Abbott and the arts led recovery!

OK, I suppose that you all know that the Australian economy’s in a mess owing to Labor’s profligate spending which led to the GFC and all those unhealthy windfarms driving up the price of gas! So I do see the argument for tax cuts in an attempt to boost spending.

It’s just strange that Abbott government is still arguing that we need to return to surplus as soon as possible, while doing everything they can to ensure that this doesn’t happen. If the idea is that the tax breaks to small business is to stimulate spending, why not a tax cut for everyone? The average person was meant to get a tax cut on July 1 when the tax free theshold was lifted to $19400. but as Matthias “The Terminator” Corman said last month:

“By abolishing the tax-free threshold hike linked to Labor’s former carbon pricing levy, 10 million tax payers affected from July 1 will lose less than $2 a week

“The budget position is now improving, we are now on a believable pathway back to surplus.”

We are now on a believable pathway back to surplus? So up until now it’s been unbelievable? Anyway, we miss out on a tax cut but small business has been given one. Logically, one would have thought that the $2 a week might have been an enormous stimulus for small business, but anyway we know that this government is a strong believer in private enterprise.

And why not? After noticing some musician writing about “Stephanie” and complaining because he wasn’t enterprising enough to earn $300,000 a year, I took a look at some of the other examples on the government’s Budget website.

Clearly the musician writing the article was untypical of musicians in this country, because if you ticked “No” to the question about whether or not you were buying something for your business, you encountered Jacqueline who also earns $300,000, but can’t afford a paltry $2400 to buy a new guitar – even less when you take in the tax break!

Some of you may notice the striking similarity between the two guitars, so it’s pretty clear that Stephanie hasn’t bought her new one yet. (BTW – has anyone else seen the separated at birth photo of Abbott and Strop? Practically twins…)

With so many musicians earning this sort of income, one wonders why the Abbott government isn’t encouraging more people into the Arts Industry. We could have an arts led recovery, and the great thing about it is that there’s no limit to how many arts practicioners we could have. All those Toyota workers could be retrained as dancers or singers.

Anyway, it’s not just musicians who benefit from the government’s largesse in the Budget. Take Bradley. He’s in financial services, so he gets a car. And even though he’s on a taxable income of $166,725, he only buys a car worth $19,990, which just sneaks in under the $20,000 threshold. Lucky Bradley. Even though he’s in finacial services and not earning the sorts of income that musicians do. Yes, Lucky Bradley pays $7,625 less tax in 2015-16.

And it’s not only those battlers over $100,000 who get the breaks. Fish and Chip shop owner, Johnny, earns $51,125 and from this meagre income, he can purchase a new deep fryer worth $14,542. (Bad luck about the new shoes kids, but back in my day we used to wear shoes till there were holes in the bottom and then we’d pass them on to the younger members of the family who’d wear them until we ran out of younger children at which time, mother would boil the leather and use it repair the holes in the roof.)

Yes, yes, I know. Johnny would go to the bank and borrow the money, because what bank wouldn’t be aware that Johnny is probably not declaring his full income and probably has piles of cash hidden under the bed.

Rebecca owns a business. Now, she’s not going to buy a car because she’s a woman and doesn’t work in financial services like Bradley. Rebecca, of course, works in education, and in spite of the handicap of being female, she’s going to buy one of those new-fangled “interactive whiteboard” things.

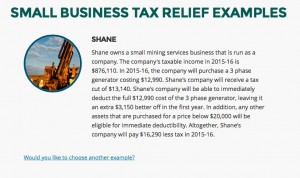

There so many industries I could have been there all day, but I decided to have a look at the mining sector before I called it quits. And surprise, surprise, the example in the mining sector was a bloke named Shane.

Shane is the luckiest of all, because he’ll be getting the biggest tax break of all the ones I looked at – a whopping $16,290!

Some very cynical people have suggested that Abbott will go to the polls early because he’s worried that the economy will get worse and the Budget deficit will grow to such an extent that even Barnaby Joyce will be able to see that it’s bigger than when Labor were in power. Well, with all these tax breaks, we can now see how the Budget is on a “believable” path to surplus. I mean, it’s not like there’s any problem with the revenue side of things, apart from a bit of a hiccup where the iron ore price has failed to stay at record highs. Once Greece gets back on her feet, iron ore and coal prices will soar like a Qantas jet.

No, the reason that Abbott will go to the polls early is to head off the challenge from Malcolm Turnbull who seems to have worked out that some members of the Liberal Party would rather lose than see him as PM, so he might as well try and make himself popular with the electorate by occasionally acknowledging that sometimes Tony Abbott goes a little bit too far. When Turnbull acknowledged that an ABC interviewer had a “fair point” last night, he was as good as telling Abbott that he was counting the numbers and, unlike Joe, he can get past ten without removing his shoes and socks.

7 comments

Login here Register here-

i have a nugget of pure green -

Matters Not -

Möbius Ecko -

Itsazoosue -

Metta Bhavana -

Rossleigh -

Lee

Return to home pagei love your sense of humour.

While Ross has a great sense of humour, his real strength lies in his political insights. They are superb.

Certainly the means of delivery are important (Marshall McLuhan) but it’s the underlying message that really hits home.

And he does so very, very well. Further, his attitude to ‘technical’ detail now excels also.

Really impressed.

Comes on the back of the news that the ATO is owed $35b in tax debt, 2.3% of GDP. The main offenders and the biggest late payers, small business.

So if they’re not paying tax in the first instance why not give them cuts to encourage them to pay something. Why don’t we all not pay tax or delay for as long as possible so we all can get a tax cut.

I needed a good laugh. Thanks, Rossleigh. Great piece.

What is the URL for this budget website?

@Metta Bhavana

http://www.budget.gov.au/2015-16/content/highlights/jobsandsmallbusiness.html

To find the examples, go down the page and see Small Business Examples. It gives you a number of drop down boxes from which to choose.

Thanks for a good laugh, Rossleigh.

“Once Greece gets back on her feet, iron ore and coal prices will soar like a Qantas jet.”

http://www.bloomberg.com/news/articles/2015-07-13/the-latest-sign-that-coal-is-getting-killed

Probably more like a Malaysian Airlines jet.