closed schools” it is just a Coalition fabrication to try to offset their own massive “debt” ?

The authors of the article go back to their old Rudd/Gillard era Murdoch barrage of criticism, such as “The scheme was plagued by shoddy workmanship, over-inflated costs charged by construction companies, and complaints from schools that were forced to build facilities that they did not want under a cookie-cutter approach.”

Besides the usual Murdoch distorted presentation of the facts, there is a token reference to the Labor explanation that the aim was to stimulate the economy – and that it was internationally acclaimed.

Nor do the authors here say much about the “mess” created by building companies. It was all Labor’s fault, you know, wasting money.

Because, damn it, some of the schools have closed since 2013! How dare they! Change is not allowed in the conservative view of the world. So we have two women as witnesses, lamenting this travesty dumped on the school they attended – and a pic to illustrate.

The Orgill Report is also brought in the verify a $1.1bn waste – in a scheme which cost some $16bn to implement. That is, a 14% over-run? How does that compare with cost blowouts in other large projects, such as Turnbull/Abbott’s NBN?

So the poor Education Minister is trying to recover some of the “waste”. Is he serious?

Australia’s gross debt is now 500 billion, the highest ever. It was 250 bn when the Coalition came to power.

How can it be Labor’s fault ???

It is nobody’s fault helvityni, it is just an economic fact, independent of whichever party is in office. As I said previously, it should not be thought of as “debt” and nothing else, but rather as a net financial asset injected into the private sector. Without the federal budget deficit – and the corresponding Treasury securities purchased by the private sector – we would undoubtedly be in a deep recession.

economicreform, it’s not me who’s saying it’s Labor’s fault; it’s the mantra of the Coaltion.

Everything, be it possible or not, is Labor’s fault, just listen to Cormann and Co….

Helvityni: clearly the $500 billion debt is Labor’s fault because if they hadn’t left that $250 billion debt, the Coalition would only be $250 billion in debt.

Mr King you don’t make sense. No matter which way you look at it the coalition added $250 billion.

Australia has been pressed into prostitution by LNP, they all treat her like a slut, such vile and despicable people are our ruling class.

I’m catching up with reading some old AIMN articles hence my late comment. I’m not an economist, just a humble mechanical engineer but I have been interested in economics and politics all my adult life and I have put a lot of time into reading about the MMT approach to macroeconomics and have concluded it is all correct and extremely relevant.

Economicreform’s comments are all valid as are those made by other MMT commentors.

Although lies and misrepresentations about the so called federal government debt and any deficits are successfully used by Conservatives to attack Labor, Labor supporters should not use these same false arguments to attack the Conservatives as it plays into their hands. Yes the so called debt has increased substantially under the Conservatives but as mentioned this is actually a good thing as unemployment would have been far higher if it had not increased. The Senate blocked many of the spending cuts and some tax cuts for the wealthy so we must thank them.

The federal governments ‘debt’ is a measure of additional money that was spent into the economy which is essential for economic growth. The interest expense is also nothing to fear as it is met by adding it to the “debt’. In fact the issuing of government bonds is a separate parallel activity and these bonds do not pay for any deficits, money is simply created by the federal government when money is deposited into the accounts of recipients.

The federal governments deficits can be significantly larger before they become inflationary and the best approach is to adjust them upwards until we have full employment.

A UBI does not add appreciably to economic output and taxation receipts, unlike full employment and so cannot be funded at a livable level even with fiscal stimulus as inflation will result.