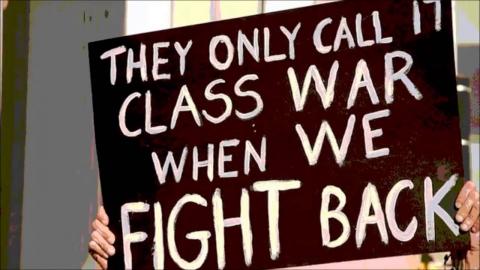

Bill’s ‘Class War’? ; Credlin must be Joking

“Bill’s low-rent class war” is scrawled across the pages of the “Herald-Sun” (6/7/17). Liberal operator and Opinion columnist Peta Credlin in full flight: defending the rights of the very rich against unconscionable calls to contribute to the common good.

Defending the wealthy and corporations against the ungrateful masses – who in the face of a cost of living crisis are feeling inequality more acutely than before ; and who scandalously expect tax evasion loop-holes to be closed ; for affordable housing ; for an end to punitive welfare ; for a modern living wage ; high quality public Health and Education, and so on.

Credlin asserts that “the top one per cent pay nearly 20 per cent of all tax.” And: “there are nearly four million households that pay no net tax after transfer payments.”

Further, Credlin draws on Roger Wilkins to argue “Australia is more equal today than forty years ago.”

And so Credlin infers that any kind of redistribution: whether through welfare or the social wage will drive “businesses and people offshore”; and hence Shorten is “[pushing] a hard left agenda.”

How to respond to this?

To begin, ‘the top 1%’ comprise people on incomes of over $227,000 a year ; and these would still end up with post-income-tax incomes of over $150,000. (calculated according to the income tax scales) They are not ‘battlers’.

Joe Hockey made similar claims in 2015 when he argued that “50% of all income tax in Australia paid [was] by 10% of the working population”.

We will deal with Hockey’s claims as a way of responding obliquely to Credlin’s arguments.

‘The Conversation’ concluded that Hockey’s claims were accurate , but put it down to Australia’s progressive taxation system. Without progressive taxation distributive outcomes would be skewed even further towards the rich, and against everyone else, especially the poor.

Therefore these figures must be considered in the context of rising income and wealth inequality. That is – the rich (including the top one per cent) are paying more tax because they are bringing in much more money. (at other peoples’ expense ; it does not ‘trickle down’ ; exploitation is a reality)

As I have observed elsewhere: Professor Robert Wilkins conceded that the portion of national income going to the top 1 per cent has approximately doubled since the 1970s to over 8 per cent, and that inequality is “high by modern standards” (‘the Australian’ (22/7, pp 1, 8).

And if we include the GST in our calculations we might acknowledge the fact that the wealthy also pay more GST because they can indulge in so much more conspicuous consumption.

The Conservatives in this country have also been concerned at the possibility that Australia may develop a European-style welfare state. But when put in context we see (admittedly according to 2009 and 2013 figures) that in 2009 Australia devoted just over 7 per cent of GDP to cash payments (welfare) ; compared with roughly 17 per cent in France. And in 2013 France devoted roughly 34 per cent of GDP to “social expenditure” compared with roughly 19 per cent in Australia. Even with very significant reforms such as I project in this article – we are nowhere near a “European style welfare state”.

The Conservatives also say nothing with regard the fact the Aged Pension takes the lion’s share of the social security Budget. They take the ‘aged demographic’ for granted ; but ultimately want a retirement age of 70. And when a greater proportion of Australians start retiring on their superannuation savings we might expect a more “frontal assault” on pensioners.

At only about 26 per cent of GDP overall levels of tax in Australia are in fact very low. Australia’s $154 billion social security and welfare bill (2016 figures) is also low by international standards, despite an obvious tactic by the Liberals of cultivating ‘downwards envy’ – intended to create resentment against the vulnerable ; often involving the distortion and misrepresentation of statistics. In fact the cost of social security and welfare in 2016 (approximately $154 billion) was somewhat less than 10% of a total $1.6 trillion dollar economy ; but is larger proportionate to the total tax take only exactly because overall Australian tax levels are comparatively so-very-low.

So again ; when you factor in a dramatically rising cost of living – as well as levels of personal indebtedness for those on lower and average incomes, or with lower to average wealth – the problem of inequality is becoming far more urgent.

This personal indebtedness includes mortgage stress. Indeed while some banks have behaved in an irresponsible and predatory way, there is the danger that the unsustainable personal debt which fuelled the housing boom (and perhaps consumption levels more generally) may finally give way to bust ; flowing into overall consumer confidence as well.

Factoring the housing affordability crisis in, that makes a strong difference to those on average or lower incomes attempting to pay off a mortgage, or even to afford the rent in an established suburb with decent amenities and infrastructure. Indeed home ownership is down to 31% from 41% in 1991, reflecting the concentration of housing in the hands of investors – to the detriment of first home buyers. The plight of those forced to the urban margins ; or to forsake the ‘Australian Dream’ of their own home also cannot be grasped by mere considerations of income inequality. Again, because of a broader cost-of-living crisis inequality is more urgent than any time in decades.

So Wilkins talks at length about income, but not so much about wealth ; this in a context where home ownership (or the lack thereof) is becoming a crucial socio-economic fault line.

And yet the Sydney Morning Herald’s Paul Maloney observes research from ‘Credit Swisse’ to the effect “the top 1 per cent of Australians own more wealth than the bottom 70 per cent combined.” And that according to ACOSS research “someone in the highest wealth group had 70 times as much wealth as someone in the lowest.” Maloney further observes the selective nature of the statistics Wilkins draws upon. Had Wilkins began by observing inequality from 2004 onwards that would have revealed a radical increase in inequality during the 2003 to 2008 period. This applies to income as well. According to the OECD, for instance, “Real incomes for the top quintile of households [in Australia] grew by more than 40 per cent between 2004 and 2014 while those for the lowest quintile only grew by about 25 per cent.”

Also since the 1970s profit-share has risen from 16.5 per cent to 26.5 per cent ; but the wage share of the economy has fallen from 62.7% to 52.3 per cent. (2016 figures) It had been assumed that increasing the profit share was necessary to spur investment ; while a falling wage share (and a largely neutralised trade union movement) would prevent a ‘wage-price spiral’. But in fact workers have less capacity to consume ; have turned to private debt to maintain lifestyles ; and the whole arrangement is beginning to look very precarious.

Neither pre-tax or after-tax income is enough to grasp the growth of inequality. While taxes have grown ‘flatter’ (less progressive) but nonetheless lower, the ‘user pays principle’ has been applied less and less discriminately , to the point where it applies now to everything from education and energy to communications, transport infrastructure and water. This intensifies the impact of inequality. Appallingly, ‘user pays’ for residential Aged Care especially has become akin to a ’death tax’ . But unlike progressive inheritance taxes or ‘death duties’, this impacts disproportionately upon families with lower to middle incomes, including those for whom the family home is the only significant asset they have.

As opposed to the earlier post-war mixed economy, the user-pays element has been increasing proportionately, and privatised entities are no longer providing cross-subsidies for ‘battlers’. Also: arguably privatised entities are abusing their market power to reinforce their bottom line. Hence the cost of “essential items such as food, electricity and insurance” is rising at almost double the rate at which wages are rising. And the position of the poor and welfare-dependant is even more precarious. A look at Medibank Private’s increasing premiums is enough to hammer these points home ; along with soaring profits.

Meanwhile policies such as capital gains tax discounts, superannuation tax concessions, and negative gearing – overwhelmingly benefit the well off – to the detriment of social programs which may otherwise further social solidarity and the common good. According to Treasury in 2015 $10 billion out of $30 billion in superannuation tax concessions alone are lining the pockets of the wealthy. (the top 10%) With time the problem could worsen markedly.

Bill Shorten’s agenda is not ‘hard left’by any reckoning. Michael Pascoe of the Sydney Morning Herald has observed that Shorten’s reforms to family trusts only scratch the surface (saving less than a third of what may have been possible). And that Shorten is even using 10 year projections to make his reforms look more substantial. Pascoe concludes that if this is ‘class war’ Shorten is “firing blanks”!

We need much stronger policies from Labor: reforms of the tax mix, and new progressive taxes to provide for significant new social policies. End inequitable superannuation tax concessions. Wind back user pays in Aged Care and Education for equity and fairness ; and improve the quality of service. Reform welfare to further ameliorate poverty (raise all full pensions by $1000/year). A big investment over time in public housing to increase supply, deflate the bubble, provide for the vulnerable. Consolidate and extend Medicare. Provide the necessary resources and apply the political will to maintain transport, communications and other infrastructure as natural public monopolies. Consider strategic re-socialisations ; maybe re-establish a public-owned savings bank. Properly fund mental health.

The lower end of the labour market needs re-regulation as well ; though this is not necessarily linked with tax.

Arguably decades of privatisation and austerity have resulted in inferior cost structures for areas of the economy properly the domain of natural public monopolies. Meanwhile in Australia a limited welfare state has restricted ‘collective consumption via tax’. That also has impacted upon cost structures ; and has given consumers worse value for money in the end analysis.

The consequence has been less consumer demand for the remainder of the economy. Capitalism is desperately striving to expand existing and new markets to stave off its contradictions. But ironically perhaps the best way it can do this is to transition to a ‘hybrid economy’ which cedes ground to socialisation (public and other democratic ownership). Efficiencies via socialisation (natural public monopolies, collective consumption, enforcement of competition in specific sectors, eg: banking, insurance – by government business enterprises with competitive charters) would mean more income left over for consumers to spend elsewhere (ie: in non-socialised sectors). Many capitalists would resist such a transition for political and Ideological reasons ; but many others still could stand to gain from such a compromise. As could the public at large.

Public investments in services and infrastructure can also comprise a ‘pull factor’ for investment (for instance an educated workforce). This gets forgotten in the constant push for more austerity and lower taxes. And it is one reason why the Nordics are so successful with their welfare states, mixed economies, industry policies and active labour market programs. The opposite of the catastrophe scenario suggested by Credlin in response to Labor’s modest policy agenda.

As things stand a Shorten government could ameliorate social injustices including economic inequality. But Labor’s existing policies are very mild. Shorten has time to develop a stronger policy profile ; though the modesty of past ALP policy is such that Labor’s recent announcements appear ‘radical’ to some.

Token reforms are not enough to deliver, even though they may convince those without a sense of proportion and history. Rather than reforms bringing in $1 billion Labor needs to think bigger ; perhaps in the vicinity of 2 per cent of GDP in a first term. (approximately $32 billion in a $1.6 trillion economy) And gradually more in subsequent terms. Not because that is just some ‘silly’ arbitrary figure ; but because Labor needs to think of what is necessary for its policy ambitions ; but also what is politically ‘do-able’ – and over what timeframe.

Meanwhile those claiming a $1 billion tax reform (that is, one sixteenth of one per cent of GDP) is ‘class warfare’ are frankly kidding themselves.

References:

http://www.smh.com.au/business/the-economy/labors-war-on-the-rich-is-firing-blanks-20170730-gxlz6r.html

http://www.abc.net.au/news/factcheck/2015-10-14/do-eight-of-ten-taxpayers-fund-welfare-bill/6822840

http://theconversation.com/what-income-inequality-looks-like-across-australia-80069

http://www.smh.com.au/federal-politics/political-opinion/roger-wilkins-claims-about-inequality-at-economic-conference-should-be-tested-20170727-gxk9m6.html

http://www.abc.net.au/news/2015-07-07/denniss-abbotts-promise-not-to-solve-our-super-tax-problem/6601112

http://www.smh.com.au/federal-politics/political-news/private-health-insurance-premiums-to-rise-by-nearly-5-per-cent-20170209-gu9p8t.html

http://evatt.org.au/papers/northern-lights.html

Dr Tristan Ewins is a Social Sciences PhD, qualified teacher and social commentator based in Melbourne. He also blogs at ‘ALP Socialist Left Forum’, ‘Left Focus’ and ‘The Movement for a Democratic Mixed Economy’. He has been a member of the Socialist Left of the Labor Party for over 20 years. The opinions he expresses here are his own only.

21 comments

Login here Register here-

passum2013Ronbarnes

-

Keith

-

Kronomex

-

paul walter

-

Phil

-

Matters Not

-

Ill fares the land

-

Jaquix

-

David1

-

Robert REYNOLDS

-

Andrew Francis Oliver

-

Zathras

-

Christian Marx

-

stephengb2014

-

diannaart

-

Tristan Ewins

-

Trish Norman

-

Trish Norman

-

Tristan Ewins

-

Shogan

-

Andreas Bimba

Return to home pageAnother top item for thourt

Corporate profits have been very high. The trickle down theory is a myth that the LNP like to push along with their other fairy tales.

The Direct Action “policy” syphoned off huge amounts to companies; not only would the expectation be that emissions come down; but, employment should also increase. Neither of those eventualities have happened.

Peta Credlin, now to be renamed Pedals Crapalot.

Of course there is class warfare, Credlin’s job is to invert the public’s understanding of who is initiating and executing it. Her medium is the Big Lie mode that so infatuated the rulers of thirties Germany.

Much food for thought – always refreshing to see reasoned arguments refuting the opinionistas on the right.

Yep. But even his modest proposals may be unacceptable including for those who are not beneficiaries and not likely to be so endowed in the future. Many people live in hope that one day they too will be able to access these lurks and perks. Heaven awaits. Just be patient.

Then there’s the concept of not letting the perfect be the enemy of the good. Policy reforms are so easily damned in a cynical world. An attentive audience is hard to find.

As for ‘class war’. It’s just a description of what is happening.

Credlin’s incredulous “opinions” show how statistics can be manipulated to create falsity. Perhaps the top income earners do pay a high proportion of the tax, but they have also accumulated a disproportionate share of Australia’s wealth. If you combine their un-taxed wealth with their income, you will find that the tax they pay as a proportion of their personal wealth starts to look rather insignificant. The reality is that despite a high top marginal tax rate (some would say penal!), the top income earners have, especially over the last 30 years, managed to substantially increase their personal wealth – and during this period we have had two significant recessions. Consider the rather corpulent Aussie Home Loans owner who was to spend $75 million on a yacht and tried to sell his Point Piper mansion for $100 million. So what if that dude pays another $5.0 million in tax – so a big boohoo – suddenly he only has $70 million to spend on a yacht. I might add that the cost to build his mansion was around $50.0 million and if he did sell for $100 million, he walks away with a tax-free capital gain of $50.0 million – the mansion was his main residence. I also note that he fought an unsuccessful (publicly reported) court case against the ATO because he tried to get some of the construction costs funded by a tax-free distribution from one of his companies – for which I suggest he paid his Big 4 tax advisor a pretty penny. Don’t you want to cry for the poor beleaguered fellow?

How can anyone other than a myopic, combative and neurotic fool like Credlin think that someone like Symonds is, far from paying too much tax, not paying enough. One measure Shorten MUST introduce, is the removal of the main residence exemption under the CGT rules where the property is worth more than say $5 to $10 million. Yes this might sound like class warfare, but aren’t people like Symonds waging class warfare on the poor every day and using opinionistas like Credlin as their mouthpiece through the ultra-conservative media.

Good to see a new author, and one who can write with such a background. With regard to calling Labor’s present policies “mild”, I think that although many would like them to be bolder, they do have to walk a fine line with regard to policy reform, if the main aim is to get into government. Australian voters seem to be very timid themselves. Anyway, great article!

Credlin, news prostitute to the rich

When people like Peta Credlin, peddle this inane and fatuous nonsense about “class warfare” and “the politics of envy”, etc. all they are doing is showing how totally bereft they are of any justification for the “smash-and-grab”, “winner-take-all”, economic system that we are operating under today.

I often joke that these people should have been around in France in 1789 or in Russia in 1917. Can you imagine the response from the masses who had for decades, if not centuries, put up with untold hardship, exploitation and deprivation, for them to be told that they were just indulging in “the politics of envy” or “class warfare”? Do people like Peta Credlin seriously believe that upon hearing these absurd slogans, the masses would stop in their tracks, and say to themselves, “Ohh yes, actually you are right? We should cease all this agitation immediately and return to our miserable lives without any further complaint.”

Peta and her ilk have forgotten their history. Perhaps they never knew it in the first place. However, the way things are going, there will be a new lesson for them to learn at some time in the future. When they speak this unequivocal drivel now it is only possible to treat their utterances with complete contempt.

As a social democrat I prefer sensible compromise. I do not find a spirit of sensible compromise or much moderation in the neoliberal class war waged by the Davos set the billionaire class or the managements of the billion dollar corporates. Now in the 1960’s under a moderate regime of Menzies, efficiency in energy and water utilisation was recognised by natural monopolies owned by the states. Where service was an issue, there were state banks, private banks, a Commonwealth bank, limited competition which enabled small business and theoretically cooperatives to exist without too much power in the local People’s Bank Manager. Ansett and TAA conducted similar limited competition with proper staffing of maintenance for safety.

Yet the greed of the 1% has undone all the compromises of the 50’s and 60’s. In economic theory there are sellers markets and buyers markets. Too much competition can lead to a buyers market and either workers or farmers or business get squeezed by take it or leave it deflationary delayed purchase threats by buyers. One theorist reckoned three big competitors were the ideal and in the USA this manifested itself as Ford General Motors and Chrysler. Nowadays economic results in competition theory, based on suboptimal equilibria arguments, are disregarded. We see simply the 1% ripping out the guts of everyone else in pure greedy lust for money.

Whitlam did make some modernisation reforms but his unilateral tariff cuts and floating of the currency and fiscal looseness did some harm to the mixed economy beloved of Keynesian theorists.

“There’s class warfare, all right, but it’s my class, the rich class, that’s making war, and we’re winning”.

– Warren Buffett

While the workers see their wages falling further and further behind, the wealthy are rewarded with tax cuts and politicians are granted significant pay rises at the same time they are cutting penalty rates.

Excellent article, Tristan. Unfortunately, until our criminal media is radically overhauled and restructured, the majority

will remain brainwashed by hard right, anti worker propaganda from the very wealthy. Labor also need to purge the right faction of their party

and begin to represent the working class again. Shorten is not the man to lead a modern day Labor. Labor need to look to the U.K and Jeremy Corbyn for the future.

Good article well written, thank you – Follow up comments are good too,.

I look a both the Left and Right, media, although I find it hard to have to read the drivel on Right leaning media, I do this to try get a feel for mood.

Also there are a number of facebook Groups, both Left and Right leaning.

I sense there’s a bit of desperation in the Right media and group commentary, its increasingly vitriol, especially after someone from the ALP makes a statement. When Bill says s0meth9ng ots like he killed someone they are desperate to villify him.

I chip in mostly with stuff from the MMT macroeconomics, but more recently I have started to call a spade a ade eecially when it comes to turnbull.

Also I have started to be more and more vocal about re-nationalisation of privatised government services and industries.

One thing which I believe to be most important is to be clear that the Federal Government must be the funder of public services and monopoly industries. The reason 8s that the Federal government is the currency issuer not a currency user, they cannot run out of m9ney and they do not jave to tax or borrow to fund any spending.

SGB

Excellent, thoughtful, well researched and referenced.

There are, no doubt, many reasons why the top of the pyramid prefer to keep middle and low income people in “their place”.

One reason, which stands out for me, is escaping from the monopolies – going off grid, which has now become a tantalising possibility – which is difficult even on a mortgage, near impossible if renting.

Control the means of savings, control the people.

Jaquix ; I think the aim is to get in ‘the goldilocks zone’ between opportunism and self-destruction. Neither one nor the other… Hypothetically: Raising tax by 20% of GDP in one term would pretty much certainly mean self-destruction… You can’t do the Nordic model overnight…. Increasing welfare by $3000 a year would probably be seen as excessive – even if right… That’s why I suggest tax reform comprising 2% of GDP in new revenue for a first term Labor Govt. Because I think its doable. Its significant enough to be truly meaningful. Modest enough perhaps not to frighten people if sold correctly… We do “what it takes” over the long term – and that means perhaps decades of reform (unless there’s some catalytic, ‘watershed’ event which accelerates things) ; But what are our limits for now? Also merely tinkering around the edges is pointless because the Liberals will just undo everything ; it will be ‘one step forward, two steps back’. Personally I don’t want to live we that hanging over our heads for the rest of our lives… Every victory pyrrhic and temporary… ‘On the back foot’ even when in government… What we need is to consolidate popular big-ticket reforms. Welfare we should do just because its right. Though probably it would popular with some despite the constant ‘dole bludger’ narratives from Murdoch and all that ; Some people realise they’d be screwed if say they lost their jobs ; we need to hammer that home ; usually we do not even try there…. Aged Care reform, extend Medicare and PBS, income tax indexation, raise the minimum wage, restore education funding wind back user pays there also – we should do these things as they are both right and will probably be popular…. Take 25% off Dividend Imputation and wind back Superannuation Concessions – should bring in at least $15 billion… Do negative gearing reform properly maybe bring in $4 billion.. and so on.

I agree with everything you have said and most people on the lower rungs of society would as well. I think we have to make counter arguments to people like Credlin so we win back the Fair Go adage. I hope Bill is told to get real and do what he really needs to do

Tristan Ewins I believe people are well informed about the the manipulations that have been taking place in New Zealand and Britain at the same time as Australia their welfare and housing mirrors the changes we have had to welfare and attacks against the poor. There is another entity decimating our welfare and theirs. so we really need to be including them in any discussions with Australians because I think the government either because of debt or some other reason have allowed our poor to be trampled. Any fight back should include any entities who have a control over the government otherwise we are playing with half the deck/ Australians do know something is not being said and they know what is happening overseas so it would not be a shock to mention it to the plebs at all.

Hi Trish ; thanks for the comments ; I think governments trample the poor for many reasons ; first they want scapegoats so they can ‘divide and conquer’ the working class ; secondly they want to ‘discipline the labour market’ where there is a ‘reserve army of labour’ the price of which if you fall in to it is destitution ; thirdly – they are looking to cut spending and make room for corporate tax cuts and the like – which they have an Ideological commitment to. For the reasons I give in the article they are mistaken in all these strategies. BTW I would support increasing all full pensions by $1000/year indexed. I think that’s ‘doable’. An extra $3000/year would be better ; but popular sentiment is not ready for it. Also you have to improve the lot of the working poor. Again because its right. But also because the conservatives will try and ‘divide and conquer’ there too. Playing the working poor off against the unemployed and welfare recipients.

Some people think that Australia’s involvement in the war in Afghanistan is our longest war, but the longest war Australians have been involved in has been the class war that has been waged against Australians by the LNP in all its various shapes & forms over the last 70 odd years!!

Great article Tristan but perhaps you could have added the following to your worthy package of proposals that you listed at the end of your article:

Fiscal policy and a Job Guarantee to bring unemployment and underemployment eventually down to near zero. Just increasing taxes on the wealthy, reducing concessions and tax evasion will not suffice to provide an adequate welfare system nor will it bring unemployment down by much. This issue will become more critical with artificial intelligence expected to replace many current jobs. Don’t fall for the neoliberal lie that our federal government must maintain balanced budgets or surpluses. In addition a livable UBI is unfortunately an unachievable dream. The MMT economists know what they are talking about!

The neoliberal lie that we need totally free trade – effectively means that any enterprise that is subject to import competition (this includes information based enterprises that can face competition via the Internet) must be at world’s best practice in terms of price/quality/market want. Sounds great for consumers but this means extinction for most of our manufacturing sector and similarly exposed sectors. With moderate tariff protection or local purchase regulations we can at least retain and develop highly automated or capital intensive manufacturing enterprises at significant net benefit to the Australian people. Manufacturing is the core of the Japanese, German and Korean economies for example and these countries all restrict imports and provide substantial support measures such as higher education, cheap finance and R&D.

The elephant in the room is global warming and ongoing environmental destruction. Economic growth and full employment are worthy goals but if we don’t at the same time rapidly transition to environmental sustainability we are doomed. Better to be affluent people on bicycles rather than poor people in grid lock about to die. This is the greatest market failure of all where the fossil fuel industry and like minded business interests have frustrated all meaningful attempts to tackle global warming even though this is an existential threat.

Business influence over politics and our democracy, including over the mass media is so overwhelming that we may have even passed the point that the public interest will ever be prioritised over predatory business interests. Hoping for a better Labor Party through persuasion or evidence will not suffice and a substantial people’s movement such as that attempted by Bernie Sanders in the US is essential to bring about meaningful change.